Topics: Accounts Receivable Automation, Finance and Accounting Outsourcing Services

Outsourced Accounts Receivable Management: Top KPIs To Track

Posted on July 01, 2024

Written By Priyanka Rout

“In God we trust. All others must bring data.” This famous quote by W. Edwards Deming underscores a timeless truth in business: data-driven decisions are paramount. Deming, a visionary in management philosophy, revolutionised business models in the mid-20th century, driving productivity and cost efficiency through meticulous data analysis. He believed that relying on instinct or speculation would lead to less effective decisions.

This principle rings especially true in outsourced accounts receivable management. The data is readily available, and your numbers are constantly communicating valuable insights. To improve AR performance, it’s crucial to understand and act on these insights.

Putting this into practice can be challenging. While AR is data-driven, the vast amount of information can be overwhelming. The key is to sift through the data to find what truly matters. Essential KPIs like Days Sales Outstanding (DSO), Collection Effectiveness Index (CEI), and bad debt to sales ratio are crucial. Focusing on detailed metrics, such as dial goals and calls resulting in payments, offers deeper insights and motivates your team. Additionally, customer satisfaction metrics provide an external perspective on the effectiveness of your AR processes.

For outsourcing the management of accounts receivable, it’s vital to establish clear metrics that align with your business goals. Transparent reporting and regular performance reviews with your outsourcing partner can help ensure that these metrics are consistently met. This enables businesses to not just track but also steer their financial operations towards desired outcomes more effectively.

In this article, we will delve into these critical benchmarks and explore how advanced metrics can transform your AR strategy. By focusing on the right data, you can enhance efficiency, boost cash flow, and maintain a competitive edge in the dynamic field of accounts receivable management outsourcing.

Cutting-Edge Metrics for Benchmarking Performance While Accounts Receivable Outsourcing

Ready to overcome AR challenges like a pro? Dive into our blog and discover how outsourced accounts receivable management can transform your cash flow strategy!

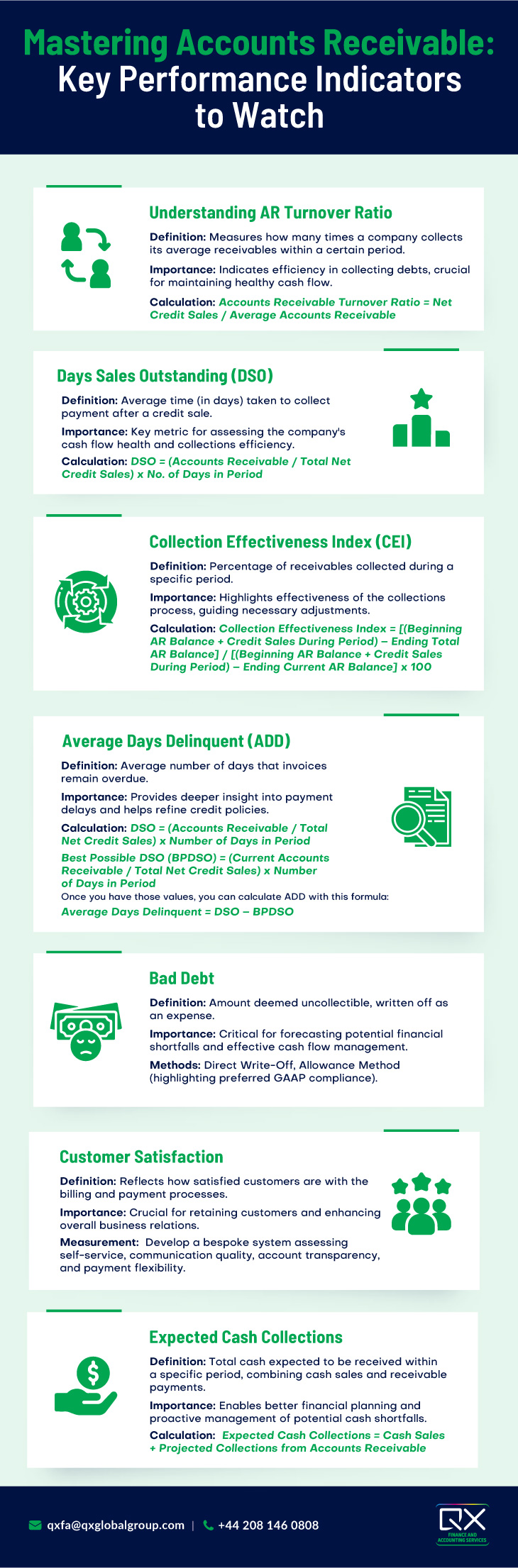

KPI 1: AR Turnover Ratio

What is the AR Turnover Ratio?

The accounts receivable turnover ratio indicates how effectively your company collects debts from customers. It shows how many times the company collects its average receivables over a specific period, such as a month, quarter, or year.

A higher AR turnover ratio is better, as it suggests the company quickly collects payments on outstanding invoices, meaning it collects its average receivables more frequently within the period.

How to Calculate the AR Turnover Ratio

The formula to calculate the AR turnover ratio is:

Accounts Receivable Turnover Ratio = Net Credit Sales / Average Accounts Receivable

Why Tracking the AR Turnover Ratio is Important While Outsourcing Accounts Receivable?

Tracking the AR turnover ratio is crucial because it helps companies ensure they are extending credit to reliable customers. It provides quick insight into the effectiveness of their collections team in managing overdue receivables and maintaining healthy cash flow.

KPI 2: Days Sales Outstanding (DSO)

What is DSO?

Days sales outstanding (DSO) measures the average time it takes for a company to receive payment after a credit sale. It’s also known as the average collection period or days receivable.

A lower DSO indicates that the company collects payments relatively quickly, while a higher DSO suggests it takes longer to collect from customers.

How to Calculate DSO

The formula for calculating DSO is:

DSO = (Accounts Receivable / Total Net Credit Sales) x No. of Days in Period

Why Tracking DSO is Important While Outsourcing Accounts Receivable?

Monitoring DSO is essential for understanding your company’s cash flow health. It helps evaluate the efficiency of your collections process and provides insights into the creditworthiness and satisfaction of your customers.

KPI 3: Collection Effectiveness Index (CEI)

What is the Collection Effectiveness Index?

The collection effectiveness index (CEI) measures the percentage of receivables a company collects during a specific period. This metric provides insight into the efficiency of a company’s collections process. A higher CEI indicates that the company is successfully collecting a larger proportion of its receivables.

How to Calculate the Collection Effectiveness Index

The formula to calculate CEI is:

Collection Effectiveness Index = [(Beginning AR Balance + Credit Sales During Period) – Ending Total AR Balance] / [(Beginning AR Balance + Credit Sales During Period) – Ending Current AR Balance] x 100

Why Tracking the Collection Effectiveness Index is Important While Outsourcing Accounts Receivable?

Monitoring CEI helps identify issues in the invoice-to-cash process that may hinder timely payments. If the CEI is low, it indicates problems in the collections process that need to be addressed, signaling the AR team to take corrective actions.

KPI 4: Average Days Delinquent (ADD)

What is Average Days Delinquent?

Average days delinquent (ADD) measures the average number of days that invoices remain overdue. It’s also known as delinquent days sales outstanding.

A higher ADD means customers are taking longer to pay their invoices, while a lower ADD indicates faster payments from customers.

However, the significance of a high or low ADD varies depending on your industry and how your competitors are performing.

How to Calculate Average Days Delinquent

To calculate ADD, you need to determine the following first:

DSO = (Accounts Receivable / Total Net Credit Sales) x Number of Days in Period

Best Possible DSO (BPDSO) = (Current Accounts Receivable / Total Net Credit Sales) x Number of Days in Period

Once you have those values, you can calculate ADD with this formula:

Average Days Delinquent = DSO – BPDSO

Why Tracking Average Days Delinquent is Important While Outsourcing Accounts Receivable?

Credit and collections teams use ADD alongside DSO and BPDSO to get a comprehensive view of how quickly invoices are turned into cash.

It’s important to note that DSO and ADD trends might not always align. For instance, an improved DSO could result from new credit terms or a shorter AR cycle, while an increasing ADD might simply reflect a seasonal increase in sales.

KPI 5: Bad Debt

What is Bad Debt?

When selling on credit, there’s always a risk that some customers won’t pay their debts. Bad debt refers to the amount that a business deems uncollectible and writes off as an expense on its balance sheet.

How to Calculate Bad Debt

There are two primary methods to recognise bad debt expense: the direct write-off method and the allowance method.

Direct Write-Off Method:

- Bad debt is recorded as an expense as soon as it’s deemed uncollectible.

- This method is straightforward but doesn’t comply with Generally Accepted Accounting Principles (GAAP), which require expenses to be recorded in the same period as the related revenue.

Allowance Method:

- Most businesses prefer this method.

- It involves estimating uncollectible accounts in advance and using an allowance for doubtful accounts.

Calculating Bad Debt with the Allowance Method

Here are the common ways to estimate bad debt:

Percentage of Sales: Bad Debt Expense = Estimated Uncollectible Percentage x Actual Credit Sales

Percentage of Receivables: Ending Allowance Balance = Estimated Uncollectible Percentage × Receivables Balance

Aging Schedule: Bad Debt Expense=∑ (Estimated Uncollectible Percentage × Receivables Balance for each aging bucket)

Why Tracking Bad Debt is Important While Outsourcing Accounts Receivable?

Monitoring bad debt helps businesses forecast potential losses and manage cash flow more effectively. By anticipating uncollectible amounts, companies can better prepare for financial shortfalls and maintain healthier financial planning.

KPI 6: Customer Satisfaction

What is Customer Satisfaction?

Customer satisfaction gauges how pleased customers are with your products, services, and overall experience. In accounts receivable, it specifically measures how smooth and convenient the billing and payment processes are for your customers.

How to Measure Customer Satisfaction

One common method to measure customer satisfaction is the Net Promoter Score (NPS), which assesses how likely customers are to recommend your company to others. However, NPS evaluates the entire customer experience, not just the billing and payment process.

For accounts receivable, there isn’t a standardised KPI for customer satisfaction. Instead, you can develop your own measurement system by evaluating the following criteria:

- Self-Service Capability: Can customers easily make payments and access necessary information and documents on their own?

- Communication Quality: How effectively does your AR team communicate with customers, especially when resolving disputes?

- Account Transparency: How transparent is the status of their accounts to your customers?

- Flexibility: How flexible are your invoice delivery and payment methods?

You can rate your company on each of these aspects (e.g., on a scale of 1 to 10) to get a better sense of customer satisfaction with the billing and payment process.

Why Tracking Customer Satisfaction is Important While Outsourcing Accounts Receivable?

Prioritising customer satisfaction is crucial because happy customers are more likely to continue doing business with you, while dissatisfied customers may look elsewhere. By assessing satisfaction in billing and payments, you can identify and address areas needing improvement, ensuring a better overall customer experience.

KPI 7: Expected Cash Collections

What is Expected Cash Collections?

Expected cash collections represent the cash a company anticipates receiving within a specific period. This includes revenue from immediate cash sales and payments collected on accounts receivable, where customers have purchased on credit.

How to Calculate Expected Cash Collections

To determine your total expected cash collections, combine the anticipated revenue from cash sales with the projected collections from accounts receivable:

Expected Cash Collections = Cash Sales + Projected Collections from Accounts Receivable

Why Tracking Expected Cash Collections is Important While Outsourcing Accounts Receivable?

Understanding your expected cash collections is crucial for managing your cash flow. By knowing how much cash you can expect to receive, you can better assess your financial position and take proactive steps if you foresee a cash shortfall.

Curious how QXProAR optimised receivables for a UK healthcare recruiter? Read our case study to see the impact on efficiency and cash flow!

Conclusion

Adopting modern benchmarking metrics and practices in outsourced accounts receivable management is essential for optimising financial operations and achieving sustainable growth. These advanced metrics not only enhance efficiency and cash flow but also provide valuable insights into overall financial health.

Looking ahead, the evolution of accounts receivable outsourcing will be shaped by emerging trends such as artificial intelligence, machine learning, and advanced data analytics. Staying abreast of these trends will be crucial for businesses aiming to maintain a competitive edge and improve financial performance.

QX Global Group is here to support you in this journey. Our accounts receivable outsourcing services are designed to help you implement these advanced benchmarking techniques, ensuring your business remains resilient and competitive in the ever-evolving financial landscape. Contact us to book a free consultation call.

Accounts receivable outsourcing involves hiring a third-party service provider to manage a company’s accounts receivable functions, such as invoicing, collections, and credit management. This service aims to improve cash flow, reduce overhead costs, and enhance efficiency in the accounts receivable process. The accounts receivable (AR) process in Business Process Outsourcing (BPO) or accounts receivable outsourcing firm involves a structured sequence of activities that companies undertake to bill clients, monitor incoming payments, and secure the collection of monies due for products or services delivered. Serving as a crucial link between sales and actual revenue generation, this process ensures that financial transactions are concluded effectively with prompt payment receipts. The main goal of a CFO (Chief Financial Officer) is to oversee and manage the financial health of a company. This includes developing and implementing financial strategies, ensuring accurate financial reporting, managing risks, optimising cash flow, and driving long-term financial planning to support the company’s growth and profitability.FAQs

What is accounts receivable outsourcing?

What is AR process in a BPO?

What is the main goal of a CFO?

Originally published Jul 01, 2024 05:07:54, updated Jan 16 2025

Topics: Accounts Receivable Automation, Finance and Accounting Outsourcing Services