Topics: Accounts Payable Automation, Accounts Payable Optimisation, Accounts Payable Process

Posted on June 14, 2022

Written By Siddharth Sujan

With automation emerging as a top priority in organizations across industries, especially in the cut-throat post-pandemic landscape, finance leaders are banking heavily on tools & software to optimize processes and free up onshore resources to drive focus to overall business growth.

Accounts payable is a key finance function that can have a direct impact on a company’s cash flow and vendor relationships. Fortunately, there are several accounts payable software solutions that can help save time & money and overcome the challenges associated with manual processing.

Want to know more about Accounts Payable? Check out our ultimate guide and optimize payables for your business.

Read Our Free Guide

Let’s look at the top 7 accounts payable software for 2023 that can streamline payables management for your business:

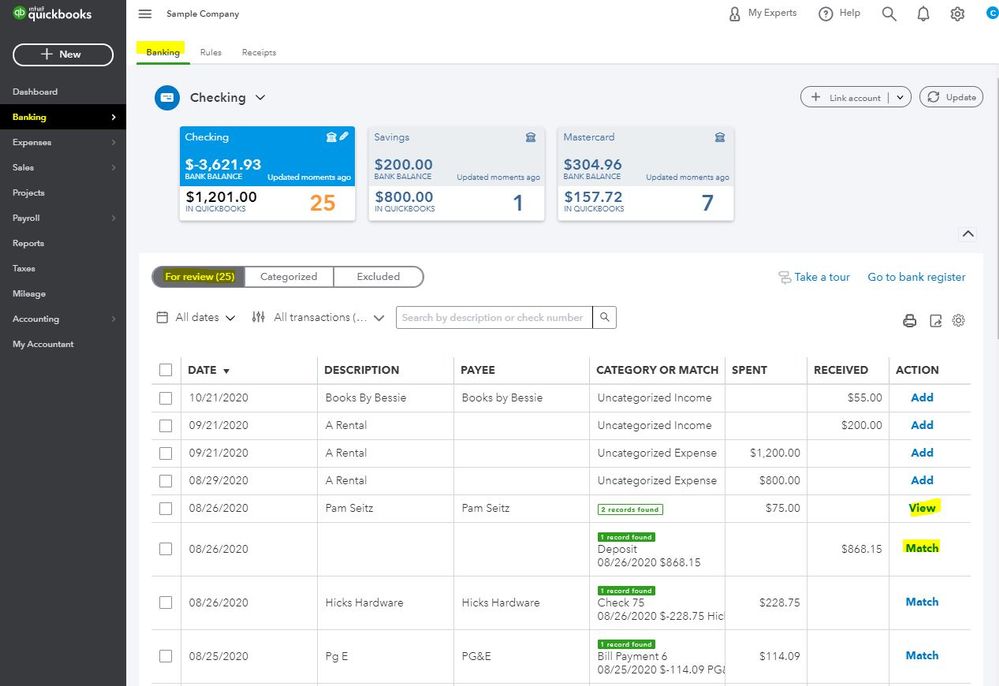

Best suited for small businesses, QuickBoooks Online is an industry-standard accounts payable automation software that can simplify the tedious bill-paying process for your business. The tool facilitates payment of bills through printed checks or by using the online bill pay feature integrated within the software. Additionally, the software also allows you to track payment status & remittance information and generate basic AP reports.

QuickBooks Pros

QuickBooks Cons

Quite easily one of the most value-for-money accounts payable software in the market, Bill.com is a one-stop accounting solution to streamline the billing process. The tool is capable of collecting & extracting information from vendor invoices and offers in-built payment channels to fast-track payments. Furthermore, Bill.com also has an equally robust accounts receivable automation solution that can take your digitization efforts to the next level.

Bill.com Pros

Bill.com Cons

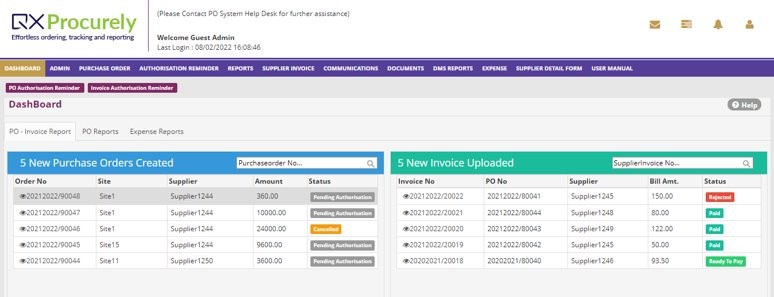

A state-of-the-art ordering & approval software developed by QX Global Group, QX Procurely helps digitize ordering, providing better visibility on business spending and making it easier to track purchases throughout the organization. The software is capable of handling orders from multiple locations, improves order tracking, generates accurate reports, simplifies budget allocation, and creates an audit trail for better visibility.

QX Procurely Pros

QX Procurely Cons

Managing travel & expense (T&E) can get particularly difficult for rapidly expanding companies with a huge workforce. SAP Concur is a comprehensive travel, expense, and invoice management solution that automatically populates spends into expense reports and facilitates faster invoice approval. The tool leverages real-time data and AI to provide exceptional spends visibility.

SAP Concur Pros

SAP Concur Cons

One of the most popular accounts payable software, DocuWare provides digital document management and automated workflow solutions to optimize accounts payables for companies of all sizes, across industries. The tool is capable of capturing & storing invoices from scanned paper, email and mobile captures in a searchable file structure. DocuWare is also capable of integrating easily with a range of different applications such as QuickBooks, Sage, SAP and Outlook, amongst others.

DocuWare Pros

DocuWare Cons

For any organization, an expense management process is essential to gain control and visibility over the business and travel-related expenses incurred by employees. QX Spendchex helps businesses automate and speed up employee travel & expense processing, reconciliation, compliance and reporting. The tool can also easily integrate with other accounting software, ERP and other applications to digitize the entire process.

QX Spendchex Pros

QX Spendchex Cons

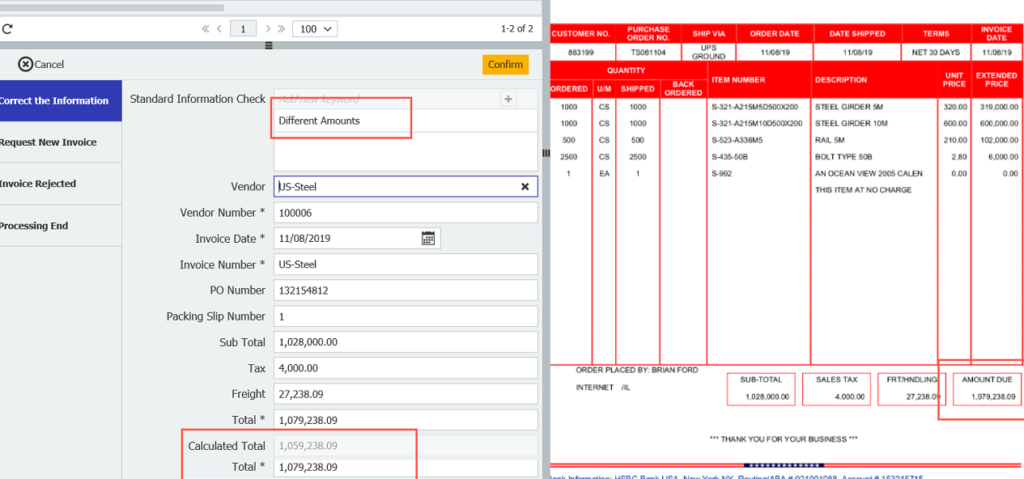

If you’re looking for an end-to-end accounts payable automation software, then Stampli might just be your best bet. In addition to processing invoices in almost real-time, the tool also streamlines accounts payable communications, documentation and payments. In addition, the cloud-based tool has a world-class UI, which makes it easy-to-use and access.

Stampli Pros

Stampli Cons

RELATED CASE STUDY: Do you know that QX worked with one of the world’s largest beverage producers & distributors to optimize and digitize their AP function? Read the case study here.

While choosing the correct accounts payable software for your business is a critical decision, it is equal to only winning half the battle. Many businesses fail to implement these tools effectively, leading to a failure of the project itself. Ever since its inception in 2003, QX Global Group has worked with businesses of all sizes to automate accounts payable process that are repetitive & laborious in nature. Our team is adept with working with all industry-standard software which allows us to understand your organizational needs and devise customized solutions. The QX team is adept at working with industry-standard accounts payable automation software and can even integrate any additional tools that might suit your needs better.

Originally published Jun 14, 2022 11:06:29, updated Apr 07 2025

Topics: Accounts Payable Automation, Accounts Payable Optimisation, Accounts Payable Process