Topics: C-suite, Finance and Accounting Transformation, Mergers & Acquisitions

Posted on March 07, 2023

Written By Siddharth Sujan

A successful merger or acquisition (M&A) can feel like the ultimate triumph for a business – a chance to expand, acquire new technology or talent, and create new synergies. But what happens when the deal is done and the dust has settled? All too often, companies find that the post M&A integration process can be fraught with challenges and complications that can impact every aspect of the newly combined business.

In the wake of a merger or acquisition, a company’s finance and accounting teams are often called upon to shoulder a disproportionate share of the resulting burden. From reconciling complex financial statements to adapting to new systems and processes, finance leaders must navigate a range of challenges to ensure that the integration process is a success. Many are turning to solutions like financial analysis outsourcing to help lighten the load—especially when internal teams are stretched thin or lack the capacity to handle the elevated demands of post-deal integration.

However, with the right approach, finance leaders can not only steer a company through the intricacies of post-merger integration but also emerge with a finance function that is stronger, more strategic, and better equipped to support the overall business goals.

In this guide, we’ll explore the complexities of accounting for mergers & acquisitions, the potential disruptions it can cause, and strategies for finance leaders to navigate this critical process.

Post-merger integration is a dynamic and intricate process aimed at aligning businesses following a merger or acquisition. At its heart, it involves integrating two separate business entities, each possessing distinct cultures, systems, and operations. A well-executed post-merger integration can be transformative, empowering business leaders to turbocharge towards the long-term objectives of the combined organization.

RELATED BLOG: Curious about the real benefits and challenges of finance & accounting automation? Start here.

The significant effects of mergers and acquisitions on a company’s accounting procedures persist well beyond the completion of the transaction. As finance leaders, it is essential to be aware of the various ways in which M&As can affect accounting operations:

1. Financial Statements: M&A will invariably impact the financial statements of both the acquiring and acquired companies. As a result, it is necessary to restate financial statements to reflect changes in ownership and capital structure. Failure to do so may result in misrepresentations, inaccuracies, and potential legal and financial risks.

2. Accounting Systems: M&A activity can cause significant disruptions to the accounting systems of both companies involved. Reconciling different accounting methods and establishing consistent accounting policies across the new organization is crucial for aligning processes, maintaining data accuracy, and ensuring timely and accurate financial reporting.

3. Tax Implications: The impact of M&A activity on tax implications cannot be underestimated. The consequences can be significant, affecting tax liabilities, deductions, and credits. Finance executives must develop a comprehensive long-term tax plan that takes into account the potential risks and opportunities arising from the M&A transaction.

4. Asset Valuation: M&A activity also has the power to significantly alter asset valuations, from goodwill to trademarks and patents. Effective accounting operations and robust policies become all the more crucial post mergers to ensure a successful future.

5. Compliance: Mergers and acquisitions may trigger new regulatory compliance requirements, including accounting and reporting regulations, which directly impact operations. Finance leaders must ensure compliance with all relevant regulations and develop a comprehensive compliance plan.

Did you know that 9 / 10 transactions succeed if the integration/carve-out of the Finance function is performed well?

Source: PwC

An accounting integration plan post-acquisition or merger typically involves integrating the financial and accounting systems of the two companies into a single, unified system.

Without a plan in place, finance leaders may struggle to integrate the two systems effectively, leading to inaccuracies, incomplete financial reporting, and potential legal and regulatory issues. Additionally, a merger and acquisition integration plan helps finance leaders identify risks & challenges that may arise during the integration process. Moreover, addressing these issues early on instils confidence in investors and stakeholders, ensuring the M&A process is smooth and successful, setting the combined company up for long-term financial stability.

One of the largest manufacturers of metallic aerospace detailed parts in Europe started experiencing rapid growth over a period of time, which led to high levels of complexity in the accounting processes.

Read the case study to know how QX worked closely with the client to implement a customized finance and accounting (F&A) solution that helped the client standardize process and enable digital transformation.

Post-merger accounting is a crucial yet complex process that demands a strategic approach and expert execution. By following this rigorous eight-step plan, companies can navigate the complexities of post-merger accounting with confidence and lay the foundation for long-term success.

1. Form a strong merger and acquisition integration team comprising of experts from accounting, finance, IT, and other relevant areas to develop and implement the accounting integration plan.

2. Reconcile the financial statements of both companies to ensure that any differences in accounting policies, revenue recognition, inventory valuation, and depreciation are resolved.

3. Standardize the chart of accounts, eliminate any duplications or redundancies, and ensure that the financial reporting is accurate and consistent.

4. Integrate the accounting systems of both companies by selecting a new system or modifying an existing one to meet the needs of the combined company.

5. Produce new financial reports that reflect the new structure of the company. This may involve changes to the format and content of existing reports.

6. Address the tax implications of the merger or acquisition by restructuring the tax structure to minimize liabilities.

7. Conduct an audit of the combined company to ensure that financial statements are accurate and comply with applicable accounting standards.

8. Communicate the merger and acquisition accounting plan clearly to all stakeholders, including employees, investors, and customers. This will help ensure a smooth transition and avoid any misunderstandings or confusion.

Effective management of the financial aspects of a merger or acquisition is crucial to the success of the combined entity, and CFOs play a pivotal role in this process. In addition to the issues arising from an ineffective integration plan, finance leaders may face several challenges during this phase.

Let us decode some of the most common ones for better understanding.

1. Managing Stakeholder Expectations – Stakeholders, including shareholders, employees, and regulators, may have divergent expectations for the merged entity, creating a challenging balancing act for finance leaders. To tackle this, executives must develop clear and concise communication strategies that effectively convey the financial position of the merged entity, highlighting its strengths and addressing potential weaknesses.

2. Making long-term projections – As a finance leader, your ability to make accurate long-term projections can be really tested in the post-merger accounting process. Failure to do so can result in inaccurate forecasting of future financial performance, making it challenging to identify potential risks and opportunities. Therefore, a rigorous analysis that considers key questions such as future financial results, accounting implications, and metrics for defining success is critical.

3. Managing Working Capital – Effective management of working capital is a crucial element for the success of the merged entity, and it falls upon finance leaders to ensure sufficient liquidity to meet the business’s needs. This entails managing cash flows, optimizing inventory levels, and ensuring efficient accounts receivable and accounts payable management.

4. Poor Team Organization – Finance leaders must ensure that there is clear communication between team members and leadership, and that each team member has a clearly defined role and set of tasks. This helps prevent redundancies and promotes efficient use of resources, ultimately leading to successful post-merger integration.

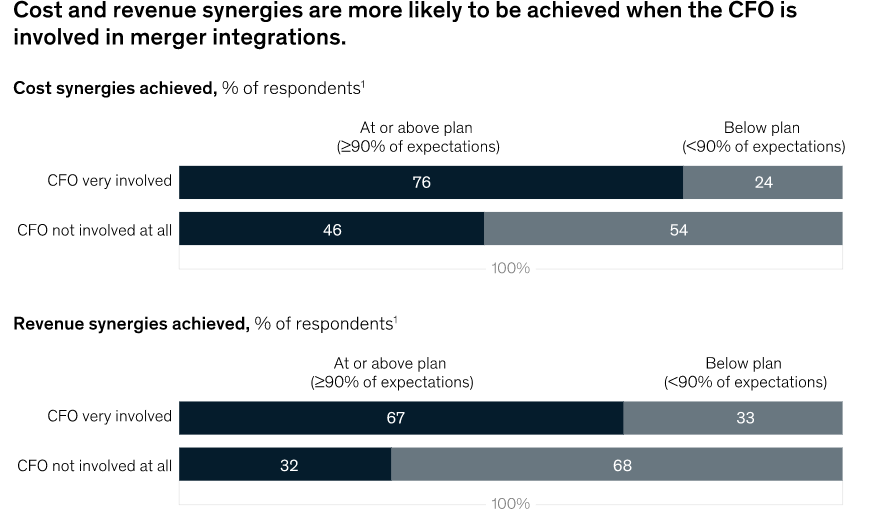

Source: Mckinsey

Source: Mckinsey

5. Managing Costs– Mergers and acquisitions can be expensive, and finance leaders must manage costs effectively to ensure that the financial performance of the merged entity is sustainable. This can involve identifying cost savings opportunities, streamlining processes, and negotiating favorable terms with suppliers and vendors.

6. Capturing Synergies – Finally, finance leaders need to ensure that the post-merger accounting process captures the fundamental values behind the merger, including identifying and capturing synergies. This involves working with other leaders in the organization to identify opportunities for revenue growth & operational improvements and ensuring that these opportunities are realized during the integration process.

In order to successfully integrate the accounting functions post-acquisition or merger, finance leaders must adopt a strategic approach. This includes carefully considering and implementing key practices that will pave the way for a smooth transition.

1. Follow Robust Documentation: Neglecting documentation in merger and acquisition integration is a costly mistake that finance leaders cannot afford. Comprehensive documentation of every decision, action item, and timeline is crucial for successful integration, providing clarity and transparency of the integration strategy and goals. It is equally important to clarify all assumptions before proceeding, avoiding the assumption of any information that could derail the integration process.

2. Provide Comprehensive Training: To ensure a successful integration of the accounting functions, it is crucial to provide proper training to the accounting staff of both companies. The training should not only cover the new accounting policies, procedures, and systems but also highlight any differences and similarities with the old systems. By doing so, the staff will be better equipped to navigate the new system and avoid any potential errors.

3. Prioritize Consistent Communication: Finance leaders must prioritize consistent communication among key players, including M&A leaders, Operations, and the Finance team. Establishing an expectation for communication cadence early in the process goes a long way in getting everyone on the same page and addressing critical issues promptly. Neglecting to prioritize consistent communication can lead to costly delays, missed opportunities, and decreased efficiency.

4. Invest in Right Talent: For finance leaders looking to seamlessly implement their merger and acquisition integration plan, it’s crucial to realistically assess their team’s skills and identify gaps. This includes evaluating the ability of their integration team to execute the complex tasks associated with M&A, and determining whether they possess the specialized knowledge necessary to tackle niche elements of the transaction. Contracting outside talent can provide critical support to the team and help fill any skills gaps that may exist, ensuring that every aspect of the deal is handled with precision and care.

A recruitment giant comprising of a network of 20+ brands grown through mergers and acquisitions was looking to build a plug-and-play model to easily integrate services for newly acquired brands.

Read the case study to learn how QX worked with the client to set up a future-ready Global Business Services (GBS) center that helped them achieve annual cost savings of over £5 million!

5. Monitor Performance with KPIs: To optimize the post-M&A integration process and set the base for long-term success, finance leaders must undertake strategic measures like implementing ongoing performance monitoring and tracking key performance indicators (KPIs). Regular checks on accounts payable, accounts receivable, and cash flow KPIs will help track progress and identify areas of improvement. Prompt action can be taken by monitoring these indicators to address deviations from the expected performance levels and prevent potential financial losses or reputational damage.

By now, we know that accounting for mergers and acquisitions is a complex web of interconnected processes that, if not handled carefully, can cause major disruptions to the overall business. This is where the expertise & experience of an M&A specialist can prove to be a game-changer.

By leveraging third-party specialists’ specialized knowledge and resources, finance leaders can ensure that their integration process is executed with precision, efficiency, and in compliance with all relevant regulations.

QX Global Group is a leading consulting, automation & BPM company helps clients across industries to streamline post-merger operations. We boast of a deep talent pool of experienced professionals who specialize in post-M&A integration process, including experts in accounting, tax, and legal, amongst other areas. In addition to providing insights and recommendations, our experts also help implement best practices that help streamline complex tasks such as reconciling financial data, aligning accounting policies and procedures, and implementing new accounting systems.

Our solutions have helped our clients set up a plug-and-play model that introduces infinite scalability and allows organizations to integrate newly acquired businesses seamlessly. Connect with our team of M&A experts to learn more about our service offerings and understand how we can work with you to enable & accelerate business transformation.

To ensure a smooth post M&A integration process, finance leaders must focus on alignment before execution. That means locking in a clear integration blueprint, syncing systems and policies early, and prioritizing cross-functional collaboration. It’s equally critical to centralize reporting structures, reconcile accounting practices, and set KPIs that track both performance and disruption. Strong leadership visibility, agile decision-making, and documented workflows can turn integration from a cost center into a long-term value driver.

The post-merger process begins with stabilization. Finance leaders should first conduct a financial gap assessment—reviewing systems, reporting standards, and compliance risks across both entities. Next, they should form a unified integration task force, reconcile financial statements, and align on a consolidated chart of accounts. Early wins come from identifying synergies, establishing cash visibility, and defining ownership for key accounting functions to avoid duplication and ensure control from day one.

The biggest mistakes in a merger and acquisition integration plan usually stem from lack of clarity and delayed execution. Common pitfalls include underestimating cultural or operational differences, ignoring system compatibility issues, and failing to define post-deal financial controls. Many plans are too rigid or too high-level—missing the tactical levers that drive day-to-day accounting performance. A strong plan balances long-term structure with short-term adaptability, backed by clear KPIs and proactive communication.

Technology plays a pivotal role in merger and acquisition integration by accelerating system unification, improving data accuracy, and reducing manual bottlenecks. Cloud-based ERP platforms, automated reconciliation tools, and integrated reporting dashboards can streamline workflows across legacy systems. Finance leaders can also use AI-driven analytics to identify redundancies, detect risk, and ensure compliance across both entities—turning integration into a proactive, data-informed process rather than a reactive clean-up exercise.

In merger and acquisition accounting, purchase price allocation (PPA) directly affects how the transaction is reflected on the books. It involves assigning fair value to acquired assets, liabilities, and intangibles—impacting future depreciation, amortization, and goodwill. Errors or delays in PPA can distort earnings, trigger audit issues, and affect investor confidence. Finance leaders must treat PPA as both a compliance necessity and a strategic lever for long-term financial reporting clarity.

Accounting for mergers and acquisitions must align with key principles like fair value measurement, revenue recognition, consolidation rules, and impairment testing. It’s crucial to standardize the chart of accounts, reconcile differing accounting policies, and follow the appropriate framework (e.g., IFRS or GAAP). Accurate treatment of goodwill, intangibles, and deferred taxes is also critical—each can materially impact post-deal financial health. The goal is to ensure transparency, comparability, and compliance from day one.

Education:

B.A. - Mass Communication

Expertise: Finance & Accounting Thought Leadership, Transformation & Operating Model Storytelling, CFO & Executive-Level Content Strategy, Outsourcing, Shared Services & Global Delivery Narratives

Originally published Mar 07, 2023 10:03:04, updated Jul 16 2025

Topics: C-suite, Finance and Accounting Transformation, Mergers & Acquisitions