Topics: Order-to-cash cycle

Posted on December 28, 2023

Written By Miyani Lourembam

Imagine closing a big deal with a client, only to realise weeks later that the payment is stuck somewhere between invoicing and collection. The sales team did their job, but finance is chasing overdue bills, and customer support is fielding frustrated calls.

This is where the cracks in the order to cash process begin to show. When businesses don’t have a clear view of their order to cash KPIs, small inefficiencies quickly snowball into cash flow delays, strained relationships, and missed opportunities.

Tracking the right order to cash process KPIs helps leaders connect the dots between sales, finance, and customer experience, turning what often feels like a back-office function into a true driver of business performance.

The order to cash process (O2C) is the journey a business follows from the moment a customer places an order to the point when the payment is received. It is not just a finance function; it is a chain of connected steps that involve sales, order management, invoicing, credit control, and accounts receivable. Each stage plays a role in shaping customer experience and in keeping cash moving through the business.

When the order to cash business process runs smoothly, collections come in on time, disputes are minimal, and working capital stays strong. But when mistakes or delays occur, the impact is felt everywhere, from payroll and supplier payments to future investment plans. That is why finance leaders pay close attention to order to cash KPI metrics. These measures provide clarity on efficiency, highlight risks, and show where improvements can be made.

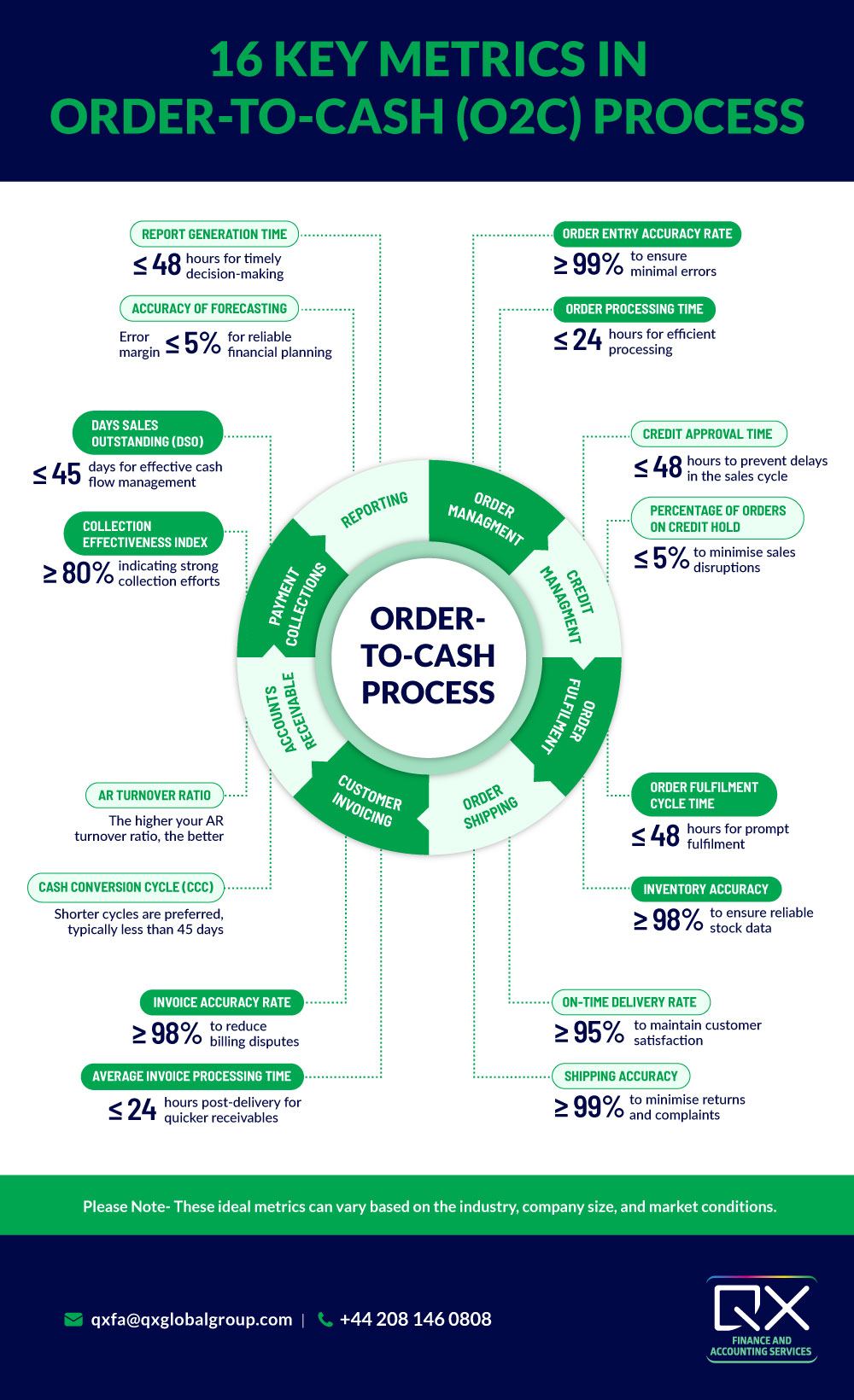

Tracking the right order to cash metrics can make the difference between healthy cash flow and constant financial headaches. These order to cash process KPIs are not just numbers on a dashboard; they reflect how well your company turns sales into actual revenue. From customer satisfaction to working capital strength, every stage of the order to cash processing cycle tells a story—and the following metrics show you where to focus.

Regularly measuring and analysing these order to cash KPI metrics helps businesses identify weaknesses, improve collections, and strengthen profitability. The ideal benchmarks may differ across industries and company sizes, but the principle remains the same: better visibility leads to better performance.

Discover how QX helped optimise the O2C process for a leading recruitment giant through bank download automation. Read the case study now!

Outsourcing the order to cash process can free up internal teams from daily complexity while ensuring efficiency and accuracy across the entire cycle. A specialised partner not only improves tracking of order to cash metrics but also provides the expertise to benchmark performance against industry standards.

Engaging with experts in order to cash processing gives finance leaders a tailored view of what an “ideal” KPI looks like for their business, backed by market-specific insights and operational best practices.

KPI in Order-to-Cash (O2C) refers to key performance indicators that measure the efficiency and effectiveness of the O2C process, helping businesses monitor their financial health and operational success.

Optimising the O2C process involves streamlining workflows, automating manual tasks, improving data accuracy, and regularly reviewing performance metrics to identify and address inefficiencies.

O2C KPIs are crucial for businesses as they provide insights into cash flow and collection efficiency, enabling better financial planning and decision-making to enhance overall business performance.

KPIs like invoice accuracy rate, average invoice processing time, and days sales outstanding highlight where invoicing delays or errors are slowing the order to cash process.

The dispute resolution cycle time KPI shows how quickly billing or order disputes are resolved, giving insight into customer satisfaction and cash flow impact.

Automation improves O2C performance metrics by reducing manual errors, speeding up invoice processing, and giving real-time visibility into order to cash KPIs.

By outsourcing the order to cash process to QX Global Group, businesses gain faster collections, improved accuracy, and more time to focus on growth while finance operations run smoothly.

Originally published Dec 28, 2023 03:12:42, updated Sep 18 2025

Topics: Order-to-cash cycle