Businesses, irrespective of their size and industry, end up procuring goods & services on short-term credit from external suppliers. This accounting entry is commonly referred to as accounts payable, or payables, or simply, AP. While this might come across as a straight-forward concept, payables is actually a complex web of interconnected processes that will have a direct impact on an organization’s cash flow, supplier relationships and regulatory compliance needs.

As a result, it becomes critical for businesses to maintain an agile accounts payable function that can scale as the company grows. But how do businesses do that? In this post, we will try to address some key concepts around accounts payable, understand how to run an efficient AP function and how that will impact your bottom line.

What is accounts payable?

Accounts payable definition

Accounts payable is defined as a liability within the general ledger that represents a company’s short-term credit for goods and/or services procured from third-party vendors. Accounts payable makes for an important aspect of any company’s balance sheet and is listed under the current liabilities section.

Since payables represent funds being borrowed from suppliers, they are considered a source of cash in the accounting world. As a result, suppliers tend to lean towards shorter payment cycles while businesses prefer longer payment terms. The number of days that a company takes to pay its suppliers is referred to as Days Payable Outstanding (DPO), the most important metric in the accounts payable context.

How to calculate accounts payable?

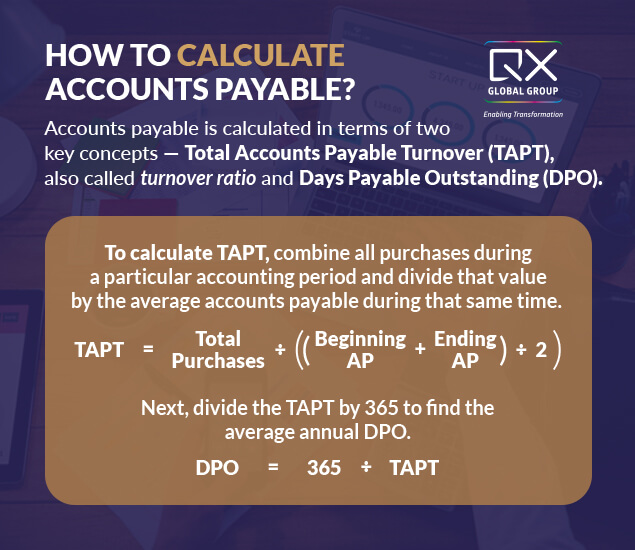

Accounts payable calculation is usually done in terms of two key concepts – DPO and Total Accounts Payable Turnover (TAPT), sometimes also called turnover ratio. To calculate the TAPT, you will have to combine all purchases made from your suppliers during a particular accounting period, then divide that value by the average accounts payable during that same time frame.

TAPT = Total Purchases ÷ ((Beginning AP + Ending AP) ÷ 2)

Once you have your TAPT, divide it by 365 to find the average annual DPO:

DPO = 365 ÷ TAPT

What is the accounts payable process?

Accounts payable is a full cycle process that starts when a business places an order to procure a good or service and ends when the payment for the said order is completed. In other words, it is the management and execution of a company’s short-term payment obligations to vendors/suppliers.

Factors affecting accounts payable process

To start with, it is important to understand that even though accounts payable is a finance function common to businesses of all size & type, it is not identical in nature and can have stark variations across business settings. For example, the payment terms followed by a small, independent clothing manufacturer will be very different from the payables process of a global fashion brand operating with manufacturing units spread across the world. Some of the main factors that determine the nature of an organisation’s AP function are:

- The number of suppliers/vendors a business procures its materials from;

- The type of documentation required internally to approve a business purchase; and,

- The total amount of payment expected to be made over a short period of time

The Basic AP Workflow Process

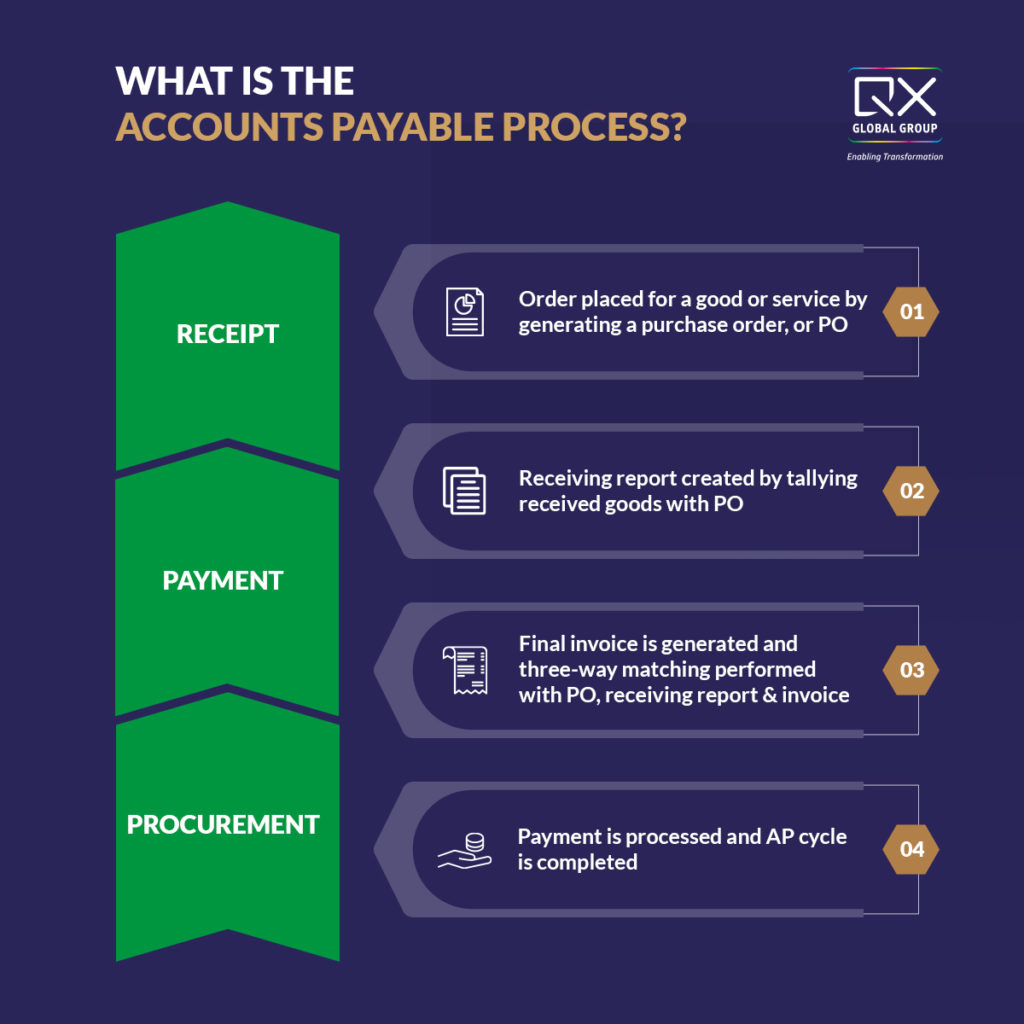

As mentioned earlier, accounts payable is a multi-step function with several interdependent processes that can vary across organisations. However, to understand the traditional AP workflow, we will try to break it down into three very broad umbrellas:

- Ordering: The first step in the payables process, ordering is the stage wherein a business places an order for a good or service by generating a purchase order, or PO. The PO acts as a contract between a business and a vendor to exchange cash for their products. More often than not, a PO will have key details of the agreement such as type of product/services to be provided by the vendor, order quantity, price and timelines by which the order will be fulfilled.

- Receiving Report: Once the order has been received, a business will take receipt of the same and work towards creating a receiving report, another key document in the AP cycle. While creating this report, the staff tallies the shipment with the PO to ensure that all the requested items have arrived in suitable condition.

- Matching & paying: After the delivery of goods/services, the vendor generates a final invoice which includes details like services provided, quantity and total cost. The business then performs a three-way-match between the PO, receiving report and invoice. Once this complete, the payment is processed and the AP cycle is completed.

What does an accounts payable specialist do?

Owing to its highly complex and intertwined nature, accounts payable as a function is heavily reliant on the skills & capabilities of the people that manage payables. In an organization, the AP team is responsible for accurately tracking what’s owed to suppliers, ensuring payments are properly approved and processing payments. Some of the key responsibilities of an accounts payable specialist are:

- Gathering, analyzing, and interpreting financial data

- Receiving, processing, verifying, and reconciling invoices

- Charging expenses to accounts and controlling petty cash spending

- Reconciling transactions with general ledger

- Resolving PO, invoice, or payment discrepancies

- Performing recordkeeping

- Financial reports preparation

- Ensuring regulatory requirements and accounting best practices

What are accounts payable services?

Accounts payable services are a set of highly specialized financial services that help in the end-to-end management of a company’s accounts payable function. These services can play a critical role for businesses in improving process efficiency, technology implementation, overall streamlining of the company’s accounting and bringing down operational costs.

Why do businesses need accounts payable services?

- Repetitive, laborious and time-consuming nature of AP tasks can drain resources

- Human errors arising out of manual processing can prove costly

- Inefficient processing can have a direct impact on the company cash flow

- Inefficient payables can hamper supplier relationships significantly

- Delayed payments can lead to late-payment fees, shipping delays, and affect credit ratings

Can accounts payable be outsourced?

Yes, absolutely. Accounts payable is one of the most commonly outsourced finance functions. In the traditional sense, operational cost reduction has been the key driver for businesses to outsource AP to specialist accounts payable outsourcing companies. However, with the evolving business landscape, finance leaders now look at AP outsourcing from a strategic viewpoint rather than merely a cost-saving method.

Benefits of accounts payable outsourcing

Some of the key benefits of outsourcing payables to third-party companies are:

- Allows rapidly expanding companies to consolidate payables across the board

- Standardization & optimization of processes to ensure accounting best practices

- Timed payments to optimize spends and gain maximum supplier discounts

- Elimination of costly human errors arising out of manual, paper-based processing

- Support for identification & implementation of latest AP tools

- Delivering infinite scalability by setting up a team of trained AP experts

- Effective recording and addressal of supplier queries to build stronger vendor relationships

- Access to dashboards and dynamic reports for in-depth AP visibility

- Frees up onshore team of repetitive AP tasks to drive focus to revenue-generating or strategic accounting activities

What are the benefits of outsourcing accounts payable for certain industries?

Though accounts payable outsourcing is common in businesses across industries, there are a few sectors where it can prove to be especially beneficial. Let us touch upon a few industries and decode the key benefits businesses in these sectors can reap from AP outsourcing.

Benefits of AP outsourcing for student housing businesses

- Consolidation post M&As: Mergers & acquisitions are quite common in the purpose-built student accommodation (PSBA) market, which can often increase accounting complexities. Outsourcing a key activity like AP introduces infinite scalability, allowing organisations to seamlessly integrate new businesses.

- Future-focus: Student housing managers often find it difficult to contribute to business growth due to the laborious nature of day-to-day payable activities. An AP specialist brings in industry expertise, allowing onshore teams to focus completely on productive endeavours.

- Improved reporting for owners & investors: PBSA owners & investors often leverage payable reports to keep a track of their company cash flow. A dedicated offshore team of AP experts can generate customised reports more efficiently and periodically.

Benefits of AP outsourcing for recruitment agencies

- Access to specialised AP staff: Finding & retaining trained AP experts can get quite difficult and expensive, especially in UK. Working with an AP outsourcing company allows agencies to tap highly talented resources at a fraction of the price.

- Cost reduction: Reduced AP costs are often one of the biggest drivers of outsourcing. When you set up an offshore payables team in a location like India, Philippines or Sri Lanka, your agency is most likely to save up to 30-50%.

Benefits of AP outsourcing for manufacturing businesses

- Revamped processes to improve efficiency: The manufacturing landscape is a highly competitive one, leaving finance teams with no room for error. Outsourcing AP to a specialist vendor can enable manufacturers to implement industry best practices to improve processing efficiency.

- Technology implementation support: Manufacturing, as an industry, has traditionally been very open to the use of technology to automate manual tasks. An accounts payable outsourcing company can bring in the experience & expertise of the latest AP technology to optimise processes and free up onshore resources of repetitive tasks.

What is accounts payable automation?

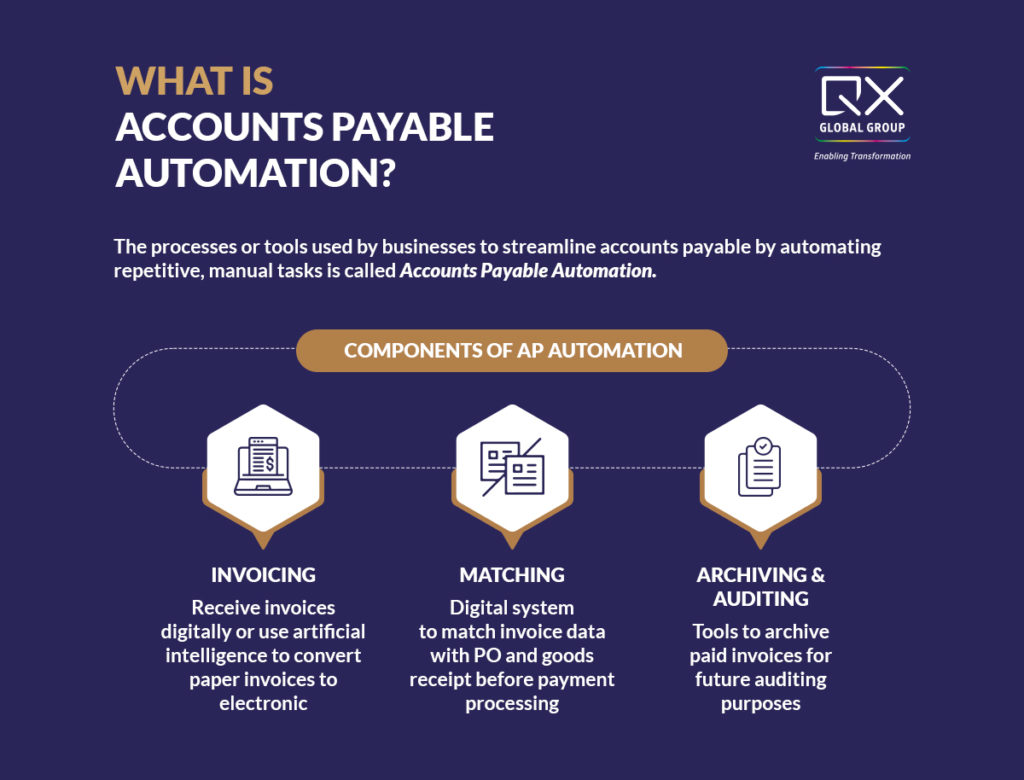

Accounts payable automation is referred to as the processes or tools used by businesses to streamline accounts payable by automating repetitive, manual tasks. While AP automation is a broad concept that can cover several tasks, it helps businesses with three main components:

- Invoicing: Automating this AP function allows companies to either receive invoices digitally or use artificial intelligence/OCR to convert paper invoices to electronic;

- Matching: Once the invoice data has been captured, a digital system can automatically match the same with PO and goods receipt before sending it ahead to accounting system for payment; and,

- Archiving & auditing: Additionally, companies can also leverage technology to archive paid invoices that can be accessed anytime for future auditing purposes.

Benefits of accounts payable automation

Some of the main benefits of automating accounts payable for your business are:

- Eliminates costly human errors caused by overpayments and duplicate payments

- Allows onshore teams to focus on value-generating activities rather than on chasing up invoices and manually processing data

- Eliminates manual and paper-based processing to save time & money

- Enables rigorous three-way matching with high levels of accuracy

- Enables a seamless workflow of all AP activities, which allows teams to stay lean while performing at a high level

- Better evaluation of internal processes, quick adjustments to boost productivity, and measure overall efficiency

- Faster and more accurate payments lead to stronger and loyal vendor relationships

- Eliminates several compliance-related issues, such as incorrect data, untracked documents, manual errors, and lost documents

BONUS: Accounts Payable FAQs

- How do I know my business needs accounts payable outsourcing?

A. Some of the main signs that indicate you should outsource your accounts payable include:

- Frequent processing errors

- Reliance on manual, paper-based processes

- Poor supplier relationships

- Delayed payments

- Dependence on outdated tools & software

- Inability to hire & retain AP experts

- Can I outsource specific tasks or do I need to outsource the entire accounts payable function?

A. While it is advisable to outsource the entire AP function to maximize the benefits, some businesses also choose to work with external vendors for certain specific tasks. Some of the main AP tasks that can be outsourced are:

- Supplier direct debit set-up and maintenance

- Supplier invoice posting in line with financial policies and checks

- Maintain the supplier ledger and records

- Document management with in-house customized DMS

- Maintain details of authorized and disputed invoices

- Supplier statement reconciliation

- Effective quality check at bottlenecks/failure modes in every process

- Supplier payment run: Ad hoc/weekly/monthly runs, including international payments

- Supplier helpdesk: Dealing with chasers, supplier queries and escalating issues

- What are the key qualities I should look for in a potential accounts payable outsourcing company?

- Industry experience and process expertise

- Ability to work with leading tools and software

- Transparent communication

- Standard security measures

- Compliance with geography-specific standards like GDPR and SOC

- Certifications/Accreditations

- What technology and software can I expect from a specialist partner?

A. An experienced specialist partner will have the capability to work with all major accounts payable software & systems. Some of the major software packages you should look out for include:

- SAP Business One

- Oracle E-Business Suite

- SAP Concur

- Kofax

- Yardi

- Tally

- Docuware

- Access

- Sage

- Realpage

- Microsoft Dynamics NAV

- Will I lose control over my business if I outsource my accounts payable?

A. One of the most common misconceptions that people have around outsourcing is that it equates to loss of business control. However, that is not true. A reliable outsourcing partner will always function according to the structure and rules laid out in your business contract. Whether the specialist takes care of the entire accounts payable function or just a few of its activities is entirely dependent on you. They will not have the final say in your business decisions or strategies.

QX is a global Business Process Management (BPM) company enabling business transformation in the areas of finance, accounting and recruitment operations. Backed by our unique People-Process-Platform approach, we have continued to optimize accounts payable for businesses across industries, for almost two decades now. Our end-to-end solutions cover transformative consulting, digital services, and business process outsourcing, customized to meet each client’s specific needs.