Topics: Finance & Accounting Outsourcing, Finance and Accounting Transformation

Posted on May 21, 2024

Written By Priyanka Rout

At a certain juncture, successful entrepreneurs face a crucial decision: whether to accelerate growth or maintain a steady pace. By this point, they’ve likely nailed down their product-market fit, navigated early-stage funding, and are eyeing further investment to ramp up quickly. Scaling isn’t a natural progression; it demands intentional planning, adept management, resource mobilization, and a seasoned advisory team to boost capabilities steadily and generate swift revenue.

If they opt for scaling, founders must ready the business to:

This marks a pivotal stage in any company’s journey. Successfully scaling, though challenging, achieves rapid growth without burdening core business functions, and outsourcing key processes when contemplating scaling provides significant advantages.

Finance and accounting services outsourcing is crucial for expanding businesses facing complex financial needs. Timely and accurate financial reporting is vital for informed decisions, attracting investments, and meeting regulatory requirements.

Deloitte reports that 65% of successful organizations use outsourced support. Managing finances internally can be overwhelming and divert resources from core operations. Finance and accounting services outsourcing offers an effective solution to scale your business efficiently.

In this article, we’ll delve into the advantages and techniques of leveraging financial services outsourcing to scale your business effectively.

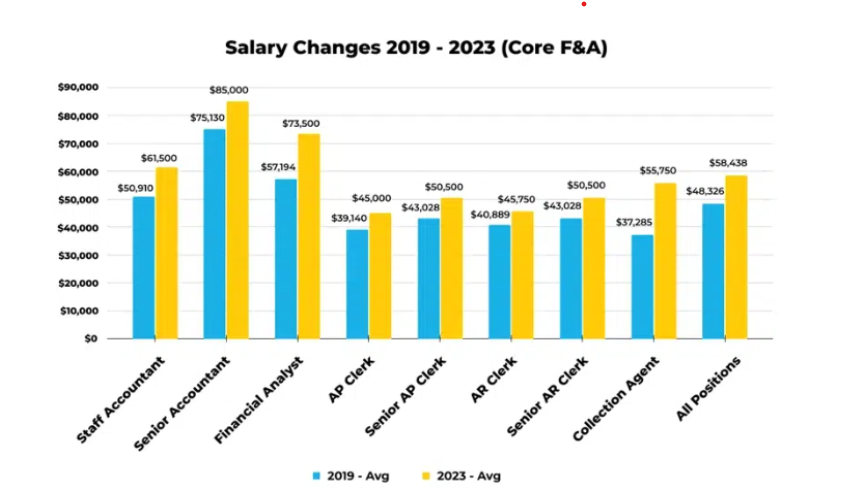

Increasing Salary Demands of FnA Professionals; Source: Robert Half Salary Survey Data Report

Increasing Salary Demands of FnA Professionals; Source: Robert Half Salary Survey Data Report

Before discussing the benefits of finance and accounting services outsourcing, it’s important to recognize the difficulties of managing an F&A team internally:

RELATED BLOG: Learn why outsourcing accounts receivable is a smart move for your business by clicking here.

Let’s begin with some numbers. In 2022, nearly all senior managers (91%) faced difficulty in locating proficient finance and accounting professionals, especially in areas like financial planning and analysis, accounts payable/receivable/bookkeeping, and budgeting.

Finance and accounting services outsourcing presents a strategic remedy to these challenges. By teaming up with a reputable financial services provider, you gain access to a squad of financial experts skilled in managing your business’s financial intricacies. Here’s how outsourcing can effectively aid in expanding your business and bring in finance transformation:

When you’re searching for a finance and accounting services outsourcing partner that can grow with your business, there are a few important things to keep in mind. Here’s what you should look for to make sure they can adapt to your needs as you expand.

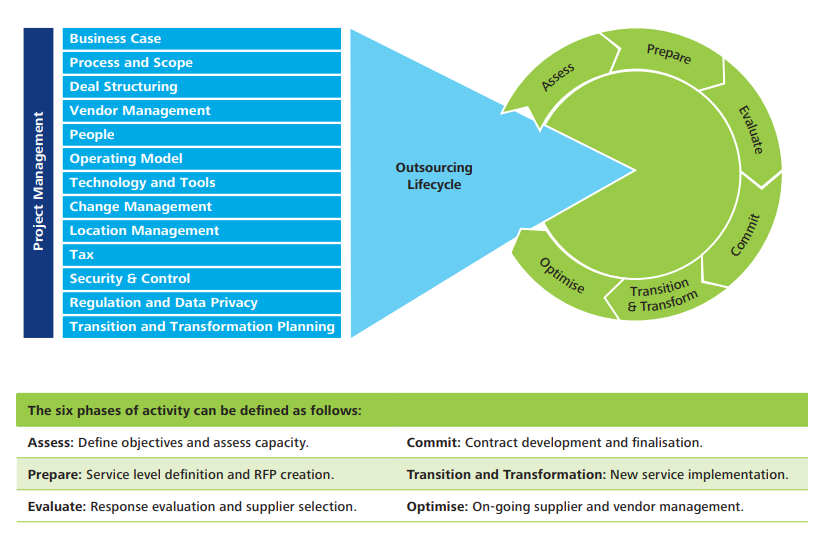

Finance and accounting services outsourcing provides the flexibility needed to navigate changing market conditions and accommodate future growth. It allows businesses to scale their financial operations seamlessly, whether it’s handling increased transaction volumes, expanding into new markets, or adapting to evolving regulatory requirements.

Moreover, financial services outsourcing enables access to specialized skills and technologies that might be costly or challenging to develop in-house. This approach not only optimizes operational efficiency but also enhances overall agility and competitiveness.

Learn how QX Global Group can be a great partner in improving your finance and accounting processes. Contact our experts today to start transforming your operations with greater efficiency and innovation!

Education:

BA (English Literature); Executive MBA (Marketing)

Priyanka Rout is a B2B marketing professional with 5+ years of experience in marketing, specialising in content-led growth, performance strategy, and sector-driven brand building. She has worked extensively on developing structured marketing programs that align closely with sales priorities, measurable outcomes, and executive-level engagement. At QX Global Group, she leads hospitality-focused marketing initiatives while overseeing central SEO and social media strategy across the UK and USA markets. Working closely with business development and sector leaders, Priyanka develops thought leadership, event-led campaigns, and digital programs that translate complex finance and outsourcing themes into commercially relevant narratives for CFOs and senior decision-makers.

Expertise: B2B Marketing Strategy & Sector Positioning, Hospitality Industry Marketing (UK Focus), Finance & Accounting Services Marketing, Content-Led Growth & Thought Leadership Development, CFO & Executive-Level Content Strategy, Sales Enablement & Marketing Alignment, Event Marketing & Industry-Led Campaigns, SEO Strategy & Organic Growth (UK & USA Markets), Social Media Strategy & Brand Visibility, Outsourcing & Global Delivery Narratives, Industry-Specific Campaign Development, Performance-Driven Digital Marketing Programs

Originally published May 21, 2024 03:05:28, updated Jun 24 2025

Topics: Finance & Accounting Outsourcing, Finance and Accounting Transformation