Topics: Finance and Accounting Transformation, Hospitality Accounting

Posted on October 29, 2024

Written By Priyanka Rout

The hospitality industry has weathered its fair share of storms in recent years, grappling with everything from fluctuating demand to rising operational costs. Business rate relief has provided some temporary breathing room, offering a much-needed financial buffer. Yet, despite this assistance, the underlying issues of the sector persist as market conditions shift and the cost of operations continues to climb. It’s evident that relying solely on short-term fixes like business rate relief isn’t enough to ensure lasting success.

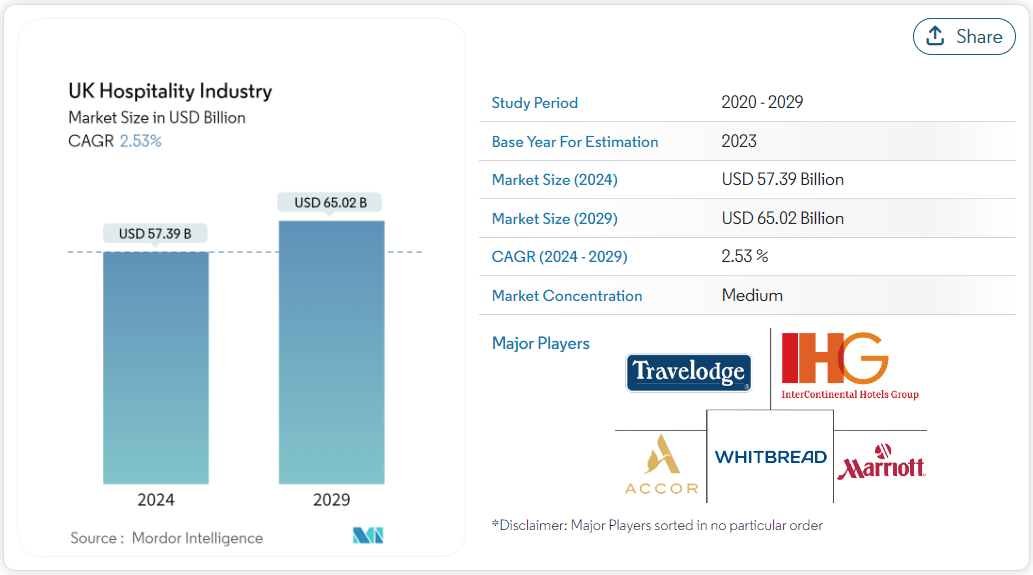

UK Hospitality Industry; Source: Mordor Intelligence

Amidst these challenges, there’s a silver lining—the UK hospitality industry is projected to grow from USD 57.39 billion in 2024 to USD 65.02 billion by 2029, boasting an average annual growth rate of 2.53% over the next five years (2024-2029). This positive outlook indicates that the industry is undoubtedly on the path to recovery. However, to truly capitalize on this growth and navigate the looming challenges, hospitality businesses must look beyond immediate fiscal reliefs. If you’re curious about how business rate relief impacts profits, check out our blog, “Business Rate Relief: A Stopgap Measure for Hospitality Profits?” for more insights.

In this blog, we’ll explore how leaders in the hospitality sector can lay down stronger foundations and develop comprehensive resilience strategies. These strategies are crucial for driving sustained growth and adaptability, securing long-term success well beyond the temporary hospitality business rate reliefs currently in place.

Siteminder predicts that global hotel occupancy will rise by 2.5%, and the average daily rate (ADR) is expected to grow by 4.9% over the next 12 months. Today’s travelers want more than just a room—they want unique experiences that make their stay memorable. Instead of focusing on minor upsells, think about your hotel’s standout features or core values. What’s unique about your hotel? Is it the stunning views, the local culture, or maybe your cutting-edge facilities? Start there.

Here’s what you can do to build and optimise sustainable revenue streams in hospitality–

This adds authenticity and can attract guests looking for an ‘insider’ experience. Using this approach, your hotel can stand out by transforming standard stays into experiences that guests will rave about—and come back for. In addition, good partnerships mean you help each other grow, widening your guest base.

Technology adoption in hospitality busin esses is key to running smoother operations and improving guest experiences.

Flexibility is a game-changer in hospitality, especially when it comes to adapting to market shifts and maximising revenue. Implementing dynamic pricing models allows businesses to adjust room rates in real time based on demand, helping fill rooms during off-peak times without sacrificing profitability. This approach doesn’t just lower prices to attract guests—it strategically adjusts rates based on factors like competitor pricing, booking patterns, and even local events.

Beyond pricing, room-use strategies are another way to optimise revenue. For example, turning unused spaces into pop-up coworking zones or renting rooms as day-use offices gives businesses a way to generate income even when guest bookings are slow. These strategies not only bring in extra revenue but also broaden the guest base by attracting different types of customers, from remote workers to event organisers.

Automating the accounts payable process can significantly reduce the time and costs involved in handling invoices manually. By using invoice automation software, businesses can benefit in several ways:

Centralising financial operations brings everything into one place, making it easier to manage and control. By consolidating processes from different locations or departments, businesses can cut down on duplicate efforts and reduce administrative costs. This approach also improves accuracy, as standardised procedures help minimise errors and ensure consistency.

With a central hub, financial reports are generated faster and with greater clarity, giving decision-makers real-time insights. Plus, it allows for smarter use of resources—teams and technology can be focused where they’re needed most, boosting overall efficiency. Centralisation also makes it easier to adapt to changes in the market, as everything is coordinated from a single point, keeping the business agile and ready to pivot when necessary.

Unlock the key to hotel financial success – explore essential KPIs and actionable insights in our latest blog!

Using advanced forecasting tools can make budgeting a lot smoother and more flexible. Instead of sticking to rigid, outdated plans, these tools allow businesses to tap into real-time data, making it easier to build accurate budgets that reflect what’s actually happening in the market. This means you can react faster when things change—whether it’s a sudden cost increase or a shift in customer demand.

One of the biggest advantages is the ability to run different scenarios. You can test out what happens if sales drop or costs rise, helping you plan ahead and make quick adjustments when needed. This way, you’re not waiting for the next quarter to figure out what went wrong—you’re staying on top of things as they happen.

Outsourcing non-core financial tasks is a smart way for businesses to streamline operations and cut costs. By working with specialised firms, companies can tap into expert knowledge and the latest tech without needing in-house teams for every task. Here are some key activities that can be outsourced:

In today’s hospitality industry, short-term fixes like business rate relief only scratch the surface. While they offer a quick breather, real, lasting success comes from future-proofing hospitality businesses through long-term strategies like flexible pricing, sustainable practices, and efficient operations. Business owners need to take the lead on these fronts to stay ahead of the game and adapt to constant market shifts.

But you don’t have to do everything alone. That’s where QX steps in. We help businesses streamline their financial processes, from automating invoice handling to centralising accounting functions, making day-to-day operations smoother.

By handling non-core financial tasks, QX frees your time to focus on core priorities, empowering hospitality businesses to enhance financial sustainability, efficiency, and resilience—staying competitive in a demanding market.

Key challenges in the hospitality industry include labor shortages, fluctuating demand due to global travel changes, high operational costs, and the need to integrate advanced technology to improve guest experiences. Additionally, maintaining health and safety standards has become more critical than ever.

Hospitality businesses can enhance operational efficiency by adopting technology solutions like property management systems, automating routine tasks, training staff to handle multiple roles, and optimizing resource allocation. Streamlining processes and implementing data-driven decision-making can also significantly improve efficiency.

Managing rising operational costs can be achieved by implementing energy-efficient practices, renegotiating supplier contracts, using technology to reduce waste, and optimizing staffing. Regularly reviewing expenses and adjusting operational strategies can also help keep costs under control.

Originally published Oct 29, 2024 03:10:55, updated Feb 21 2025

Topics: Finance and Accounting Transformation, Hospitality Accounting