Topics: Accounts Receivable Process, Global recruitment services, Recruitment, Recruitment Challenges

Best Practices for Accounts Receivable Management in the Recruitment Industry

Posted on May 10, 2023

Written By Siddharth Sujan

Effective accounts receivable management is critical for any successful business, and even more so for companies in the recruitment industry. In an industry where payment timeliness and cash flow management are paramount, effective management of accounts receivable can make or break your business.

However, many recruitment firms continue to struggle with AR management, leading to issues with cash flow, damaged client relationships, and increasing bad debts.

In this post, we will explore the specific challenges that recruitment agencies face when managing their accounts receivable and provide actionable tips to help you stay on top of your finances and maintain strong relationships with your clients.

Challenges of AR Management in the Recruitment Industry

Managing accounts receivable in the recruitment industry can be a daunting task due to several industry-specific challenges. Let us explore some of the most pressing challenges faced by recruitment agencies in AR management.

SEASONALITY

The recruitment industry often experiences seasonal fluctuations in demand, which can result in cash flow issues. During peak periods, there may be a high volume of placements, but payments may not be received until after the end of the financial year. Conversely, during slow periods, cash flow may be constrained, making it difficult to cover operational expenses.

PAYMENT TERMS

Clients in the recruitment industry may negotiate extended payment terms, which can cause cash flow issues for recruitment firms. Longer payment terms can also increase the risk of bad debt, especially if clients delay payments or default on their payments.

COMMISSION-BASED PAYMENTS

Many recruitment firms are paid on a commission basis, which can lead to issues with accounts receivable management. Commission payments are often tied to successful placements, which can make it difficult to predict cash inflows and manage accounts receivable effectively.

INVOICING ACCURACY

Inaccurate or incomplete invoices can cause delays in payment and strain client relationships. In the recruitment industry, invoices may include multiple placements, different fees, and other details, making it more challenging to ensure accuracy and completeness.

RELATED CASE STUDY: Global Recruitment Agency Implements GBS to Achieve 99.7% Accuracy in Invoice Processing

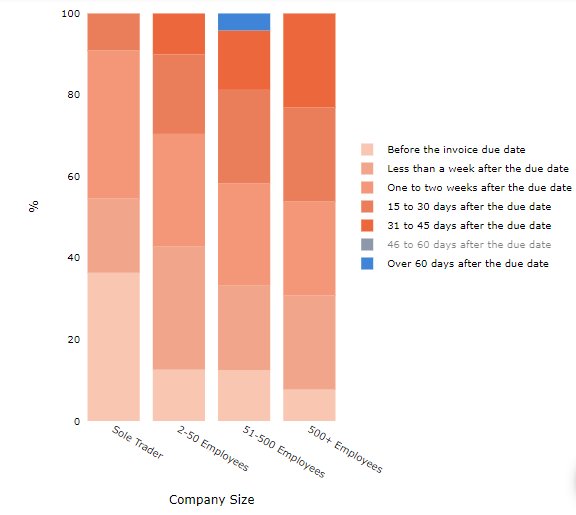

INCONSISTENT PAYMENT BEHAVIOUR

Clients in the recruitment industry may have inconsistent payment behavior, making it difficult to predict when invoices will be paid. This can result in cash flow issues and increased risk of bad debt.

Recruitment AR Management Best Practices

In the recruitment industry, prompt payment is the name of the game. Without it, companies can quickly find themselves in financial trouble, with unpaid invoices piling up and cash flow being disrupted. Let us look at some best practices that can help avoid such scenarios and stay competitive.

CREDIT ANALYSIS & RISK MANAGEMENT

Conducting a thorough credit analysis of new clients can significantly reduce the risk of non-payment and bad debt. By establishing a risk management strategy, recruitment firms can protect their financial interests and ensure that they are working with clients who have a strong financial position.

RELATED BLOG: Guide to Creating & Implementing Effective Credit Policies

CLIENT SEGMENTATION

Segmenting clients based on their payment history and behavior can help tailor communication and follow-up strategies to improve the efficiency of collections. This approach allows you to focus your efforts on clients who require more attention, ensuring that you` are able to collect payments more effectively.

TECHNOLOGY IMPLEMENTATION

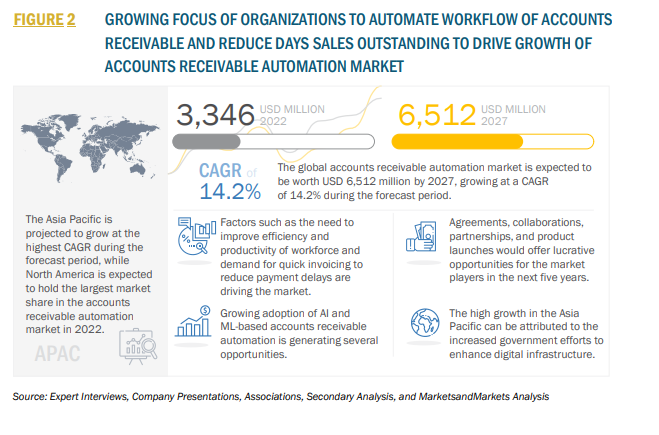

Recruitment firms can leverage technology to streamline invoicing and collections management, improve efficiency, and reduce the risk of bad debt. By implementing online payment portals, automated invoicing, and other technology solutions, firms can enhance the customer experience and simplify the collections process.

FACTORING OR INVOICE FINANCING

Factoring or invoice financing can provide an immediate cash injection to improve cash flow and reduce the risk of non-payment. These options allow you to continue operating your business without worrying about unpaid invoices.

IMPROVING CUSTOMER RELATIONSHIPS

Incentives for early payment and timely collections can improve customer relationships and increase the likelihood of repeat business. Focusing on customer experience and providing personalized payment options can enhance the overall customer experience and differentiate the firm from competitors.

LEVERAGING DATA ANALYTICS

By using data analytics, you can identify trends in payment behavior, make informed decisions about credit policies and invoicing procedures, and determine which clients require more attention. This information can help you streamline your invoicing and collections process, improve efficiency, and minimize the risk of bad debt.

OUTSOURCING ACCOUNTS RECEIVABLE MANAGEMENT

Establishing a dedicated accounts receivable team or outsourcing to a reputable accounting firm can ensure consistent and effective management of invoices and payments. This approach can help you streamline your invoicing and collections process, improve efficiency, and reduce the risk of bad debt.

RELATED CASE STUDY: Optimizing Receivables for UK Healthcare Recruiter

INVESTING IN CREDIT INSURANCE

Credit insurance provides an added layer of protection by transferring the risk of non-payment to the insurer, allowing you to focus on growing your business without worrying about financial losses. Not only does this reduce the financial impact of non-payments, but also improves credibility amongst clients and investors.

REGULAR TRAINING & AUDITS

Providing regular training and support to staff responsible for accounts receivable management can ensure they are up-to-date with best practices and industry trends. Regular audits of accounts receivable can help you identify and address any discrepancies or errors, ensuring that your records are accurate and up-to-date, and reducing the risk of clients disputing invoices.

QX Global Group: Your Expert AR Management Partner

At QX Global Group, we understand that timely and efficient accounts receivable management is critical to optimizing your recruitment firm’s cash flow and overall performance. By leveraging our expertise, industry best practices, and cutting-edge automation technologies, we can help you achieve up to 50% operational cost reduction, improve cash allocation, consolidate documentation and gain improved visibility with customized reports.

Our unique people-process-platform approach ensures that you receive comprehensive and customized AR management solutions that address your specific needs. Contact us today to book a free consultation and learn how we can help you optimize your accounts receivable management and drive growth for your recruitment business.

Originally published May 10, 2023 06:05:15, updated Feb 14 2025

Topics: Accounts Receivable Process, Global recruitment services, Recruitment, Recruitment Challenges