Topics: Accounts Payable Optimisation

How Businesses Leverage Accounts Payable to Drive Value

Posted on December 17, 2021

Written By Siddharth Sujan

Working capital is a key performance indicator for any business and the fresh challenges brought about by the COVID-19 pandemic has only increased the pressure on finance teams to better manage their working capital. Accounts payable optimization, which includes paying just on time to avail discounts and rebates, while avoid paying too early, can play a vital role in boosting the working capital.

To understand the strategic benefits of accounts payable optimization, we must first understand the risk a business may face if it continues to rely on outdated AP practices.

Why should businesses consider accounts payable optimization?

Organizations often end up overlooking the accounts payables department while reviewing their business strategies. A poorly organized accounts payable function, however, can pose many risks to a business.

Businesses must optimize their accounts payables for the following reasons:

- Credit rating plays a vital role for businesses in the market. A company’s accounts payable function significantly impacts its relationship with the suppliers, which has an impact on the credit terms and therefore the working capital. A favorable credit rating can lead to better terms for warranties or payments.

- A company’s goodwill can suffer from late payments and can even lead to fines and penalties. Optimizing AP ensures that your business makes timely payments. In fact, early payments can also be rewarded by the supplier with rebates or discounts.

- Along with timely payments, it is also vital to reconcile them with invoice orders. Overpayments and duplicate payments can occur as a result of inefficient accounts payable practices.

- Human errors may occur in matching the goods and services received with those invoiced from suppliers. Employees may fail to process invoices for new orders or enter incorrect information on contract notes or data files.

How to enhance the value through accounts payable optimization?

Following are some ways in which businesses can optimize their accounts payable processes:

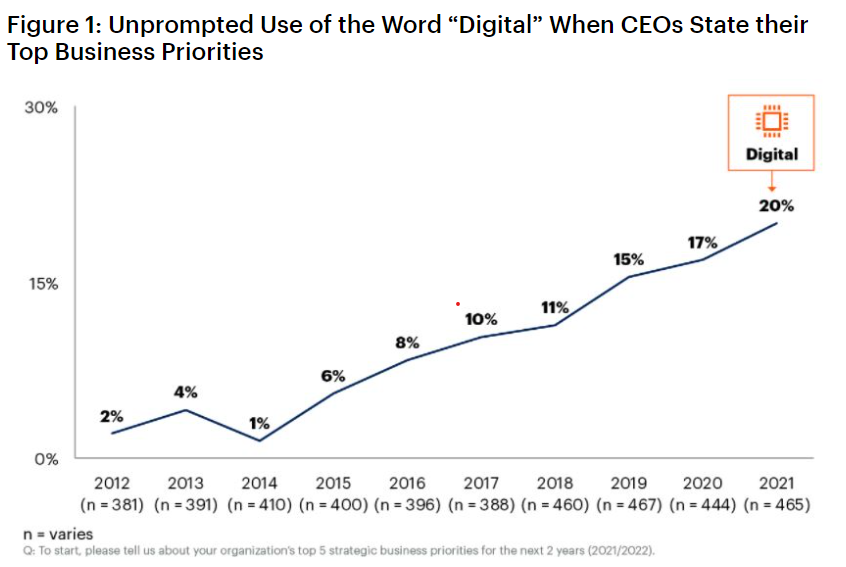

Introduce automation technology for accounts payables

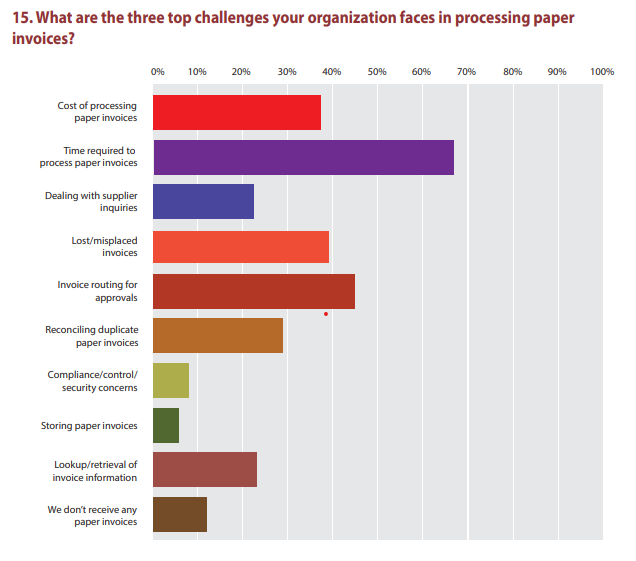

Businesses that rely on manual, paper-based accounts payable processes are prone to costly errors and discrepancies. Accounts payable automation, on the other hand, allows finance teams to digitize repetitive tasks like procurement, invoice management and supplier management, amongst others. Using technology to automate these activities reduces human errors associated with manual processing.

Managing payments and electronic invoices from one place not only simplifies the payment process but reduces the risks associated with losing the bills or invoices. Automation can also help speed up the orders and lead to faster resolution of customer inquiries.

Additionally, it can also reduce overhead costs or costs of employing additional employees in case of high-volume processing. Businesses may take some time to implement accounts payable automation solutions, but once they master it, it can provide a substantial competitive advantage.

Process reengineering and effective reporting

As you must be aware, accounts payable is actually a complex web of inter-connected tasks and involves multiple stakeholders. It is this multi-step nature of the AP process which makes it more prone to costly errors and frauds. Optimizing the AP function can allow your businesses to define clear SLAs, identify bottlenecks and streamline overall processes, leading to higher accuracy & efficiency rates.

Similarly, in the modern-day business scenario, business owners expect their finance teams to leverage financial data to contribute to overall company growth. Optimizing the AP function can directly lead to enhanced value as accounting teams gain access to easily digestible & customized reports that in turn lead to smarter procurement decisions.

Implement efficient control systems

Setting up stringent approval processes is another way to optimize accounts payables. For example, separate authority controls should be set for orders of different sizes. In addition, the validation of high-value orders should be subject to top-level approvals. All these actions will streamline the purchasing process within the organization.

Accounts Payable outsourcing to set up future-ready finance teams

Process optimization and technology implementation can get extremely exhaustive and can completely drain out a company’s onshore resources. To add to that, finding & retaining qualified accountants is not only difficult but also expensive. In such scenarios, accounts payables outsourcing is often the go-to solution.

As you might be aware, accounts payable outsourcing allows a business to leverage the expertise of third-party company to handle its procurement processes. Let us touch upon a few other benefits of accounts payable outsourcing:

- Spare resources for other projects

- Fewer errors, like overpayment to vendors

- Higher efficiency and quicker results

- Lower costs, like the cost of training employees for new technology

- Better security in paper processing and less chances of fraud

Other accounts payable optimization practices

As mentioned earlier, accounts payable is actually a multi-step function that includes activities like vendor selection, supplier data, invoicing, and payment schedules. In addition to the above-mentioned steps, organizations can also implement the following strategies to further optimize their payables:

- Only key personnel and higher authorities should have access to vendor negotiations. This increases the chances of getting favorable buying terms.

- Setting up supplier portals can go a long way in accounts payable optimization. However, it is important to periodically review and update data regularly for any changes in payment structure or discounts.

- In case the vendor defaults, the organization must include suppliers’ clauses in their contracts. This will play a crucial role in protecting them from fraud or loss.

- Implement policies and procedures, as well as train and educate your employees about following them.

Conclusion

You can see what an important a role an optimized accounts payable process plays in simplifying routine transactions and lowering business risks. Therefore, companies must, from time to time, evaluate their strategies to assess and benchmark their accounts payables performance. Outsourcing accounts payable can turbocharge your optimization goals and help your business maximize value. Get in touch with us to schedule a o-obligation consultation.

Originally published Dec 17, 2021 07:12:46, updated Jun 28 2024

Topics: Accounts Payable Optimisation