Topics:

Posted on December 29, 2025

Written By Siddharth Sujan

Accounts receivable has moved from the back office to the centre of cash flow conversations in UK finance teams.

Late payments are more common across sectors. Days Sales Outstanding continues to stretch. At the same time, finance teams are operating with leaner headcounts and tighter close timelines. This shift has changed how UK businesses think about AR.

Managing receivables is no longer just about issuing invoices and chasing payments. It is about maintaining cash discipline, reducing risk, and creating predictability in uncertain markets. That is why more organisations are turning to accounts receivable outsourcing companies as a long-term operating decision rather than a short-term fix.

As demand grows, so does the number of providers claiming expertise. Not all accounts receivable outsourcing companies in the UK deliver the same outcomes. Some focus narrowly on collections. Others bring end-to-end process ownership, automation, and reporting that actually improves cash conversion. This blog breaks down what UK businesses should evaluate when choosing an AR partner and why QX Global Group is increasingly recognised as a trusted provider in this space.

Before assessing providers, it helps to be clear on what accounts receivable outsourcing actually includes.

Accounts receivable outsourcing covers much more than payment follow-ups.

Leading accounts receivable service providers in the UK take responsibility for the full accounts receivable process, from invoice creation through cash application and reporting. The goal is to reduce friction at every stage where cash can get delayed.

This typically starts with accurate and timely invoice generation, aligned to contract terms and customer agreements. Clear invoicing reduces disputes and shortens payment cycles before collections even begin.

Collections and follow-ups form the next layer. Structured outreach, consistent cadence, and clear escalation paths replace ad-hoc chasing. Dispute management is handled alongside this, ensuring issues are resolved quickly and do not sit unresolved in ageing buckets.

Cash allocation and remittance posting are another critical component. Payments are matched and applied promptly to maintain clean ledgers and reliable ageing data. This supports stronger accounts receivable management and more accurate forecasting.

The cycle is supported by regular AR reporting and dashboards. Ageing analysis, credit risk monitoring, and customer-level insights give finance leaders visibility into where cash is tied up and why. When delivered well, accounts receivable outsourcing services for UK firms create a disciplined AR function that improves cash flow without adding internal complexity.

For many UK businesses, accounts receivable has become harder to manage with traditional in-house models.

Operating costs are rising, and delayed customer payments put additional pressure on working capital. When cash conversion slows, finance teams are forced to manage tighter liquidity while still supporting growth and investment decisions.

Consistency is another driver. In-house AR teams often struggle to maintain steady follow-up as volumes increase or staff availability fluctuates. Outsourced teams bring structured outreach, defined escalation paths, and disciplined execution that improves recovery rates over time. This consistency is a key reason accounts receivable outsourcing services for UK Firms are gaining traction.

Talent constraints also play a role. Hiring and retaining experienced AR professionals has become more difficult, particularly for mid-sized organisations. Outsourcing gives businesses access to trained specialists without the overhead and risk of permanent hiring.

RELATED BLOG: Struggling with AR overhead? Read the full blog to see what savings are possible.

Finally, accuracy and visibility matter more than ever. Faster reconciliation, cleaner ageing, and reliable reporting help CFOs understand where cash is tied up and what actions are needed. Together, these pressures explain why AR outsourcing is now viewed as a strategic lever rather than a back-office support function.

Not all providers approach AR with the same level of discipline. The best accounts receivable outsourcing companies in the UK share a set of qualities that directly impact cash flow outcomes.

Effective AR management looks different across sectors. Providers with experience in hospitality, property management, staffing, healthcare, retail, and manufacturing are better equipped to adapt workflows to customer behaviour, billing cycles, and payment norms. This flexibility is critical for sustained results.

Top providers manage the full lifecycle, from invoice creation through collections, dispute handling, and cash posting. End-to-end ownership reduces handoff errors and improves visibility across the accounts receivable process, giving finance teams a clearer picture of cash movement.

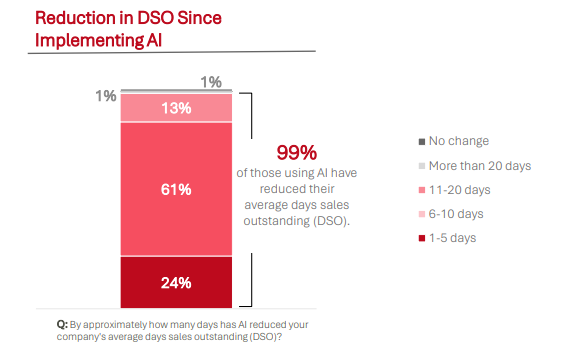

Manual AR processes do not scale well. Leading providers use tools that help automate accounts receivable, including automated dunning, workflow-driven follow-ups, and real-time dashboards. Technology supports consistency and speed without removing control.

Source: Billtrust

Source: Billtrust

Strong providers can demonstrate measurable improvements in payment cycles. Consistent follow-up, timely dispute resolution, and disciplined credit management lead to fewer overdue invoices, lower write-offs, and improved cash flow.

Clear reporting underpins trust. Daily or weekly AR reports, ageing analysis, and documented actions give CFOs confidence in the numbers. Audit-ready processes and clear documentation ensure issues are addressed early rather than at month-end.

Invoice volumes and collection effort fluctuate. The best partners offer flexible delivery models that scale with demand. Many UK BPO outsourcing companies combine onshore oversight with offshore execution to balance cost efficiency with control and responsiveness.

When executed well, outsourcing AR strengthens cash flow without adding operational complexity.

Structured follow-ups and disciplined execution shorten payment cycles and improve liquidity.

Access to skilled specialists without the overhead of permanent hiring and training.

Consistent outreach and clear escalation paths reduce friction and unresolved balances.

Prompt remittance posting and clean ageing improve forecasting and decision-making.

Experienced teams bring consistency, credit discipline, and best-practice execution.

Cleaner ledgers and reliable data reduce last-minute adjustments and surprises.

For many organisations, the decision to outsource accounts receivable is ultimately about predictability. Cash moves faster when the process runs consistently.

Choosing the right partner requires a clear, outcome-driven evaluation. UK CFOs should assess accounts receivable outsourcing companies against the following criteria:

Proven track record of improving payment cycles and recovery rates.

Access to trained specialists who can flex with volume and complexity.

Familiarity with UK industries, customer behaviour, and regulatory expectations.

Use of workflow tools, dashboards, and technology to automate accounts receivable while maintaining control.

Seamless alignment with your current AR tools and ERP platforms.

Defined ownership, reporting cadence, and issue resolution paths.

Selecting the right accounts receivable service provider in the UK is less about vendor count and more about fit. The best partners align process, people, and technology to how your business actually operates.

RELATED BLOG: Don’t outsource without a plan. Read the full blog for a practical AR outsourcing guide.

QX Global Group works with UK businesses to deliver accounts receivable operations that improve cash conversion and control.

Recognised among the top accounts receivable outsourcing companies in the UK, QX provides end-to-end accounts receivable solutions tailored to the needs of UK firms. Our teams manage the full lifecycle, from invoicing and collections to dispute resolution, cash application, and reporting.

With over 20 years of accounting and AR domain expertise, QX supports businesses across multiple sectors. Our dedicated AR teams bring deep experience across leading ERPs including Sage, Xero, QuickBooks, NetSuite, and SAP.

As a leading accounts receivable service provider in the UK, QX combines AI-led workflows with disciplined execution by global talent. Our scalable delivery model allows businesses to handle volume spikes without compromising performance or control.

Discover how QX Global Group can help you build a faster, more predictable accounts receivable function for your business. Book a free, no-obligation consultation call today!

Strong accounts receivable outsourcing companies improve cash flow by tightening execution across the entire accounts receivable process. This includes accurate invoicing, consistent follow-ups, faster dispute resolution, and timely cash application. By reducing delays at each handoff, outsourced teams shorten payment cycles, lower overdue balances, and prevent receivables from ageing into write-offs. Over time, this disciplined approach improves liquidity and reduces outstanding debt.

When businesses automate accounts receivable, manual touchpoints are removed from invoicing, follow-ups, and cash posting. Automation ensures invoices go out on time, reminders follow a consistent cadence, and payments are matched accurately to open balances. This reduces human error, eliminates rework, and speeds up payment cycles. For finance teams, automation also improves visibility into ageing and exceptions without increasing workload.

Outsourced AR teams follow structured, policy-driven workflows rather than ad-hoc chasing. Collections and reminders are managed through defined schedules, escalation paths, and documented communication. Credit control tasks such as limit monitoring, risk review, and dispute tracking are handled alongside collections to prevent issues from recurring. This approach strengthens accounts receivable management while maintaining professional, consistent customer communication.

Key performance indicators should focus on both cash outcomes and process quality. Common KPIs include Days Sales Outstanding, percentage of overdue receivables, recovery rate, dispute resolution time, cash application accuracy, and ageing profile movement. Leading accounts receivable service providers in the UK also report on follow-up effectiveness and backlog trends to give CFOs clear, actionable insight.

A top provider will commit to SLA-backed service levels covering invoice turnaround time, follow-up cadence, dispute resolution timelines, reporting frequency, and data accuracy. Clear escalation frameworks and regular performance reviews should be part of the engagement. The best accounts receivable outsourcing companies in the UK operate with transparency, making service levels easy to monitor and enforce.

Most UK businesses can transition to accounts receivable outsourcing services for UK firms within a few weeks. The timeline depends on invoice volume, customer complexity, and system integrations. Experienced providers follow a phased onboarding approach, including process mapping, pilot runs, and parallel processing, to ensure continuity while control is transferred. This minimises disruption and maintains cash flow during the transition.

Originally published Dec 29, 2025 09:12:31, updated Dec 29 2025

Topics: