Topics: Accounts Receivable Process, Finance & Accounting Outsourcing

Posted on February 26, 2024

Written By QX Global Group

Companies are always looking for solutions that can trigger business growth. One of the ways this can happen is by achieving a degree of operational scalability; this ties in with business expansion. The more you expand your business, the more scope for growth. Rising interest rates and higher taxes are putting pressure on businesses in the UK, which can impact their growth prospects in 2024. However, companies cannot look at the darkening economic outlook and not take corrective measures; these companies must look for new ways to grow and save money.

But this is better said than done.

Growth is a direct outcome of investing in technology and people, which allows companies to explore new opportunities and extend their footprint in more unique markets. There are many challenges that can be detrimental to these efforts.

Let’s see this in the AR (Accounts Receivable) context.

As a business grows, so does its volume of accounts receivable. The more your customers, the more the number of products or services sold, and the more money legally owed to your business by customers who have been extended lines of credit. This is good news for any company because they are poised to grow their revenue, but that is only possible if the AR process is managed optimally. For that to happen, you will need a well-qualified and experienced team of accountants at the helm of accounting affairs, and you must be able to scale this team when needed. A well-honed and scalable accounts receivable process is also a direct outcome of the technology that supports this function and automation that optimises and improves task velocity. The focus should be leveraging an accounting tech stack that brings immense value to the AR process.

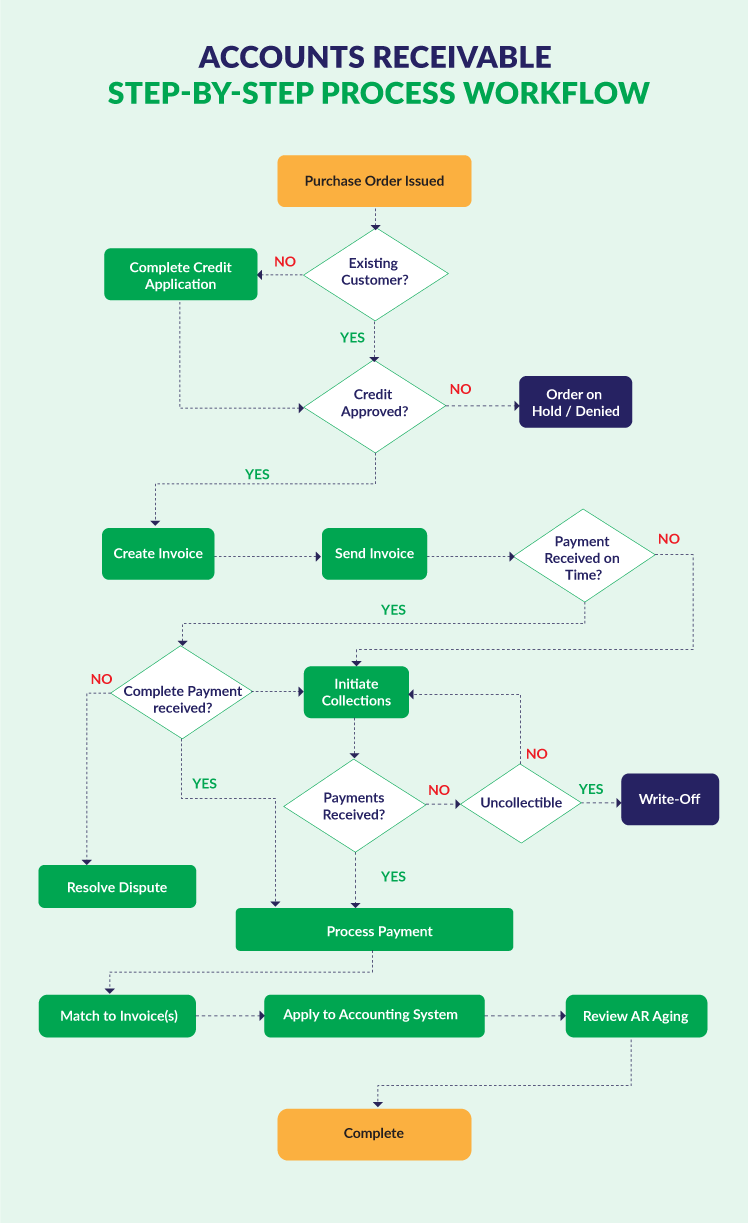

We touched upon how accounts receivable and growth are interconnected. But let’s also discuss why AR is so critical to accounting. At its very basic, AR includes sending invoices, managing collection, payment processing, and recording and reporting these payments by matching payments to invoices.

AR throws light upon the business’s revenue, which is tied up in credit, which means the bills still need to be paid by customers. Therefore, accountants focus on optimally managing their accounts receivable so that the business has enough working capital to pay its dues, make the necessary investments in people, processes, and platforms, and continue its growth trajectory.

This is why AR is such an essential part of accounting, and the AR department’s ability to convert AR quickly positively impacts the business outlook.

The accounts receivable process consists of specific vital steps, including setting up credit policies that enable your company to extend well-defined lines of credit to customers, a timely and accurate invoicing and documentation process that allows you to track customer sales, creating invoicing based on precise deal and customer information, establishing a system that enables you to track accounts receivables, customised AR reporting, creating receipts for cash allocations and much more.

The problem is that not every company can follow an extensive accounts receivable process with zero gaps. If left unattended, such issues can result in unhealthy cash flows and thus impact growth.

Accounting talent in the UK is shrinking while the demand is increasing. Is your business well-placed to hire top-tier account talent to scale the team in line with business growth? Lack of scalability can destroy your efforts to build a robust accounts receivable process. Also, while 75% of companies are well aware of the importance of digital transformation, only 30% can realise their true potential. This is the technology challenge. As a business, you will need to make sustained investments in accounting technologies to ensure maximum AR outcomes and benefit from the automation of repetitive tasks. Your F&A team can also get actionable insights from different AR activities, and the accounting department can experience sustainable tech ROI. Failure to do so will impact your company in two ways – limited upside from investment in technology and an AR process that is still manual or relies on outdated technology.

Both these challenges can be addressed by outsourcing accounts receivable management.

We discussed how a growing business will result in increased accounts receivable volumes and that the accounts teams must manage this volume well. Now, let’s take a look at it from another perspective. You evaluate your growing AR volumes and the number of accountants you can assign to the AR processes. You find that they aren’t enough, but you can’t scale your team as quickly as the need demands.

It would be best if you had a solution.

This solution is partnering with an accounts receivable outsourcing firm. This partnership will give you the confidence to grow your business because you now have an outsourced team of accountants managing all your AR activities. But it doesn’t end there; you are assured that business expansion resulting in increased accounting work will be managed effectively. The outsourcing provider can add more team members to your AR team if and when needed.

You are not impacted by the skills shortage or the high costs of hiring in-house employees. Everything is linked. A growing business needs an AR process that can be scaled quickly, improving your company’s cash flow, which can be invested in further business growth.

But there is yet another component to business scalability, which is technology, and again, an essential facet brought to the table by outsourcing that can facilitate automation.

Useful read: Solving the AR Dilemma: In-House Vs. Accounts Receivable Outsourcing

Accounts receivable automation or AR automation is a process that harnesses the power of digital transformation to automate repetitive tasks, previously managed manually, that are a part of accounts receivable.

Accounts receivable, a vital component of a business’s accounting function, is responsible for efficiently managing the company’s collections. Implementing AR automation involves utilising sophisticated software that automates tasks such as real-time data entry. This automation also streamlines processes and facilitates the generation of comprehensive reports, providing key insights crucial for well-informed organisational decision-making.

The technology aspect is easy enough to understand but challenging to implement from the cost perspective, and again, your accounts receivable outsourcing firm can help. Choosing the right firm that leverages advanced technology and automation to improve AR processing velocity will help your business scale faster.

The idea is to look at accounts receivable outsourcing strategically. Not looking at this working arrangement purely from the cost perspective will help. With this move, you are bringing new and improved skill sets and advanced technology to your organisation, thus further improving its processes. This means you are taking the necessary steps to build a more robust operational posture for your company to align with its scalability goals.

For that to happen, you must work with a veteran accounts receivable outsourcing firm. QX optimises accounts receivable by combining industry best practices, expert knowledge, and automation. Our approach aims to provide cost-effective and highly efficient solutions. Through well-defined performance benchmarks and service level agreements (SLAs), we guarantee that our services not only help you achieve your cash flow objectives but also contribute to a reduction in operating costs.

Contact QX to know more about how we can help scale your business with our accounts receivable services.

Originally published Feb 26, 2024 05:02:52, updated Jan 16 2025

Topics: Accounts Receivable Process, Finance & Accounting Outsourcing