Posted on November 14, 2023

Written By Siddharth Sujan

The role of a modern CFO or a Finance Director is no longer confined within the rigid walls of cost management and budget supervision. Today’s finance leaders are at the forefront of pioneering value creation, a journey from cautious savings to dynamic strategy formulation.

Imagine a world where financial decisions are guided by forward-looking insights rather than past events. High-end record-to-report (R2R) and financial planning & analysis (FP&A) services make this a reality, transforming the traditional ledger-focused approach into a narrative of growth, foresight, and innovation.

In a world where adaptability and foresight are paramount, understanding and embracing this shift is not just an advantage—it’s a necessity. Read on to understand how these high-end FP&A services hold the potential to redefine the finance function, and in turn, the future of business.

Financial Planning & Analysis (FP&A) is the strategic heartbeat of contemporary finance, bridging historical data with future planning. In the modern business scenario, FP&A as a service leverages advanced technologies like AI and machine learning for predictive modeling, offering nuanced insights into market trends, operational efficiencies, and potential growth areas.

Record to Report (R2R), meanwhile, has evolved beyond basic bookkeeping. In the era of Big Data, R2R services ensure data integrity, compliance, and streamlined reporting. They are integral in providing the reliable foundation necessary for effective FP&A.

The role of high-end R2R & FP&A activities is pivotal in shifting the finance function’s focus from traditional cost-centric approaches to long-term, strategic value creation. Here’s how this transition is being catalyzed:

Shifting from Cost Management to Value-Driven Forecasting: Beyond mere cost control, high-end financial planning & analysis activities open doors to identifying and seizing growth opportunities. They empower finance leaders to weave narratives of potential and prosperity, turning financial foresight into a canvas for value creation.

Transforming Data into Strategic Assets: The transformation of data from historical records to strategic resources marks a significant leap. R2R services ensure that this data is not just a reflection of the past but a beacon guiding towards smarter, future-focused decisions.

From Reactive to Proactive Financial Leadership: The transition to proactive leadership is a game-changer. It’s about being one step ahead, where high-end R2R & FP&A services enable finance professionals to shape, rather than just react to, the financial destiny of their organizations.

In a world where the pace of change is relentless, the strategic leverage provided by high-end FP&A and R2R activities is more than a competitive edge—it’s a necessity for survival and success. Here’s how:

Embracing Digital Transformation for Strategic Insights: By adopting digital technologies, finance teams can move from traditional reporting to offering strategic guidance, utilizing data to shape business strategies that align with long-term goals.

Ensuring Compliance as a Foundation for Trust: In a landscape where trust and transparency are crucial, R2R services play a key role. By ensuring compliance and accuracy in financial reporting, these services lay the foundation for building stakeholder trust, which is essential for sustainable, long-term relationships and growth.

Aligning Financial Goals with Broader Business Objectives: High-end financial planning & analysis services are crucial in aligning financial goals with broader business objectives, including sustainability and corporate social responsibility. This alignment ensures that financial strategies contribute not only to the bottom line but also to the organization’s long-term vision and societal impact.

RELATED BLOG: Building a Robust FP&A Process: Best Practices and Key Considerations

In the midst of complex market dynamics, the fusion of technology and analytics within finance opens up a breadth of unprecedented opportunities. From predictive analytics reshaping decision-making processes to AI and ML redefining operational efficiency, this integration is a key driver in the transition towards a more agile, insightful, and strategically focused finance department.

Predictive Analytics in Financial Strategy

The strategic value of predictive analytics in finance lies in its dual capacity to foresee risks and uncover opportunities. This approach transcends traditional reactive financial management, positioning organizations to proactively leverage market dynamics for competitive advantage.

Compliance and Operational Excellence

In the current financial landscape, effective R2R activities are essential not just for compliance but for operational excellence. They ensure accuracy and efficiency in financial reporting, serving as a foundation for strategic decision-making.

Technology Integration in Finance

Integrating technologies like AI & ML into FP&A and R2R processes represents a significant stride towards a more insightful and efficient finance function. This integration marks a shift from traditional finance roles to a more strategic, advisory role within the organization, aligning financial operations with broader business objectives.

Integrating advanced R2R & FP&A activities into the fabric of a business can be challenging, but these challenges also present opportunities for strategic growth and organizational enhancement. By addressing common obstacles and adopting targeted strategies, C-suite executives can effectively navigate this transformative journey.

Challenge: The innate resistance to change within organizations, often due to comfort with existing processes or fear of the unknown.

Strategy: Cultivate a change-positive culture by emphasizing the strategic benefits of advanced FP&A and R2R. Engage stakeholders through transparent communication and involve them in the transition process.

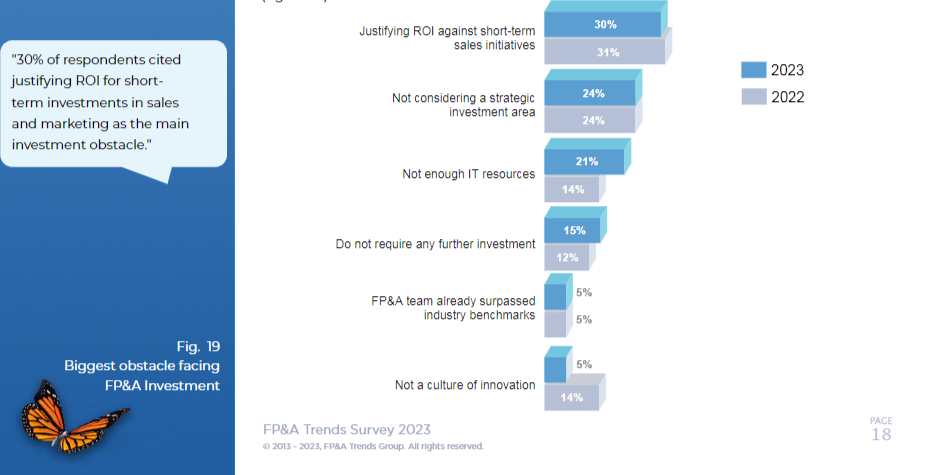

Challenge: Initial investment concerns can overshadow the long-term value of advanced financial systems.

Strategy: Reorient the conversation from cost to investment. Highlight the potential ROI, efficiency gains, and competitive advantages to illustrate how the strategic benefits far outweigh the initial outlay, leading to substantial long-term gains.

Challenge: The shift to sophisticated systems can reveal skill gaps in current teams.

Strategy: Proactively address these gaps through targeted training and development initiatives. Foster a learning environment where teams are equipped not just to use new technologies but to extract maximum strategic value from them.

QX Global Group stands at the forefront of facilitating this strategic transition in financial services. Our approach goes beyond mere implementation; we empower businesses to embrace the full potential of advanced R2R and FP&A services:

End-to-End Transformation Expertise: Our outsourced FP&A services are tailored to interpret financial data accurately, analyze business performance, and initiate strategic actions for growth.

Cost-Effective Professional Teams: We specialize in offshore FP&A, enabling companies to establish expert teams at a fraction of the cost. These teams excel in extracting and analyzing vital business data, guiding unbiased, strategic decision-making.

Strategic Support and Guidance: Understanding the intricacies of these transitions, QX Global Group offers comprehensive support. From seamless integration to ongoing training and strategic guidance, we ensure your finance function not only adapts but excels in this evolving landscape.

Originally published Nov 14, 2023 07:11:22, updated Apr 07 2025