Topics: Student Housing

How international student mobility trends are reshaping the student accommodation market

Posted on May 16, 2017

Written By QX Global Group

Over the last few years, purpose-built student accommodation has transformed from an alternative investment opportunity to a full-blown global real estate class. Between 2015 and 2017, the sector saw tremendous consolidation via mergers and acquisitions, with $14.9 billion invested in 2015. The UK market saw over $7 billion investment in 2016 alone.

This growth parallels that growth of the internationally mobile student population. The top markets for international students – the US and the UK – have received a bulk of the investments so far. However, other markets like Australia, Germany, Spain, France, the Netherlands and various other mainland European countries are actively attracting international students and are beginning to pique the interest of student accommodation investors.

While purpose-built student accommodation has hitherto experienced much higher demand than supply, international student mobility trends in the coming years will determine how rapidly it can continue to grow. For the two top markets, the potential policy changes resulting from the election of Mr Donald Trump in the USA and Brexit in the UK (and the possible changes in attitudes towards immigration and post-work study rules) are the factors that are most likely to impact international student mobility trends.

Snapshot of international student mobility trends

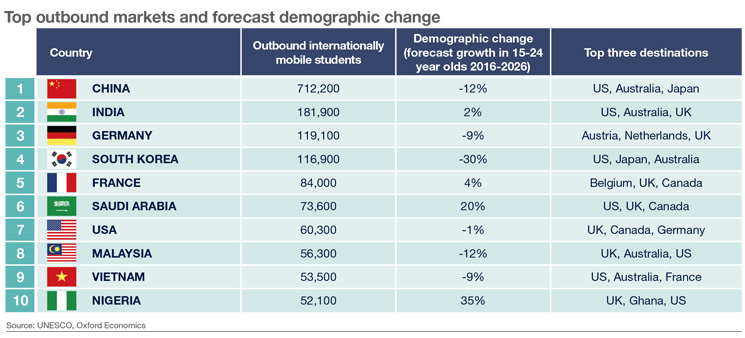

The growing Asian economies of China and India, along with South Korea have been major contributors to the growth of international student mobility. Over 50% of all international students originate from an Asian country. However, the number of outbound students from South Korea has been falling over the years.

In addition, the demographic trends in Saudi Arabia and Nigeria (rising population of 15-24-year-old), in conjunction with an increased appetite for international study in these countries, shows that they will grow as outbound markets in over the next decade.

The below chart from Savills: Spotlight World Student Housing 2016-17 report enumerates the total number of outbound students and the demographic change forecast:

Impact on the US student housing market

US leads the pack as the top destination for international students. According to a UNESCO Institute for Statistics analysis, US is the top destination for Chinese international students (the largest market by far), followed by Australia, Japan, UK and Canada. With over one million international students, the US’s higher education sector has seen a consistent growth in the number of international students over the last decade; until last year in fact when the 10% growth in the number of international students in 2014-15 fell to 7% in 2015-16.

While the real impact of the anti-immigrant rhetoric on international student mobility will become clear only after a few months, a survey by IIE (Institute of International Education) highlights a drop in international student applications for 40% of the schools, especially from the Middle East. Reports also show fewer applications from China and India. Also, compared with the UK and European nations that are making dedicated efforts to attract international students, the US lacks a coherent policy and doesn’t have a central agency that is solely responsible for promoting higher education.

Owing to the combination of these factors, it is possible that the US may see a dip in the growth figures of international applications. However, education in the US is held in high esteem by the biggest outbound student sources – China and India – so there is unlikely to be a drop in the total number of applications, but the year-on-year growth may stall.

As the demand for dedicated student accommodation far outstrips the supply, the sector is expected to perform strongly. Nat Kunes, Vice President of Product Management at AppFolio Inc. says: “It would be pretty hard to overbuild in most markets, there is such strong demand… In most markets you could double the amount and not overbuild.”

Impact on the UK student accommodation market

While the bulk of international students in the US come from China and India (which are the largest outbound sources of international students), the UK is seeing a consistent decline in the number of Indian students and witnessing a relatively slow growth in the number of Chinese students.

Data from HESA (Higher Education Statistics Agency Ltd) shows that the number of students originating from India dropped by 44% over from 2010-11 to 2015-16. One of the primary reasons for the decline is the abolishment of the Tier-1 post-study work visa. Amidst the confusion created by Brexit and the upcoming elections, more and more Indian students are looking at other alternatives. Indian and UK officials have talked about better post-study work visa terms, but that is unlikely to happen during this educational year. The other reason is the introduction of higher tuition fees that saw the overall student numbers in the UK fall by 8.1% in 2015-16, down from the peak year of 2010-11.

Similarly, there has been a drop in the number of Nigerian and Saudi Arabian students choosing the UK. The data also shows the total number of Chinese students preferring the UK for their education has grown by 35% over the last 5 years, which is much lower than the 109% increase the US has witnessed. Post-Brexit, the UK may also lose a significant number of EU students (numbering over 125,000) who see the fees rise and work prospects dampen.

Saville’s Spotlight: UK Student Housing report notes that international student numbers may rise after the general election: Assuming students are excluded from immigration targets in party manifestos, we forecast international student numbers to rise by 6% per year over the next three years.”

It would be an understatement to say that a lot rides on the General Election and how Brexit is managed, but the student housing marketing, especially in top-tier cities with low supply, is still ripe for investment.

Wrapping up: rising competition from European countries

While the UK and the US have dominated international study for the last decade, in no small way helped by English as the default language of education, the climate of political uncertainty and anti-immigration rhetoric is pushing students to explore other avenues. On one hand, countries like China with huge outbound student population are investing in raising the level of local education institutes, and on the other hand countries like Australia and Malaysia are emerging as attractive education destinations.

However, the strongest competition to the US and the UK comes from European nations like Germany, France, the Netherlands and Spain which are offering courses in English and are following a policy of attracting international students. Also, many of the countries in the EU have not revised tuition fees and attract value-seeking students.

International students accounted for 11% of the total student population in 2015-16, and the number is expected to rise to 22% by 2022. Similar trends in France: the international student population is expected to rise from the 12% in 2015-16 to 30% of total students by 2020. Most of the EU nations are undersupplied and the tradition of renting common residences is gradually giving way to specialised student housing. The low maturity of student accommodation markets in these countries have kept away institutional investors but activities by entrepreneurial capital are paving the way for a possible student accommodation boom.

Originally published May 16, 2017 09:05:10, updated Jul 24 2024

Topics: Student Housing