Topics: BTR, Finance and Accounting Transformation

Why Is High Tenant Demand Outpacing BtR Supply?

Posted on November 25, 2024

Written By Priyanka Rout

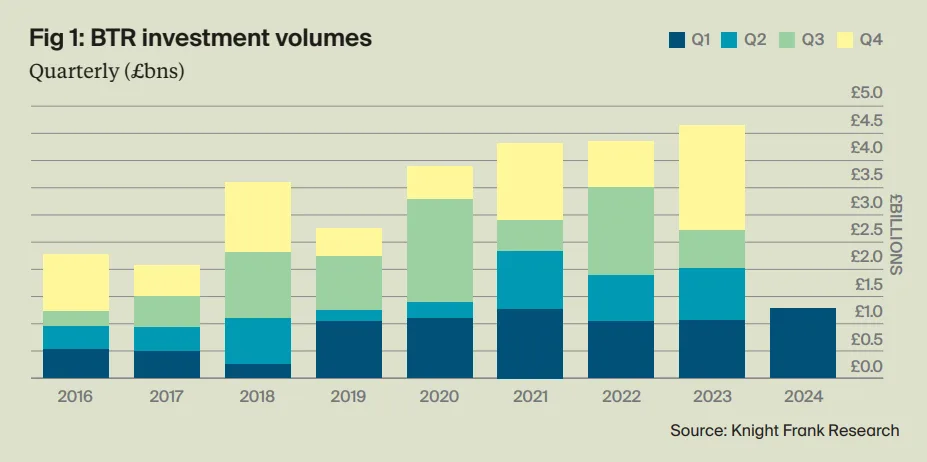

The UK’s Build to Rent (BtR) sector is experiencing remarkable growth, backed by record-high investments and an escalating demand from tenants. In the first quarter of 2024 alone, BtR investments hit an unprecedented £1.3 billion—a 21% increase from the previous year, marking the strongest start ever recorded.

BtR Investment Volumes; Source: Knight Frank Research

Yet, even as tenant demand surges, the BtR sector faces a critical issue: supply simply can’t keep up with the influx of prospective renters. This shortage is placing intense pressure on the broader rental market, driving up rents across the country and pushing housing affordability further out of reach.

The reasons behind this imbalance are complex but interwoven. Interest rate hikes and previous tax changes have made traditional buy-to-let investments less attractive, leading to a mass sell-off of rental properties and leaving a gap that BtR developments haven’t been able to fully bridge.

For many would-be first-time buyers now sidelined by the soaring cost of mortgages, the BtR sector is an increasingly attractive, and often necessary, option. This tenant demand surge in the BtR sector has led to maximum occupancy levels across operational buildings, with the Royal Institute of Chartered Surveyors (RICS) projecting this trend to persist.

According to recent figures from the ONS, average rents spiked by 6% in 2023—a record increase likely to repeat this year as the CBRE multifamily index forecasts rental growth outpacing other markets.

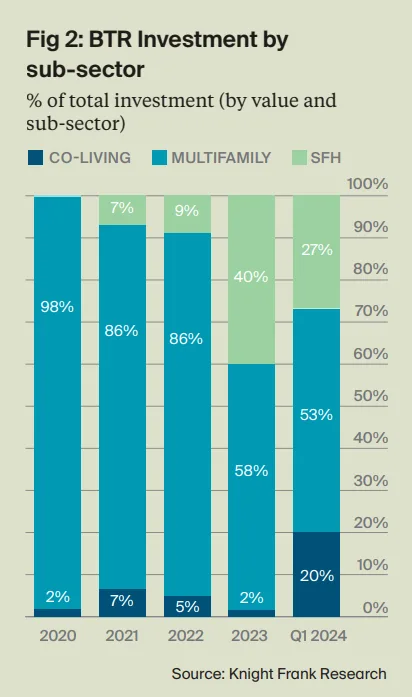

BtR Investment By Sub-Sector; Source: Knight Frank Research

Despite the clear demand, the development pipeline hasn’t kept pace. The number of BtR properties completed in 2023 was only half of 2022’s total, and projections for 2024 show no signs of reversing this trend. This shortage has already impacted tenants, with average rental prices climbing by over £2,800 in the last three years alone.

So, as we look forward, the question arises: how can the BtR sector scale up efficiently to meet this demand while supporting sustainable growth and affordability? In this blog, we’ll unpack the factors behind this supply-demand imbalance, the challenges in expanding BtR developments, and potential solutions that could shape the future of the sector.

Understanding the 4 Factors Driving High Tenant Demand

1) A Cultural Shift Towards Renting

Renting has become a lifestyle choice, especially for young professionals and families, as rising home prices make buying out of reach. It offers flexibility, fewer commitments, and the freedom to live in prime locations without the cost of ownership.

2) Urbanisation and City Growth

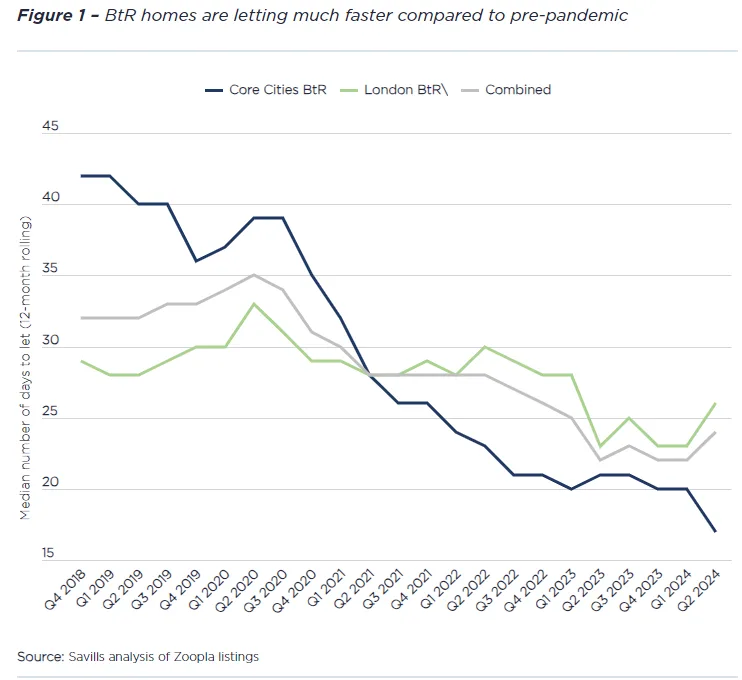

BtR Homes are letting much faster compared to pre-pandemic; Source: Savills

Cities like London, Manchester, and Birmingham are booming, attracting people for jobs and urban amenities. This influx fuels demand for rentals, particularly in Build to Rent (BtR) properties, where people can live close to work and entertainment without the hassles of buying.

3) Economic Pressures and High Mortgage Rates

With high mortgage rates and economic uncertainty, buying a home feels out of reach for many. Renting provides a flexible and financially safer option, especially for first-time buyers wary of long-term financial commitments.

4) Growing Demand Across All Age Groups

Rental demand now spans all age groups. Families appreciate BtR’s amenities and convenience, while older renters enjoy the low-maintenance lifestyle and community vibe. BtR’s appeal across generations showcases its versatility in meeting diverse needs.

Ready to get a clearer picture of your BtR financial health? Check out the 12 essential KPIs every Build-to-Rent company should track!

Key Challenges Contributing to Low BtR Supply

High Construction and Development Costs

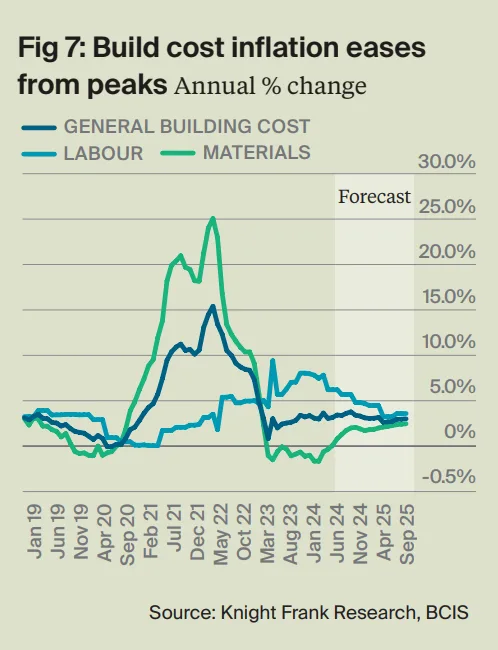

While there’s a little relief, the costs are still high; Source: Knight Frank Research

The costs of building BtR developments have climbed steeply, with construction materials and labor expenses rising, making new projects a tough financial gamble. Even with signs that building costs might ease, developers remain cautious, unsure if prices will drop enough to make new projects feasible. For many, the risk of high upfront costs, especially in urban areas where BtR demand is strong, means they’re holding back. Until costs stabilise, many BtR projects might stay on the drawing board instead of breaking ground.

Regulatory and Planning Hurdles

Getting a BtR project approved is no easy task, with strict planning regulations, policies like the Renters’ Rights Bill, and potential rent controls adding more hoops for developers to jump through. These policies, while essential for tenant rights, create uncertainty for investors who worry about limited returns. Additionally, planning delays and zoning restrictions can drag out the approval process for months, or even years, slowing the delivery of new rental housing. Unless the approval process becomes quicker and less complex, these regulatory obstacles will continue to curb BtR growth.

Limited Availability of Land in Key Locations

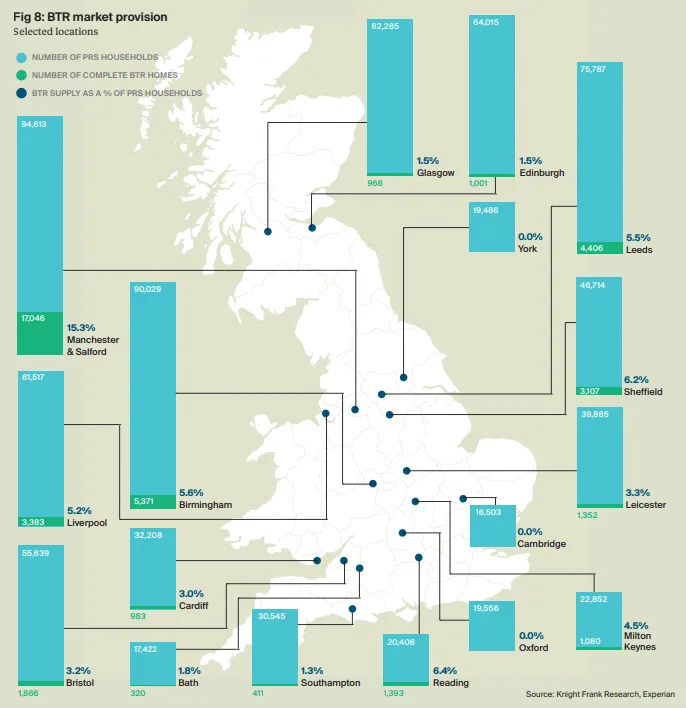

Availability of Land for BtR in Core Locations; Source: Knight Frank Research

A major challenge for BtR developers is finding suitable land in high-demand urban areas. Limited space, fierce competition, and high prices make securing key locations tough, especially against commercial real estate. To expand BtR where it’s needed most, cities may need to rethink urban planning and creatively allocate land for residential use.

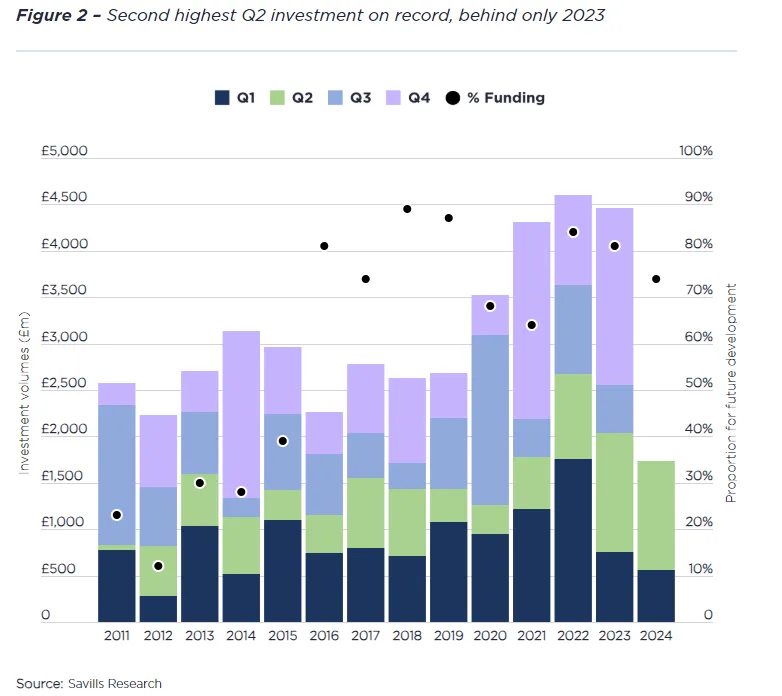

Competition for Investment Capital

Investments made in the BtR industry; Source: Savills

Finding funding for BtR developments can also be a struggle, as developers face stiff competition from other real estate sectors that are just as appealing to investors. BtR projects need to show strong return potential to attract capital, but high costs and regulatory challenges can make them seem like a risky bet. As investors weigh their options, BtR projects may lose out to alternatives seen as more predictable or profitable. Without enough investment capital, BtR developments might be stuck waiting, unable to move forward at the pace needed to meet demand.

4 Ways to Tackle the Demand-Supply Imbalance in BtR

1) Expanding BtR into Regional Markets

While BtR is thriving in major cities, regional towns like Manchester, Birmingham, and areas across the Midlands offer untapped potential. Expanding BtR here provides affordable, community-focused options for renters, easing pressure on big cities and creating quality rental choices outside costly urban centers.

2) Building Partnerships Between BtR Operators and Housebuilders

Teaming up with housebuilders can fast-track the delivery of new homes. By working together, housebuilders can sell bulk units to BtR investors, making large-scale projects easier to tackle and faster to complete. These partnerships spread the risk and help both sides manage costs, all while delivering more rental units to the market.

3) Using Technology to Make Operations Smoother

Investing in property management tech can bring efficiency and a better tenant experience to BtR developments. Tools like tenant portals, maintenance apps, and payment systems make life easier for both renters and property managers. Tenants can pay rent, report repairs, and even track maintenance requests with a few taps, while property managers stay on top of it all without the usual admin hassles.

Adding outsourcing into the mix—think bookkeeping, property management support, and financial reporting—can give operators more breathing room. QX, for example, offers the kind of back-office support that keeps things running smoothly, allowing BtR teams to focus on what matters most: tenant satisfaction and property expansion.

4) Pushing for Government Support and Policy Changes

Government support can make all the difference in BtR sector growth in the UK. Incentives for developing brownfield sites, easier planning regulations, and affordable housing subsidies could make BtR projects more feasible, encouraging more investment. Streamlining approvals would also reduce delays and cut down on costs, helping new developments come to life faster.

Curious about maximising ROI in Build-to-Rent? Dive into our latest insights on optimising BtR operations!

What’s Next?

The tenant demand surge in BtR sector isn’t just a passing phase—it reflects the way people’s lifestyles and housing needs are evolving. But with supply struggling to keep up, it’s clear that new approaches are needed. Expanding BtR into regional areas, building smart partnerships to fast-track development, and embracing tech for smoother operations are just a few ways the sector can respond to this demand.

For those in the BtR space, this is a chance to think differently and find fresh ways to address tenant needs. By coming together, exploring creative solutions, and focusing on what renters really want, the BtR sector can build a more flexible, dynamic rental market—one that’s ready for the future.

Originally published Nov 25, 2024 11:11:53, updated Dec 19 2024

Topics: BTR, Finance and Accounting Transformation