Topics: Finance and Accounting Transformation, Procure-to-pay cycle

Optimizing Procurement: Leveraging ERP Systems for Procure-to-Pay Success

Posted on June 27, 2024

Written By Priyanka Rout

Introduction

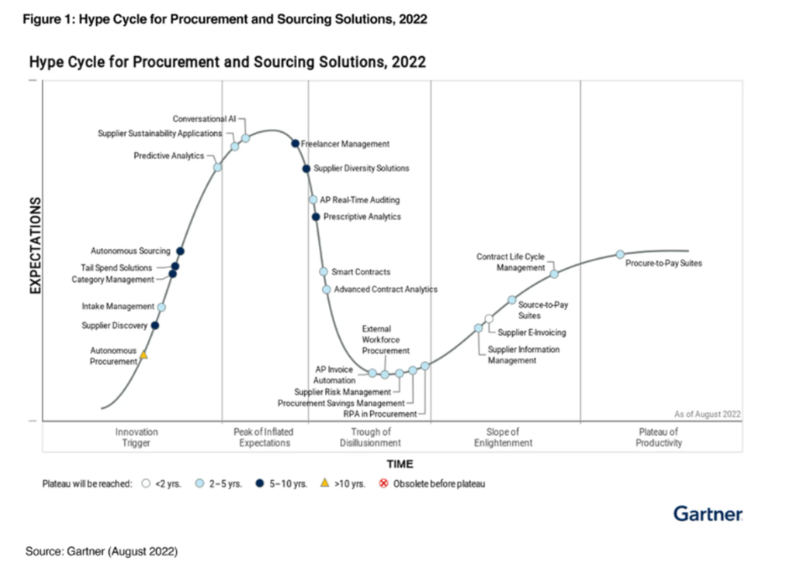

Gartner mentioned in its 2022 Hype Cycle for Sourcing and Procurement Solutions that even though the advantages of automating procure-to-pay processes are well-known, many companies find it hard to justify the expense of P2P solutions and create a compelling business case.

Hype Cycle for Procurement and Sourcing Solutions, 2022; Source: Gartner 2022 Hype Cycle for Sourcing and Procurement Solutions

In an era where supply chain disruptions and fluctuating markets have become the norm, businesses face unprecedented procurement challenges. Traditional procurement methods are increasingly inadequate in addressing the complexities of today’s global trade environment. Amid these challenges, the procure-to-pay (P2P) process has emerged as a game-changer, offering a holistic approach that integrates procure to pay and accounts payable functions to drive efficiency and cost savings.

One of the most transformative trends in P2P is the adoption of advanced Enterprise Resource Planning (ERP) systems. These systems are not just tools but strategic enablers that redefine procurement practices. Modern ERPs leverage AI and machine learning to predict demand, optimize inventory levels, and automate repetitive tasks, significantly reducing human error and administrative burden. Moreover, the integration of blockchain technology within ERP systems is enhancing transparency and trust in supply chains, ensuring every transaction is secure and verifiable.

By the end of this blog, you’ll have a comprehensive understanding of how to optimize your procurement operations and drive your business towards greater efficiency and success.

Understanding Procure-to-Pay (P2P)

The P2P cycle involves several critical stages: it starts with requisitioning, where employees identify needs and submit forms for approval, followed by the creation of a purchase order (PO) that outlines the specifics of the purchase. After the delivery of goods or services, the vendor sends an invoice, which is matched against the PO and receipt to ensure accuracy. The final stage is payment processing, where the company verifies the invoice and proceeds with payment according to agreed terms, incorporating approval workflows and checks to prevent errors and fraud.

Common Challenges Faced in Traditional P2P Processes

Traditional P2P processes often encounter several challenges that can hinder efficiency and accuracy:

- Manual Data Entry: Manual entry of requisition forms, purchase orders, and invoices can lead to errors, delays, and data inconsistencies.

- Lack of Visibility: Inadequate visibility into the procurement process can result in excessive spending, where purchases are made outside of approved channels.

- Approval Bottlenecks: Delays in the approval process can slow down the entire procurement cycle, leading to delayed deliveries and payments.

- Disjointed Systems: When procurement, invoicing, and payment systems are not integrated, it can create silos, making it difficult to track and manage the entire process.

- Compliance Issues: Ensuring compliance with company policies and regulatory requirements can be challenging without a standardized and automated P2P process.

The Impact of Inefficiencies in P2P on Business Operations

Inefficiencies in the P2P process can have significant repercussions on business operations:

- Increased Costs: Errors and delays in procurement can lead to higher costs, including late payment fees and missed early payment discounts.

- Operational Delays: Slow procurement cycles can disrupt the supply chain, leading to delays in production or service delivery.

- Supplier Relationship Strain: Inconsistent or late payments can damage relationships with suppliers, potentially leading to a loss of favorable terms or supply disruptions.

- Cash Flow Management: Inefficient payment processes can negatively impact cash flow management, making it difficult for businesses to maintain liquidity.

- Risk of Fraud: Manual and disjointed processes increase the risk of fraudulent activities, which can have severe financial and reputational consequences.

The Role of ERP Systems in Procurement

Enterprise Resource Planning (ERP) systems are integrated software platforms that manage and automate various business processes within an organization, unifying functions such as finance, human resources, manufacturing, supply chain, services, and procurement into a single system. This integration enhances data flow and operational efficiency, facilitating better decision-making. ERP systems provide functionalities like data integration, automating routine tasks, real-time reporting and analytics for strategic planning, scalability to support business growth, and compliance and risk management to ensure regulatory adherence and mitigate risks.

Key Features of ERP Systems Relevant to Procurement

ERP systems offer several features specifically beneficial for procurement processes:

Automated Workflows

- Purchase Requisitions and Orders: Automate the creation, approval, and tracking of purchase requisitions and orders, reducing processing time and minimizing errors.

- Supplier Management: Streamline supplier onboarding, evaluation, and performance tracking through automated workflows, ensuring consistent and efficient supplier relationships.

- Invoice Processing: Automate the matching of purchase orders, receipts, and invoices to facilitate quicker and more accurate payments.

Centralized Data Management

- Supplier Data: Maintain a centralized repository of supplier information, including contact details, pricing, and contractual terms, ensuring easy access and consistency.

- Inventory Levels: Monitor and manage inventory levels across multiple locations from a single platform, optimizing stock levels and reducing excess inventory.

- Procurement Records: Store and manage all procurement-related documents and records in a centralized system, enabling easy retrieval and compliance with audit requirements.

Real-Time Tracking and Reporting

- Procurement Activities: Track the status of purchase orders, deliveries, and payments in real-time, providing visibility into the entire procurement process.

- Spend Analysis: Generate real-time reports on procurement spend, identifying cost-saving opportunities and ensuring budget compliance.

- Supplier Performance: Monitor supplier performance metrics, such as delivery times, quality, and responsiveness, allowing for data-driven supplier management.

Understanding ERP Integration with P2P

ERP integration with P2P means creating a unified system where procurement processes—from the initial request to payment—are efficiently managed and visible within the ERP system.

Why is ERP Integration with P2P Important?

This integration is becoming increasingly popular due to several factors:

1. Better Supplier Management:

Good supplier relationships are vital for business success. Integrating ERP with P2P systems helps businesses manage supplier information more effectively, streamline the procurement process, and ensure timely payments. This leads to increased supplier satisfaction and stronger, long-term partnerships.

2. Transition to Digital Invoicing and Payments:

The move towards digital invoicing and payments is another major driver for ERP and P2P integration. Digital processes reduce the risk of fraud, minimize errors, and improve payment efficiency. Additionally, digital invoicing provides greater visibility into spending, aiding better cash flow management and financial planning.

3. Improved User Experience:

Many ERP systems have poor intake processes, hindering user adoption and efficiency. In contrast, P2P solutions prioritize user experience with intuitive interfaces and streamlined workflows. Integrating ERP with P2P systems combines the best of both worlds, creating a user-friendly environment that boosts adoption and maximizes the technology’s value.

Why Now?

Market trends and operational challenges are pushing businesses to integrate their ERP and P2P systems more than ever. The benefits include improved supplier relationships, a shift to digital invoicing and payments, and enhanced user experiences. These integrations help businesses stay competitive and efficient in a rapidly evolving market.

Improved Efficiency and Reduced Cycle Times

Implementing an ERP system streamlines the entire procure-to-pay process, automating tasks that were previously manual and time-consuming. This leads to significant improvements in operational efficiency, reducing cycle times from purchase requisition to payment. Automated workflows ensure that procurement activities are completed promptly, minimizing delays and bottlenecks.

Enhanced Accuracy and Reduction of Manual Errors

ERP systems eliminate the need for manual data entry by integrating various procurement processes into a single platform. This integration reduces the risk of human error, ensuring that data is accurate and consistent across all stages of the procurement cycle. Enhanced accuracy improves the reliability of procurement data and helps maintain compliance with regulatory requirements.

Better Supplier Management and Stronger Vendor Relationships

ERP systems provide comprehensive tools for supplier management, including performance tracking, contract management, and communication platforms. These tools enable businesses to monitor supplier performance closely, negotiate better terms, and foster stronger, more collaborative relationships with vendors. Improved supplier management leads to more reliable supply chains and better procurement outcomes.

Real-Time Visibility and Improved Decision-Making

One key advantage of ERP systems is providing real-time visibility into procurement activities. This real-time insight allows procurement managers to make informed decisions quickly, based on up-to-date data. Enhanced visibility also facilitates better tracking of inventory levels, purchase orders, and payments, ensuring that procurement operations are aligned with business needs and objectives.

Cost Savings and ROI from Optimized Procurement Operations

By automating and optimizing procurement processes, ERP systems help businesses achieve significant cost savings. Reduced cycle times, fewer manual errors, and better supplier management contribute to lower procurement costs. Additionally, the insights gained from real-time data enable more strategic sourcing decisions, further enhancing cost efficiency. The overall return on investment (ROI) from ERP implementation is realized through streamlined operations, reduced procurement costs, and improved financial performance.

Wrapping Up!

It’s clear that ERP systems are game-changers for procure-to-pay services. By unifying procurement workflows, these systems provide real-time insights, enhance compliance, and drastically cut down on manual errors. The result? Not just cost savings, but a strategic edge in an increasingly competitive market.

In a world where efficiency and agility are paramount, optimizing your procurement process is no longer optional—it’s essential. Leveraging the power of ERP solutions can transform procurement from a back-office function to a strategic driver of business success.

FAQs

What are the benefits of the P2P process?

The Procure-to-Pay (P2P) process streamlines procurement and payment activities, enhancing efficiency and accuracy. Key benefits include reduced procurement costs, improved supplier relationships, better compliance and control, increased transparency, and enhanced cash flow management. Automation within P2P processes can also lead to fewer errors and faster processing times.

What is a procure-to-pay strategy?

A procure-to-pay strategy outlines the end-to-end process of requisitioning, purchasing, receiving, and paying for goods and services. It aims to optimize procurement activities, ensuring cost-effectiveness, compliance, and efficiency. This strategy involves integrating procurement and financial systems to provide a seamless workflow, from sourcing to payment, leveraging technology and best practices to maximize value.

How to improve the P2P process?

Improving the P2P process involves several steps:

- Automate Workflows: Implement automated systems to reduce manual errors and increase efficiency.

- Standardize Procedures: Establish consistent procurement and payment procedures.

- Enhance Supplier Management: Foster better relationships and negotiate favorable terms with suppliers.

- Use Data Analytics: Leverage analytics to monitor performance and identify areas for improvement.

- Improve Compliance: Ensure adherence to procurement policies and regulations.

- Streamline Approvals: Simplify and expedite approval processes to avoid delays.

Originally published Jun 27, 2024 04:06:26, updated Jun 27 2024

Topics: Finance and Accounting Transformation, Procure-to-pay cycle