Topics: Accounts Payable Process, Property Management

Posted on May 09, 2025

Written By Siddharth Sujan

Manual accounts payable processes are still surprisingly common in property management. Paper invoices, email threads, spreadsheet trackers—they’ve stuck around longer than they should. But here’s what often gets overlooked: the hidden costs.

Slow approvals delay payments. Missed invoices rack up late fees. Skilled staff waste hours chasing paperwork instead of focusing on more strategic work. Vendors lose trust. And those small manual errors? They quietly chip away at your bottom line.

In this blog, we’ll unpack the real, hidden costs of manual AP processes and explore how switching to automated AP in property management can help reduce waste, streamline approvals, and free your finance team to focus on what really moves the business forward.

On the surface, manual accounts payable in property management may seem manageable—until portfolios scale, vendor lists grow, and late payments become the norm rather than the exception. That’s when the cracks show.

From missed early payment discounts to overworked finance teams stuck chasing invoice approvals, the hidden costs of manual AP processes add up fast. And while these costs may not always be visible in standard P&L reports, they chip away at profitability, cash flow stability, and vendor trust.

Every manual entry is a chance to get it wrong—duplicate payments, lost invoices, mismatched line items. These aren’t just clerical slip-ups. They can throw off your reporting, invite audit issues, and add hours of rework to already overstretched teams.

Manual AP is slow. Invoices sit in inboxes or wait on approvals. Deadlines get missed. Late fees pile up. And vendors who rely on timely payments start losing confidence. In property management, that’s a risk you can’t afford.

When your most capable finance professionals are buried in invoice matching or chasing signatures, you’re underutilizing serious talent. The true cost here? Less time for forecasting, analysis, and growth-focused financial planning.

What works for five properties might fall apart at fifty. The problems with manual invoice processing don’t scale—they snowball. The more invoices, vendors, and locations you add, the harder it gets to maintain accuracy and control without a system that grows with you.

It’s not just about being slow—manual accounts payable in property management creates blind spots that make it harder to manage your cash with confidence. And when you can’t predict your cash position, it’s tough to plan, invest, or respond to change.

Manual systems make it nearly impossible to run payments in a consistent, controlled rhythm. Some vendors get paid too early, others too late. That makes it harder to time outflows around rent collection cycles or seasonal expenses—and much easier to miss early payment discounts that could’ve padded your margins.

Without accurate, real-time AP data, your forecast is always looking backward. By the time you spot a budget overrun, it’s already happened. And if your invoice backlog spans multiple inboxes, properties, or approvers, finance leaders end up making decisions with an incomplete picture of actual liabilities.

This is where the hidden costs of manual AP processes start to hit harder. It’s not just the late fees or duplicate payments—it’s the missed chance to optimize vendor terms, the inability to negotiate based on real-time data, and the lost flexibility in how you manage your short-term working capital.

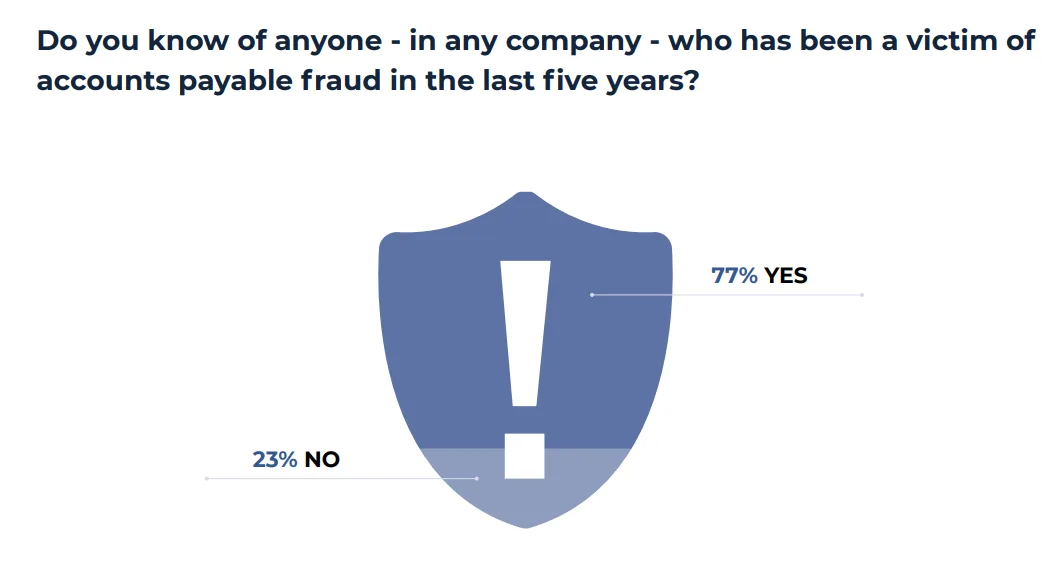

Property management leaders often focus on AP process efficiency—but what’s less visible (and far more dangerous) are the compliance and security risks tied to manual accounts payable in property management.

Unlike automated systems that log, flag, and track every step, manual AP leaves gaps. And in property management, those gaps can quickly turn into red flags.

That’s the real problem with manual AP—it doesn’t just slow you down, it leaves your operations exposed. And patching those gaps with more people or workarounds only adds to the cost. If property management teams want to fix the root of the problem, they need something smarter.

This is where automated AP solutions come into the picture.

RELATED BLOG: Want faster invoices, fewer errors, and better cash flow? Start with this AP automation guide.

Once you’ve seen what manual AP costs you, the case for change becomes impossible to ignore. But it’s not just about replacing paper with software—it’s about rethinking the entire payables engine.

Here’s how accounts payable automation helps cut through complexity—and costs.

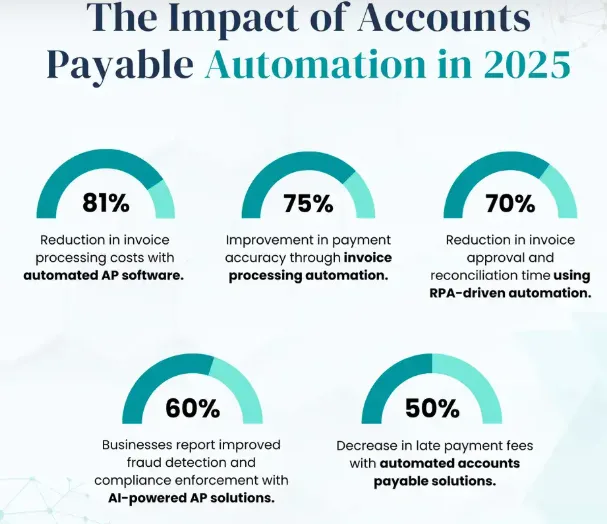

The days of keying in invoice data line by line are done. AP automation platforms now use intelligent OCR (Optical Character Recognition) and AI to extract line-item data, match it to purchase orders, and route it for approval—automatically.

Fewer errors. Faster processing. And a huge drop in time spent on invoice validation and coding. That’s not just AP process efficiency—that’s time and money back to the business.

Manual approvals move at the speed of inbox clutter. Automated accounts payable solutions change that with rule-based workflows that instantly route invoices to the right people and follow up until it’s done.

The result? You close the loop quicker, unlock early payment discounts, and improve vendor trust. In property management, where margins are often razor-thin, this kind of agility can be a real differentiator.

Still relying on end-of-month reports to see what’s been spent? That’s part of the problem. With automated AP solutions, every invoice status, payment due date, and exception is visible in real time.

This can prove to be a game-changer for operations. Real-time AP dashboards let you track liabilities across properties, flag anomalies instantly, and make smarter decisions before the close, not after it.

Manual AP can barely keep up with today—let alone what’s coming next. With automation, you can handle 5,000 invoices or 50,000 without adding headcount or complexity. And because today’s property management accounting software integrates with leasing, maintenance, and vendor systems, your entire ecosystem becomes more connected, more compliant, and more efficient.

Pro tip: Don’t just look at accounts payable automation as a finance upgrade. It’s a business performance upgrade. When you can pay faster, spot issues earlier, and report cleaner—you’re not just saving money. You’re building trust, freeing up capital, and giving your teams the space to think strategically.

RELATED CASE STUDY: Optimized AP, 60% cost savings, 1-day processing—see the QX impact on a global beverage leader.

The longer you stick with manual AP, the more it chips away at efficiency, accuracy, and trust. From missed discounts to strained vendor relationships and cash flow blind spots, the real cost of doing nothing is far greater than most realize.

Switching to automated AP in property management means giving your finance teams the tools they need to move faster, close cleaner, and think bigger. It means fewer errors, stronger controls, and more room to focus on strategic goals instead of chasing approvals.

At QX Global Group, we help property management firms ditch outdated processes and move toward scalable, automated finance functions that support real growth. Whether it’s AP automation, real-time dashboards, or end-to-end finance transformation—we build solutions that work the way you do.

Ready to take a hard look at your payables? Let’s talk about what accounts payable automation could unlock for your business.

Originally published May 09, 2025 08:05:22, updated Jul 16 2025

Topics: Accounts Payable Process, Property Management