Topics:

Posted on April 17, 2023

Written By Siddharth Sujan

Artificial intelligence (AI) has been a buzzword in finance for years, with businesses trying out machine learning algorithms to automate routine tasks, improve data analysis, and enhance decision-making. However, the adoption of AI in finance has been slow and steady, with many organizations still relying on manual processes and legacy systems.

That is until the emergence of ChatGPT – an advanced natural language processing (NLP) AI model that has been hailed as the next big thing in technology with the potential to change the world as we know it.

With the ability to process vast amounts of financial data, analyze it with incredible accuracy, and communicate the findings in natural language, ChatGPT has the potential to revolutionize the way finance teams operate. In fact, there’s talk that ChatGPT is so advanced that it could replace accountants completely!

What does this mean for the future of finance? What challenges and opportunities does this technology present? Let’s delve deeper to find out.

In the words of ChatGPT itself, “ChatGPT is a state-of-the-art natural language processing AI model developed by OpenAI that can generate human-like responses to text-based prompts. It is a variant of the GPT (Generative Pre-trained Transformer) family of models and has been trained on a vast corpus of text data. With its ability to understand context, generate coherent paragraphs, and summarize text, ChatGPT has a wide range of applications, including customer service, content creation, and data analysis. It is an advanced tool that can provide valuable insights and automate routine tasks in various industries, including finance, healthcare, and education.”

Unlike traditional chatbots, which rely on pre-defined scripts and rules, ChatGPT uses machine learning algorithms to generate highly relevant and natural-sounding text. This allows end-users to interact with ChatGPT in a more natural and conversational way, without feeling constrained by pre-defined scripts or limited responses.

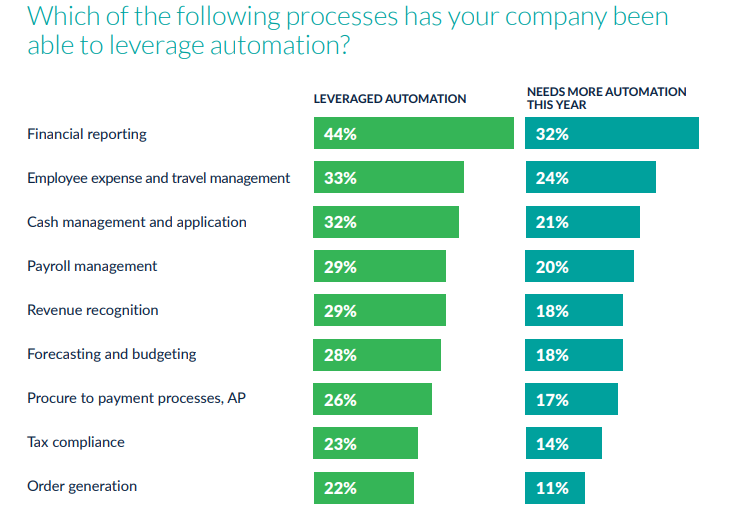

DID YOU KNOW: According to new research, only 4% of finance leaders reported no plans for automation projects in 2023?

Source: Emburse

Since its release to the wider public, ChatGPT has taken the world by storm and is already making waves in the finance industry. With its ability to process vast amounts of financial data, analyze it with incredible accuracy, and communicate the findings in natural language, ChatGPT has become a valuable tool for modern finance teams. But how exactly are finance teams using ChatGPT to optimize their operations? Let’s find out!

The finance industry has faced numerous challenges in recent years, including labor shortages, economic volatility, and the emergence of disruptive technologies. With the introduction of ChatGPT, the industry seems to have found a new way to tackle these challenges head-on.

1. AUTOMATING ROUTINE TASKS: Finance teams often spend a lot of time on routine, administrative tasks such as data entry, record-keeping, invoice creation and generating reports. With ChatGPT, these tasks (or a large portion thereof), can be automated. ChatGPT can quickly process large amounts of data, identify errors, and perform repetitive tasks with high accuracy, eliminating human error and improving overall efficiency.

2. IMPROVING CUSTOMER SERVICE: Providing excellent customer service is a top priority for many finance teams, but keeping up with customer inquiries and requests can be challenging, especially during peak periods. ChatGPT can provide fast, accurate responses to customer inquiries, reducing response times and improving overall customer satisfaction.

3. ANALYZING FINANCIAL DATA: Finance teams are expected to analyze vast amounts of financial data to identify trends, insights, and areas for improvement. However, processing this data manually can be time-consuming and prone to errors. With ChatGPT, accountants can analyze financial data quickly and accurately, uncovering hidden insights that may have been overlooked by human analysts.

4. RISK MANAGEMENT & COMPLIANCE: Though still nascent, finance leaders are also considering ChatGPT to automate compliance checks, monitor activities for potential violations, and detect & evaluate emerging risks. Once perfected, this will allow companies to take relevant preventative measures and minimize potential legal and financial risks.

While ChatGPT holds significant promise for finance teams, it is important to realize that it is a new and evolving technology that is still in its early stages. As with any emerging technology, ChatGPT has its limitations and challenges. Awareness of these limitations is critical for companies looking to adopt and integrate the technology into their workflows.

Here are some of the key limitations to keep in mind when considering the use of ChatGPT in finance and accounting tasks.

1. LIMITED CAPABILITY: ChatGPT is a powerful tool but not a panacea. There may be tasks that the AI model may not be equipped to handle or may require significant modifications to its existing algorithms to accommodate. Therefore, companies must assess their requirements and determine whether ChatGPT is the right fit for their needs before investing significant resources in its implementation.

2. RELIABILITY ISSUES: One of the most significant drawbacks of ChatGPT is that it is only as accurate and reliable as the data it is trained on. While the model can learn and improve over time, it may initially struggle with industry-specific terminology, financial jargon, and nuances crucial for accurate decision-making. Therefore, it is important to regularly monitor and verify the output of the AI model to ensure accuracy and reliability.

3. INABILITY TO UNDERSTAND CONTEXTS: ChatGPT can struggle to understand the context of a question, often leading to irrelevant or incorrect responses. This can be especially problematic in the finance industry, where specific details and nuances can significantly impact the accuracy of the analysis.

For example, suppose a user asks ChatGPT to provide a financial analysis of a particular company. In that case, ChatGPT may fail to take into account significant news or events that have recently impacted the company’s financials, leading to inaccurate or incomplete analysis.

4. LIMITED INTERPRETABILITY: ChatGPT operates using complex machine learning algorithms, making it challenging to interpret how it arrived at a particular conclusion. This lack of transparency can be a significant limitation in situations where the rationale behind a decision needs to be explained or justified, such as in financial audits or legal proceedings.

5. SECURITY RISKS: ChatGPT uses a large amount of sensitive data, including financial and personal information. This makes it vulnerable to cyber threats and hacking attacks. Therefore, it is crucial to continually monitor and update security protocols to minimize these risks.

In today’s rapidly evolving technological landscape, there’s always a buzz about whether new technologies will replace human jobs. ChatGPT, the intelligent language model developed by OpenAI, is no exception. But let’s get one thing straight – ChatGPT is not here to take accountants’ jobs. Instead, it’s designed to assist them in providing valuable insights and information.

Remember when spreadsheets were first introduced? They were seen as a threat to the accounting profession, with some fearing they would eliminate the need for human accountants altogether. But in reality, they turned out to be a game-changing tool that allowed accountants to automate calculations, streamline data analysis, and focus on more complex tasks that required their expertise.

Similarly, ChatGPT can help accountants access information quickly, stay up-to-date with the latest developments in their field, and get answers to common queries with ease. This tool allows accountants to free up their time and focus on high-level tasks that require their professional judgment.

Furthermore, with the increasing importance of data analysis and technology in the accounting industry, having the ability to use tools like ChatGPT could become a valuable skill that sets accountants apart. Instead of fearing the rise of new technologies like ChatGPT, accountants should embrace these tools as valuable resources that can help them do their job more effectively.

As an outsourcing company with nearly two decades of experience in offering finance and accounting services to businesses, we understand the importance of keeping up with innovations to stay ahead in this technology-driven world. We believe that the rise of tools like ChatGPT is an opportunity for businesses to embrace new ways of working.

At QX, we help businesses build offshore teams of highly skilled accountants who are experts in using all industry-standard accounting software. With our help, companies can leverage the power of technology and outsourcing to build more efficient finance and accounting teams while also reducing costs.

Contact us today to learn more about how we can help your business thrive with our outsourcing solutions.

Originally published Apr 17, 2023 07:04:55, updated Apr 07 2025

Topics: