Over the past few years, the business landscape has become more and more competitive. As a result, companies are increasingly offering credit as a means of payment. While this is bound to increase sales, it also puts a business at risk of delayed payments. This is where Accounts Receivable (AR) function enters the picture. Simply put, accounts receivable is an accounting term for any money your customers owe you for goods or services purchased on credit.

While AR may appear as a straightforward process of getting customers to pay on time, it is a chain of processes that directly impacts your company’s bottom line and customer relations. So how do businesses ensure seamless accounts receivable management? What are the different sub-processes within accounts receivable? We can understand this critical finance function better by answering some of the most common questions:

What is Accounts Receivable?

Accounts Receivable Definition

Accounts receivable, or AR, is the accounting term used to refer to the payment that a business will receive from its customers who have purchased its goods & services on credit. Since AR are funds that a company expects to receive from its customers in the near future, they are listed as a current asset on the balance sheet.

Accounts receivable is a complex chain of processes that starts once a sale is made & invoice generated and ends when the payment has been received & reported. On the one hand, customers have a tendency of delaying payments as much as possible, while a business that has provided goods or services will expect to receive payments as soon as possible and maintain its cash flow.

Accounts Receivable Example

Let’s consider the case of a hypothetical battery manufacturer, XYZ Pvt. Ltd., to understand accounts receivable. For instance, XYZ Pvt. Ltd. receives an order worth $10,000 from an e-bike manufacturer. Once the batteries are delivered, XYZ Pvt. Ltd. raises an invoice for the amount and as per its agreement with the e-bike maker, allows a buffer of 60 days for the payment to be made. As soon as the invoice is generated, the sum of $10,000 will be accounts receivable for XYZ Pvt. Ltd. and will be listed under the company’s current assets. Once the payment is complete, the cash segment in the balance sheet will increase by $10,000, and the account receivable will be decreased by the same amount.

Difference Between Accounts Receivable & Accounts Payable

Accounts receivable and accounts payable (AP) are quite simply, two sides of the same coin. While accounts receivable is the money that a business is expecting to receive from its customers, AP refers to the money that it owes to its suppliers or third-party vendors. While AR is recorded as a current asset on the balance sheet, AP falls under current liabilities and is considered the same until paid.

How to Calculate Accounts Receivable?

Accounts receivable calculation is usually done by keeping track of the many key KPIs pertaining to this finance function – with the most common of them being Accounts Receivable Turnover Ratio. Also sometimes referred to as debtor’s turnover ratio, AR Turnover Ratio measures how efficiently a business uses its assets and the number of times it collects the average accounts receivable over a given period of time.

Accounts Receivable Turnover Ratio = Net Credit Sales / Average Accounts Receivable

Once you have your AR Turnover Ratio, you can also find out the average number of days it takes for a customer to pay for credit sales.

Accounts Receivable Turnover Ratio in Days = 365 / AR Turnover Ratio

Many businesses also rely on Days Sales Outstanding (DSO) as a metric to track the efficiency of their receivables function. A high DSO indicates that the company is experiencing delays in receiving payments, while a low DSO suggests that the business is getting paid promptly. AR and credit control teams often work hard to reduce the DSOs.

DSO = Accounts Receivable / Total Credit Sales X Number of Days

What is the Accounts Receivable Process?

As mentioned earlier, the accounts receivable process starts as soon as an invoice is generated for a credit sale and ends when the payment is received and has been accounted for. However, as a whole, accounts receivable processes can vary significantly across organisations, depending on business size, industry dynamics, and customer dynamics, amongst other factors. Let us get a brief overview of the four pillars of the accounts receivable process that are common to most organisations:

Accounts Receivable Workflow

- CREDIT POLICIES: The first step in the receivables process, and easily the most important, involves setting credit terms for individual customers. This process helps identify the amount of credit a business will extend to a particular company, determine payment terms like time period and take a call on early payment rebates & late payment fees, if applicable. Though businesses often tend to overlook the importance of credit policies, these terms & conditions can actually play a crucial role in reducing the chances of delayed or missed payments.

- CUSTOMER INVOICING: Generating easy-to-understand invoices that clearly outline payment terms is the key to efficient accounts receivable management. During this process, a company, as best practice, generates invoices with key details like invoice number, product details, amount due, and payment date. Businesses are now also adapting electronic invoices & payment methods to further optimize receivables – something that we will touch upon in detail in the following sections.

- ACCOUNTS RECEIVABLE TRACKING: As the name suggests, this step in the accounts receivable workflow involves keeping track of accounts, their due payments and ensuring that completed payments are allocated to their relevant invoices. While smaller organizations tend to rely AR Officers to carry out tracking through manual tools like Excel, larger companies often deploy accounts tracking software systems to help improve efficiency & accuracy.

- ACCOUNTS RECEIVABLE ACCOUNTING: As a last step in the process, a business will either use cash-basis accounting or accrual-basis accounting to verify its accounts receivable. It is also important to note that during this step, businesses need to perform accounting for both collected payments as well as ones that were written off.

Accounts Receivable Best Practices

By now you must have understood why accounts receivable management is vital for any business. An ineffective receivables function can put your business at risk of running out of cash in-hand to sustain daily operations. While there is no sure-shot formula to guarantee timely payments, you, as a business, can implement certain best practices to optimize this function. Some of the top accounts receivable best practices are:

- ELECTRONIC INVOICING: Manual invoices can really pull your receivables down. Electronic invoices, on the other hand, help speed up the process, increase customer satisfaction and facilitate faster payments.

- INTEGRATED PAYMENTS: Over the last few years, businesses have realized the importance of digital payments in optimizing receivables. Integrating payments within the invoice allows your customers to click right from the bill itself to initiate payments. In addition to faster payments and superior customer experience, integrated payments also set the base for automated record-keeping.

- ROBUST CREDIT & COLLECTION POLICIES: Many times, businesses, in a bid to increase sales, end up extending credit to customers without understanding their capability to pay back – putting the company at risk of bad debts. Therefore, it is crucial for any business to have a solid credit policy and adhere to it. Similarly, having a robust collection policy in place will also help take escalation measures in case of delayed payments—more on these in the following sections.

- PROACTIVE APPROACH: To prevent hampered customer relationships, AR officers often tend to get apprehensive about chasing payments. As a best practice, ensure that your teams have a well-defined process of communicating with customers. Follow a proactive approach and send out firm yet professional reminders that are easy to understand and also highlight steps to pay.

- TRACKING AR PERFORMANCE: Keeping a regular check on and tracking key accounts receivable KPIs can help understand the efficiency of AR teams and facilitate further process improvements. As a business, ensure you are tracking important metrics like Days Sales Outstanding (DSO), Accounts Receivable Turnover Ratio, and Average Days Delinquent (ADD). Make sure to leveraging these stats to optimize the function.

How to Create a Credit Policy?

Rapidly expanding businesses often end up focusing too hard on selling, overlooking accounts receivable management. In addition, no company ever wants to be on bad terms with its customers. As a result, businesses find themselves reeling under late payments and bad debts.

A credit policy is a set of guidelines that sets credit and payment terms for customers and establishes a course of action for late payments. A well-drafted and implemented credit policy can protect the interest of businesses as it delineates payment expectations & guidelines to minimize bad debts.

While some companies rely on in-house teams to draft their credit policies, others introduce a team of outsourced accounts receivable experts that can understand the business thoroughly, draft a solid credit policy and ensure proper implementation. Some of the key aspects that a credit policy must cover are:

- Credit limit for each customer and their payment due dates;

- Credit terms in case of delayed payments;

- Accepted methods of payment;

- Early payment discounts & rebates; and,

- Delinquent accounts policy.

What Does an Accounts Receivable Specialist Do?

Owing to the critical nature of accounts receivable function, accounts receivable specialists are quite simply the backbone of any finance team. On the whole, these highly skilled individuals are responsible for maintaining a company’s financial accounts with incoming transactions. Here are some of the primary duties of an accounts receivable specialist:

- Preparation, generation & sending of invoices

- Tracking incoming payments

- Communication with customers for payment resolution

- Addressing payment discrepancies

- Maintaining billing accounts and records

- Recording and reconciling payments

- Evaluation of current policies and recommendations for process improvements

- Generating business & case-specific reports

What are Accounts Receivable Services?

Accounts receivable services are a set of highly specialized financial services that help a business keep track of customer payments and better manage cash flow. It is important to understand that this broad umbrella can cover a whole range of tasks like invoicing, collections, customer service and reporting, amongst others.

Why do businesses need accounts receivable services?

- Dependence on traditional collection process can slow down receivables

- Complex and time-consuming nature of accounts receivables can drain inhouse resources

- Human errors arising out of manual collection can prove to be costly

- Inefficient accounts receivable management can hamper customer relationships

- Delayed payments and bad debts can affect the bottom line severely

Can Accounts Receivable be Outsourced?

Absolutely! In fact, accounts receivable is one of the most commonly outsourced finance activities. Traditionally, businesses have taken to accounts receivable outsourcing to reduce costs. However, due to the changing business landscape, CFOs, FDs and Finance Managers now look at AR outsourcing from a strategic viewpoint.

Benefits of accounts receivable outsourcing

Some of the key reasons why businesses outsource their collections to third-party companies are:

- Drafting & implementation of solid credit & collections policies

- Standardization & optimization of processes to speed up collections and bring down DSO

- Implementation of receivables best practices across the board

- Access to a global pool of accounts receivable specialists at a fraction of on-shore cost

- Infinite scalability through flexible offshore teams

- Support for identification & implementation of latest AR automation tools

- Timely reminders, due alerts, and negotiations with customers to ensure smooth cash flow

- Generation of a wide variety of reports including daily cash collection, monthly DSO, unallocated cash vs. target, performance dashboard, and more

- Frees up in-house teams, driving focus to strategic accounting activities

Accounts receivable outsourcing vs. in-house teams

In-house accounts receivables management and outsourcing are the two most common approaches businesses take to manage their collections. In fact, some companies also adapt a hybrid approach, outsourcing the repetitive, time-consuming tasks to a third-party vendor while continuing to perform the other higher-end activities in-house. If you’re wondering what approach might be the best for your business, don’t worry. We’ll touch upon some common parameters to understand where AR outsourcing might be a better idea and where in-house management would work better.

TEAM EXPERTISE: Due to a limited talent pool and high hiring costs, finding and retaining in-house accounts receivable professionals can get quite complex. Working with a third-party vendor, on the other hand, gives business access to a global pool of highly skilled AR experts that can not just match inhouse efficiency levels but also exceed them.

OPERATIONAL COSTS: In addition to the sky-high hiring costs, performing collections in-house also brings about a range of associated costs, which diminishes the resulting profit. In case of outsourced teams, your business won’t have to worry about overheads like additional software costs, staff training and retention costs. All these factors can come together to result in operational cost reduction of up to 50%!

TECHNOLOGY & AUTOMATION: Barring the additional investment a business will have to make in revamped systems, access to technology & automation is one aspect where both AR outsourcing & in-house management can be effective. However, while initiating an automation project with in-house resources, businesses must be mindful of the expertise of their teams in migrating to new systems. Remember, a failed automation project can prove to be catastrophic for any business.

PROCESS CONTROL: While it can get a little difficult to manage, especially in rapidly growing organizations, in-house accounts receivable management offers complete process control to finance leaders. On the other hand, outsourcing reduces the control factor and puts the security of the project in the hands of a third-party vendor. This is one of the primary reasons why one should be extremely careful while picking their outsourcing partner – more on this in the following sections.

Qualities to look for in your AR outsourcing partner

Choosing an AR outsourcing partner is one of those critical decisions that can define the success or failure of your outsourcing project itself. Some of the key qualities you should look for while zeroing down on potential partners are:

- Industry experience & expertise

- Knowledge of industry-standard tools and software

- Certifications/Accreditations

- Flexibility in terms of staffing & processes

- Transparency in communication

- Compliance and security measures

- Attention-to-detail

- Commitment to on-time delivery

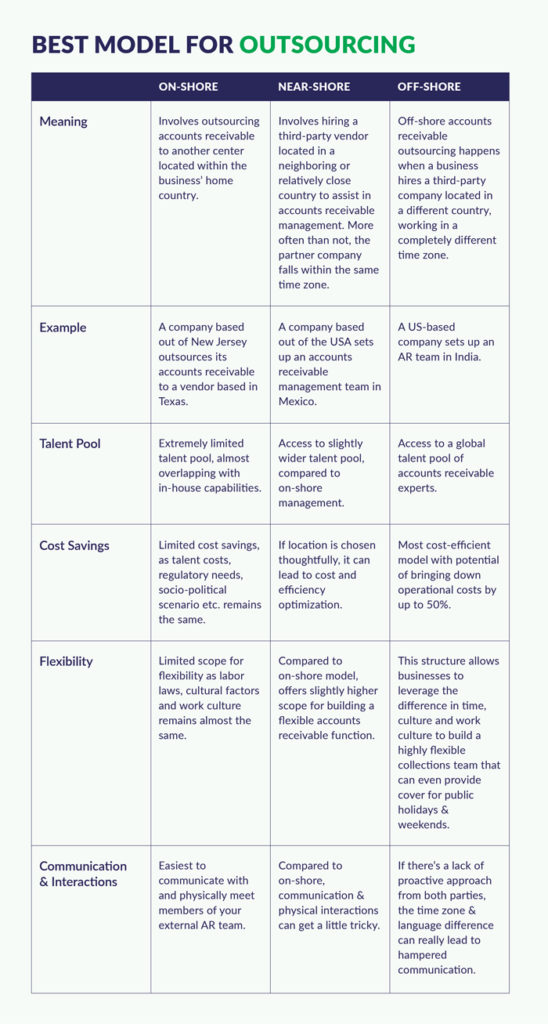

On-shore, Near-shore or Off-shore – Which model is best for AR outsourcing?

Now that we are aware of the benefits of an outsourced accounts receivable and know how to look for potential partners, let us compare the three most common outsourcing set-ups and try to understand the plus points and shortcomings for each of them:

What is Accounts Receivable Automation?

Simply put, Accounts Receivable automation, or AR Automation, is leveraging processes and software to automate manual, repetitive and time-consuming tasks within the accounts receivable function.

How does AR automation work?

Much like other forms of accounting automation, the scope of AR automation is quite broad and will vary from organization to organization. However, on a broader level, it helps businesses with:

- INVOICING: Automating this part of the AR process allows businesses to generate clear, standardized invoices promptly and initiate an efficient receivables system;

- TRACKING: Automated AR tracking enables collection teams to stay on top of pending payments, send out timely reminders and initiate escalation measures, where required;

- ACCOUNTING: Automating the final steps of the AR function allows businesses to perform reconciliations with higher accuracy and generate bespoke reports to drive strategic decision-making.

Benefits of accounts receivable automation

Some of the main benefits of automating accounts receivable for your business are:

- Improved efficiency through automated invoicing & processing to facilitate faster payments

- Brings down late payments caused by disputes and reduces the chances of bad debts

- Frees up in-house teams of repetitive, time-consuming AR tasks to drive focus to core activities

- Adds infinite scalability to your AR teams by reducing dependence on people-based processes

- Streamlines invoicing & communications to deliver a top-notch customer experience

- Allows global organizations to standardize processes & tools across the board

- Turbocharges the AR function to result in significant time & cost savings

- Enables companies to better track data and generate timely, accurate reports

How to choose the right accounts receivable software?

The big automation boom has resulted in the emergence of many accounts receivable software in the market and zeroing down on one can get quite overwhelming. Here are a few generic tips that you must keep in mind while choosing an accounts receivable software for your business:

REGROUP INTERNALLY: Regardless of whether your business is small in size or a global organization, internal expectations need to be aligned from the word go. When choosing an AR automation software, ensure that both the finance team as well as the senior leadership are involved in the decision-making process.

INTEGRATION: Many times, businesses end up investing in tools that address just their current needs – which is a big faux pas. Look for a tool that is open and scalable in nature and can integrate easily with third-party applications. Remember, automation is a long-term game and you want to invest in a tool that is capable of growing with you.

FUNCTIONALITY: Quite easily, the most important aspects of them all – you need a tool that addresses all your business needs. Make sure you do a thorough analysis of things like features, customization, ease-of-use, customer support etc. before making a decision.

TRY & COMPARE: Once you’ve shortlisted a few tools, the next best step is to do an in-depth comparison and reach out to vendors for demos. It is imperative to know whether your teams are able to work around a particular software and if it’s solving your issues in the real world, before taking the big plunge.

Which are the most popular accounts receivable automation tools?

By now, we know that manually carrying out accounts receivable activities can be back-breaking for any organization. As a result, forward-thinking companies are increasingly looking at accounts receivable automation tools to automate invoicing, payment collection and reporting. Some of the best-regarded AR automation tools currently available are:

- FreshBooks

- Oracle NetSuite ERP

- QuickBooks

- Sage

- Xero

- AccountsIQ

- SoftLedger

- NetSuite

- Gaviti

- Melio

- YayPay

- Zoho Books

- Bill.com

Accounts Receivables FAQs

Why should I outsource my accounts receivable functions?

Most businesses outsource their accounts receivable function to a third-party company with the intention of driving focus to core business operations. Additionally, these specialists also allow companies to overcome staffing shortages, build scalable teams, reduce the cost of operations, optimise processes and improve the service quality. Nowadays, businesses also leverage the expertise of AR service providers to accelerate their finance & accounting transformation.

Which accounts receivable activities can I outsource?

- Customer set-up and maintenance

- Credit checks

- Customer queries resolution

- Invoice chasing, escalation, and resolution

- Sales ledger maintenance

- Invoice discounting reporting and reconciliation

- Revenue reconciliation on a weekly and monthly basis

- Master vendor reconciliation

- Accounts receivable deductions management

When should I consider outsourcing accounts receivable functions for my business?

There are many early signs that can indicate your business needs an outsourced accounts receivable function. Some of the most common ones are:

- Inability to generate & send out invoices in a timely manner

- Frequent late payments

- Inconsistency in sending payment reminders

- Heavy dependence on traditional AR processes or outdated software

- Lack of standardised processes

- Inexperienced staff

- Writing off bad debts frequently

Will outsourcing my AR activities affect my customer relations?

An experienced specialist partner will have a customer-centric approach to payment collections. The key role of a specialist is to build trust with your customers and encourage them to make timely payments. They will also provide you with regular updates and reports on their activities to ensure you’re in the loop. Additionally, they will consult you before taking any action against disputed invoices and accounts that might be of concern.

How much can I save by outsourcing my accounts receivable function?

Cost-saving is one of the key benefits of outsourcing this function. However, the figure will vary depending on the size of the organisation and the number of customers it deals with. Several businesses end up saving costs ranging between 40-60%. Additionally, streamlining processes and improving efficiency adds to your overall savings.