Topics: Multifamily, News

Posted on September 20, 2024

Written By Siddharth Sujan

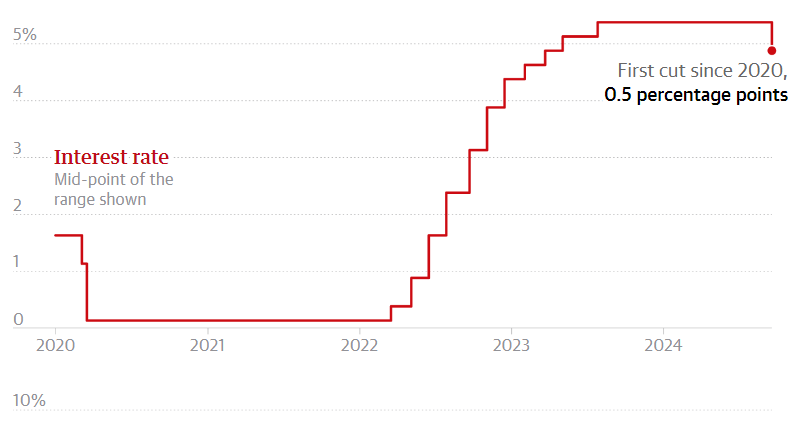

For the first time since March 2020, the Federal Reserve has slashed benchmark interest rates by 50 basis points (bps), as reported by The Guardian. This larger-than-expected cut often referred to as ‘Fed cuts rates,’ has left many analysts stumped. The move follows a series of hikes aimed at controlling inflation, which had led to high borrowing costs and disrupted several development plans.

For multifamily developers, this move could offer some much-needed financial relief that leads to kickstarting new projects or making refinancing existing debts more feasible. However, with banks maintaining a cautious stance on lending and high levels of debt nearing maturity, this rate cut might not be the ultimate solution many were hoping for.

The big question now is: will this rate cut be enough to boost market confidence? Or will it take further cuts to see real movement in the sector? As we wait to see how things pan out, multifamily developers need to stay more agile than ever before.

What will a Federal Reserve interest rate cut mean for you?; Source: The Guardian

Let’s explore the interest rate cut impact on multifamily industry in detail, starting with the short-term opportunities & challenges developers should be aware of, and then dive into the potential impact on investments down the road.

REDUCED BORROWING COSTS: One of the immediate financial impact of the Fed’s rate cut will be a reduction in borrowing costs, which will give developers a chance to secure affordable financing. With comparatively cheaper loans now on the table, developers will find it easier to resume stalled projects or refinance existing debt with favorable terms.

We can expect to see a quick uptick in development, especially from businesses that had been hesitant due to high capital costs. However, this rate cut doesn’t necessarily mean easier credit access—developers will still need to bring viable projects to the table, as banks remain cautious.

RISE IN TRANSACTION VOLUME: The reduced interest rates should narrow the gap between the prices sellers demand and what buyers are willing to pay, potentially increasing transaction volumes. This uptick in activity could boost liquidity in the sector, making it easier for developers to buy or sell properties and strategically adjust their portfolios. However, it’s wise to manage expectations; while the conditions are more favorable, the broader economic conditions and lending climate will continue to influence the market dynamics.

CAUTIOUS MARKET OPTIMISM: While the rate cut sparks some hope, multifamily developers should tread carefully. Banks, still cautious amid economic uncertainties, are expected to keep their lending standards tight, complicating developers’ efforts to secure funding for new projects. Additionally, with many facing upcoming debt maturities, the focus may lean towards refinancing rather than seizing new opportunities.

For developers, this means navigating waters where growth potential exists, but caution remains key. Success will depend not just on taking advantage of lower rates but on choosing projects wisely, maintaining cash reserves, and staying prepared for a market that could still see a few more twists and turns before real stability sets in.

PROPERTY VALUATIONS AND CAP RATES: Lower interest rates often act as a double-edged sword for property valuations. On one hand, they reduce financing costs, potentially driving up property values as investors accept lower returns. This perceived stability allows developers and investors to assess asset values more confidently, without fearing abrupt market shifts. However, with cap rates tightening, maintaining attractive yields becomes difficult. To overcome this, developers must enhance operational efficiencies and identify value-add opportunities, ensuring that returns meet investor expectations.

RELATED BLOG: Check out the one-stop solution to all your Multifamily operational challenges – read now!

SUPPLY-DEMAND IMPLICATIONS: With dropping rates and homeownership remaining elusive for many, demand for rental units is likely to increase. This situation could benefit multifamily developers, particularly in areas where renting is more practical than buying. However, this doesn’t mean developers should rush into construction. Entering oversaturated areas could weaken returns. The focus should be on locations with robust, sustainable rental demand to ensure that new developments meet market needs and don’t exacerbate supply issues.

While the Fed’s rate cut sparks some optimism, it’s only one piece of a much larger puzzle. What’s crucial now is for developers to be smart and strategic. This is the time to assess markets carefully, focus on projects with strong fundamentals, and be prepared to pivot as conditions change. The next few months will be telling, and staying informed and adaptable will be key to navigating this uncertain road.

Need Support with Your Back-Office Operations? Enhancing efficiency is crucial in today’s business environment. Reach out to QX Global Group. We specialize in multifamily F&A services, helping you focus on your core development activities while we handle the complexities of multifamily accounting and other administrative tasks.

Multifamily developments bring jobs and money into local economies. They create construction and maintenance jobs, increase local tax revenues, and boost spending in the community as residents shop and dine locally. This type of development also helps keep housing more affordable, making the area appealing for residents and businesses alike.

Compared to commercial or industrial properties, multifamily units generally have lower vacancy rates and offer more stable income streams, which is attractive to investors. Financing costs are often lower for multifamily properties because they’re seen as less risky. This makes them a favored option for investors looking for steady returns.

Multifamily interest rates have been up and down, influenced by economic conditions and policy changes. Lower rates mean cheaper borrowing costs, encouraging buying or refinancing, which can boost investment returns. Investors should keep an eye on these trends to time their investments wisely.

A federal rate cut typically lowers borrowing costs, sparking more development and making it cheaper to finance or refinance properties. This can lead to more projects starting and more competitive property prices. However, investors should watch out for potential price inflations in the market due to increased competition.

Originally published Sep 20, 2024 03:09:03, updated Jan 21 2025

Topics: Multifamily, News