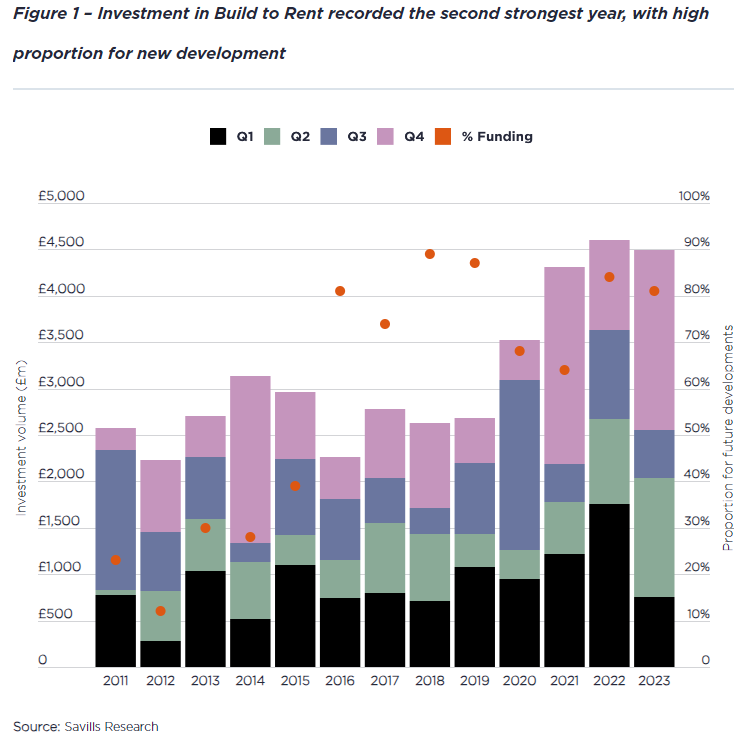

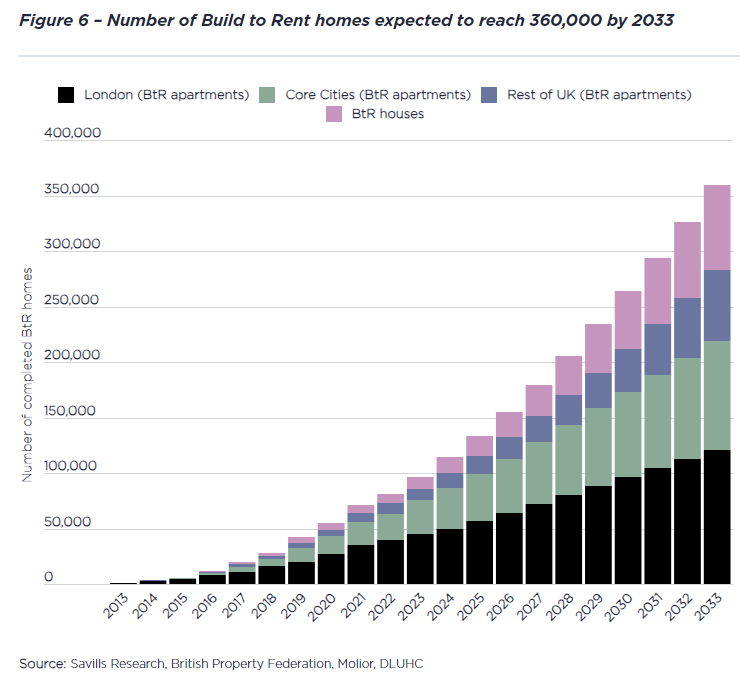

The UK’s Build-to-Rent (BtR) sector is booming. In 2023, the UK’s BtR sector attracted £4.5 billion in investments, making it the second highest year for investment on record, according to Savills. This figure is slightly down by about £100 million (2%) from 2022, yet it surpasses the investment levels of 2021.

High Investments in BtR; Source: Savills

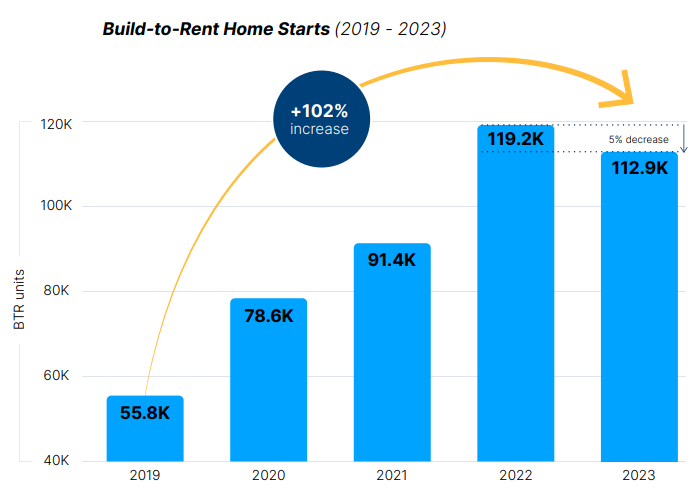

With a keen eye on strategic locations and solid market insights, it’s fast becoming a hotbed for savvy investors and property developers. This isn’t just about more buildings popping up; it’s about creating spaces that fit modern lifestyles, which are reshaping rental market demands. This shift has caught the eye of big-time institutional investors, pumping money into BtR properties because they see the potential for steady, lucrative returns.

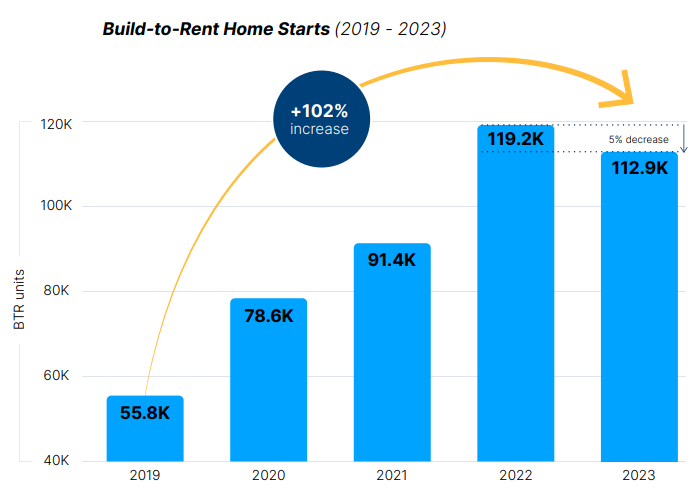

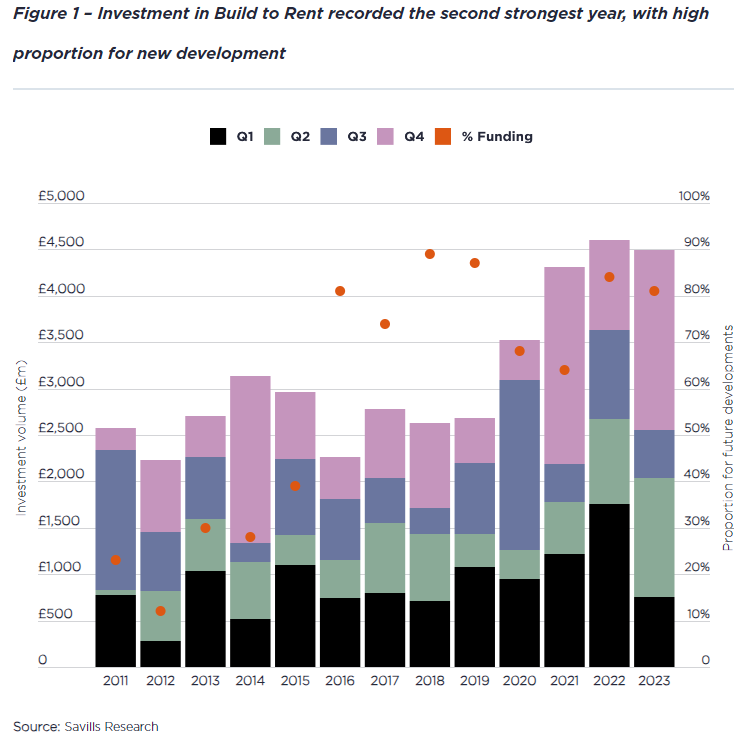

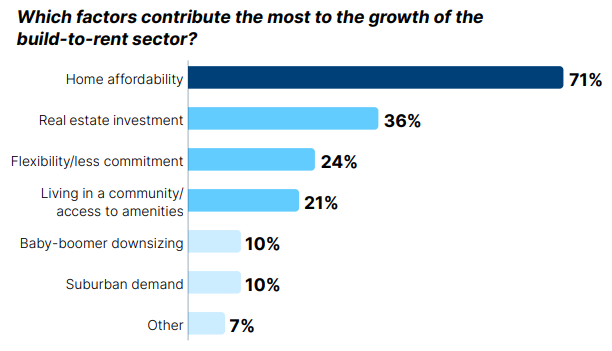

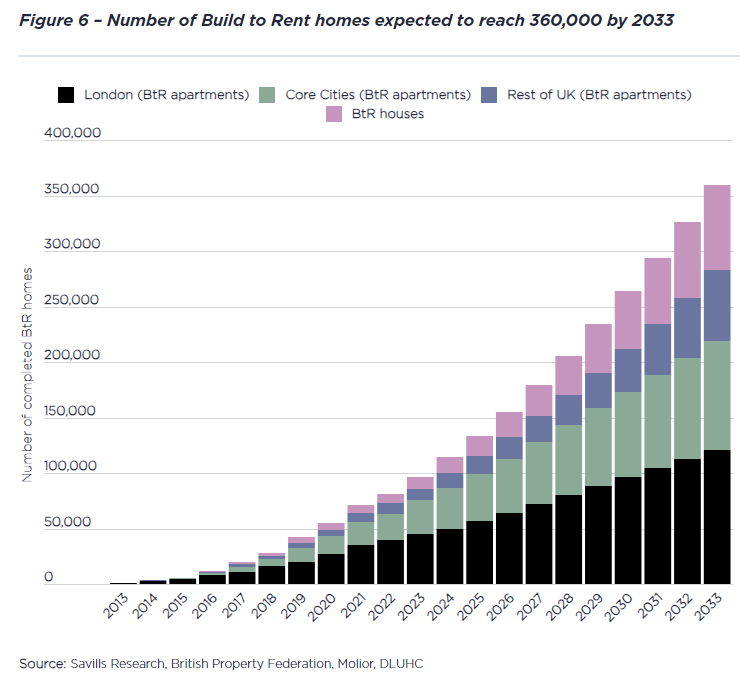

Increase in BTR units worldwide; Source: Built-to-Rent Homes Report 2024

But here’s the catch: as more players jump into the fray, the race to maximise return on investment (ROI) heats up. It’s no longer just about getting these properties filled; it’s about making them stand out in a crowded market and ensuring they keep delivering financially.

Today’s BtR operations lean heavily on tech solutions to streamline everything from rent collection to maintenance requests, making life easier for both tenants and landlords. And let’s not forget the design aspect—optimising living spaces not just for sleep, but also for work and play, can make a property far more attractive to potential renters.

Plus, focusing on creating an excellent tenant experience—from responsive management to community-building activities—can boost tenant retention rates, which is key to securing a healthy ROI.

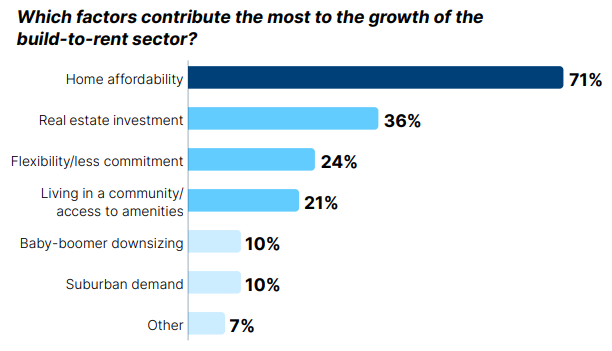

Factors contributing to growth of the BTR sector; Source: Built-to-Rent Homes Report 2024

In this blog, we’ll dive into how BtR stakeholders are using these strategies to their advantage, making sure their properties do more than just exist—they thrive in a competitive market.

How Can You Optimise BtR Operations for Maximising ROI?

1) Leverage Technology for Process Optimisation

PropTech is transforming rental management far beyond the buzz; it leverages advanced property management software to streamline tasks from lease management to rent collection. The global proptech market was valued at $30.16 billion in 2022 and is expected to grow to around $40.5 billion by 2024, fueled by significant investments in the sector. This technology simplifies operations and enhances tenant satisfaction by making their interactions with property managers as smooth as possible, enabling more efficiency with less effort.

In the first half of 2022, proptech investments surpassed $8 billion, with 70% going to AI startups. Investors are focusing on AI applications in property valuation, predictive maintenance, and personalised user experience.

As 64% of businesses adopt AI for productivity, proptech venture capitalists remain optimistic about high returns. Predictive AI goes a step further by not just analysing but forecasting market trends, using insights to predict tenancy gaps and adjust pricing dynamically. This capability ensures properties are priced optimally, minimising vacancies and maintaining profitability.

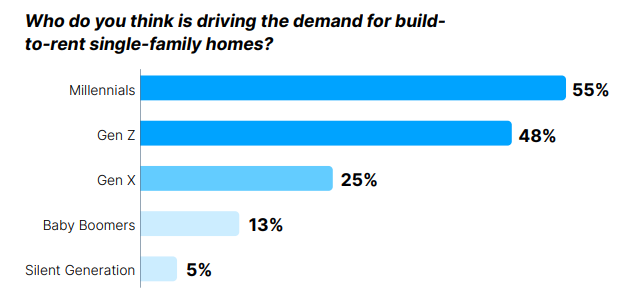

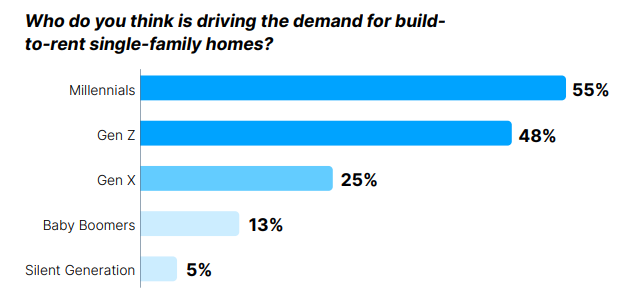

Millennials and Gen Z Are Driving the BtR Boom; Source: Built-to-Rent Homes Report 2024

Data-driven revenue management utilises real-time data through sophisticated systems to refine leasing strategies and pricing models. These insights allow property managers to make well-informed decisions that boost profitability. This strategic approach ensures that every pricing decision is robustly supported by data, optimising revenue potential across property portfolios and solidifying a competitive edge in the market.

2) Financial Management for BtR Operations

Navigating the financial side of Build-to-Rent (BtR) operations can really make or break your success. It’s all about staying in the black and making sure your projects not only survive but thrive. Managing your costs wisely and locking down the right kind of financing are key.

From the initial property purchases right through to ongoing maintenance and managing tenant services, every dollar counts. You’ll also want to explore financing options that match your long-term ambitions—whether that’s snagging favorable loan terms, tapping into equity, or teaming up with investors.

Effective financial management hinges on strong budgeting and accurate forecasting. These practices let you predict cash flows, allocate resources wisely, and plan for the future with confidence. Modern financial tools and software are game changers here, automating the grunt work of accounting and delivering deep insights through analytics. This technology doesn’t just save time—it sharpens your financial decisions, making sure your business strategies are data-driven and set for growth.

3) Financial Performance Tracking and Reporting

Effective financial tracking and reporting are vital for Build-to-Rent (BtR) operations. Adopting real-time financial reporting tools for built-to-rent properties lets property managers keep an eye on key metrics such as cash flow, occupancy rates, and costs as they happen. This quick access to data speeds up decision-making, improves resource allocation, and enables swift responses to market shifts, keeping financial insights fresh and actionable.

Centralising financial data management by combining all financial details—from rent to maintenance costs—into one platform also makes operations smoother. This approach cuts down on the complexities of using multiple systems, enhances the accuracy of forecasts, and allows managers to spot trends and predict future financial scenarios with greater clarity. With all the data in one place, it’s easier to make informed decisions and plan strategically.

4) Cost Control through Efficient Budgeting

Keeping costs in check is key to the profitability of Build-to-Rent (BtR) projects. A smart move is automating accounts payable (AP) and accounts receivable (AR). This not only cuts down on the manual effort but also reduces errors, which can be costly. Automated systems process transactions faster and reduce administrative burdens, ultimately saving money. They also keep track of built-to-rent cash flow management in real time, enabling property managers to make quick, informed financial decisions.

Another critical strategy is to monitor the cost per unit. This means keeping tabs on what it costs to run each rental unit—think maintenance, utilities, and other operational costs. Comparing these figures with industry standards helps managers see if they’re spending too much and identify opportunities to cut costs. Regularly reviewing these costs ensures pricing and operations are adjusted strategically, keeping BtR ventures competitive and profitable, even as market conditions change.

5) Capital Allocation and ROI Forecasting

Capital allocation is crucial for the profitability and longevity of Build-to-Rent (BtR) operations. It’s essential to fine-tune your capital expenditure (CapEx) strategies. Using detailed financial models, property managers can estimate the return on investment (ROI) for potential upgrades, like renovations or new amenities.

These models pinpoint the financial benefits of each project, guiding managers to focus on investments that promise the best returns and quickest paybacks. This isn’t just spending money—it’s investing wisely to boost property value and attract tenants.

Scenario analysis is equally important in financial forecasting and risk management within BtR operations. By considering different market scenarios, like changes in interest rates or tenant demand, managers can predict how these factors might impact their finances. This analysis provides a well-rounded perspective on potential future situations, aiding in smart built-to-rent financial planning and proactive risk handling.

With smart capital management and precise ROI forecasting, BtR operators can secure a competitive advantage and drive ongoing success in the ever-changing real estate market.

6) Tax Optimisation

Tax optimisation can make a big difference to the bottom line in Build-to-Rent (BtR) operations. A smart move is to take advantage of tax credits and incentives for energy-efficient upgrades or affordable housing. Installing solar panels or upgrading to energy-saving systems doesn’t just cut energy costs—it can also earn you valuable tax reliefs.

And if you’re investing in affordable housing, there are additional incentives to tap into. On top of that, it’s worth regularly checking your property tax assessments. You might find opportunities to challenge and lower overestimated values, which can lead to significant savings year after year. Combining these strategies helps keep tax bills lower and profits higher.

What’s the Bottom Line?

The BtR Industry Is Increasing; Source: Savills

To truly maximise ROI in Build-to-Rent (BtR) operations, it’s essential to take a well-rounded approach. This means combining smart financial management, streamlined cost control, and the latest technology to keep everything running smoothly. While each strategy—from PropTech adoption to tax optimisation—plays its part, the real magic happens when they all work together.

At QX, we specialise in bringing these elements together seamlessly. We help BtR operators navigate the complexities of the market with tailored solutions that drive profitability and growth. By partnering with us, you’re not just optimising your BtR operations; you’re setting the stage for long-term success. Click here to set up a consultation call with our experts.

FAQs

Originally published Oct 08, 2024 01:10:08, updated Apr 09 2025

Topics: BTR, Finance and Accounting Transformation

Don't forget to share this post!