Topics: Finance & Accounting, Finance & Accounting Outsourcing, Finance Leaders, US elections 2024

Posted on November 01, 2024

Written By Chithrakala Babu

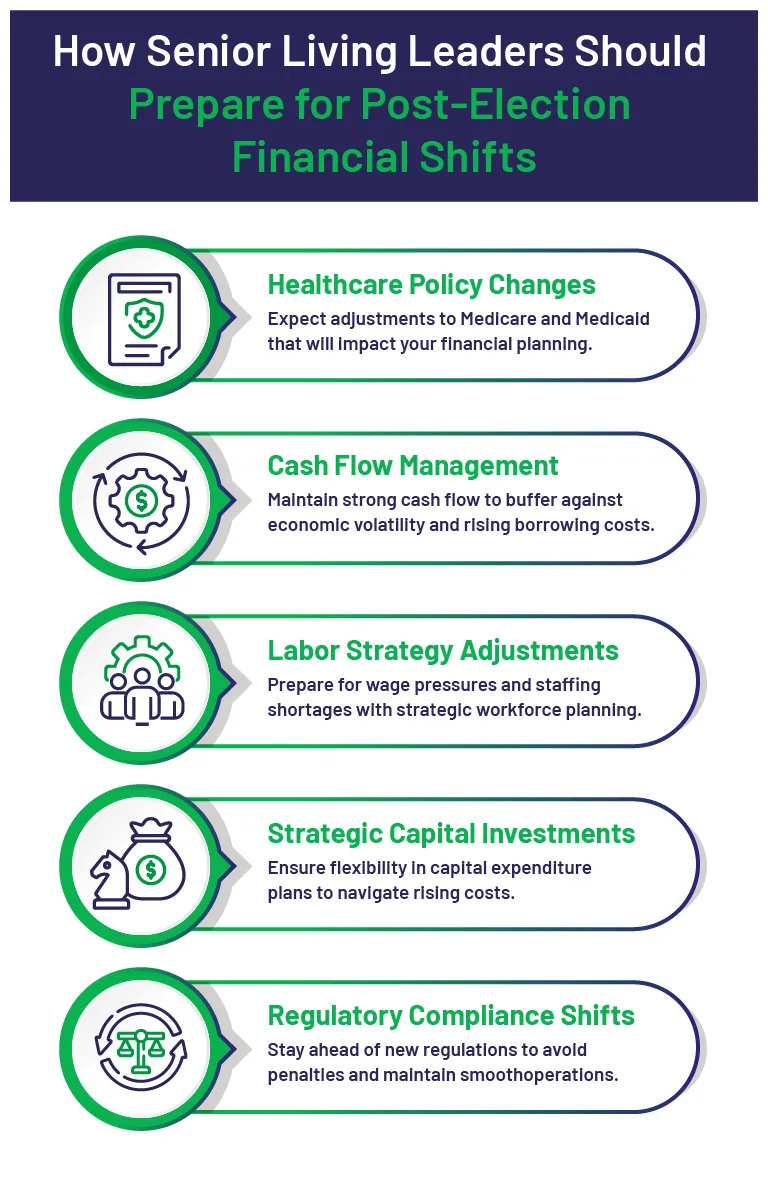

The 2024 U.S. election could shake things up for the senior living industry in a big way. From changes in healthcare funding to shifts in labor laws and tax policies, the results could heavily influence how senior living communities manage their finances. For CFOs, having the right strategies for senior living financial management is more important than ever.

Staying ahead of regulatory shifts, optimizing resources, and identifying growth opportunities will be crucial in navigating the post-election landscape. So, how can CFOs prepare? Let’s dive into a few key strategies for senior living CFOs to stay resilient and proactive.

Medicare and Medicaid funding remain critical lifelines for the senior living sector, contributing significantly to revenue streams. Depending on the election outcome, there could be adjustments in reimbursement rates, expansions of value-based care models, or even new initiatives targeting long-term care. According to a 2024 article by Forbes, one in five of senior living residents rely on Medicaid and other government funds, making any changes in these programs crucial to financial planning.

Preparation Tip: CFOs should build flexible financial models that can quickly adapt to changes in funding or reimbursement policies. Engage with industry associations to stay informed about legislative changes and advocate for favorable policy outcomes.

Election periods often bring economic volatility, affecting borrowing costs, inflation rates, and overall market sentiment. For senior living communities, maintaining robust cash flow is essential for operational stability. Recent trends show that a strong cash flow can buffer against unexpected costs and economic downturns, especially when interest rates are high.

Preparation Tip: Enhance cash flow forecasting and diversify revenue sources. Consider implementing more efficient billing cycles and strengthening your accounts receivable processes to ensure reliable and timely cash flow.

Labor is a significant cost center in the senior living sector, and changes to minimum wage laws, healthcare benefits, or immigration policies can have a profound impact. With more than 80% of senior living facilities reporting staffing shortages, any policy changes could exacerbate the existing challenges. It’s crucial for CFOs to stay ahead of these developments and plan accordingly.

Preparation Tip: Consider diversifying your staffing model, including outsourcing non-core functions like finance and HR, to reduce overhead costs. Streamline recruitment, training, and retention strategies to maintain a stable workforce, regardless of policy shifts.

Capital projects—whether for facility upgrades or new developments—are vital for maintaining competitive senior living communities. However, the economic shifts post-election could make capital financing more expensive or restrictive. With increased scrutiny on how investments are managed, it’s crucial for leaders to plan strategically.

Preparation Tip: Reevaluate your capital structure and be ready to pivot. Explore alternative financing options and partnerships to ensure flexibility in your investment plans. Develop robust financial analysis to justify capital expenditure and gain stakeholder support.

Post-election periods often see a reshuffling of regulatory frameworks, from data privacy to labor laws. The Centers for Medicare & Medicaid Services (CMS) has already set forth new staffing rules for nursing homes, and similar updates could affect other parts of the senior living sector. CFOs need to be prepared for increased compliance requirements and potential costs.

Preparation Tip: Invest in systems that improve compliance tracking and make audits simpler. By keeping your processes flexible and up-to-date, you can minimize disruptions and avoid regulatory penalties.

For senior living CFOs and business leaders, preparing for post-election financial shifts requires a balanced mix of strategic foresight, operational flexibility, and robust financial management. Anticipating policy changes, strengthening cash flow, and planning capital investments are all critical steps toward maintaining stability in an evolving landscape.

At QX Global Group, we understand the complexities and challenges facing the senior living sector, particularly in times of economic and regulatory uncertainty. Our finance and accounting outsourcing solutions are designed to streamline cash flow management, reduce labor costs, and ensure compliance, allowing you to navigate shifts in policy and market conditions with confidence. By leveraging our scalable, expert-backed services, senior living communities can optimize their financial operations, enabling you to focus on delivering exceptional care.

Interested in learning more about how we can support your organization through these financial shifts? Connect with us today to explore tailored solutions designed for your needs.

Post-election policy shifts can impact funding, tax laws, healthcare regulations, and labor costs—directly affecting the financial stability of senior living communities. CFOs need to stay ahead of these changes to adjust strategies and ensure compliance.

CFOs should monitor regulatory changes, reimbursement models, labor market trends, tax policies, and funding opportunities to safeguard financial health and adapt their long-term strategies accordingly.

CFOs should conduct risk assessments, review potential policy impacts, prioritize high-ROI projects, explore alternative financing options, and maintain financial flexibility to navigate uncertainties.

Industry associations provide legislative updates, networking opportunities, financial best practices, and advocacy efforts to help CFOs stay informed and influence policies affecting senior living communities.

Originally published Nov 01, 2024 11:11:04, updated Apr 04 2025

Topics: Finance & Accounting, Finance & Accounting Outsourcing, Finance Leaders, US elections 2024