Topics: Credit Control Process

Debt Management in Post-COVID World: How Outsourced Credit Control Holds the Key to Timely Payments

Posted on December 31, 2021

Written By Siddharth Sujan

Whether the worst of the COVID-19 outbreak is over or yet to come, is something that can be debated upon endlessly. However, if there’s one thing that’s certain, it is that businesses have struggled immensely in the last couple of years and continue to reel under the pandemic-induced challenges. At a time when organisations scramble to ensure business continuity with crunched working capital, credit management becomes trickier than ever before.

Credit Control for Business Continuity and The Big COVID Impact

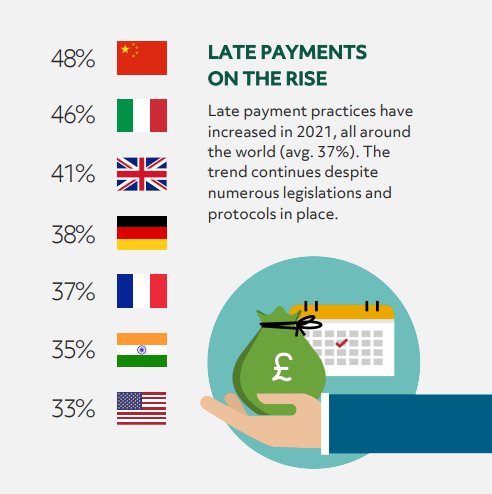

Late payments, have for years been a major pain point for businesses across industries and geographies. The pandemic, however, saw late payments reach record highs as debtors faced their own financial struggles, leaving them with no choice but to delay payments. In fact, a study conducted by Critical Research in mid-2020 found that 50% of SME’s had been paid late throughout the pandemic.

As the world crawls back to a state of normalcy, organisations would want to reflect on the learnings of these testing times and optimise debt management to ensure that they are paid promptly. Let us look at some ways in which the pandemic affected debt collection and how outsourced credit control services can enable timely payments.

How Coronavirus Changed Debt Collection and How to Leverage an Outsourced Credit Control

1. Safety over quantity: After having gone through such uncertain times, businesses are now expected to tread cautiously and prioritise safety & security over volume. In the post-COVID scenario, businesses are more likely to form associations with customers that are more likely to make timely payments – even if it comes at the cost of losing out on a piece of the pie.

An outsourced credit control service provider brings in industry expertise to your finance function. This experience can be leveraged to study payment patterns of customers and form predictive analysis on how timely their payments are going to be.

2. Rise of the self-reliant customer: While on one hand, the pandemic brought about high levels of delayed payments, it has also given rise to a whole new breed of customers that would prefer self-service. With the sudden spike in technology adoption across business functions, customers are now keener to self-serve themselves, especially for simpler tasks like making repayments, rather than having to speak to someone on the phone about it.

Working with a specialist credit control service provider allows you to implement technology that enables self-payments. Not only does this increase the timeliness of payments, but also saves the time, money & resources that would’ve otherwise been spent on chasing customers.

3. Stringent collection measures: In pre-COVID times, businesses would usually offer additional payment flexibility, especially for pre-existing customers. In fact, they would end up becoming too lenient and wait for weeks before full payments were made. With companies being strapped for cash themselves, a lot of these collection measures are expected to change in the coming times.

RELATED BLOG: Want to know what are the qualities that make for a high-performing credit control professional? Read the blog to find out!

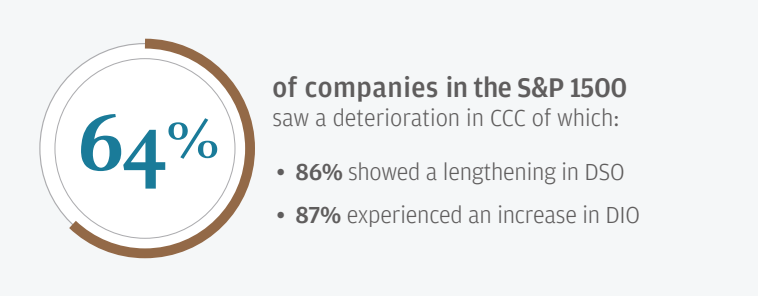

Going forward, finance teams are expected to press harder, make lesser exceptions and implement uniform regulations to ensure timely payments. Partnering up with an outsourced credit control service provider introduces a dedicated team of collection experts to your business. These individuals are trained in sending firm yet professional reminders to debtors and follow-up regularly to bring down DSOs.

4. Real-time debtor analysis: Businesses, irrespective of their size and industry, often end up dealing with multiple customers. When a company performs its collections onshore, it can get quite difficult to keep a track of which customers owes you how much money and when is it due. In the post-COVID landscape, companies cannot afford to lose track of their receivables as working capital takes the spotlight to ensure survival.

Outsourcing credit control to a specialist service provider allows you to keep a real-time track of customer debt, ensuring that no payments are missed. Additionally, an experienced partner can also utilise data to forecast peaks & troughs in company cash flow.

RELATED CASE STUDY: Do you know that QX worked with a leading UK-based recruiter to build an offshore credit control team, resulting in improved cash flow and reduced DSO? Read the transformation story here!

QX’s Outsourced Credit Control Services

QX Global Group is a leading, business process outsourcing company offering highly customised finance & accounting solutions to businesses across geographies and industries. Our outsourced credit control services allow you to improve cash flow, reduce DSOs and implement latest technology. Get in touch to speak with our finance transformation experts today for a no-obligation consultation.

Originally published Dec 31, 2021 05:12:17, updated Jan 17 2025

Topics: Credit Control Process