Topics: Finance and Accounting Outsourcing Services, Finance and Accounting Transformation

Posted on June 26, 2024

Written By Priyanka Rout

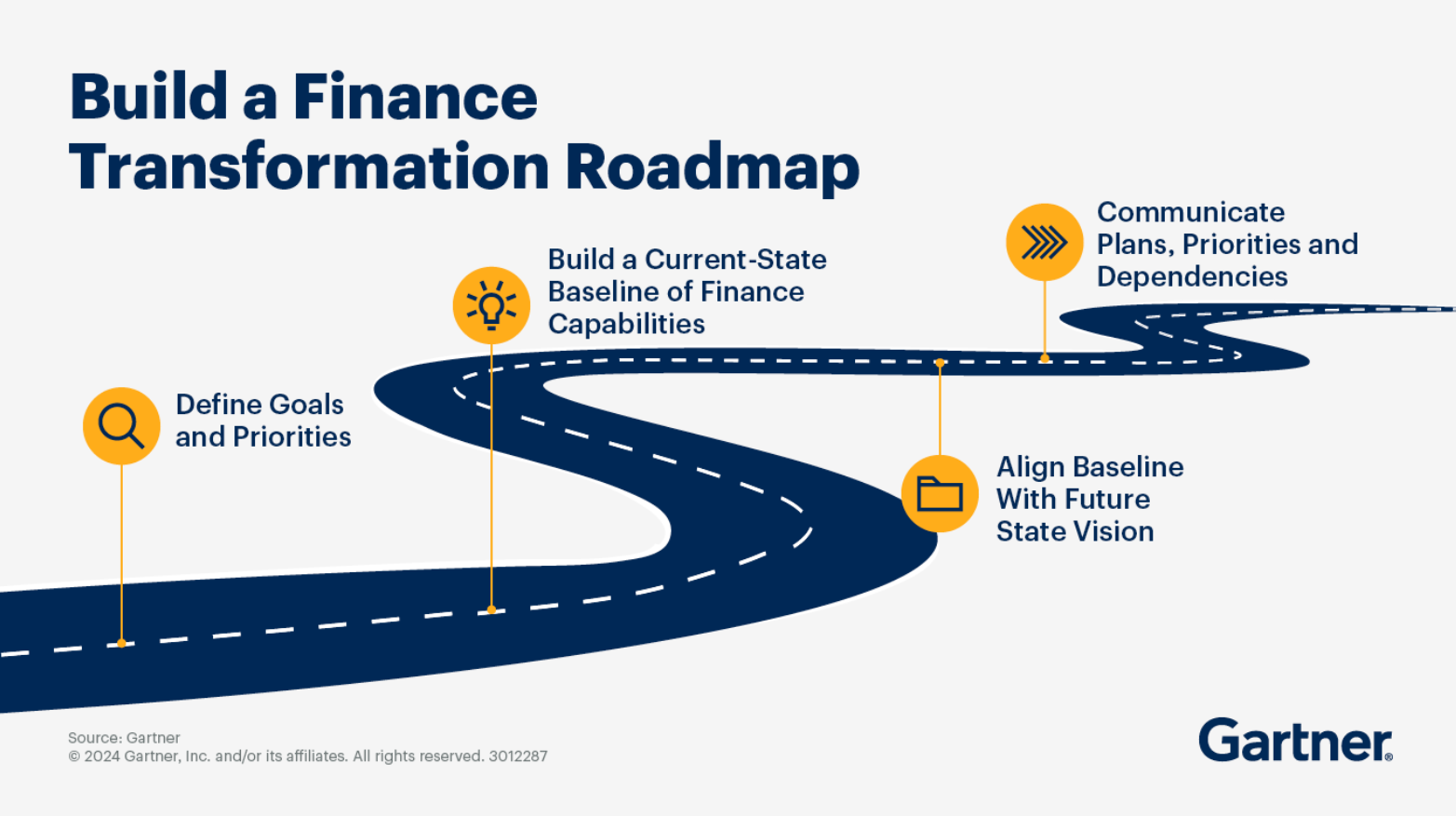

How to build a finance transformation roadmap?; Source: Gartner

Let’s start with an insightful stat: CFOs are concerned about their digital finance transformation paths. A recent Gartner survey found that 55% of finance leaders are unhappy with their current progress, and only 37% have a digital finance strategy in place.

In today’s fast-paced business environment, CFOs face narrowing profits, tougher competition, and stricter regulations. These challenges demand innovation and adaptation, as traditional methods and outdated systems are no longer sufficient. Every bit of efficiency matters, and with competitors constantly advancing, embracing digital finance transformation is essential for staying ahead.

Digital transformation is reshaping industries worldwide, and the finance sector is no exception. For financial institutions, integrating advanced technologies like AI, blockchain, and cloud computing has become crucial for maintaining a competitive edge. This transformation enhances efficiency, accuracy, and security, addressing the need for real-time data analytics, seamless transactions, and robust cybersecurity.

Accounting and finance outsourcing has emerged as a key strategy in this transformation. Partnering with specialized service providers allows companies to access the latest innovations and focus on their core competencies, driving growth and gaining a competitive advantage. In the finance sector, outsourcing plays a crucial role in managing digital transformation effectively, ensuring that organizations can navigate this evolving landscape with agility and success.

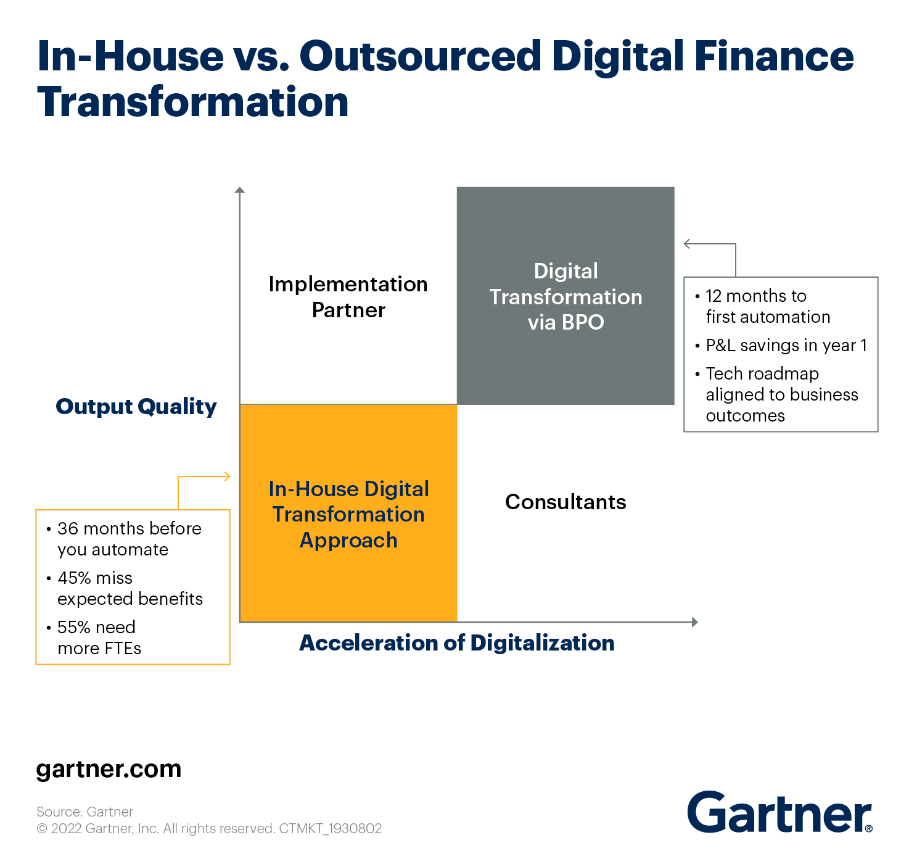

In-House vs. Outsourced Digital Finance Transformation; Source: Gartner

The global market for finance and accounting business process outsourcing was valued at $56.42 billion in 2022. It is expected to grow at a rate of 9.1% per year from 2023 to 2030.

Digital transformation in finance involves integrating digital technology into all areas of financial operations, fundamentally altering how organizations operate and deliver value to customers. This transformation necessitates a cultural shift where organizations must continually challenge the status quo, experiment, and become more agile in responding to market changes.

Accounting and finance outsourcing providers have recognized the low satisfaction levels and slow returns associated with in-house transformation efforts. In response, they have significantly transformed their service offerings, bringing digital services and transformation expertise to the finance sector.

Digital finance transformation typically consists of three phases:

Assess and Benchmark:

Consolidate and Standardize:

Digital Process Automation:

RELATED BLOG: Essential Finance and Accounting Outsourcing Questions Answered

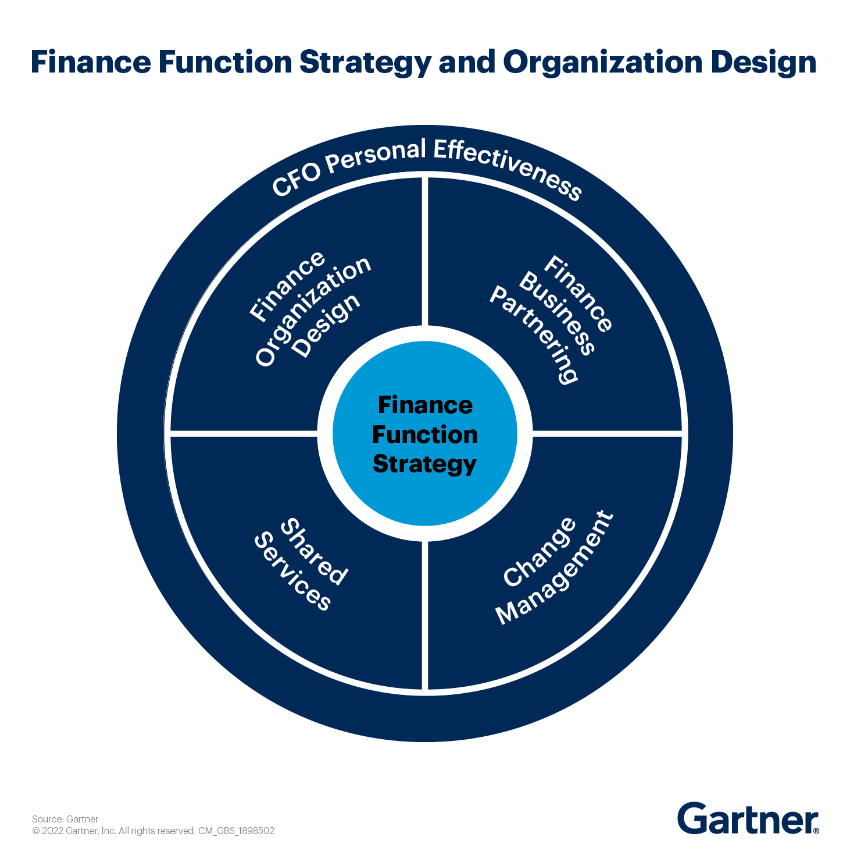

Finance Function Strategy and Organization Design; Source: Gartner

Effective data management is crucial for finance teams. Deloitte’s 2023 Crunch Time Report shows addressing data challenges improves cost management, performance, growth, talent, compliance, and innovation. With 54% of financial leaders citing data silos as a key innovation barrier, accessible data enhances agility and decision-making.

Embracing data skills also helps CFOs attract and upskill talent, fostering growth and a culture of problem-solving and data-driven decisions.

The finance sector faces job vacancies due to burnout and the “great resignation.” To maintain momentum, more organizations are outsourcing to speed up digital transformation.

Gartner predicts 36% of controllers prioritized outsourcing in 2023 and advised assessing BPO capabilities based on technology and transformation expertise, not just labor costs. A cost-benefit analysis and thorough evaluation of providers are crucial.

Digitally savvy finance organizations handle volatility best. Deloitte estimates effective digital transformation can add up to $1.25 trillion in market capitalization for Fortune 500 companies, highlighting the importance of staying updated on technology.

Prioritizing technology helps solve challenges and prepares teams for future disruptions. Generative AI like ChatGPT, though debated, holds potential for smarter financial planning.

CFOs should avoid unlikely projects but train employees in new technology to implement innovative solutions when needed.

Key Roles in Finance Transformation Roadmap; Source: Gartner

The finance industry is undergoing a significant transformation driven by advanced technologies. These innovations are enhancing efficiency, accuracy, and strategic decision-making across financial processes.

Overview: RPA involves using software robots to automate repetitive and rule-based tasks. These tasks include data entry, transaction processing, and report generation.

Overview: Quantum computing leverages the principles of quantum mechanics to perform computations at unprecedented speeds, solving complex problems that are infeasible for classical computers.

Overview: Advanced data analytics and big data involve the analysis of large and complex data sets to uncover patterns, trends, and insights that can drive strategic decisions.

Overview: AI-supported analytics involves using artificial intelligence to analyze data, identify trends, and make predictive and prescriptive recommendations.

In a 2022 EY survey, 62% of CFOs and senior finance executives said they intended to boost co-sourcing for some finance and tax tasks. Additionally, 96% anticipated that their finance teams’ technical skills would be enhanced with expertise in process, data, and technology.

Outsourcing vendors have developed unique methods and solutions to tackle the challenges during the three stages of digital transformation, standing out in two significant ways. CFOs who utilize these services are more likely to see success in their digital finance transformation efforts.

Accounting and finance outsourcing providers include technology in their services, showcasing their capabilities before you commit. This speeds up evaluation and shows how their tech addresses your operational issues, highlighting potential benefits.

Accounting and finance outsourcing providers manage all vendor relationships for your tech stack, simplifying tech management and ensuring access to the best technology. This relieves your internal finance and IT teams from handling multiple vendors and updates.

RELATED CASE STUDY: F&A Operations Transformation For a Global Real Estate Company Through Shared Services

Embracing technology in finance through outsourcing is essential for businesses to thrive today. Advanced tech solutions enhance financial operations, improve accuracy, and boost efficiency, strengthening the bottom line.

When outsourcing accounting and finance for digital transformation, choose a partner with industry expertise and a proven track record. Start with a thorough assessment of your financial processes to identify where technology and outsourcing can add the most value.

At QX Global Group, we specialize in providing top-notch outsourced financial services that align with your company’s strategic goals. Our team of experts is dedicated to helping you streamline operations, reduce costs, and stay ahead of the curve.

To learn more about how QX Global Group can support your financial transformation, visit our website or contact us directly. Take the first step towards a more efficient and tech-savvy financial future today.

Outsourcing can significantly enhance financial performance by reducing operational costs, improving efficiency, and enabling companies to focus on core competencies. It can lead to better cash flow management, access to specialized skills, and scalability of operations, ultimately driving profitability and financial growth.

Outsourcing boosts the economy by creating jobs, promoting global trade, and increasing business efficiency. It allows companies to leverage cost-effective labor markets, leading to lower production costs and competitive pricing. This, in turn, stimulates economic activity, encourages investment, and fosters innovation.

Outsourcing has positively impacted India by creating millions of jobs, enhancing skill development, and contributing significantly to GDP growth. It has positioned India as a global hub for IT and business process outsourcing, attracting foreign investment, improving infrastructure, and boosting the standard of living for many citizens.

Originally published Jun 26, 2024 05:06:37, updated Jun 26 2024

Topics: Finance and Accounting Outsourcing Services, Finance and Accounting Transformation