Topics:

Building a Robust FP&A Process: Best Practices and Key Considerations

Posted on March 27, 2023

Written By

Siddharth Sujan

Over the past few years, the business landscape has undergone significant changes, leading to new expectations for finance teams and their Financial Planning & Analysis (FP&A) processes. While traditional FP&A processes have provided a structured approach to budgeting, planning, forecasting, and reporting, they have often resulted in operations that react to changes rather than seize opportunities.

The modern business environment calls for a dynamic, data-driven FP&A function that can guide the organization towards its strategic goals. Let us try to understand what exactly FP&A is, the importance of building a robust FP&A function and explore best practices to enable businesses to achieve this goal.

What is Financial Planning & Analysis?

FP&A, or, Financial Planning and Analysis, is a finance function that is typically responsible for analyzing financial data, preparing budgets, forecasting future financial performance, and providing strategic insights to facilitate decision-making processes.

In a traditional setting, the FP&A team works closely with senior management to identify trends, evaluate financial risks & opportunities, and recommend actions that support the company’s overall goals and objectives. The FP&A function relies heavily on data analytics, and other quantitative techniques to provide accurate and actionable financial information to help drive the company’s success.

Why is it Important to Build a Robust FP&A Function?

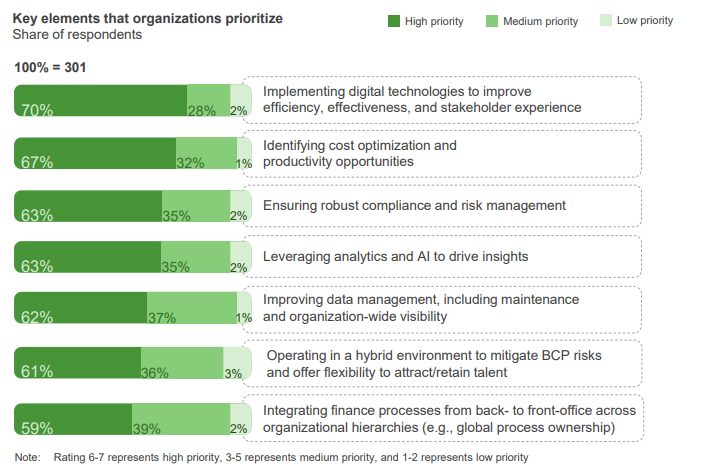

The FP&A function is crucial for any organization’s long-term financial sustainability and growth. By gaining access to reliable financial data, companies can identify potential risks and opportunities, adjust their strategies, and make informed decisions to achieve their financial goals. In essence, FP&A is the backbone of an organization’s success – which is why optimizing this function is often one of the top strategic priorities for finance leaders across organizations.

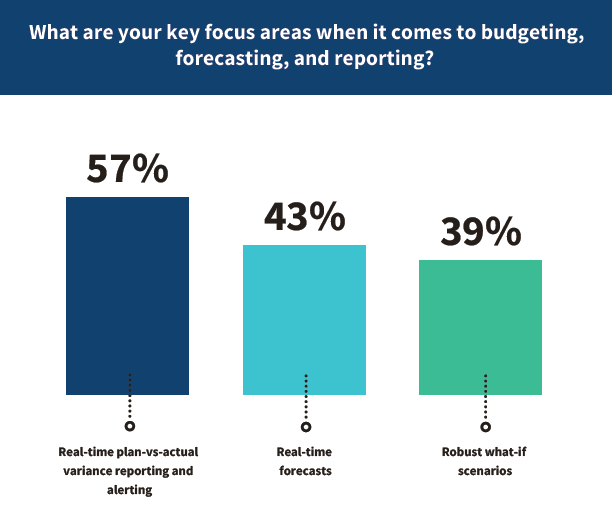

In fact, a well-structured FP&A function can enhance the efficiency & effectiveness of a company’s overall financial operations. A financial planning & analysis team that follows best practices and leverages technology will likely have a streamlined budgeting, forecasting & reporting process, experience fewer redundancies, and communicate better.

Additionally, having a strong FP&A function can help your organization maintain financial discipline, transparency, and accountability throughout the company. When financial reports are accurate and provided on time, everyone involved can have a better understanding of your organization’s financial performance. This fosters trust and confidence in your company. Plus, it helps you comply with regulations and avoid expensive legal and reputational issues down the road.

What are the Best Practices for Building a Robust FP&A Function?

The FP&A function is essential to any organization’s strategic decision-making process. To build a robust FP&A function, there are several best practices that businesses should follow:

1. Clearly define the role: One of the key best practices to building a robust FP&A function is to clearly define the role and responsibilities of the function within the organization. This involves identifying the key performance indicators (KPIs) the function will track and measuring its success against them. Not only does this avoid confusion, but also ensures that everyone understands the function’s responsibilities and how it fits into the organization’s overall strategy.

2. Align financial planning & analysis with business goals: To maximize its value to decision-makers, the FP&A function must be tightly aligned with the organization’s business goals and objectives. Adopting this approach ensures that FP&A doesn’t function just as a financial reporting mechanism, but rather as a key partner driving decision-making to support the overall strategy.

3. Build a strong team: Another critical aspect of building a robust FP&A function is developing a team with the required skills and experience to support the strategic objectives. This involves recruiting talented individuals with relevant experience, providing ongoing training and development, and fostering a culture of collaboration and accountability.

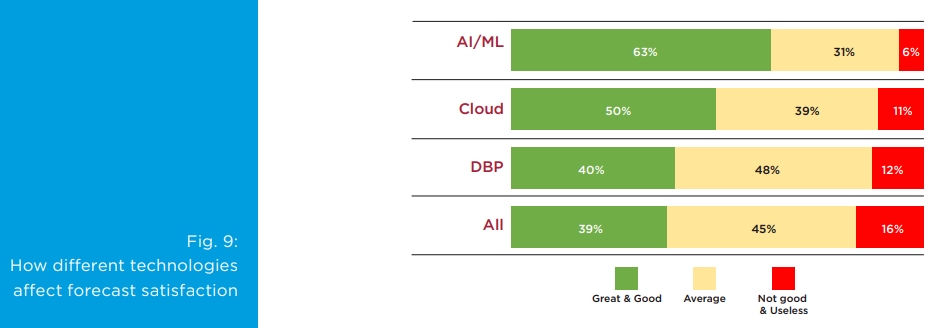

4. Leverage technology: Organizations that fail to leverage technology to improve the accuracy and efficiency of their financial planning & analysis processes are more likely to lose out to the competition. Financial planning software, data analytics tools, and other technologies can go a long way in streamlining workflows and providing real-time insights.

5. Communicate effectively: Effective communication is also essential to the success of the FP&A function. This includes regular communication with stakeholders, such as senior management, investors, and other key decision-makers, as well as ensuring that financial information is presented in a clear and easy-to-understand format.

6. Ensure compliance: By maintaining compliance with relevant laws and regulations, the FP&A function can help to mitigate the risk of financial reporting errors, which can lead to regulatory fines, reputational damage, and legal liabilities. Furthermore, by setting clear policies and procedures, the FP&A function can help ensure that all employees know their responsibilities and are held accountable for their actions.

7. Improve continuously: By continuously improving its processes and procedures, the FP&A function can optimize its workflows, increase efficiency, and enhance the quality of financial analysis and reporting. Continuous improvement also helps to promote innovation within the function. By encouraging team members to think creatively and experiment with new approaches, teams can identify opportunities to add value and stay ahead of emerging trends and technologies.

QX Global Group: Optimizing Financial Planning & Analysis for Businesses Across Industries

The above-mentioned best practices can significantly improve the effectiveness of the FP&A function, but for businesses with a forward-looking approach, a more comprehensive solution may be necessary. Outsourcing financial planning & analysis can allow companies to focus on their core competencies, gain access to cutting-edge analytics tools & benchmarking data and improve decision-making. Furthermore, outsourcing can provide businesses with the scalability and flexibility needed to adapt to changing market conditions and pursue growth opportunities.

QX Global Group is a leading consulting, automation and BPM company offering comprehensive FP&A services to businesses across industries and geographies. By leveraging our FP&A services, businesses can establish a team of skilled professionals who can efficiently extract data from key business functions and analyze it objectively. This service helps companies identify strategic actions that align with their goals and implement them effectively – all at a fraction of the cost of maintaining an in-house financial planning & analysis team.

Get in touch with us today to start your journey towards a more robust FP&A function.

Originally published Mar 27, 2023 06:03:32, updated Mar 27 2023

Topics: