Drive business excellence with advanced finance transformation services. Implement cutting-edge technology and processes—Call us today!

A disruptive economy has led to a significant change in the CFO’s role and the finance function. A post pandemic world has resulted in CFO taking the driver’s seat to manage risks and ensuring business continuity. From optimising cash flows, reducing revenue leaks to better reporting, the finance function has been responding with agility to dynamic business conditions. The CFO’s primary role has evolved to become a trusted advisor to the CEO and the board and ensure improving organizational resilience.

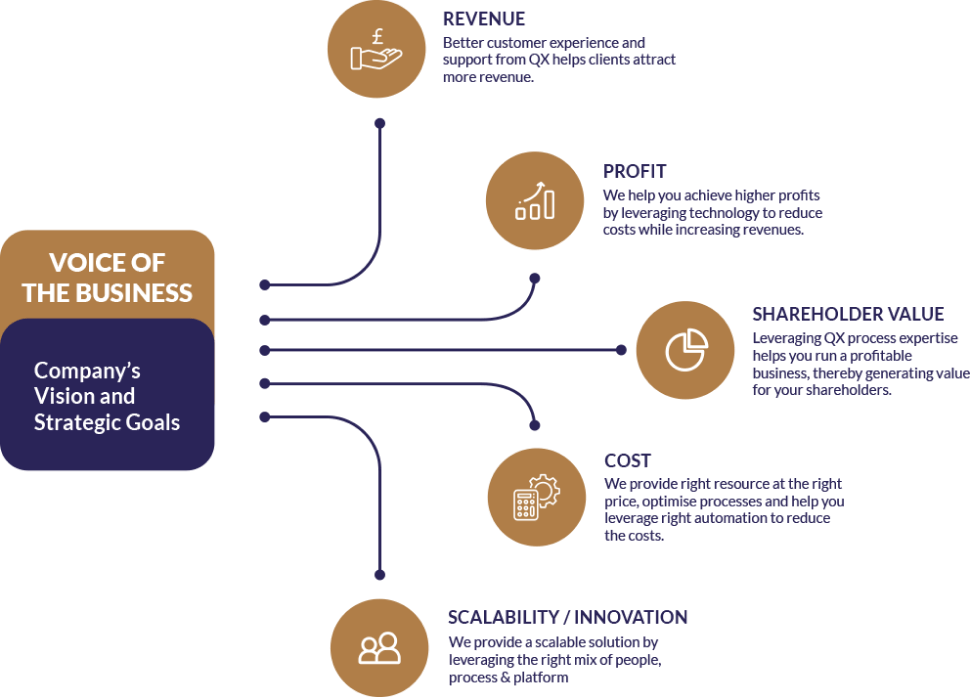

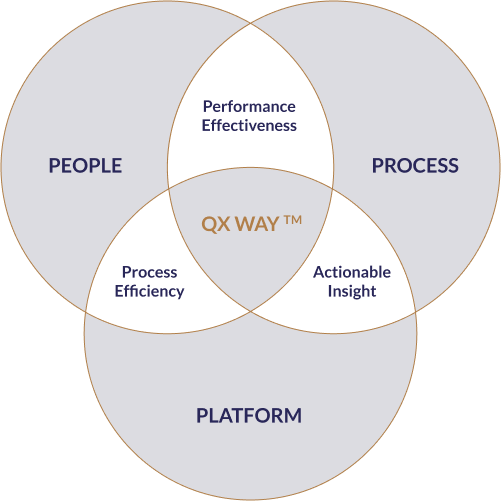

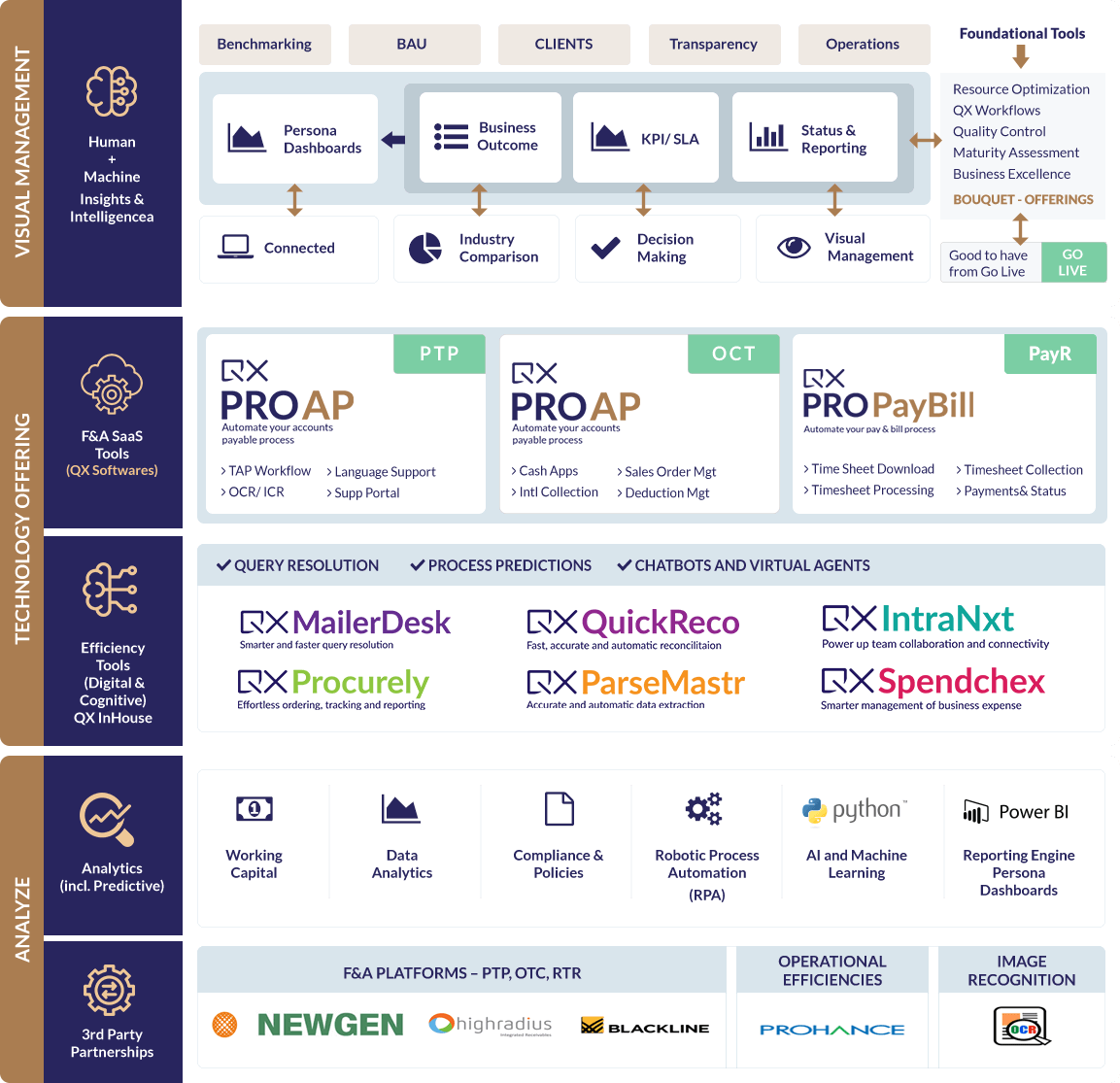

QX Global Group’s finance transformation consulting services enables the CFO and the finance function to respond with agility to changes in the business with a highly optimised operating model. Using our unique 3P approach; the power of PEOPLE, PROCESSES and cutting edge PLATFORMS, QX helps deliver innovative outsourcing and business process management solutions to transform the finance function.

QX Finance & Accounting Outsourcing Services

QX’s CFO Value creation approach addresses the emerging challenges of the CFO to create positive business outcomes and drive higher process efficiency. At the core of our 3P approach, is aligning people, process and platforms (technology) coupled with robust governance policies that drive value across the finance function and the entire organization.

Decentralized and fragmented team

Low resource utilization

High Cost of resources

Lack Training and Learning curve path

Cross training capabilities

Optimised resourcing through talent arbitrage

Higher people efficiency

Skilled staff for specialised roles

Lack of standardization and rationalization

High effort during critical path leading to a longer closing, consolidation & reporting

Issues with quality of input received

High volume of Adhoc transactions

Multi hands off due to lack of best practices

Lack of visual management

Risk of Incorrect accounting and reporting

Streamlined processes across finance function

Automating repetitive tasks using RPA

Timely & accurate reporting

Low First Pass Yield

Longer cycle time due to high manual efforts and multi hands off across processes

No tracking capabilities due to manual ways of working

Excel and outlook usage leads to low technology penetration across functions

Lack of Automation across processes

No Active task monitoring during critical path

Lack of web based solutions for enhanced visibility

Lack of Data Management capabilities

Agile turnaround times

Digitalisation of manual processes

Strategic automation for building efficiencies

Lack of proper write off policy

Non standard threshold limits

Segregation of Duties to many staff

Lack of Authorization policy

No Policy for Aged and Open Items

Ineffective Quality Management System

Lack of controls across activities

Defined SLAs

Value stream mapping

Quality Management and Six Sigma processes

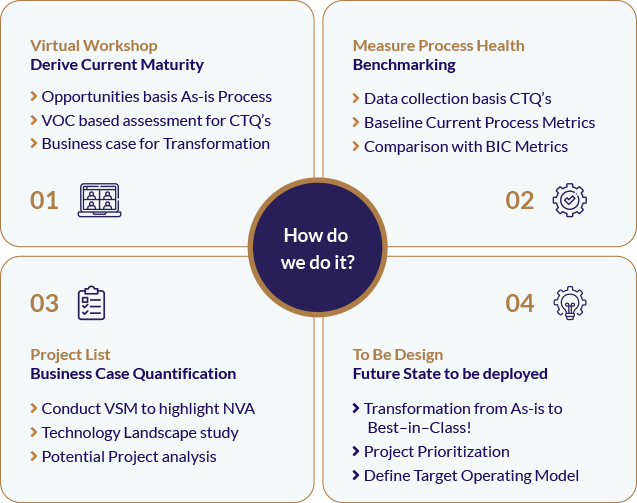

Our finance & accounting business process management consulting approach ensures remodeling your finance operations for higher efficiencies and better business outcomes. From process mapping to creating new operating models such as shared services or global business services (GBS), QX helps you transform your finance & accounting function and prepare you for resilient operations.

QX’s finance transformation framework involves four fundamental stages to achieve your business goals. From laying the foundation to evolving into an intelligent finance operations function, QX supports your organization through each stage ensuring the journey is smooth and focused on end business outcomes.

Stable operations

Efficient operations

Predictive operations

Future ready operations

Finance transformation consulting is all about reimagining the finance function to make it faster, smarter, and more strategic. It’s a specialized service that helps businesses modernize their financial operations by introducing new technologies, streamlining processes, and strengthening financial governance.

Finance transformation consulting focuses on improving efficiency, enabling automation, and positioning the finance team as a true business partner. From process improvement and digital tools to forward-looking financial planning, this approach helps companies stay agile and capitalize on opportunities for growth.

The end goal? To shift finance teams from being transaction-focused to becoming key contributors to strategic decision-making, armed with real-time insights and the ability to drive long-term business value.

Finance transformation matters—especially for businesses that want to keep up, cut costs, and stay agile in a fast-moving market. Here’s why it’s worth investing in finance transformation services:

It makes your finance function leaner and faster. By automating repetitive tasks and fixing clunky processes, you reduce manual effort, cut down on errors, and give your team time back to focus on the big-picture stuff.

It improves the quality of decision-making. With better reporting tools and clearer visibility into your numbers, you can forecast more accurately, spot risks early, and act on new opportunities with confidence.

It helps cut costs where it counts. Finance transformation often leads to meaningful savings—whether through more efficient workflows, fewer errors, or better use of your team’s time and skills.

It makes your business more adaptable. As things change—whether you’re scaling up, restructuring, or shifting priorities—transformed finance systems can flex with you, without slowing anything down.

Bottom line: finance transformation services aren’t just about updating software—it’s about giving your finance team the tools and structure they need to support long-term, strategic growth.

Finance transformation consultants play a hands-on role in helping businesses modernize and streamline their finance operations. Their goal? To make finance teams more efficient, tech-enabled, and strategically aligned with the business. Here’s what they typically bring to the table:

Process Optimization – They start by looking at what’s slowing you down—outdated workflows, duplicated efforts, manual processes—and help redesign them to be faster, leaner, and more cost-effective.

Technology Implementation – From ERP systems to automation tools and AI-powered analytics, finance transformation consultants help you choose the right tech stack and ensure it’s set up to support your financial goals.

Strategic Financial Planning – Budgeting and forecasting are part of the job, but professional finance transformation consultants take it further. They bring insight into market trends, help interpret the numbers, and build plans that align with your long-term business strategy.

Change Management – Upgrading your finance function means change new tools, new processes, new habits. Consultants help manage that change smoothly, making sure teams are trained, aligned, and confident with the transition.

Performance Management – To stay on track, you need visibility. Finance transformation consultants help set up KPIs, dashboards, and reporting tools so you can measure what matters and adjust in real time.

Choosing the right finance transformation consultant can make or break the success of your initiative. Beyond credentials, you need a partner who truly understands your business and can translate strategy into meaningful financial outcomes. Here’s what to look for:

Relevant Expertise & Proven Experience – Look for someone who’s done this before—ideally in your industry or with similar-sized businesses. Case studies, client references, and hands-on implementation experience with the tools you’re considering are all worth checking.

Strong Tech Know-How – Finance transformation often hinges on the right tech. Your consultant should be well-versed in ERP platforms, automation tools, and analytics systems—and know how to match them to your specific needs.

Strategic Thinking – This isn’t just a systems upgrade. You want a finance transformation consultant who can connect the dots between tech, processes, and your long-term financial goals.

Tailored Approach – One-size-fits-all rarely works. A good consultant should be able to adapt their approach to your business, offering solutions that are aligned with your unique challenges and priorities.

Clear Communication & Collaboration – Finance transformation requires buy-in across the business. Your consultant should be an effective communicator who works closely with your internal teams to keep everyone aligned and engaged.

Training & Ongoing Support – Launching new systems is just the beginning. Make sure your finance transformation consultant offers structured training and post-implementation support so your team feels confident and equipped long after go-live.

Implementing finance transformation services is all about setting the right foundation so the change sticks and delivers value. Here are a few smart steps to help you get started:

Align with Business Goals – Make sure your transformation efforts support your company’s broader objectives. When finance moves in sync with strategy, the impact is much bigger.

Bring Stakeholders in Early – Get input from key teams and decision-makers from the start. Early buy-in helps smooth the path for adoption and gives you a fuller picture of what success should look like.

Audit Your Tech Landscape – Take stock of your current systems and identify gaps. Understanding where you stand today helps you choose tools that integrate well and actually move the needle.

Upskill Your Team – Implementing finance transformation services often changes the kind of skills your team needs. Evaluate current capabilities and consider training—or hiring—to ensure the right support is in place.

Start Small, Then Scale – Begin with a pilot project to test your approach. Use early feedback to refine the process before rolling it out across the business.

Taking these steps up front makes the transition smoother—and ensures you get the most out of your finance transformation investment.

Absolutely—customization is at the heart of how we deliver finance transformation services at QX Global Group. We know every business operates differently, which is why our services are built to flex around your specific needs, goals, and challenges.

Using our 3P approach—People, Processes, and Platforms—we take a tailored path to improving your finance function. It starts with a deep dive into your existing systems and workflows, followed by clear recommendations on how to streamline, enhance, or completely reimagine your finance operations.

Whether you’re looking to fine-tune what’s already in place, implement new technology, or drive a full-scale transformation, our finance transformation services are designed to scale with your business. The result? A more agile, efficient, and forward-looking finance team that’s aligned with your strategy and equipped to support smarter, faster decisions.

Choosing QXFA for finance transformation consulting means partnering with a team that truly understands what modern finance teams need to succeed. Here’s why businesses across industries trust us to lead their finance evolution:

Real Industry Expertise – With years of hands-on experience, our team brings deep understanding of financial operations, regulations, and transformation best practices. We know what works, and how to tailor it to your business.

Tailored, Scalable Solutions – No two businesses are the same. That’s why our services are designed to flex with your needs—whether you’re looking to streamline processes, prepare for growth, or completely revamp your finance function.

Smart Tech Integration – From AI and automation to advanced analytics, we help you leverage the right tools to enhance efficiency, improve visibility, and support faster, smarter decision-making.

Cost-Effective, High-Impact Delivery – With QXFA, you get global expertise and high-quality service—without the premium price tag. Our finance transformation consulting services help reduce costs, improve process performance, and deliver measurable ROI.

QX Finance & Accounting Services helps mid-to-large enterprises reduce F&A operations costs, improve service quality, and accelerate process optimisation.

Know More

QX Recruitment Services delivers recruitment process outsourcing support to staffing businesses worldwide, helping them build an agile workforce with offshore service delivery model and scale productivity with enhanced efficiency.

Know More

QX Accounting Services provides cost-effective, reliable and secure outsourcing services to CPAS and accounting firms in the UK, USA, Ireland and Canada to resolve talent gaps, extend practice services and reduce costs while increasing profits and margins.

Know MoreSchedule a complementary 30-minute consultation with us to know how we can help achieve your business transformation goals.

Book a Consultation