Topics: Finance and Accounting Outsourcing Services, Finance and Accounting Transformation

Posted on September 02, 2024

Written By Priyanka Rout

Finance and accounting aren’t just about crunching numbers and balancing budgets; they’re the backbone of strategic business decisions, encompassing everything from daily bookkeeping and risk management to auditing and tax strategies. These functions play a critical role in shaping a company’s future, influencing everything from day-to-day operations to long-term strategic planning.

With such critical tasks at stake, businesses today face a pivotal decision: should they keep these tasks in-house, or are finance and accounting outsourcing providers a better option? This isn’t just a logistical choice—it’s about weighing the benefits of cost, expertise, and technology against the need to maintain control over strategic financial operations.

At first glance, hiring an in-house bookkeeper might seem like a good idea. However, for a growing organisation that aims to enhance its processes and utilise cutting-edge technology, finding an individual capable of handling all these aspects is exceptionally difficult. Typically, much of the workload still ends up on the shoulders of the owners and CEOs, who must verify and follow up on critical data. In reality, it’s often not just one person, but several full-time employees who are needed.

For instance, Boeing recently moved its accounting operations to India. This strategic decision was aimed at streamlining processes, reducing costs, and relieving their staff from routine tasks to concentrate on higher priorities. Boeing, a giant in the aerospace sector, showcases the complexities of such operations. Their shift underscores a broader trend among major corporations recognising the benefits of finance and accounting outsourcing providers. This raises an important question: Why stick with in-house solutions when outsourcing can offer significant cost advantages and efficiencies?

According to Gartner, 79% of CFOs in 2024 prioritise leading transformation efforts. To achieve this, many companies are turning to finance and accounting BPM services for quick access to advanced technologies like analytics, automation, and generative AI. The CFO outsourcing decision-making process often involves evaluating how external expertise can enhance strategic guidance and financial management within a company.

Our goal here is straightforward. We want to demystify this decision-making process, offering a clear comparison of managing F&A internally versus outsourcing it. By adopting strategic financial function outsourcing, businesses can leverage specialised skills to streamline operations and focus more effectively on core competencies. We’ll explore current trends, assess technological innovations, and consider the operational impacts of both options. By the end of this blog, you’ll have a clearer understanding of which approach might best suit your business’s needs, helping you make an informed decision that aligns with your company’s goals and operational style.

RELATED CASE STUDY: Discover how QX helped a top real estate corporation save £1.8M annually with a world-class shared service center. Click here to read the case study.

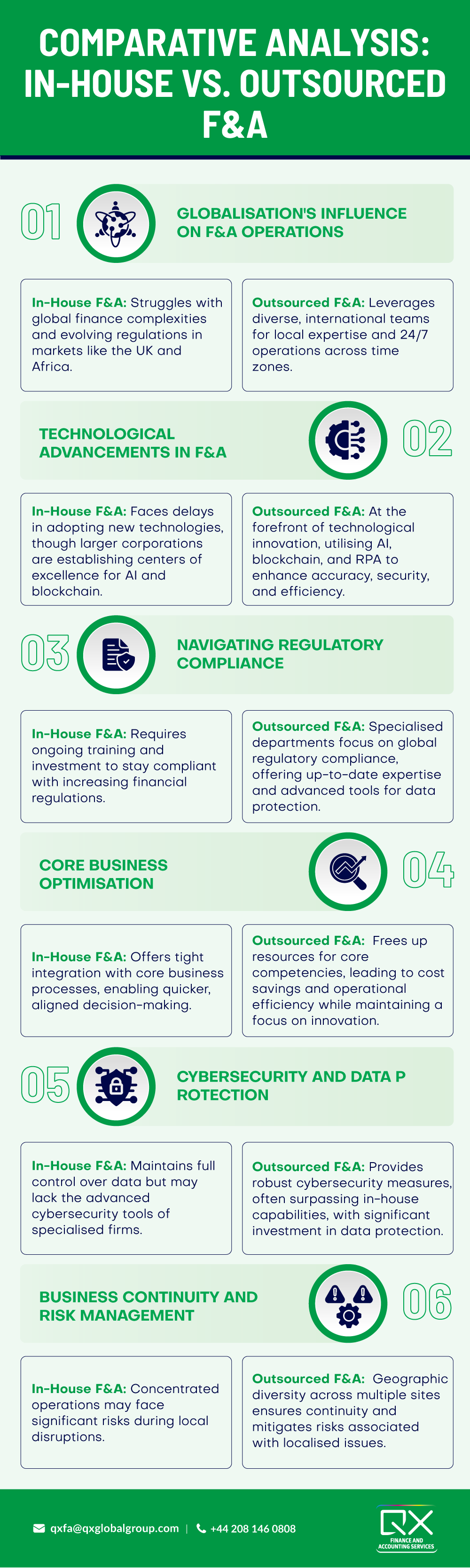

In-House F&A: Operating an in-house F&A department often means grappling with the complexities of global finance without the breadth of international expertise that diverse teams provide. As companies grow and expand into new markets, in-house teams can struggle to stay updated on multiple regulatory environments, especially in rapidly evolving markets such as the UK and Africa.

Outsourced F&A: Outsourcing capitalises on globalisation by employing diverse international teams who bring local knowledge and expertise from around the world. This setup enables a 24/7 operation cycle, optimising response times and productivity by aligning work across time zones. This model has become increasingly valuable as companies seek to enter fewer familiar markets where nuanced local knowledge can significantly impact compliance and market entry strategies.

In-House F&A: In-house teams may face significant delays in adopting new technologies due to budget constraints and the challenges of integrating legacy systems with new software. However, recent pushes towards digital transformation have seen some larger corporations developing in-house centers of excellence for technologies like AI and blockchain to keep pace with industry innovations.

Outsourced F&A: Finance and accounting outsourcing companies remain at the forefront of technology, incorporating tools like AI for predictive analytics, blockchain for transparent and secure transactions, and RPA to eliminate manual errors and reduce costs. The pandemic accelerated the adoption of cloud-based platforms and tools among outsourcing firms, allowing for more resilient and flexible service delivery that can quickly adapt to changing market dynamics.

In-House F&A: In-house teams require ongoing training and must constantly adapt to new financial regulations, a task that has become more daunting with the increase in financial regulatory changes post-2020. Companies are finding that maintaining compliance internally requires significant investment in both human and financial capital.

Outsourced F&A: Outsourcing firms often have specialised departments that focus solely on compliance with global financial regulations. These providers invest in continuous training and technology to ensure compliance, which has become a major selling point, particularly with the growing complexity of data protection laws like GDPR and CCPA.

In-House F&A: Maintaining an in-house F&A team allows for tight integration with the core business processes and can lead to quicker decision-making aligned with corporate strategies. This model is preferred by companies that prioritise direct control over all business aspects, particularly where financial operations are closely tied to their primary offerings.

Outsourced F&A: Outsourcing allows companies to focus on their core competencies by offloading routine financial operations to external experts. This can lead to significant cost savings and operational efficiencies, as seen in the trend towards outsourcing complex but non-core tasks like tax management and payroll processing. The freed-up resources and management bandwidth can then be redirected towards innovation and expanding the business’s core areas.

In-House F&A: While in-house teams fully control their data, they may lack the advanced tools and protocols that specialised outsourcing firms implement. Recent high-profile data breaches have pushed companies to reconsider the security advantages of outsourcing, which can provide more robust defenses against cyber threats.

Outsourced F&A: Many outsourcing providers market their services on the strength of their cybersecurity measures. These companies invest heavily in securing client data through advanced technologies and protocols, reflecting a commitment to data integrity that can often surpass the capabilities of in-house systems.

In-House F&A: In-house operations are often concentrated in specific locations, which can pose significant business continuity risks in the event of local disruptions. The recent global disruptions have highlighted the importance of geographic diversity in operations.

Outsourced F&A: Outsourcing providers typically maintain multiple operational sites across different geographic areas, offering better resilience through redundancy and diversification. This geographical spread helps mitigate risks associated with local disruptions, ensuring continuous operation even under adverse conditions.

RELATED BLOG: Explore our latest blog, F&A Process Outsourcing: How to Make it Work, where we dive into practical strategies and insights to help you successfully navigate and optimise your outsourcing journey.

To wrap up, our analysis clearly demonstrates the advantages of finance and accounting outsourcing providers. On one hand, outsourcing can substantially reduce costs, boost operational efficiency, and bring in specialised skills that enhance your business operations. This lets you concentrate on what you do best—growing your core business.

On the other hand, it’s important to be aware of potential hurdles, like differences in work culture, communication issues, and concerns about data security. These challenges call for a thoughtful approach to selecting the right outsourcing partner and maintaining vigilant oversight.

Before deciding, businesses must carefully assess their needs and objectives. By aligning these factors with the right outsourcing strategy, your company can not only minimise risks but also leverage the benefits of outsourcing finance and accounting services as a powerful tool for business finance transformation.

Choosing the right outsourcing partner involves evaluating several factors, such as the provider’s industry experience, technical expertise, service offerings, and understanding of your specific business needs. It’s essential to assess the provider’s track record, client testimonials, and ability to scale services according to your business growth. Additionally, a successful partnership requires clear communication, well-defined processes, and ongoing collaboration to ensure alignment with your business goals.

Yes, outsourcing accounting is generally cheaper and more efficient. Hiring and training staff incurs significant expenses and risks of turnover. Outsourced teams offer more experience and reduce mistakes. For example, replacing a staff member earning $46,000 can cost $23,000, while outsourcing might cost $12,000 to $24,000 annually, saving $35,683 to $47,683. These savings can be invested in other business needs. Outsourced accounting also scales with your company, ensuring continued growth without added manual processes.

Hiring an in-house accounting team involves multiple costs, such as salaries, benefits, and the risk of mistakes. The U.S. Bureau of Labor Statistics reports the median accountant salary is $45,560, with benefits adding up to a total cost of $59,683 per year. Additional expenses include training new hires, recruiting, and dealing with turnover, which can cost up to 50-60% of the employee’s annual salary. As the company grows, these costs and inefficiencies increase, making in-house accounting more expensive.

Education:

BA (English Literature); Executive MBA (Marketing)

Priyanka Rout is a B2B marketing professional with 5+ years of experience in marketing, specialising in content-led growth, performance strategy, and sector-driven brand building. She has worked extensively on developing structured marketing programs that align closely with sales priorities, measurable outcomes, and executive-level engagement. At QX Global Group, she leads hospitality-focused marketing initiatives while overseeing central SEO and social media strategy across the UK and USA markets. Working closely with business development and sector leaders, Priyanka develops thought leadership, event-led campaigns, and digital programs that translate complex finance and outsourcing themes into commercially relevant narratives for CFOs and senior decision-makers.

Expertise: B2B Marketing Strategy & Sector Positioning, Hospitality Industry Marketing (UK Focus), Finance & Accounting Services Marketing, Content-Led Growth & Thought Leadership Development, CFO & Executive-Level Content Strategy, Sales Enablement & Marketing Alignment, Event Marketing & Industry-Led Campaigns, SEO Strategy & Organic Growth (UK & USA Markets), Social Media Strategy & Brand Visibility, Outsourcing & Global Delivery Narratives, Industry-Specific Campaign Development, Performance-Driven Digital Marketing Programs

Originally published Sep 02, 2024 08:09:50, updated Jan 16 2025

Topics: Finance and Accounting Outsourcing Services, Finance and Accounting Transformation