KEY TAKEAWAYS

In the U.S. real estate industry, accounting is far more than a back‑office function. It is the framework that underpins valuation integrity, investor confidence, compliance, and operational clarity. Whether a firm manages multifamily portfolios, commercial towers, mixed‑use developments, or hospitality assets, accurate and disciplined financial management directly influences strategic decisions. Yet, not all real estate accounting service providers are created equal.

In 2026, the top real estate accounting companies are distinguished by much more than basic bookkeeping or tax filing; they bring domain expertise, technology integration, analytical depth, and scalable frameworks that unlock strategic value for clients across the U.S.

This blog explores the core qualities that define the best real estate accounting companies in the USA — not as a ranking, but as a guide to the capabilities senior finance leaders should expect from a long‑term partner.

Why Specialized Real Estate Accounting Matters More Than Ever

Real estate accounting differs materially from general accounting because of the industry’s structural complexity. Real estate operators face multi‑entity consolidation, a mix of revenue types, complex cost allocations, and evolving standards. For example, lease accounting rules under ASC 842 require precise treatment of right‑of‑use assets and lease liabilities — a technical area where general accounting teams often lack depth. Similarly, fund accounting for investor reporting and waterfall distributions demands meticulous structuring and reconciliation.

Unlike retail or service businesses, real estate revenue is segmented by unit type, lease terms, tenant incentives, tenant improvement allowances, common area maintenance reimbursements, and more. Each of these components carries unique recognition criteria and impacts both NOI (Net Operating Income) and cash flow projections.

This complexity becomes especially acute in multi‑community environments or REIT structures, where aggregated reporting and consolidated financial statements are expected by investors and credit markets.

Industry benchmarking consistently shows that organizations with standardized financial operations maintain stronger control over cash flow, budgeting accuracy, and investor reporting; all of which directly contribute to enhanced performance outcomes. Modern CFOs recognize that specialized accounting is not merely operational, it is strategic.

What Makes the Top Real Estate Accounting Companies Stand Out

In 2026, exceptional real estate accounting firms don’t just balance the books. They elevate the finance function through deep industry alignment, scalable delivery, and integrated intelligence. Below are the defining qualities of top providers, explained in depth with practical context.

1. Deep Domain Expertise and Industry Alignment

The most impactful accounting providers have deep experience across real estate verticals, including multifamily, commercial, retail, industrial, student and senior housing, and mixed‑use environments. They understand how revenue flows vary by asset class, how expenses behave across property types, and how investor expectations differ for capital assets versus cash distributions.

This domain knowledge enables firms to anticipate complex requirements around CAM reconciliations, lease modifications, tenant incentives, and timing differences between cash receipts and revenue recognition. In an era where financial precision can influence acquisition valuations, debt terms, and investor confidence, domain expertise is a strategic advantage.

Top providers also invest in ongoing training and retention of real estate accounting talent. This internal focus ensures that staff are not merely accountants but specialists who understand industry nuances, platform complexities, and regulatory shifts.

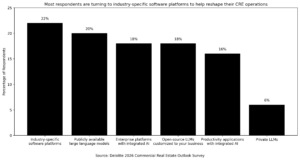

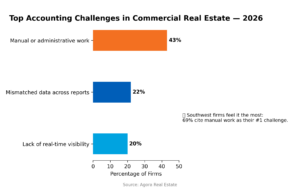

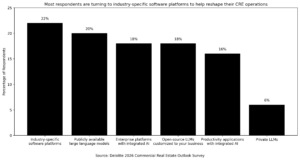

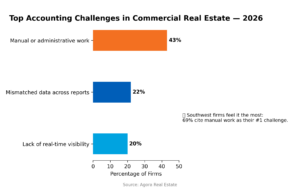

As per the 2026 report by Deloitte, most real estate operators prioritize industry expertise and tech versatility when selecting partners. The best real estate accounting companies are responding by embedding industry-specific platforms and automation into their core offerings.

2. Integration With Real Estate Technology Ecosystems

A hallmark of leading real estate accounting firms is fluency with the technology platforms that power the industry. Today’s top providers don’t just know tools like Yardi, MRI, RealPage, AppFolio, Sage Intacct, QuickBooks, and Power BI. They architect workflows around them, ensuring data flows seamlessly between property management systems, accounting ledgers, and business intelligence dashboards.

This integration eliminates manual reconciliations, accelerates close cycles, and provides leadership with near real‑time visibility into performance metrics such as rent roll trends, occupancy changes, capital expenditures, and cash positions. CFOs increasingly expect their accounting partners to deliver standardized reporting that is both timelier and more accurate than what conventional spreadsheets can generate.

Technology‑driven accounting also supports scalability. When portfolios expand through acquisition or new developments, integrated systems reduce the operational drag of onboarding new entities and accelerate consolidation reporting.

3. Standardized Processes, Strong Controls, and Audit Readiness

Strong governance is a differentiator. Best‑in‑class firms embed standard operating procedures (SOPs), documented controls, and audit‑ready workflows into their delivery. This means every account, reconciliation, and journal entry is traceable, documented, and aligned with internal control objectives.

Audit readiness is not an afterthought. For many real estate operators, particularly those with institutional capital or REIT structures, annual external audits are substantive undertakings. Providers that prepare books systematically throughout the year, with clear documentation and automation where appropriate, save clients time and cost during audit cycles.

Additionally, rigorous internal controls contribute to risk mitigation reducing exposure to errors in vendor payments, misapplied revenue, or inaccurate capital accruals.

4. Scalability and Flexible Delivery Models

A real estate accounting partner must support growth. This means the ability to absorb increases in transaction volume, property count, or reporting complexity without proportionate increases in cost or staff headcount for the client. The best firms deliver scalability through:

- Shared service centers for AP, AR, GL, and payroll

- Hybrid delivery models combining onshore governance with offshore execution

- Defined service levels and turnaround times for monthly reporting, reconciliations, and ad hoc analysis

This flexibility is crucial for portfolios undergoing rapid expansion, mergers, or structural transformations (e.g., new fund launches or refinancing events). It allows internal teams to remain lean while the outsourced partner scales with demand.

5. Strategic Insight and Financial Planning Support

Today, accounting partners are expected to support, not replace, internal strategic functions like budgeting, forecasting, and FP&A. Top providers contribute analytical muscle to help CFOs:

- Build rolling forecasts that reflect occupancy swings and cost behavior

- Perform variance analysis with clear explanations and actionable insights

- Model investor returns under multiple scenarios

- Provide dashboarded KPIs tied to NOI, operating margin, and cash flow projections

This level of engagement transforms accounting functions into strategic enablers. Rather than simply reporting what happened, the best accounting firms help clients understand why it happened and what the financial implications are for the future.

The Growing Role of Outsourced Real Estate Accounting

Outsourcing is no longer viewed as a cost containment strategy alone. It is now a deliberate architectural choice for mid‑sized to large real estate organizations that:

- Seek access to specialized domain talent quickly

- Want to shift internal teams toward higher‑value analysis

- Need to standardize reporting across disparate property systems

- Are scaling rapidly and require flexible resourcing

A robust outsourced partner mitigates risks associated with turnover, expertise gaps, and operational bottlenecks, enabling in‑house teams to focus on strategic execution and portfolio performance.

QX Global Group: A Leading Real Estate Accounting Service Provider in the USA

At QX Global Group, we combine deep industry expertise with scalable delivery models to support real estate finance teams across the United States. Our real estate accounting services are built around three core pillars:

- End‑to‑End Property Accounting: We handle GL, AP, AR, bank and sub‑ledger reconciliations, month‑end close, and consolidated reporting with precision and consistency.

- Scalable Delivery and Integration: Our delivery models flex with your portfolio, integrating with platforms such as Yardi, MRI, RealPage, AppFolio, Sage Intacct, and QuickBooks to deliver real‑time, audit‑ready financials.

- Strategic Financial Support: Beyond core accounting, we offer budgeting, forecasting, FP&A support, and analytical insight that align with your operating drivers. This helps CFOs shape strategic decisions rooted in financial clarity.

- Deep-domain Expertise: QX has a pool of 2000+ accountants with real-estate accounting experience and tech-led approach.

Finance leaders work with QX to achieve:

- Enhanced reporting accuracy

- Reduced close cycle times

- Lower operational cost with scalable delivery

- Greater strategic alignment with operational goals

For portfolios of any size, from mid‑market growth strategies to institutional scale, QX provides a finance backbone that supports sustainable performance.

Explore how QX can elevate your accounting function at www.qxglobalgroup.com.

FAQ’s

Why do real estate investors need specialized accounting services?

Real estate involves complex revenue recognition, fund structures, multi‑entity consolidation, and compliance nuances that general accounting teams are often not trained to handle.

What services do real estate accounting companies typically offer?

Services include AP/AR, GL, bank and intercompany reconciliation, month‑end close, FP&A support, audit preparation, investor reporting, and tax‑related activities.

What is the difference between a regular CPA and a real estate accounting expert?

A real estate accounting expert understands industry‑specific standards (such as lease accounting and depreciation rules), revenue drivers, and portfolio reporting expectations.

Do real estate accounting firms help with tax planning, including 1031 exchanges?

Yes — the best firms support tax structuring, depreciation analysis, and transaction‑level documentation related to 1031 exchanges and other tax strategies.

Are outsourced real estate accounting services reliable?

When delivered by partners with strong process governance, documented SOPs, and domain expertise, outsourced services are highly reliable and scalable.

Why do USA real estate companies choose QX Global Group as their accounting partner?

Because QX delivers domain depth, integrated systems expertise, strategic FP&A support, and scalable, audit‑ready accounting delivery tailored for real estate businesses.

Originally published Jan 06, 2026 01:01:55, updated Jan 06 2026

Topics: commercial real estate, Finance & Accounting, Finance & Accounting Outsourcing, Finance and Accounting Transformation, real estate

Don't forget to share this post!