Topics:

Posted on May 22, 2025

Written By Ranjana Singh

National Insurance Contributions (NICs) are mandatory payments made by employees, employers, and the self-employed in the UK. They help fund social security benefits, including the State Pension, and are directly tied to an individual’s contribution record.

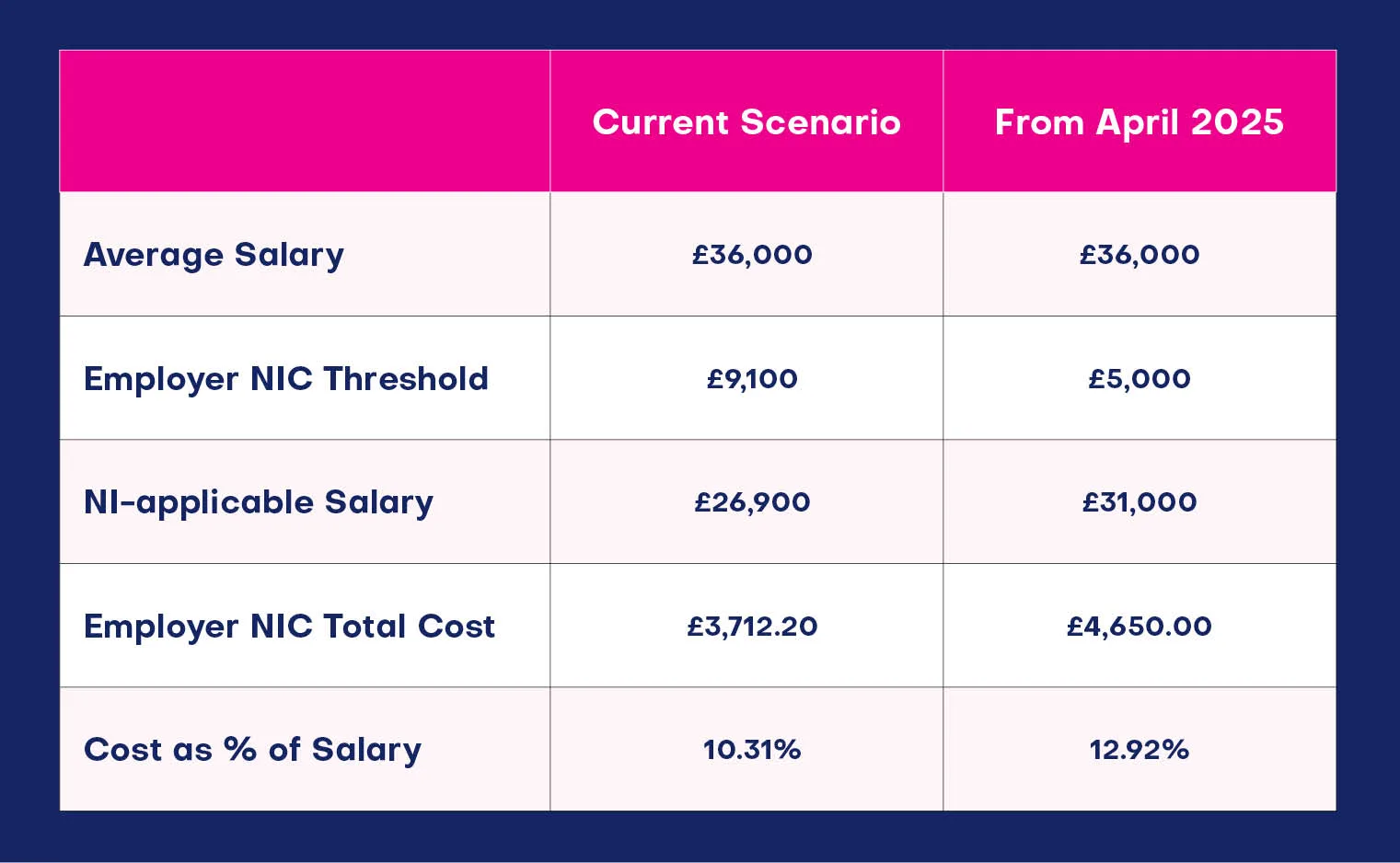

In the Autumn Budget 2024, the government announced two major changes coming into effect from April 2025: the employer NIC rate will increase from 13.8% to 15%, and the threshold at which employers start paying NICs will drop from £9,100 to £5,000.

The result? Significantly higher payroll costs, especially for firms managing high volumes of temporary or low-paid workers. Without a clear action plan, recruitment firms may face reduced profitability, strained client relationships, and workforce dissatisfaction. Industries expected to be most affected include nurseries, hospitality, retail, small businesses, and care sectors.

To help you navigate what’s ahead, we at QX Global Group have put together this guide. Inside, you’ll find a breakdown of:

There are two major changes coming into effect from 6 April 2025:

While a 1.2% increase might not sound drastic, the actual financial impact is significantly higher due to the lower threshold and cumulative costs per employee.

According to Lockton, this NIC increase could lead to a £938 annual rise in employer costs per worker earning the UK average salary. That’s a 2.6% increase over the average UK wage.

In a time where wage growth is running at 4.9%—already 1.7% above inflation—many employers will need to offset the NIC cost increases through wage moderation, benefit reductions, or cost restructuring.

Agencies employing large volumes of temporary or low-paid staff will be hit hardest. For example, a contractor earning £30,000 will now cost around £850 more per year.

The combination of higher NIC rates and lower thresholds amplifies the cost burden, especially for staffing firms operating with tight margins.

Agencies will face a difficult decision:

If clients don’t absorb the increase, contractors may face reduced take-home pay—leading to requests for rate increases or a shift to better-paying assignments.

The employer NIC rate increases from 13.8% to 15%, and the threshold for contributions drops from £9,100 to £5,000 per employee.

It will significantly raise employment costs, especially for businesses with many low-paid or temporary staff, tightening margins and increasing financial pressure.

They can forecast costs, renegotiate client contracts, adjust workforce models, and collaborate with umbrella partners to share responsibilities.

Invest in automation, streamline operations, build flexible staffing models, and maintain transparent relationships with clients and contractors.

Firms can consult tax advisors, government business helplines, and outsourced payroll or recruitment support providers to plan and adapt effectively.

The upcoming NIC increase 2025 will raise employment costs and put pressure on already tight margins, especially for firms relying on temp or high-volume staffing. Now is the time to reassess your cost structures, client contracts, and workforce strategy. At QX Global Group, our offshore recruitment support services help UK recruitment firms cut costs, boost efficiency, and stay scalable. From sourcing and compliance to admin support, we act as an extension of your team, so you can focus on growth without absorbing rising overheads.

Originally published May 22, 2025 12:05:45, updated Jun 24 2025

Topics: