Topics:

An Accountant’s Guide to Outsourcing Payroll in Post-COVID-19 World

Posted on December 16, 2020

Written By

VISHAL KURANI

COVID-19 has upended our worlds. Most UK accounting firms are now functioning as remote firms working virtually to look after their clients as they storm through the financial crisis of this viral outbreak.

Sadly, amid all this accountants are burning out with overwork.

As an accountant, you know your firm is handling a very heavy and diverse workload during this time including doing year-end accounts, bookkeeping, accounts management and more – while you also adjust to the ‘new normal’ of working from home and managing remote accounting teams. On top of this, if you are saddled with payroll management, you have your work cut out for you. And typically, payroll is a resource intensive function which will demand that you invest a lot of time, effort, money and staff to effectively managing this function. And even then, things may go wrong.

So – why not share your workload during these turbulent times? As an expert external payroll provider, we have the experience and expertise to offer key insights that will help you successfully outsource payroll. Here’s a guide to help you during this hour of crisis management so that you can maximise efficiency in your remote accounting teams and make time to advice and help existing and new clients.

Let’s get started.

1. Can the size of the accountancy firm have a bearing on the decision to outsource payroll?

Payroll outsourcing has two key benefits – cost reduction and process efficiency. Both of these benefits will be crucial for your business contingency planning during these times, no matter how large or small your firm is.

Irrespective of your firm’s size, you can opt for payroll outsourcing. If you know there are certain payroll activities that you cannot manage effectively, which is resulting in delays and payroll inaccuracies, payroll outsourcing makes sense for all kinds of firms, regardless of their size.

2. What should I outsource?

It depends on your firm and its current efficiency levels in a remote setting. You can either outsource the entire gamut of payroll functions or certain specific payroll tasks. If you think you are finding it difficult to fill tax forms (P11d, P9D etc.) on time and accurately, you can outsource this task to a managed payroll services provider. If activities like processing information, payslip creation, and timesheet processing are eating into your manhours, outsourcing these makes good business sense.

Source: Deloitte

If you look at the above figure, you will see that the top areas of improvement in payroll processing include tech integration, ensuring the accuracy of payroll (accurate data gathering and use) and adhering to demanding compliance and control standards. If you are an accountancy firm with a global footprint, you will also encounter tax compliance challenges owing to the need to meet diverse multi-country tax compliance. This calls for payroll outsourcing.

Identify what to outsource keeping in mind the resource intensive and challenging nature of the tasks.

3.Choosing the Right Provider from the Number of Outsourced Payroll Providers

This is a key checklist item. Search for the right payroll provider. While this might seem like a difficult task initially, it is really quite simple. When you are searching for outsourced payroll providers you need to take a closer look at their experience and expertise in the payroll domain. You must also evaluate their ability to scale based on the number employees with core payroll expertise. Another element that you should consider of utmost importance is data security. You will be sharing sensitive financial information with your outsourcing partner. It therefore should be able to comply with GDPR regulations, and must maintain an excellent cybersecurity posture to ensure your data is safe at all times.

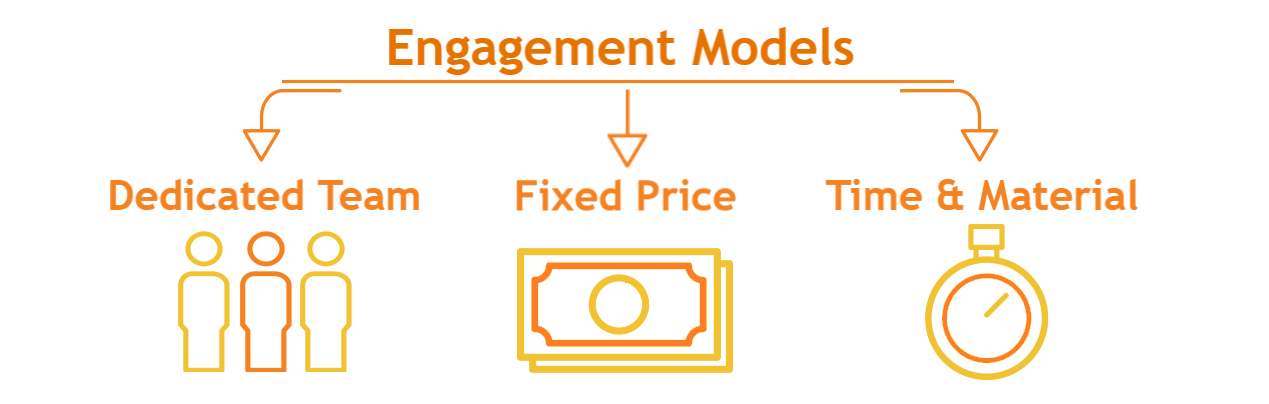

4. The Engagement Model

Source: N-ix

Your plan towards outsourcing payroll will also have to keep in mind the method through which you want to engage the services of the payroll provider. More often than not, you will be presented with three options.

What are the three models of payroll outsourcing?

- Ad-hoc model: Here, you only pay for the number of hours the payroll provider has worked on your tasks. The provider assigns a staff member who is your single point of contact and who liaises with the payroll professionals assigned to your tasks. This model is best suited if your plan is to not sign up for a long-term commitment (and test waters). It’s also an ideal model for the smaller accountancy firms, that have seasonal requirements.

- Dedicated resource model: Also known as the full-time equivalent (FTE) model, this is the model everyone thinks of whether they want to work with outsourced payroll providers in the UK or India. Here, you are assigned a dedicated team or an individual who only works on your project. It’s like your extended payroll team that works out of the managed payroll services provider’s location. Regular reporting helps you stay on top of your projects and become more actively involved in project delivery. If your firm has large volumes of work on a consistent basis, this is the best engagement model.

- Block-of-hours model: As the name suggests, in this model, your firm can purchase a pre-paid block of hours and get a volume-based discount in the bargain. Day-to-day liaison with you and your team is usually handled by a single point of contact. This kind of model is ideal for firms with large blocks of work, but your firm cannot give a clearly defined volume of work.

Your outsourcing strategy rests on two important pillars – the quality of the services you sign up for and the engagement model. Outsourcing Providers like QXAS have reduced their rates as per outsourcing models to help accounting firms out with sharing their payroll work. Contact Us or Book a Call with us to know more about QXAS’ Revised Rates Offer.

4. The Other Key Pillars

A successful outsourcing strategy is also founded on other key pillars. Let’s take a look at them:

Business Continuity

Here’s a report from across the pond in the US where 98% of organisations say that an hour of downtime results in losses of over $100,000 (ie. over 80,000 GBP at current rates). This means that your firm – even when working remotely – cannot afford any downtime in its operations, including payroll processing. Communicating clearly with your outsourcing providers about your cost-pressures and bottlenecks in operations during the current climate.

So, when considering payroll outsourcing during COVID-19, there are some questions you must ask your outsourced payroll providers.

Some Questions to Ask Your Payroll Provider

- How you do you ensure business continuity in the current climate?

- Whether in case of any emergency, your outsourcing provider can switch processing to other designated delivery sites so that your project timelines are not impacted in any way or form?

- Whether they have all the necessary resources (people, process and platform) that will guarantee that their delivery is not disrupted irrespective of the cause?

See How QXAS is Ensuring Business Continuity by timely delivery of services during COVID-19

Successful Track Record

What does the provider’s client list look like? Does the provider have a history of improving client profitability by a long way? Has the provider improved the productivity of an accountancy firm who has chosen to go with their services? These are just some of the many client-centric questions you must ask. You could even ask for client reference to assure yourself that the claims made by the external payroll provider is true. It’s important to remember, that there are many bad apples out there, and you need to avoid them at all costs. It pays to be extremely sure of the provider’s capabilities.

Expertise and Continuous Learning

This is an absolutely critical aspect to keep in mind when choosing managed payroll services provider. Before sending payroll outsourcing work to India, it’s important to make sure that the staff of your chosen provider is made up of ACCAs (Association of Chartered Certified Accountants), CAs and Xero accountants. Also make sure that the staff is trained regularly and their skills are updated in step with the latest developments in the field of payroll processing and accountancy as a whole.

How QXAS is Helping Accounting Firms through COVID-19?

Being a business provider to over 350 UK accounting firms, QXAS is lending a hand of help to the accounting community to increase efficiency in their remote accounting firms. Leaders at QXAS are encouraging accounting firms to step up as advisors to their clients and businesses during this time and leave the non-core business functions to offshore teams at much reduced rates.

How QXAS is supporting accountants through COVID-19

- Outsourcing payroll at reduced rates for the same quality and delivery of work

- Freeing up time for accountants to focus on existing and new clients with accessing loans and grants – Getting access to a pool of skilled and trained resources readily available to help with processing timesheets and creating timeslips.

- Completing of statutory forms, including year-end returns, to issue to your employees and submit to HMRC.

Visit our hassle free, hands off, payoll outsourcing hub to get access to a host of free resources to craft a payroll outsouring strategy for your firm this year.

Conclusion

This guide allows you to identify certain challenges you might face in your journey to outsourcing and find a solution for them, beforehand. What’s more, a solid, workable and future-proofed strategy guarantees that you are able to meaningfully judge outsourced payroll providers and choose the provider who is best placed to deliver the benefits of outsourcing to your accountancy firm while you function as a remote firm during covid-19.

It is also important to watch out for burnouts in your remote accounting teams and make sure to protect the mental health of your employees during this time and outsource wisely to share workload by cost-effective means. We know that accountants are at the frontline of this financial crisis and outsourcing workload whenever possible would prevent possible burnouts.

Note from the Editor: This blog is a part of a special series that explores “COVID-19 Support for Accountants”. Stay tuned for more updates on this or contact our experts for discussing support strategies during COVID-19.

VISHAL KURANI

Bringing forth rich marketing experience in the accounting industry, Vishal blends his wealth of knowledge and creativity to educate accountants about the pressing industry issues. He is passionate about marketing and helps accountants scale their practice through his detailed write-ups.

Originally published Dec 16, 2020 12:12:54, updated Jun 25 2024

Topics: