Scaling a property management company (PMC) isn’t just about acquiring new clients—it’s about doing so efficiently while maintaining or even reducing operational costs. A crucial aspect of this growth is financial planning for property management, ensuring that cash flow, budgeting, and investment strategies align with long-term business goals.

The property management market is projected to reach $37.25 billion by 2029 and the main challenge for PMC owners lies in sustainable, manageable growth. This is especially pertinent in an industry where operational efficiency remains a significant hurdle, as indicated by the 2023 NAA Property Management Industry Pulse.

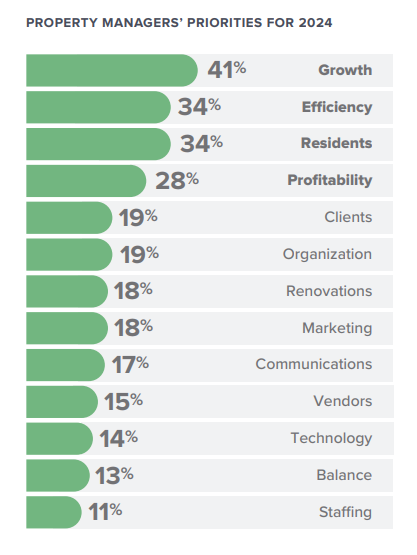

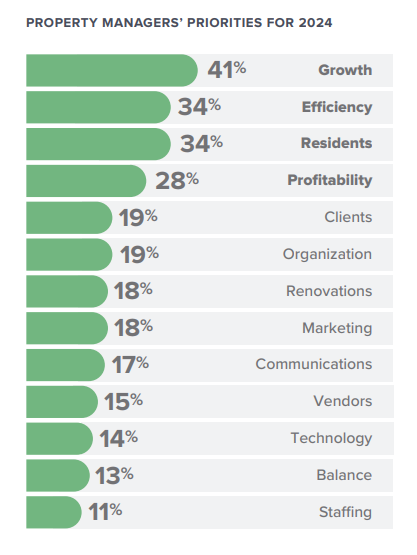

Property Managers’ Priorities for 2024; Source: 2024 State of the Property Management Industry Report by Buildium

In this blog, we will explore not only the ‘when’ but the crucial ‘how’ of scaling your property management business. We’ll discuss strategies to balance the management of single-family, student, affordable, and multifamily properties, and delve into creating a real estate portfolio that not only builds wealth but also achieves broader financial goals through diversification and smart risk management.

Why Expand Your Property Management Portfolio?

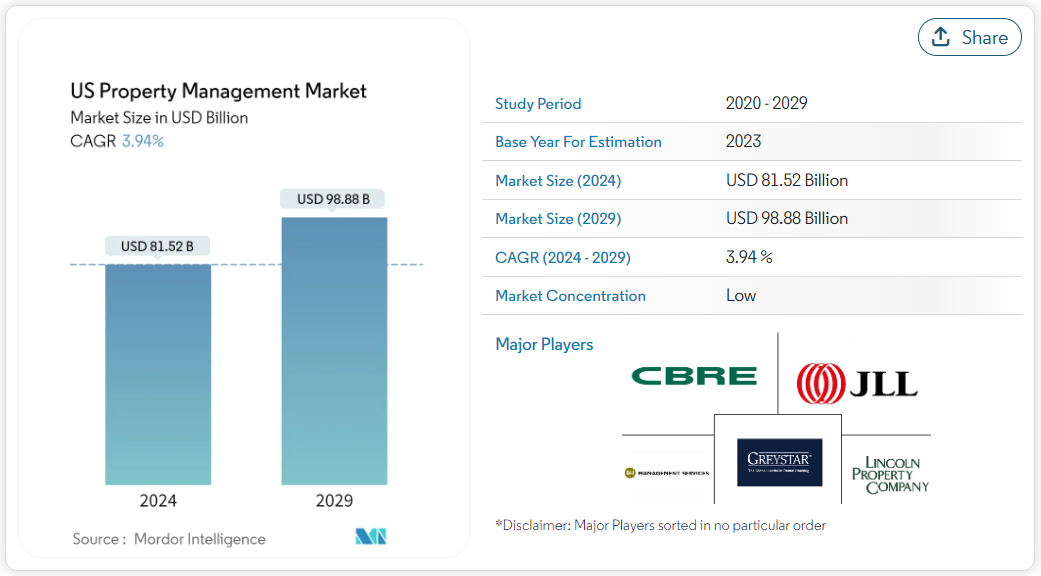

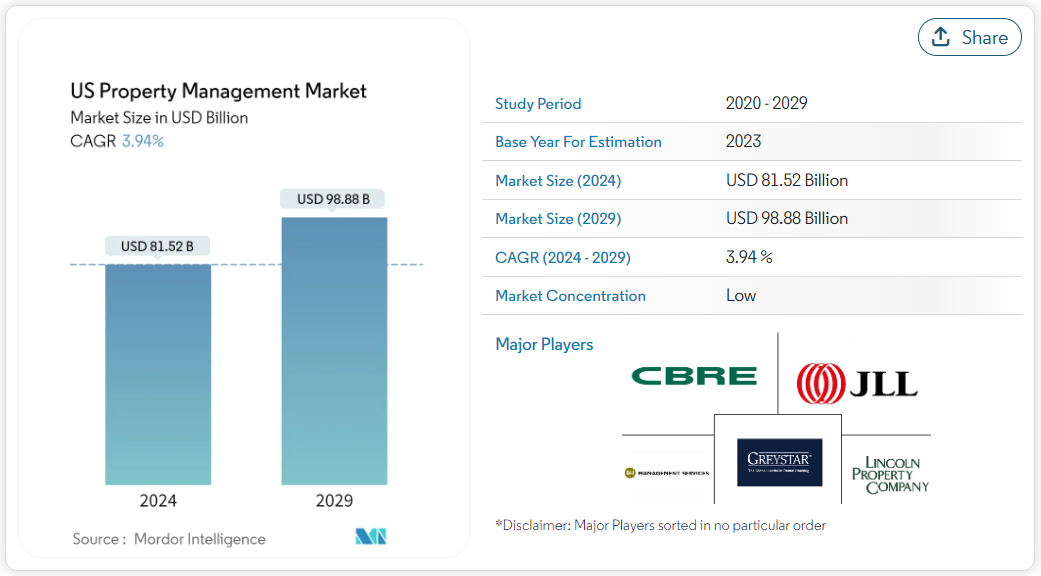

US Property Management Market; Source: Mordor Intelligence

Expansion isn’t just about growth; it’s a strategic move to adapt and thrive in a dynamic market. For property managers, deciding to grow their portfolios often stems from spotting untapped potential and timely opportunities. Here’s why you might consider it:

- Riding the Wave of Demand: Urban sprawl and demographic shifts often create new pockets of demand in both familiar territories and emerging neighborhoods. If you’re noticing more “For Rent” signs going up or an uptick in inquiries, it might be a sign that the market is ripe for you to step in and fill the gaps.

- Mixing It Up for Stability: Adding a mix of residential, commercial, and niche properties like student housing or vacation rentals can cushion your business against fluctuations in any single market. Think of it as not putting all your eggs in one basket, ensuring you have continuous revenue streams even if one sector dips.

- Boosting Your Bottom Line: Expanding your portfolio can also mean better economies of scale. Managing more properties efficiently can reduce per-unit costs and boost overall margins. It’s about making more from what you have and finding new avenues that promise better returns.

Discover how QX partnered with a prominent senior living operator, managing over 60 communities across eight states to optimize their back-office accounting operations.

Assessing Market Conditions for Scaling Property Management Business

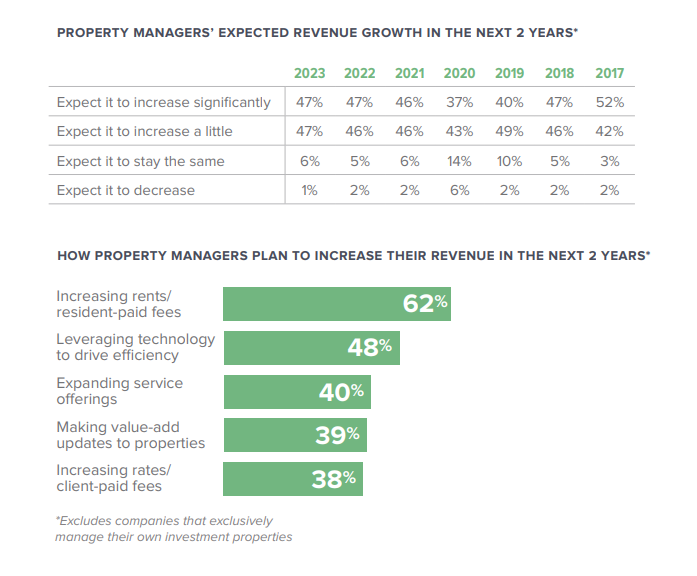

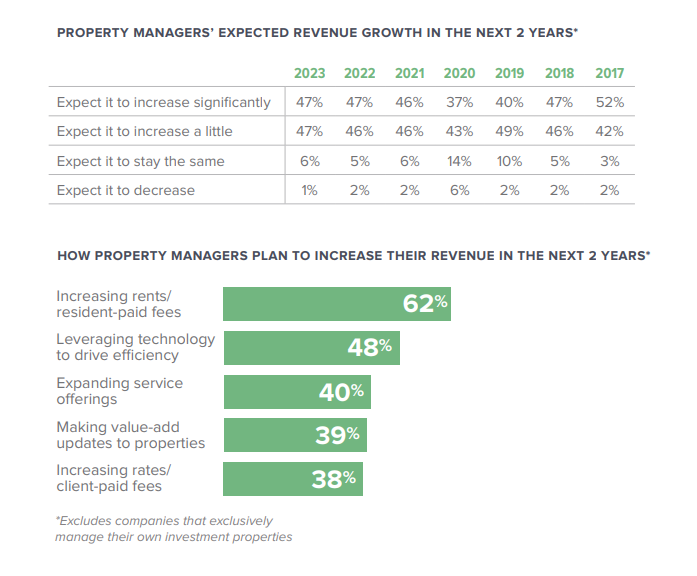

The Revenue Scenario for Property Management Companies; Source: 2024 State of the Property Management Industry Report by Buildium

When you’re considering expanding your property management business, getting a solid grasp of the market conditions is essential. Here’s a more detailed approach on what to analyze and how to interpret the data to strategically plan your expansion:

Market Analysis

Starting with a comprehensive market analysis can set the foundation for your expansion plans:

- Demographic Trends: Take a close look at who lives in the area you’re targeting. Are there more families or singles? What’s the average age and income level? Understanding these factors can help you determine the type of properties that might be in high demand, whether it’s family homes, upscale apartments for young professionals, or budget-friendly units.

- Economic Conditions: Assess the economic vitality of the area. Are major companies setting up shop there? What are the main employment sectors? A strong job market usually correlates with higher demand for housing, while a diversifying economy might suggest stability and growth potential.

- Competitor Analysis: Identify who else is managing properties in your target area. What services do they offer? What are their pricing structures? By knowing your competition, you can find gaps in their offerings that you might fill, or you can identify areas where you can outperform them in quality or price.

Demand Forecasting

Accurately forecasting demand is crucial for successful expansion:

- Historical Data Analysis: Review the past few years’ trends in rental prices, occupancy rates, and property values in the area. This will help you understand the market dynamics and predict future movements. Look for patterns of growth or decline and relate them to external factors like economic changes or population movements.

- Predictive Modeling: Leverage advanced analytics and modeling techniques to predict future market behaviors. You can use regression models, machine learning algorithms, or economic forecasting tools to simulate different scenarios and see how changes in the market could affect demand for rental properties.

Current Financial Status

Before expanding, you need a clear picture of your company’s financial health:

- Financial Statements Review: Deep dive into your balance sheets, income statements, and cash flow statements. This thorough review will help you understand your financial capacity for expansion and whether you need external funding.

- Debt-to-Equity Ratio: Calculate your debt-to-equity ratio to evaluate your financing structure. A higher ratio could indicate potential risk if the market turns volatile. Ensure your debt levels are manageable and aligned with industry norms.

- Liquidity Check: Ensure you have sufficient liquid assets to cover upcoming liabilities. This is crucial to maintain smooth operations during the expansion phase, as new investments might not generate immediate returns.

Risk Assessment

Exploring funding options comes with understanding the associated risks:

- Equity Financing: While this can dilute your control, it reduces personal financial exposure. Consider how much influence you’re willing to share and evaluate potential partners’ alignment with your business philosophy.

- Debt Financing: Analyze the terms of potential loans or credit lines. Ensure that the interest rates are favorable and that repayments fit comfortably within your projected cash flows. Always have a contingency plan to manage unexpected shifts in market conditions.

- Reinvesting Profits: This approach avoids additional debts or dilution of ownership but limits your financial flexibility. Make sure that reinvesting won’t leave you too strapped to handle unforeseen expenses.

- Risk Mitigation: Develop strategies to mitigate risks, such as maintaining a reserve fund, opting for fixed interest rates to protect against rate increases, or diversifying your investment portfolio to spread risk.

Budgeting for Property Management Expansion

Expanding your property management business is an exciting step, but it demands meticulous financial planning. Let’s break down how you can sketch out a budget that’s both thorough and ready for the twists and turns of growth.

Crafting Your Budget

Think of your budget as your expansion blueprint—covering everything from the get-go to the day-to-day:

- Acquisition Costs: Line up all the initial costs associated with acquiring new properties. This includes the buying price, any closing fees, payments to brokers, and the first rounds of legal advice. These costs can vary depending on the property and location, so local insights are a must.

- Renovations and Upgrades: Tally up what you’ll need to spend to upgrade each new property to standard. Whether it’s major overhauls or just some fresh paint and fixtures, list out these costs property by property to control spending.

- Staffing: Consider the additional staff required to maintain smooth operations. Expanding your property portfolio likely means hiring more property managers, maintenance crews, or customer service representatives. Factor in the budget for recruiting, onboarding, and their salaries and benefits.

- Marketing and Advertising: Allocate a portion of your budget for marketing your new properties. This could include digital campaigns, billboard advertising, hosting open houses, or offering enticing leasing specials to quickly attract tenants.

- Operational Costs: Don’t forget the everyday expenses—things like utilities, upkeep, office supplies, and tech upgrades needed to handle more properties. These are the ongoing costs that will continue to accrue.

- Legal and Professional Fees: Keep a line item for the experts. You’ll want ongoing access to legal and accounting pros, especially as you navigate new markets or regulatory mazes.

Planning for the Unexpected

While property expansion often goes as planned, surprises can still occur. That’s where a solid contingency fund comes into play:

- Fund Size: A good rule of thumb is to set aside 10-20% of your total project budget for surprises. This fund will be your financial safety net.

- Fund Use: Be clear about what this money can be used for—think unforeseen repairs, legal snags, or budget overruns. Setting rules helps keep your contingency fund intact for real emergencies.

- Risk Buffer: This fund is your shock absorber, softening any financial jolts during the expansion process, ensuring they don’t knock your plans off course.

Navigating Compliance

Stepping into new territory means dealing with a web of legal and regulatory demands:

- Zoning Laws: Research zoning rules to make sure your new properties can operate as intended. Overlooking this up can mean big fines and big delays.

- Property Taxes: Figure out how your property taxes might shift with your new purchases. This will affect your ongoing costs, so it’s best to brace for any increases.

- Licensing Requirements: Every area has its own set of rules. You might need new business licenses, real estate licenses, or construction permits.

- Environmental Regulations: If you’re building or renovating, adhere to environmental laws regarding waste, pollution, and energy use to stay compliant.

- Accessibility and Safety Standards: Make sure all your properties meet the latest accessibility and safety regulations. Staying compliant avoids legal trouble and ensures everyone can safely access your properties.

Implementation Plan for Property Management Expansion

Rolling out an expansion plan in property management needs a hands-on, structured approach to ensure everything ticks along smoothly and stays on track. Here’s how to lay out a practical project management framework, sketch out a timeline with milestones, and keep tabs on the performance of your new properties.

Setting Up Your Project Management Framework

To keep the many moving parts of your expansion under control, a solid project management setup is essential:

- Choose a Project Manager: Pick someone with experience in property management expansions to lead the charge. This person will be your point person for everything related to the project, ensuring that every task is on point.

- Map Out Roles and Responsibilities: Clearly define who does what. This includes everyone from your internal team to external contractors, legal consultants, and any other stakeholders. Knowing who’s responsible for each task ensures nothing falls through the cracks and everyone knows what’s expected of them.

- Use the Right Tools: Bring in project management software to help plan, track, and manage all phases of your project. Tools like Asana, Trello, or Microsoft Project can help keep track of deadlines, progress, and tasks, and they make it easier to keep everyone in the loop.

- Keep Communication Open: Set up regular meetings to go over progress, address any issues, and make decisions on the fly. This keeps everyone aligned and ensures the project keeps moving forward smoothly.

Crafting Your Timeline and Milestones

A detailed timeline with clear milestones helps pace your project and measure its success:

- Build a Comprehensive Timeline: Divide the expansion into clear phases—like planning, buying, fixing up, marketing, and launching. Set realistic deadlines for each based on your past experiences and what you expect to face this time around.

- Identify Key Milestones: Within each phase, pinpoint major milestones. This could be things like closing on property deals, wrapping up major renovations, getting new team members on board, or hitting target occupancy rates. These milestones are like checkpoints that help you see how you’re doing and make tweaks as needed.

Tracking Performance

Making sure your newly expanded properties are doing well means keeping a close eye on their performance:

- Set Clear KPIs: Decide on the key performance indicators that matter most for monitoring your new properties. Think about things like how full your properties are, how long they stay full, rental income averages, how quickly you fill empty spots, and what you’re spending on upkeep. Choose KPIs that line up with your specific goals and challenges.

- Regular Financial Check-Ups: Do financial audits regularly to check up on the health of the new properties financially. Look over all the financial documents—like income statements and cash flow statements—to ensure everything is transparent and on target.

- Get Feedback: Set up ways to collect feedback from tenants and staff regularly. This input is invaluable for spotting issues early and figuring out how happy your tenants are. Use this info to fine-tune how you manage your properties and boost overall performance.

- Leverage Technology: Think about bringing in advanced property management tech that offers real-time analytics, automatic reporting, and streamlined financial management. This kind of tech can give you deeper insights and help make managing everything a lot smoother.

What’s the Bottom Line?

As you consider expanding your property management business, remember that the key to efficient scaling often lies in simplification. Streamlining back-office operations is crucial, as it helps reduce overhead costs and boost operational efficiency, allowing you to focus more on growth and less on administrative burdens.

At QX Global Group, we understand the challenges of expansion. We specialize in helping businesses like yours streamline their back-office functions, ensuring a smoother transition as you grow. If you’re planning your expansion strategy and need support with the complexities of scaling, feel free to reach out or visit our website for more information. We’re here to help you focus on what you do best—managing and growing your property portfolio.

FAQs

What is property management scaling?

Property management scaling refers to the strategic expansion of operations to manage more properties efficiently while maintaining or reducing costs.

Why is financial planning important for scaling property management?

Financial planning ensures that growth is sustainable by managing cash flow, budgeting effectively, and making informed investment decisions to avoid financial strain.

What are the initial signs that indicate it’s time to scale property management operations?

Signs include consistent demand growth, operational efficiency at current capacity, strong financial performance, and the ability to streamline workflows through technology.

What are the best practices for budgeting during the scaling process?

Best practices include setting realistic revenue goals, forecasting expenses, allocating funds for technology and staffing, and monitoring cash flow regularly.

How can property managers secure funding for scaling operations?

Property managers can secure funding through bank loans, investor partnerships, government grants, or reinvesting profits to support expansion efforts.

What’s the best way to achieve property management growth while keeping up with service quality?

To grow your property management business while maintaining service quality, focus on integrating advanced technologies for automation, investing in continuous staff training, and maintaining open lines of communication for feedback from tenants and property owners. Standardizing processes ensures that quality doesn’t slip as your portfolio expands, and leveraging property management software can streamline operations, reducing the risk of service degradation.

What should I consider when expanding my property management portfolio to new types of properties?

When expanding your portfolio to include new types of properties, consider the unique market demands, regulatory requirements, and operational needs of these properties. Conduct thorough market research to understand the nuances of each new property type, assess the financial implications and potential returns, and ensure your team is prepared and trained to manage these new challenges effectively. Additionally, evaluate whether your existing operational infrastructure can support these new property types or if you need to invest in new systems and technologies.

How can I maintain operational efficiency in property management as my portfolio grows?

Maintaining operational efficiency as your portfolio grows involves streamlining processes through technology, outsourcing non-core functions like maintenance, and continuously training your team to handle increased demands. Implementing robust property management software can automate many day-to-day tasks, allowing your team to focus on strategic activities and tenant relations. Regular performance reviews and updates to operational protocols will also help ensure that your business remains efficient and responsive as it expands.

Originally published Sep 12, 2024 01:09:05, updated Apr 04 2025

Topics: Finance and Accounting Transformation, Property Management

Don't forget to share this post!