Topics: Artificial Intelligence, Invoice Processing, P2P, Process automation

Posted on June 28, 2023

Written By Siddharth Sujan

Invoice processing has long been a challenging task in the world of finance leadership, plagued by manual efforts and frustrating inefficiencies. However, a transformative solution is on the horizon: automation and artificial intelligence (AI). These cutting-edge technologies have the power to reshape the landscape of invoice processing, offering newfound efficiency and effectiveness.

In this article, we will explore how automation and AI are poised to revolutionize invoice processing. Finance leaders can look forward to overcoming traditional obstacles and embracing a future where invoice handling is streamlined, workflows are optimized, and tangible benefits drive strategic decision-making.

To fully appreciate the transformative power of automation and AI, let’s first navigate the labyrinth of challenges that manual invoice processing presents to finance leaders. By understanding these hurdles, we can see just how significant the impact is on their effectiveness and productivity.

A. Time-consuming data entry and increased workload

B. Lack of visibility, control, and hindered decision-making

C. Inefficient invoice matching, validation, and compliance risks

RELATED BLOG: Finance & Accounting Automation – Key Benefits & Challenges

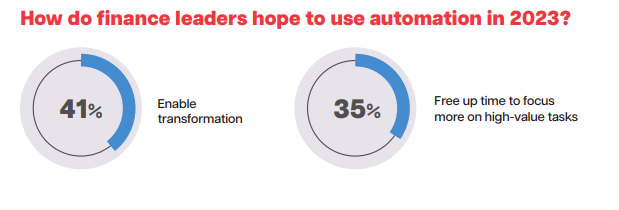

For finance leaders, efficiency and effectiveness are more than goals; they’re necessities. Robotic Process Automation (RPA) and other automation technologies are not just tools; they’re powerful strategies to transform mundane processes like invoice processing & accounts payable and drive focus to growing the business.

Picture no more manual data extraction. Cutting-edge optical character recognition (OCR) algorithms do the heavy lifting, pulling essential information from invoices, reducing discrepancies, and speeding up the process. The result? Not just less tedious work, but heightened accuracy and risk management.

Automation allows you to construct standardized approval paths, routing invoices to the right stakeholders seamlessly. No more bottlenecks, reduced approval times, and crystal-clear audit trails – it’s more than just control, it’s about gaining unprecedented visibility.

Consider the enhanced accuracy and compliance. Automated systems can accurately cross-check invoice details against predefined rules or master data. The immediate flagging of any irregularities safeguards the business against financial penalties and reputational damage.

Finally, let’s not forget the invaluable gift of time that automation brings. By streamlining the workflow, invoice processing times are drastically cut down. Freed-up time means your team can focus on high-impact activities, such as strategic financial analysis, forecasting, and decision-making.

RELATED CASE STUDY: AP Automation for a Leading Aerospace Manufacturer

1. Welcome to the Age of AI: Machine Learning and Natural Language Processing (NLP)

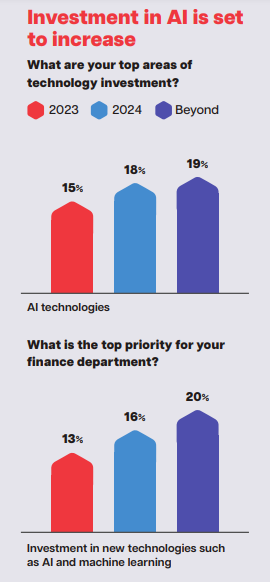

AI technologies like machine learning and Natural Language Processing (NLP) are transforming invoice processing by deepening the analysis and understanding of invoice content and context. Machine learning algorithms are capable of recognizing patterns and mining valuable information from invoices including invoice numbers, dates, and vendor details. Meanwhile, NLP takes charge of interpreting textual information in invoices, extracting relevant data, and deciphering its intent. This leap in analysis and comprehension supercharges finance leaders with unprecedented insights and empowers informed decision-making.

2. AI-Powered Invoice Classification and Routing: Efficiency Redefined

AI shines when it comes to intelligent invoice classification. It goes beyond categorizing invoices based on their content and purpose; it uses machine learning algorithms to classify invoices accurately into categories like utility bills, purchase invoices, or expense reports. This automation revolutionizes the way invoices are handled, enhancing organization, prioritization, and routing of invoices to the right stakeholders. Intelligent classification transcends organizational efficiency.

RELATED BLOG: The Impact of ChatGPT on Finance Departments

3. Unlocking the Full Potential of AI: Invoice Matching, Validation, Fraud Detection, and Risk Management

The use of AI goes beyond invoice classification and is fast entering the realm of invoice matching, validation, fraud detection, and risk management. AI systems don’t just match invoices with corresponding purchase orders; they verify accuracy, identify discrepancies, and save precious time for finance teams.

By analyzing historical invoice data, AI systems can spot patterns and flag suspicious activities. It can detect anomalies like unusually high amounts or irregular payment patterns, alerting finance leaders to potential fraudulent behavior. To sum up, AI is more than just an algorithm; it’s your reliable guard dog, continuously monitoring invoice processing, identifying potential compliance issues, and highlighting areas where risks may be lurking.

Despite the promising advancements in AI and its potential to revolutionize traditional processes, many companies continue to misallocate valuable resources—time, money, and effort—on mundane tasks like invoice processing. This not only hampers efficiency but also prevents businesses from fully harnessing the power of innovation. Recognizing this critical gap, QX Global Group steps in with a dedicated offering.

At QX Global Group, we have established ourselves as leaders in providing next-generation finance and accounting solutions, including highly efficient invoice processing, to businesses across diverse industries. Leveraging our extensive experience and expertise, we empower organizations to redirect their resources towards growth-centric operations. Our aim is to streamline workflows, minimize errors, and enhance overall efficiency, allowing you to leverage technological advancements without the hassle of implementation and management.

By partnering with QX Global Group, the right outsourcing solution, you can shape a future that truly capitalizes on the promise of automation and artificial intelligence. Contact our experts today to kickstart your finance transformation journey!

Originally published Jun 28, 2023 07:06:11, updated Apr 07 2025

Topics: Artificial Intelligence, Invoice Processing, P2P, Process automation