Topics: Accounts Receivable Automation, Finance and Accounting Outsourcing Services

Posted on June 13, 2024

Written By Priyanka Rout

The increasing integration of technology in financial services highlights the growing importance of digital transformation, with 91% of businesses engaged in such initiatives according to Gartner research. While automation in Accounts Receivable (AR) enhances operational efficiency, the need for personal connections in customer relationships remains crucial. The global AR Automation Market, valued at $3.3 billion in 2022, is projected to grow at an annual rate of 14.2%, reaching $6.5 billion by 2027. This growth is driven by the need for more efficient workforce practices and faster invoicing processes to minimize payment delays.

Despite the shift towards automation in financial processes, from invoicing to credit risk management, the essential elements of customer service—empathy and precise response to customer needs—cannot be completely automated. This blog will discuss the critical role of the human touch in accounts receivable outsourcing services and its potential to strengthen customer relationships in the digital age. We will explore how businesses can successfully integrate advanced technology with the unique benefits of human insight and empathy to build lasting customer connections.

Human interaction in financial operations involves professionals handling tasks like accounting and auditing, characterized by their ability to analyze complex data, make informed decisions, and communicate effectively with clients and stakeholders.

A Forbes survey showed that while 51% of American consumers prioritize efficient customer experiences over friendly interactions during purchases, an equal percentage would switch providers without human support. In healthcare, where empathy is critical, 77% prefer speaking to human agents despite potential delays.

The advantages of human interaction include:

Fully automated systems in accounts receivable outsourcing are designed for efficiency and speed, processing large volumes of transactions or data with minimal human intervention. These systems are invaluable for tasks that require high accuracy and repetition. However, they lack the ability to manage exceptions or make judgment calls in ambiguous situations.

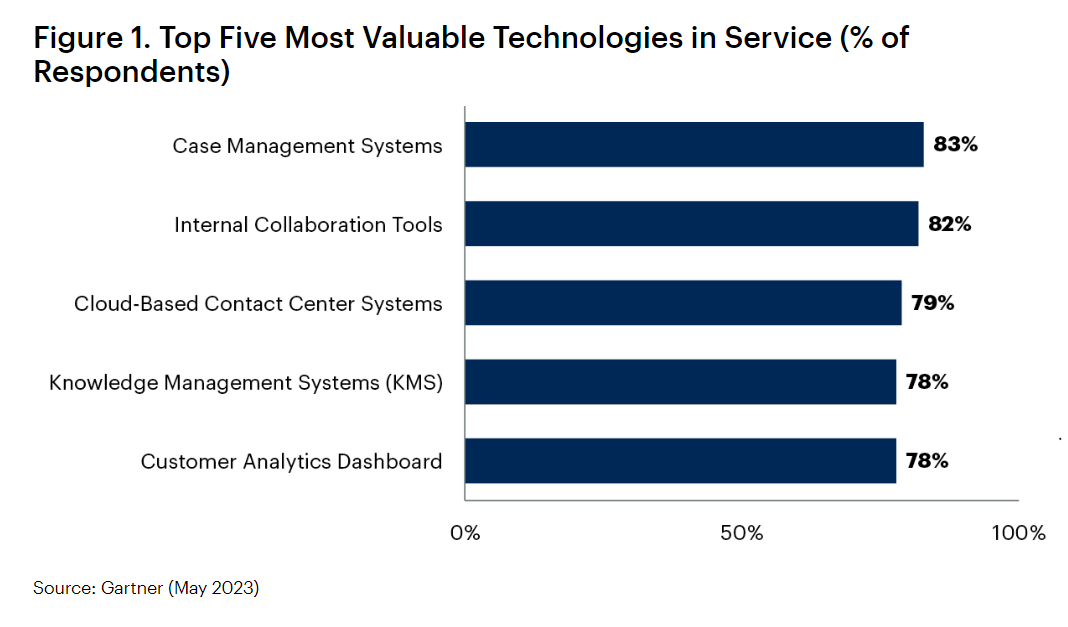

Gartner surveyed over 200 leaders in customer support and service between December 2022 and February 2023. The survey identified the top technologies influencing customer service:

Top 5 Most Valuable Technologies in Service; Source

While automation in customer service has many advantages, it doesn’t always result in a positive customer experience. Therefore, contact centers aim to provide a more complete customer experience by including human interaction, especially for complex issues or when customers need empathy and understanding.

In contrast, systems supplemented by human oversight incorporate the strengths of technology while leveraging human skills for higher-level decision-making and problem-solving. Did you know that 81% of top-performing customer service teams focus on building relationships during customer interactions? In contrast, teams with lower performance show nearly 20% less focus on this aspect. This hybrid approach allows for:

RELATED BLOG: Cash Flow Equilibrium: Balancing Accounts Receivable and Payable for Financial Health

Ensuring a personal touch in accounts receivable outsourcing services is crucial for maintaining customer relationships while leveraging automation.

According to Qualtrics XM Institute, 94% of customers who have had a “very good” experience with a company are likely to buy from them again. In contrast, only about 20% of customers who had a “very poor” experience would do the same.

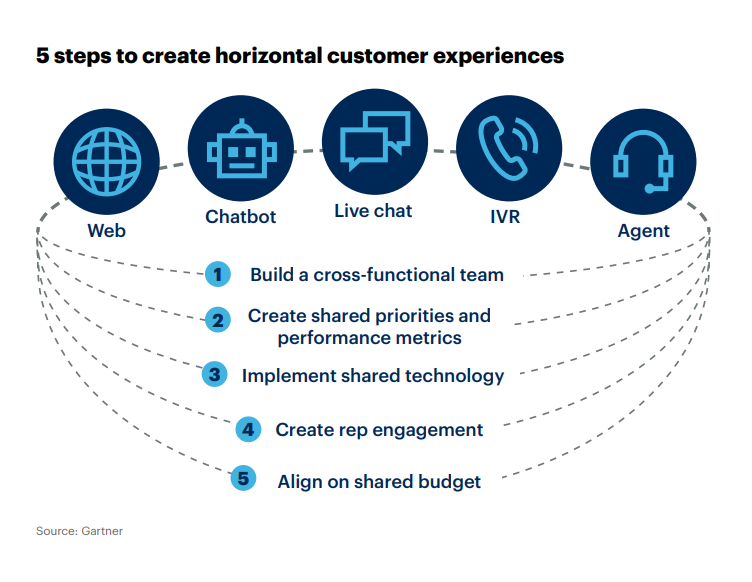

5 Steps to Create Horizontal Customer Experiences; Source: Top Customer Service Trends and Priorities To Watch In 2024 (gartner.com)

Here’s how to achieve a balance that respects and enhances the customer experience:

To integrate a human touch into automated accounts receivable outsourcing services, businesses should focus on both technology and customer relationships. This approach can elevate the customer experience significantly. Here are some restructured practices with fresh examples relevant to the accounts receivable sector:

Human-Like AI Responses: IDC predicts that by 2025, at least 90% of new enterprise applications, products, and processes will include AI technology. Utilize advances in natural language processing to train your AI systems to respond in a way that mimics human conversation, which can make automated interactions less mechanical and more comforting. Example: A telecom company, Verizon, uses advanced natural language processing in its customer service chatbots to provide responses that feel conversational and relevant, helping customers navigate billing issues smoothly.

Accounts receivable services outsourcing automation undoubtedly boosts business efficiency. Advanced technologies like Artificial Intelligence, Machine Learning, and Blockchain are set to revolutionize the finance and accounting sectors, just as they are impacting many other industries globally. Research by Gartner indicates that 89% of businesses have either adopted a digital-first strategy or are planning to do so.

While automation in accounts receivable outsourcing services bring undeniable efficiency, the enduring value of human interaction cannot be overstated. Companies must strive for a synergy that respects the irreplaceable qualities of empathy, understanding, and personal engagement in customer interactions.

By carefully integrating technology with the human touch, businesses not only enhance operational efficiency but also build deeper and more resilient customer relationships. This balanced approach is crucial in today’s digital landscape where personalized service can distinguish a company from its competitors and foster long-term loyalty and trust among customers.

RELATED CASE STUDY: End-to-end F&A Outsourcing for PBSA Giant to Improve Efficiency and Reduce Costs by 50%

QX stands out as a premier partner in outsourced accounts receivable management by going beyond traditional service roles to drive long-term growth. Our commitment includes adhering to accounting best practices, utilizing our extensive industry experience, and harnessing the latest technologies. By focusing on digital transformation, we enable clients to automate and gain real-time insights into the AR cycle, enhancing operational efficiency and reducing operating costs by 40-60%.

Originally published Jun 13, 2024 04:06:05, updated Jan 15 2025

Topics: Accounts Receivable Automation, Finance and Accounting Outsourcing Services