Topics: Student Housing

Posted on September 07, 2017

Written By Priyanka Rout

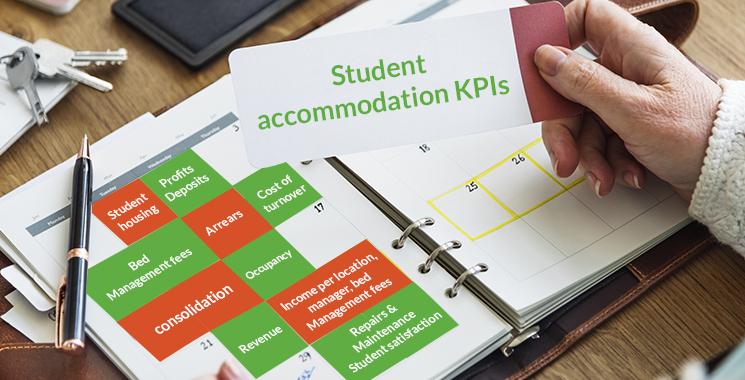

Navigating student housing isn’t just about picking the right locations or adding the coolest amenities. As the market sees more mergers and acquisitions, old challenges of disjointed operations don’t just disappear. This is where knowing your Key Performance Indicators (KPIs) really makes a difference. These aren’t just dry stats—they’re your roadmap to smarter decisions, better efficiency, and bigger returns.

To keep your operations smooth and revenue growing, it’s crucial to keep a close eye on the right metrics. From how full your buildings are to how much you’re spending to keep them running, these KPIs clear up how well you’re doing and where you can improve. Join us as we dive into the top 8 student accommodation KPIs you need to track to ensure your investment hits the mark every time.

Occupancy rates for student accommodation one of the most efficient and straightforward metrics to assess the operational efficiency and performance of any site or property is occupancy rates. Student housing occupancy rates can be impacted by a number of factors such as; the location of the site, travel facilities, standard of the housing, efficiency of sales & marketing functions, and rental rates (high or low). The data of year on year growth or decline in the percentage of occupancy can be a powerful tool for measuring the expected cash flows for the near future and for discovering opportunities of growth through development or acquisition of new sites in specific locations.

Contracts for student accommodation are normally limited to the length of the active school year. This means there will be substantial time when the units won’t be utilised. In addition to vacancy losses, preparing the vacated property includes the cost of apartment preparation, marketing & advertising, utilities and more. One of the better methods to reduce average-days-to-lease is to win renewals of contract from the students; another effective approach is winning new tenants for a short or medium term during summer vacation.

Student tenants have a reputation of being harder on apartments than other tenants. Over the course of a year, the need for all kinds of repairs and maintenance will arise. Finding out the exact spending on this line item can be instrumental in uncovering avoidable expenses. For example, if you manage a large portfolio of properties, but the repair and maintenance is contracted or subcontracted to local firms, a comparative analysis can help you identify spending that is way above the average. Based on the insights you glean from the data, you could decide to try a different maintenance company for a specific location, or contract the work for all the locations to the one maintenance provider that has proven trustworthy and cost-effective.

In addition to being a key KPI for PBSA companies, occupancy rates is also looked at closely by BTR businesses to evaluate their properties’ performance. Read this blog to know what metrics BTR professionals analyse to understand their profitability, liquidity, solvency, and efficiency.

The student housing sector caters to a community of young people, typically aged 18-25 (with some older students in post-graduation and research). They are often connected to each other, are tech savvy, prefer mobiles to desktops, wary of advertising, and experts at comparison shopping. Word-of-mouth and social media will play a large role in how a particular student housing property or company is viewed. So, it is essential that your student tenants are satisfied with your services. Periodic student satisfaction surveys via social media, online channels and physical surveys are necessary to gauge the student sentiment. Highlight positive feedback and weave it with the marketing message and take action on negative feedback.

The student housing sector has shown remarkable dynamism in the past few years. As this sector continues to consolidate through mergers and acquisitions, property management companies are likely to win and lose properties. In order to reduce the churn, property management companies must identify the reasons for losing any properties and strive to convert their weaknesses into strength. At the same time, property managers must understand the factors that allowed them to win a new property and build upon their strengths.

For companies that own or manage a large number of student housing across locations, detailed reports on the average income generate per bed, categorised by location, facilities, standard of living and property manager can be instrumental in measuring, understanding and improving the performance of the entire portfolio. For instance, by using such reports it’s possible to discover what each property manager is doing well. The information around the best practices followed by one manager can be shared within the entire organisation, helping raise the overall performance. Of course, in order to arrive at a reliable and realistic figure, you must compare apples to apples!

Property management firms specialising in the sector are often the natural choice for owners of student housing portfolios. However, it is imperative for the investors to keep an eye on the fees charged on monthly/annual revenue. Is the charge similar to the market-norm, or is it significantly higher than the average – considering the services provided? Similarly, property managers must also check competition and the market average to ensure that they are charging enough for their services. The percentage of fees charged can change when the level and quality of the service improves or declines.

Year on year revenue growth is a powerful indicator of the overall performance of a student housing portfolio. By analysing the in-depth data on the growth or decline in the revenue, it is possible to identify the key contributors to the growth. For instance, the revenue may have increased due to the fall in the repair and maintenance costs, while the rents have increased. Or it could be the rise in rents has not kept pace with inflation, which has led to a decline in revenue growth. Also, student housing management companies tend to focus on the revenue generated through leases as it helps to get a whole picture which includes revenues from other sources, e.g. rent for using facilities, food, utilities, parking, etc. Again, by comparing the revenue growth across sites, it is possible to recognise fresh revenue generation opportunities.

QX worked with a leading student housing provider in the UK to deliver end-to-end F&A outsourcing solutions that helped improved efficiency and reduce operational costs by 50%. Read the case study to learn more about this partnership.

As demonstrated in the above points, analysing the key KPIs on a periodic basis can help student housing owners, investors and managers make tactical course corrections and take wide-reaching strategic decisions to secure future growth. For this to become possible, it is necessary to have accurate and timely financial reports.

But that is easier said than done in a market that is witnessing rapid growth through mergers and acquisitions. As a student accommodation accounting services provider we have seen that, in many cases, property managers across sites use diverging accounting and reporting processes – this is especially true when it comes to recently merged businesses. How can this situation be remedied?

Read a real-life story of how one of the leading student accommodation providers managed to consolidate accounting and reporting for a large and diverse portfolio.

Key performance indicators (KPIs) for student accommodation typically include occupancy rates, tenant turnover rates, average rental income, maintenance costs, tenant satisfaction scores, and operational efficiency. Monitoring these KPIs helps property managers and owners ensure their properties are performing optimally, identifying areas that require improvement to enhance profitability and tenant satisfaction.

The 7 core KPIs for student housing—occupancy rate, rent growth, collection loss, cost per acquisition, tenant retention, maintenance response time, and net promoter score—are essential as they provide a comprehensive view of both financial and operational performance. These KPIs help in making informed decisions about pricing, marketing, maintenance, and customer service, which are crucial for enhancing the profitability and sustainability of student housing investments.

By closely monitoring student accommodation KPIs, investors and managers can identify trends and issues early, allowing for prompt adjustments in strategy. For instance, improving tenant satisfaction can lead to higher retention rates, reducing vacancy losses. Similarly, efficient cost management through maintenance KPIs can decrease operational expenses. Overall, a strategic focus on these KPIs not only boosts the day-to-day efficiency of property management but also enhances the long-term value of the investment by ensuring the accommodation remains competitive and appealing to students.

Occupancy rate directly reflects revenue performance. A high rate indicates strong demand and operational efficiency, while a low rate signals potential issues in leasing or marketing strategies.

Tracking renewal rates helps predict future occupancy, reduce turnover costs, and assess resident satisfaction. High renewal rates often mean better stability and lower marketing spend.

Key challenges include seasonal demand fluctuations, high turnover, maintenance coordination, ensuring security, and balancing affordability with profitability.

Technology streamlines operations through automated leasing, digital payments, smart maintenance systems, and data analytics for occupancy, renewals, and facility usage—enhancing both efficiency and student experience.

Education:

BA (English Literature); Executive MBA (Marketing)

Priyanka Rout is a B2B marketing professional with 5+ years of experience in marketing, specialising in content-led growth, performance strategy, and sector-driven brand building. She has worked extensively on developing structured marketing programs that align closely with sales priorities, measurable outcomes, and executive-level engagement. At QX Global Group, she leads hospitality-focused marketing initiatives while overseeing central SEO and social media strategy across the UK and USA markets. Working closely with business development and sector leaders, Priyanka develops thought leadership, event-led campaigns, and digital programs that translate complex finance and outsourcing themes into commercially relevant narratives for CFOs and senior decision-makers.

Expertise: B2B Marketing Strategy & Sector Positioning, Hospitality Industry Marketing (UK Focus), Finance & Accounting Services Marketing, Content-Led Growth & Thought Leadership Development, CFO & Executive-Level Content Strategy, Sales Enablement & Marketing Alignment, Event Marketing & Industry-Led Campaigns, SEO Strategy & Organic Growth (UK & USA Markets), Social Media Strategy & Brand Visibility, Outsourcing & Global Delivery Narratives, Industry-Specific Campaign Development, Performance-Driven Digital Marketing Programs

Originally published Sep 07, 2017 12:09:25, updated Jul 16 2025

Topics: Student Housing