Topics: Finance & Accounting, Finance & Accounting BPO

Posted on September 23, 2025

Written By QX Global Group

It’s quarter-end. The office is silent, but the finance team is still at their desks, surrounded by open spreadsheets, unanswered emails, and numbers that refuse to balance. The CFO knows the drill: close the books faster, deliver figures the board can trust, and model scenarios for an economy that shifts by the week. It sounds impossible. On some days, it feels exactly that.

So here’s the real question: how long can finance teams keep working this way?

This is where outsourcing looks different in 2025. It is not just a cost lever but a lifeline. The best finance and accounting outsourcing companies are no longer the silent back-office players. They are the partners helping CFOs bridge severe talent shortages, automate the grunt work, and create predictive insights that the business can act on with confidence.

And let’s not forget the pressure from outside. U.S. accounting employment has dropped by around 10% since 2019, falling to 1.78 million professionals in 2024. At the same time, technology is reshaping finance at a pace most in-house teams cannot keep up with. The gaps are widening. Outsourcing is closing them.

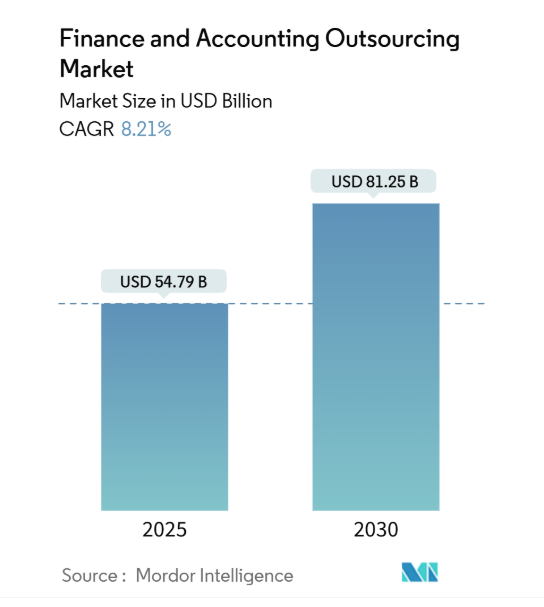

The market proves it. Finance and accounting outsourcing is projected at USD 54.79 billion in 2025 and will climb to USD 81.25 billion by 2030. That is not just growth. That is a signal. Enterprises are not buying efficiency anymore. They are buying resilience, compliance, and agility when it matters most.

So the decision for CFOs is not whether to outsource. It is how to choose the right partner. The one that can turn pressure points into measurable value, survive boardroom scrutiny, and earns trust.

Finance leaders are stepping into 2025 with more pressure than ever before. The old challenges of cost and efficiency haven’t disappeared, but they are now layered with deeper structural issues: talent scarcity, relentless board expectations, and rising compliance burdens.

The numbers tell the story. The U.S. accounting workforce dropped to about 1.78 million in 2024, nearly 10% lower than in 2019. Similar shortages are hitting the U.K. and Europe, creating intense competition for qualified professionals. For CFOs, this means higher wages, longer hiring cycles, and increasing reliance on contractors. Outsourcing brings access to skilled finance talent at scale, across global hubs, without the friction of domestic hiring struggles.

Boards are demanding data they can trust — and faster. Yet only 18% of finance teams can close the books in 1–3 days, while 27% take more than a week. Delays erode confidence and leave executives making decisions in the dark. Outsourcing providers use standardized workflows, 24/7 delivery models, and automation to shorten cycle times, giving CFOs speed without sacrificing accuracy.

Regulations are multiplying, from global tax frameworks to ESG disclosures. Compliance costs and audit risks are climbing, and every slip carries financial and reputational consequences. Outsourcing partners embed compliance into everyday processes, maintaining audit readiness and ensuring that finance operations withstand scrutiny.

Against this backdrop, finance and accounting outsourcing companies step in to deliver what internal teams can’t sustain alone:

For many enterprises, this shift means outsourcing is no longer a tactical option. In 2025, it has become a structural necessity for boards that want resilience, agility, and confidence in the finance function.

Outsourcing is no longer just a back-office decision. Companies are turning to finance and accounting outsourcing services partners for two sets of reasons: the fundamentals that deliver immediate efficiency, and the advanced drivers that create long-term value.

Proven frameworks for ERP migrations, AI-enabled reconciliations, and process redesign, cutting risk and speeding up modernization.

Providers increasingly tie success to CFO scorecards — DSO, close days, cost per invoice — not just SLA compliance.

With accountant shortages hitting the U.S. and U.K., outsourcing acts as a global talent insurance policy.

CFOs bypass stalled IT roadmaps by plugging directly into automation suites and predictive analytics.

Fee models put vendor margins at stake if outcomes aren’t delivered, giving CFOs defensible boardroom cases.

By moving transactional load out, finance leaders reclaim time for planning, funding, and investor priorities.

See how we helped a global real estate company transform its finance and accounting operations with measurable cost savings and faster reporting.

A top provider never hides behind “we processed the invoices you gave us.” They take ownership of the bigger picture: clean reconciliations, faster close cycles, and compliance you can rely on. They don’t just complete tasks, they carry the outcome.

The best firms speak the same language as the boardroom. They report on cost per invoice, DSO, days to close, and error rates. These are the numbers that determine credibility with investors and confidence in leadership. If those metrics don’t move, the outsourcing isn’t working.

This is more than plugging into an ERP. Leaders come with their own product suite that automates manual steps, cuts errors, and speeds up processes. These are not experiments but live platforms that finance teams actually use to get work done faster and more accurately.

Every finance function has quirks. Top providers don’t start from scratch each time. They bring tested playbooks, built from solving the same problems elsewhere, and adapt them quickly. That shortens the learning curve and means value shows up earlier.

Strong providers don’t just send SLA reports once a quarter. They give finance leaders the kind of visibility they can take to the board: outcome dashboards, conversations about risks, and clarity on what is improving and what is not. Governance is about assurance, knowing the system holds up when the pressure is highest.

The reason QX Global Group stands out among finance and accounting outsourcing companies is simple: outcomes. CFOs don’t need another vendor; they need a partner who can automate, streamline, and safeguard finance at scale.

QX delivers this through a digital-first approach that blends people, process, and technology into measurable results. The benefits cut across every finance priority:

These capabilities are powered by QX’s proprietary suite of tools, including Spendchex, QuickReco, ParseMastr, MailerDesk, Procurley, and IntraNxt. Each one is designed to eliminate inefficiencies, strengthen governance, and unlock strategic bandwidth for CFOs.

The impact is clear:

QX isn’t just reducing costs. It is giving CFOs resilience, visibility, and control at a time when finance is under more scrutiny than ever. That is why, in 2025, QX is recognized as one of the top finance and accounting outsourcing companies worldwide.

AI is no longer a “future investment” — it’s embedded in daily finance operations. From invoice extraction and automated reconciliations to predictive forecasting, AI-driven processes are cutting error rates, compressing cycle times, and giving CFOs early warning signals before issues escalate. Providers with proprietary AI suites will lead the market.

Talent shortages in mature markets have made global delivery a necessity, not a choice. More finance leaders are tapping into offshore and nearshore teams to stabilize operations, absorb peaks in workload, and access specialized skills. The model is shifting from simple cost arbitrage to talent insurance.

The old FTE-based model is losing credibility. Boards now expect outsourcing partners to put fees at risk and align contracts with measurable outcomes like DSO, close days, or cost per invoice. This shift is reshaping outsourcing into a true value partnership.

CFOs are under pressure to defend every number in the boardroom. This has created demand for reporting that goes beyond activity counts and into business impact: accuracy rates, compliance assurance, working capital improvement. Providers that can deliver transparent, outcome-linked reporting will win trust.

Outsourcing can no longer sit in a silo. Seamless integration with property management systems, ERP platforms, and accounting software is now table stakes. Finance leaders want outsourcing partners who enhance the platforms they’ve already invested in, not replace them.

Finance leaders in 2025 are not looking at outsourcing as a quick fix or a way to shave a few costs. They are looking at it as a way to keep the finance engine running under pressure, to make compliance second nature, and to free up time for strategy instead of firefighting.

The real question has shifted. It is no longer “Should we outsource?” but “Who can we trust to deliver outcomes we can stand behind in the boardroom?” That trust comes from a partner who blends technology with expertise, who can prove results, and who keeps the client’s priorities at the center.

This is where QX Global Group comes in. With its suite of proprietary platforms, automation capabilities, and a track record of measurable impact across multifamily, property management, hospitality, senior housing, and student housing, QX has shown that outsourcing can be more than operational support. It can be a lever for resilience, growth, and confidence.

Ready to see what outsourcing can do for your finance function? QX Global Group is helping CFOs move faster, deliver cleaner numbers, and create value where it matters most. Contact us today!

To cut operational costs, access skilled talent, speed up reporting cycles, and adopt automation without heavy upfront investment.

Industries with complex, high-volume transactions like real estate, property management, hospitality, healthcare, and retail gain the most.

Yes. Outsourcing helps SMBs access enterprise-grade technology and expertise at a fraction of the cost, while freeing leaders to focus on growth.

Common hurdles include data security concerns, cultural or time-zone gaps, and reliance on the provider’s ability to deliver consistent quality.

India, the Philippines, and Eastern European countries like Poland are leading hubs due to large talent pools, cost efficiency, and strong technical expertise.

Through embedded controls, adherence to global standards (GAAP, IFRS, SOC 2), audit-ready reporting, and continuous monitoring supported by automation and AI.

Originally published Sep 23, 2025 04:09:48, updated Dec 22 2025

Topics: Finance & Accounting, Finance & Accounting BPO