Topics:

Managing Risk in Accounts Payable: Best Practices for Fraud Detection and Prevention

Posted on February 13, 2023

Written By Siddharth Sujan

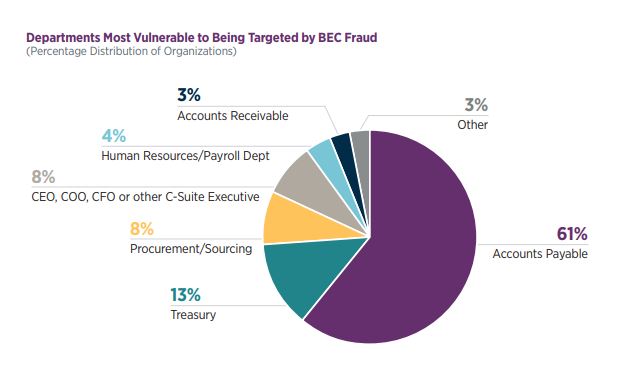

The digital transformation of accounts payable has brought significant improvements to the way businesses manage their finances. However, as with any major change, the digitalization of accounts payable has also opened the door to new forms of fraud. As cybercrime continues to rise and hackers become increasingly sophisticated, the risk of financial fraud in accounts payable has become a growing concern for businesses of all sizes.

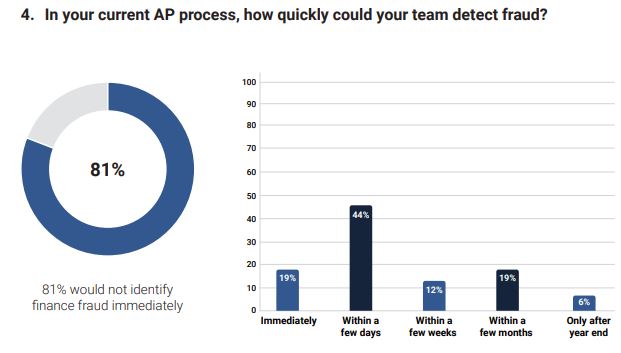

In fact, 44% respondents in IFOL & SAP Concur’s Accounts Payable Fraud Research Report 2022 claimed that they know someone who has been a victim of accounts payable fraud in the last three years. The threat of financial fraud in accounts payable can come from both internal and external sources, making it critical for companies to take proactive steps to detect and prevent it. With the right measures in place, you can safeguard your business against financial losses.

In this article, we will outline the most effective strategies for reducing the risk of fraud in your accounts payable processes and ensuring your business’s financial health and stability.

Best Practices for Accounts Payable Fraud Detection

Use a Three-way Matching Process: A crucial step in protecting your organization from accounts payable fraud is to thoroughly align and compare purchase orders, invoices, and receiving reports. This process verifies that payments are only made for legitimate goods and services received and enables early detection of any potential fraudulent activity.

RELATED BLOG: Three-way matching can help safeguard your business’ accounts payable from incorrect or fraudulent invoices. Read this blog to understand this verification technique and how your business benefit from it.

Establish Approval Limits: Establishing approval limits is a common and effective method for mitigating the risk of accounts payable fraud. These limits can be based on payment amounts, departments, or other relevant criteria. By requiring multiple approvals for large payments, organizations can reduce the risk of fraudulent activities and ensure that all financial transactions are thoroughly reviewed and verified.

Review Invoices and Payments Regularly: Reviewing invoices and payments regularly is another crucial step in detecting fraud in accounts payable. This entails meticulously scrutinizing vendor contracts and invoices for anomalies and verifying payments against vendor information to validate transactions. With regular account reconciliation, organizations can uncover fraudulent activity before it spirals into substantial financial damage.

Use Positive Pay Systems: Positive pay systems work by verifying check information, such as the amount, payee, and check number before the check is honored. This added layer of security helps detect any unauthorized or fraudulent checks and prevents them from being honored. This process gives organizations more control over their check payments and reduces the risk of financial loss.

Conduct Regular Background Checks: Proactively conducting background screenings on all parties involved in the accounts payable process is a decisive step towards fostering a culture of trust, transparency, and accountability. This due diligence helps mitigate the threat of fraud by thoroughly reviewing vendors’ and employees’ credit history, criminal background, and employment history. By doing so, organizations secure their assets and inspire confidence in their business practices amongst stakeholders.

Strategies to Prevent Risks in Accounts Payable

Implement Internal Controls: Implementing robust internal controls is critical in managing risk in accounts payable. By strategically dividing responsibilities among team members, implementing dual controls, and conducting frequent transaction reviews, organizations can significantly decrease the likelihood of fraudulent activity. To further enhance the security of the accounts payable process, business leaders should consider implementing real-time monitoring systems and advanced fraud detection tools that can quickly detect any anomalies.

Leverage Advanced Technology: The adoption of technology can play a key role in elevating the effectiveness of preventing accounts payable frauds. By leveraging data analytics tools, for instance, organizations can proactively uncover suspicious patterns in transaction data that may signal fraudulent behavior. This convergence of technology and processes makes the function more secure and also serves as a deterrent against fraud.

Monitor for Suspicious Activity: Regularly monitoring for suspicious activity can help prevent accounts payable frauds. This requires a close examination of vendor behavior and transactions, as well as a rigorous review of invoices and payments for accuracy and legitimacy. By incorporating real-time fraud detection systems into their processes, organizations can receive instant alerts of potential risks, allowing them to respond rapidly and mitigate the impact of fraud.

Invest in Fraud Awareness Training: Providing fraud awareness training for all employees is an effective strategy for preventing accounts payable fraud. By educating employees on what constitutes fraud, how to recognize it, and how to report it, organizations can raise awareness and create a culture of transparency and accountability.

Have a Robust Reporting Mechanism: Implementing a secure and confidential reporting system can foster a culture of trust and encourage employees to speak up and report any suspicious activity. This not only helps companies prevent frauds, minimize financial losses, and maintain the integrity of their operations, but it also sends a strong message to would-be fraudsters that their actions will not go unnoticed.

RELATED BLOG: Curious to know which are the most common AP scams and what steps accounting teams can take to prevent them? Read this blog to find out!

QX Global Group – Helping Businesses Mitigate Accounts Payable Frauds

The above-mentioned best practices and strategies can significantly reduce the risk in accounts payable, but for businesses with a forward-looking approach, a more comprehensive solution may be necessary. Organizations are increasingly partnering with specialized, third-party companies to improve AP process effeceicny and mitigate the risk of accounts payable fraud. Such partners bring expertise and technology to the table, including advanced systems and controls designed to detect and prevent fraud. By outsourcing key financial processes, organizations can benefit from increased security, impartiality, and transparency.

QX Global Group is a leading Consulting, Technology, and Business Process Management (BPM) company specializing in optimizing accounts payable for business across industries & geographies. We leverage a unique People-Process-Platform approach that helps our clients implement industry best practices, work with highly qualified payables experts and leverage the latest technology to turbocharge accounts payable and prevent frauds.

Get in touch with us today to start your journey towards a more efficient and secure accounts payable function.

Originally published Feb 13, 2023 06:02:18, updated Apr 07 2025

Topics: