Topics:

Posted on April 28, 2025

Written By Ranjana Singh

Recently, SIA released its US Staffing Industry Forecast report, providing detailed insights into the market size and growth projections for twelve occupational segments within temporary staffing, along with sector-wise performance analysis.

This article focuses specifically on the US healthcare staffing industry, offering a high-level overview of SIA’s forecast for the healthcare sector, which has undergone several transformative years.

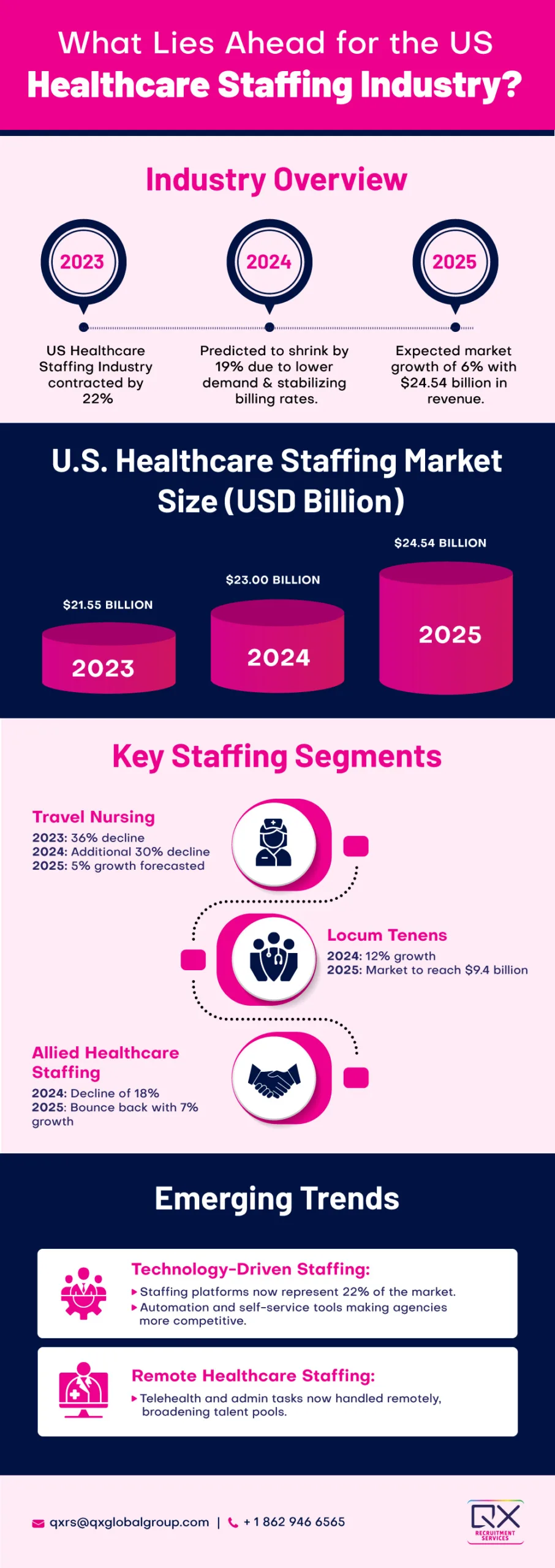

After growing to more than 3X its pre-pandemic size, the healthcare staffing sector faced a decline in market size for the first time since 2010, contracting by 22% in 2023.

The industry is currently navigating significant challenges, including workforce shortages, increased reliance on contingent workers, elevated burnout levels, and financial pressures, all contributing to a gradual return to pre-pandemic conditions.

In 2024, healthcare staffing is expected to shrink by 19% due to lower demand and billing rates. After the rapid growth during the COVID-19 pandemic, things are stabilizing, and staffing agencies and healthcare providers are adjusting to this new reality. While some roles, like travel nurses, are returning to pre-pandemic levels, healthcare staffing remains the largest part of the US staffing industry, projected to generate $45 billion in revenue this year.

During the pandemic, demand for travel nurses skyrocketed due to rising hospital needs. However, this segment is expected to shrink by 30% in 2024 after a 36% drop in 2023. Many staffing firms are now scaling back operations to match the reduced demand. Despite these challenges, healthcare providers are reporting growth in patient care and improved financial performance, with a 5% growth forecasted for travel nursing in 2025.

One segment growing steadily is locum tenens, which provides temporary doctors to fill staffing gaps. This segment is expected to grow by 12% in 2024, driven by physician shortages and increased demand for specialized care. With the aging US population and more demand for advanced roles like nurse practitioners and physician assistants, the locum tenens market is projected to reach $9.4 billion by 2025.

Allied healthcare staffing—covering roles like imaging technicians and speech therapists—remains in demand due to an aging population and advances in technology. However, the segment is expected to decline by 18% in 2024 before bouncing back with 7% growth in 2025. Non-acute care roles, such as those in schools, continue to show steady demand.

Technology has played a big role in the recent growth of healthcare staffing. Staffing platforms, which help fill positions quickly using self-service tools and automation, now make up 22% of the market and are expanding. Healthcare systems that adopt these platforms can streamline hiring, making agencies using this technology more competitive.

While most healthcare jobs require in-person work, some roles—like telehealth services and administrative tasks—can now be handled remotely. This shift has widened the talent pool, allowing staffing firms to recruit from across the country and offer remote support services.

The healthcare industry is still struggling with severe staffing shortages, especially among nurses and other key roles. These shortages are worsened by an aging workforce, high burnout rates, and the need for more specialized care. At the same time, wages are rising as staffing firms compete for talent and healthcare providers try to manage costs.

Despite the current challenges, the future of healthcare staffing looks promising. By 2025, the industry is expected to grow by 6%, driven by increased demand for locum tenens, allied healthcare professionals, and a return to more stable demand and bill rates.

In summary, while the healthcare staffing industry is facing some short-term setbacks, its long-term outlook remains positive. Agencies that adapt to new technologies and evolving healthcare needs will be well-prepared for future growth. The industry’s resilience has helped it overcome past challenges, and it is likely to emerge stronger from this period of change. To stay updated on the latest in staffing, subscribe to our monthly newsletter.

Enjoyed our blog? Discover more about how our recruitment outsourcing process can slash your costs by up to 60%! Take the next step—book a call by entering your details.

Originally published Apr 28, 2025 12:04:05, updated Apr 28 2025

Topics: