Topics: Pay & Bill Automation

Pay & Bill Process Automation: How It Works & How QX Can Do It for You

Posted on November 04, 2021

Written By

Rukmani Krishna

For a recruitment agency, one of the most critical functions is pay and bill processing. It can often prove to be a complex and time-consuming function due to its multi-step nature and everchanging legislations. To add to that, it is also expensive to build and maintain in-house expertise, hire additional staff, and regularly upgrade payroll software. Furthermore, recruitment agencies also need to maintain complex records of several candidates and ensure that they’re all paid on time, otherwise they are at risk of losing both candidates and employers.

A smart way to streamline the pay and bill process is to partner with an experienced sourcing agency, thus freeing up your onshore teams of the complexities. At QX Global Group, we leverage a combination of the right people, processes and platforms to deliver payroll operational excellence to our clients.

Before we dive into the automation process, let us quickly look at the various processes involved in the pay and bill function.

Key Elements of Pay & Bill

Generally, the pay and bill process has five key elements:

1) Onboarding contractors and clients;

2) Processing and managing timesheets;

3) Inputting payroll information into the accounting software;

4) Running a customer helpdesk; and,

5) Monitoring performance through dashboards and reports.

Now, let’s look at how QX automates the entire payroll process.

Pay & Bill Automation

1) Information transfer: An automated interface between the front-office and payroll software enables information transfer with the help of APIs or bots.

2) Timesheet management: An automation tool identifies, extracts, and converts paper timesheets and images into the required format. For VMS timesheets, a downloader bot logs in to the client’s portal and downloads the timesheets in CSV or Excel formats.

3) Payroll processing: Direct processing of timesheets can be done through a native web or mobile interface. A proprietary timesheet calculator splits the hours as per client rules and makes automatic calculations. Timesheets that do not fulfil the processing parameters are rejected and submitted for query resolution, post which payments are processed and recipients are sent payslips and invoices.

4) Query resolution: The payroll team deals with and resolves queries from candidates, credit controllers, and front-office consultants. A proprietary query management system, QX MailerDesk, a ticketing system, tracks the turnaround time for query resolution and effectively monitors SLAs.

5) Data analysis: All the data collected by the payroll software is converted into interactive MIS reports with the help of software like Power BI & tableau to offer in-depth insights to clients.

Benefits of Pay & Bill Automation

There are several benefits that your business can reap from pay & bill automation. Let’s look at a few of them.

- Fewer errors: Manual processing is riddled with errors. Automation offers accuracy and precision, thereby eliminating human mistakes.

- Saves time: Manual, repetitive tasks can be extremely time-consuming. Automating these tasks can free up onshore teams, allowing them to focus on strategic and growth-oriented tasks.

- Better security: Automated payroll systems utilise encryption and password-protection to better protect payroll data. It also ensures that access is limited to authorised personnel.

- Lowers costs: Investing in an automated payroll system can be expensive in the short term, but in the long term, it leads to enhanced cost savings. Payroll mistakes can be costly; automated payroll systems eliminate mistakes, reduce processing time, and provide significant cost savings.

- Simplifies tax calculation: Automated payroll systems usually have tax rates and tax rules embedded in their code. This facilitates accurate and timely calculation of various taxation elements.

- Better record-keeping: Automated payroll systems store all the collected data in one single place, thereby ensuring information security and easier access. Additionally, this data can be used to gain in-depth insights on payroll performance.

QX worked with a leading recruitment agency to automate the pay & bill function, resulting in savings worth £6.5 million – click here to read the transformation story.

Automation: The Future of Payroll?

So, you’ve understood how QX automates the pay & bill function and learnt some benefits of automation. But, is automation the right move for your business? Let’s look at some recent developments on the payroll automation front.

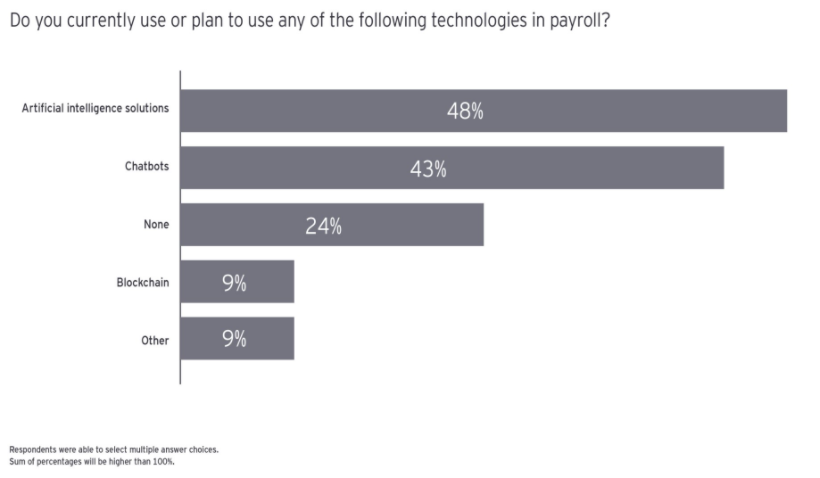

According to a 2019 study conducted by EY, automation remains a top payroll service delivery challenge as companies continue to invest heavily in emerging technologies. Additionally, it notes that cloud-based solutions and artificial intelligence (AI) are gaining momentum in the payroll space.

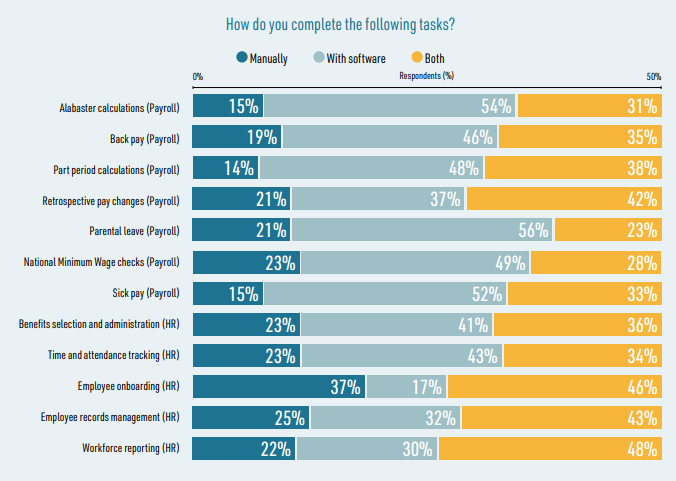

A recent global survey conducted by SSON in collaboration with Zellis found that enterprises are beginning to recognise the benefits of automating payroll processes. A staggering 80% of respondents said that they are leveraging a hybrid process for payroll processing, clearly indicating that several businesses are recognising the benefits of automation and are willing to adopt relevant technologies.

Another interesting development is that Pento, a Danish payroll automation start-up, raised $15.6 million in a Series A funding in May 2021. The start-up, which claims to have 700 clients, automates the entire payroll process, conducts payments, and integrates payroll software with other HR products.

Want to Outsource Your Pay & Bill Function?

QX is one of the leading high-volume pay & bill providers for the recruitment industry in the UK and EU, processing over 1.5M timesheets annually with an average accuracy rate of 99.8%. In addition, we can also help your business improve process efficiency by 40-50% and facilitate faster query resolution & SLA tracking.

Get in touch with our experts for personalised advice on how to transform your pay & bill function today.

Originally published Nov 04, 2021 11:11:37, updated Jul 02 2024

Topics: Pay & Bill Automation