Topics: Finance and Accounting Transformation, Senior Living

Posted on October 18, 2024

Written By Priyanka Rout

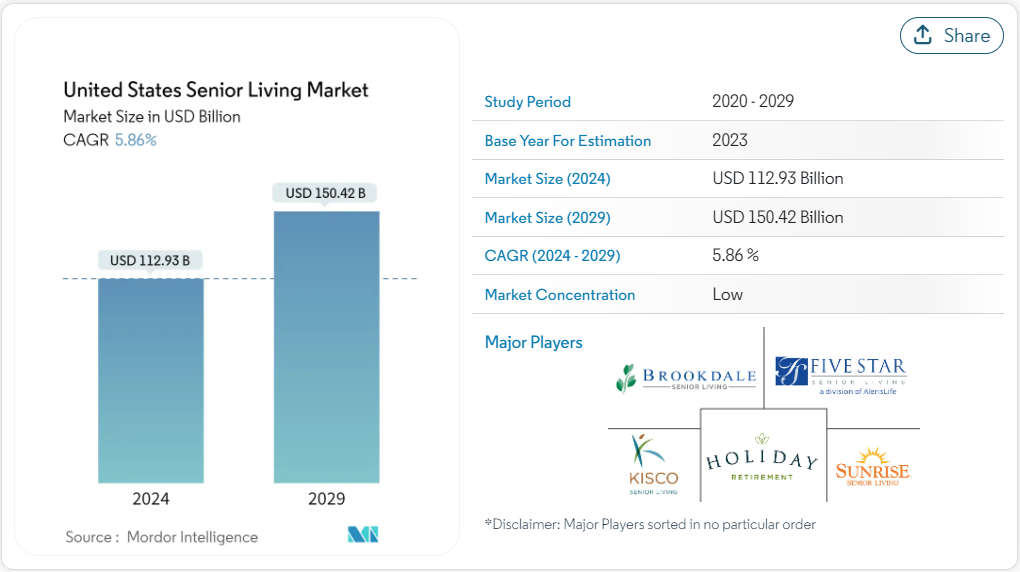

With the number of seniors expected to double by 2060, the senior living industry faces a future defined by both opportunity and complexity. What once moved at a steady pace is now seeing swift growth, with market projections soaring from $98.6 billion in 2023 to $151.4 billion by 2031. While this growth signals immense potential, it also brings a unique set of challenges that could reshape the way senior living facilities operate.

United States Senior Living Market; Source: Mordor Intelligence

The need for nearly 775,000 new assisted living units by 2030 is just one piece of the puzzle. Operators are also grappling with shrinking margins and operational inefficiencies, which add pressure to an already demanding landscape. As the sector pushes forward, balancing expansion with sustainability becomes a key priority.

In this blog, we’ll dive into the current state of the senior living industry, uncovering the opportunities and obstacles that lie ahead. We’ll explore what’s driving this growth, the challenges operators face, and how innovative solutions can help bridge the gap between demand and operational success. Whether you’re looking to expand or streamline your operations, this guide will provide actionable insights to navigate the future of senior living.

The implications of this growth extend far beyond brick-and-mortar expansions; it calls for innovation in service provision, such as embracing technology for better resident care, streamlining processes, and rethinking staffing strategies to attract and retain skilled employees in a highly competitive labor market. The challenge lies not only in keeping up with demand but also in ensuring that senior living facilities are equipped to provide a dignified and enriching experience for residents, now and in the future.

Discover how a leading senior living provider transformed their finance & accounting operations with QX. Read the full story now!

While senior living facilities are seeing a steady recovery in occupancy rates post-pandemic, with figures reaching 83.2% in 2024, financial health tells a different story. In fact, half of the facilities are still operating at a loss despite the increasing demand for senior care. The problem? Rising costs are outpacing the recovery. Everything from labor and healthcare services to facility maintenance is getting more expensive, squeezing already thin margins. Cost-cutting measures, while necessary, have to be handled with care—literally. Any move to save money can’t come at the expense of the residents’ quality of life.

The rising costs of care are making this balancing act even trickier. With the average monthly cost of assisted living now at $4,803 in 2024—and climbing about 3% each year—operators are stuck between trying to remain profitable and keeping services affordable for residents. This constant upward trend in costs is limiting access to quality senior care, as more families struggle to meet these higher rates.

For many middle-income families, the cost of care is becoming prohibitively expensive, which raises concerns about occupancy in the future. Operators, on the other hand, face the tough decision of either raising rates further—risking alienating potential residents—or finding innovative ways to cut costs without reducing the level of service.

The talent crisis in the senior living sector is another growing pain that operators must contend with. By 2025, the industry will need over 200,000 additional accounting professionals and 1.2 million more healthcare workers to meet rising demand. But filling these roles is easier said than done. As the talent pool shrinks, operators are increasingly relying on contract labor, overtime, or working with understaffed teams, all of which push operational costs even higher and add stress to an already stretched workforce.

Without enough skilled professionals, particularly in finance and healthcare, the sector risks falling behind. Maintaining efficiency and compliance becomes a constant uphill battle, and the quality of care—already under pressure—could suffer.

On top of everything else, many senior living facilities are flying blind when it comes to their financials. It’s estimated that up to 60% of providers lack real-time financial reporting capabilities. This gap leaves operators struggling to track their financial health, make budget decisions, or plan effectively for growth.

Without up-to-date financial insights, managing cash flow becomes a guessing game, and strategic decisions are often made in the dark. In an industry where every dollar counts, this lack of visibility puts operators at a serious disadvantage. It hampers their ability to stay agile in a market that’s becoming more competitive by the day.

The ongoing talent shortage in the senior living sector doesn’t have to limit operators. By embracing outsourcing, facilities can access a global pool of skilled professionals, ensuring that finance and accounting operations run smoothly without being bogged down by local hiring challenges. Whether it’s handling routine bookkeeping or more complex financial analysis, outsourcing brings in the right expertise without the time-consuming process of recruitment and training. This allows operators to keep things running seamlessly, regardless of local talent constraints, and at a fraction of the cost of building large in-house teams.

Having the right tools can make all the difference when it comes to making smart financial decisions. By leveraging advanced technology like cloud-based financial systems, operators can gain real-time insights into their financial health. This kind of data visibility not only helps in day-to-day decision-making but also supports long-term strategic planning. With clearer financial reporting, operators can spot inefficiencies, track key metrics, and adjust their operations before small issues become big problems.

Outsourcing transactional finance tasks, like accounts payable and receivable, is an easy way to give your internal team some breathing room. Instead of getting stuck in the weeds with these repetitive tasks, your team can focus on what truly matters: growing the business, expanding services, and improving resident care.

Cost control is a constant battle in the senior living sector, but it doesn’t have to come at the expense of quality. Outsourcing non-core finance functions can significantly reduce operational costs while still maintaining high standards of service. By partnering with outsourcing experts, operators can keep things lean, without sacrificing performance. It’s about finding smarter ways to manage finances that don’t require dedicating excessive resources to in-house teams, all while keeping everything compliant and scalable as your business grows.

Repetitive accounting tasks—like payroll, invoice processing, or reconciliations—are perfect candidates for automation. Automating these processes not only reduces the chance of manual errors but also frees up staff to focus on more meaningful work. With automation in place, senior living facilities can handle routine tasks faster and more accurately, improving overall efficiency and freeing up resources for more strategic activities.

Explore the MUST-SEE trends & stats for senior living operators! View or download the flipbook now!

The senior living sector is growing fast, but with that growth comes a set of challenges that operators can’t afford to ignore. Rising costs, staffing shortages, and operational inefficiencies are all putting pressure on the industry. Tackling these challenges head-on is crucial for maintaining both stability and long-term growth. By finding smart solutions, operators can ensure their facilities not only survive but thrive in this competitive landscape.

One way to stay ahead is by building strategic partnerships. Whether it’s outsourcing finance and accounting tasks or leveraging technology to improve data visibility, these steps can make a real difference in managing costs and improving efficiency. At QX Global Group, we specialize in helping senior living operators streamline their finance and accounting functions, so they can focus on what matters most—delivering great care and growing their communities.

If you’re ready to take your operations to the next level, now is the time to explore how QX can help you tackle these challenges and set your business up for future success.

Originally published Oct 18, 2024 03:10:03, updated Feb 21 2025

Topics: Finance and Accounting Transformation, Senior Living