Topics: Accounts Payable Automation, Finance and Accounting Outsourcing Services

Posted on July 02, 2024

Written By Priyanka Rout

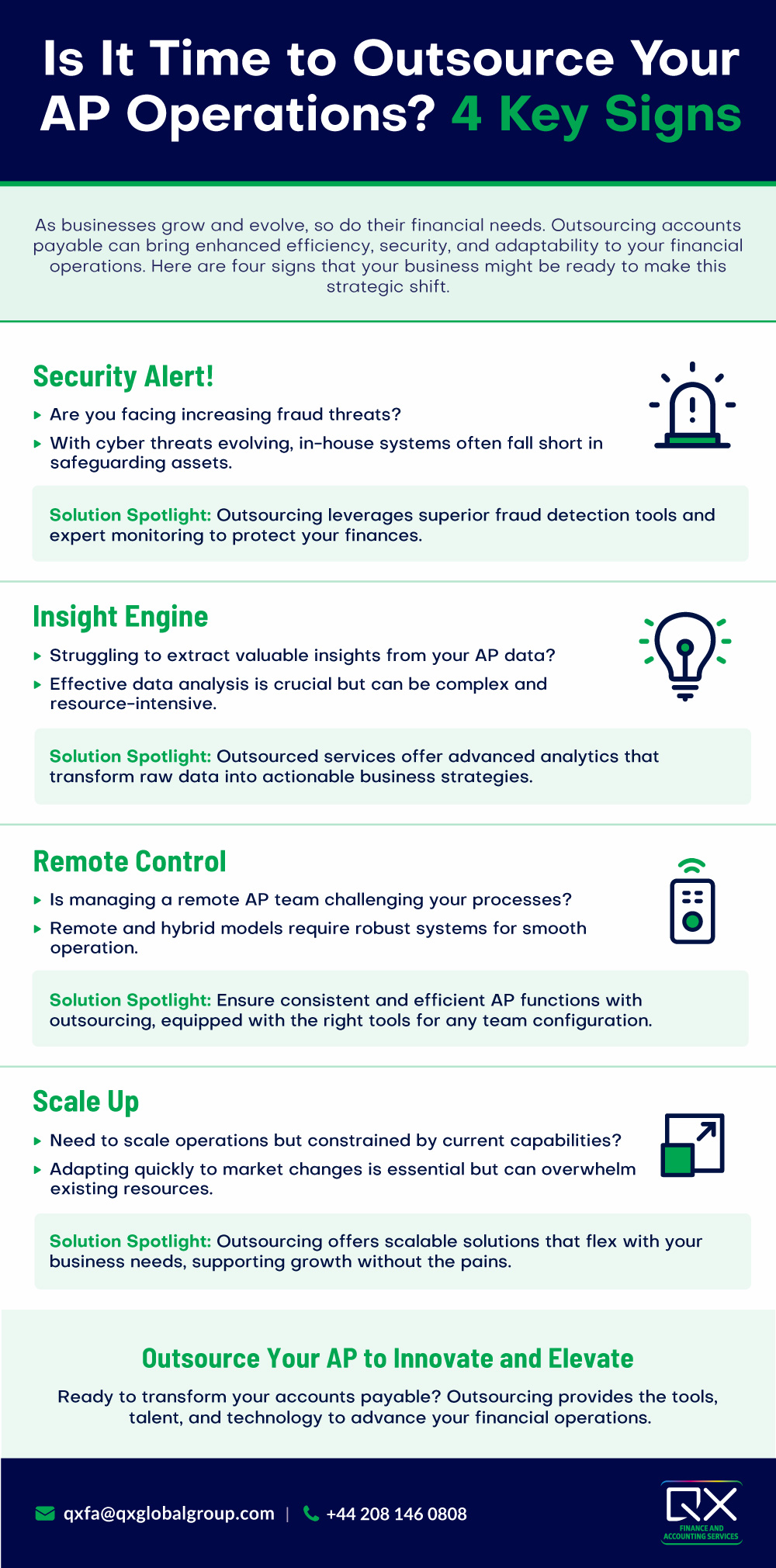

Over the past decade, outsourcing accounts payable (AP) process has gained significant traction among businesses. This interest has notably surged among small firms during the pandemic, as highlighted by Pymnts.com. The evolving market dynamics, propelled by times of disruption, are accelerating the shift towards outsourcing.

A Pymnts article states, “We are definitely in one of those market inflection points, where a typically conservative approach to the payments landscape needs some immediate solutions.”

Despite the growing inclination towards outsourcing, businesses must weigh the benefits of in-house accounting. Clutch research underscores the advantages of in-house accounting for small businesses, emphasising personalised services and increased confidentiality. Their data reveals that 62% of SMBs manage their accounting processes internally.

Outsourcing accounts payable is more than just offloading tasks; it’s about partnering with experts who understand your business and help you achieve your goals.

Imagine a scenario where deadlines are effortlessly met, cash flow is stable, and errors are minimised. That’s the transformative power of accounts payable outsourcing.

Accounts Payable (AP) fraud is rapidly evolving, with cybercriminals using increasingly sophisticated tactics. Businesses face numerous threats like phishing, invoice fraud, and ransomware, putting pressure on in-house teams.

Cybercrime costs are projected to reach $10.5 trillion annually by 2025, underscoring the need for robust fraud prevention measures.

In-house AP teams often struggle to keep pace with the advancing fraud techniques. Several factors contribute to this challenge:

Outsourcing accounts payable functions to specialised firms effectively addresses in-house fraud prevention challenges:

In the current business landscape, data analytics is more crucial than ever for strategic decision-making. Accounts Payable (AP) departments hold a treasure trove of data that can offer significant insights into a company’s financial health and operational efficiency. However, many organisations struggle to leverage this data effectively.

AP data encompasses detailed information on expenditures, vendor relationships, payment cycles, and cash flow patterns. When harnessed correctly, this data can:

Despite the clear benefits, many in-house AP teams face significant challenges in fully utilising their data:

Outsourcing AP functions to specialised service providers can address these challenges and unlock the full potential of AP data:

Managing remote and hybrid workforces has become a critical focus for organisations worldwide, especially in accounts payable (AP) processes.

Outsourcing AP processes can be a game-changer for businesses managing remote or hybrid workforces. Here’s how outsourcing can help ensure consistency and efficiency:

The ability to scale operations to meet fluctuating market demands is crucial in today’s fast-paced business environment. However, scaling in-house Accounts Payable (AP) resources to keep pace with these changes can be a significant challenge for many organisations.

Fluctuating market demands can create substantial pressure on in-house AP teams. When the market is booming, the volume of transactions increases exponentially, requiring more hands-on deck to manage invoices, process payments, and ensure compliance.

Conversely, maintaining a large AP team can become a financial burden during slower periods. This constant ebb and flow strain the resources, leading to the following:

Outsourcing accounts payable operations provides a scalable solution that can seamlessly adapt to changing business needs. Here’s how:

Recognising the subtle signs that indicate a need for outsourcing accounts payable can significantly impact on your organisation’s efficiency and financial health. Whether it’s frequent invoice discrepancies, strained supplier relationships, inconsistent cash flow management, escalating processing costs, or challenges in scaling operations, each of these signs points to the strategic advantages of outsourcing.

By leveraging AP outsourcing, organisations can streamline processes, enhance security, and scale operations more effectively. The strategic benefits extend beyond operational efficiency, providing robust security measures to safeguard financial data and the flexibility to adapt to evolving business needs.

At QX Global Group, our AP outsourcing services are designed to address these unique challenges, offering customised solutions that align with your business goals. For more information or to schedule a consultation, please visit our website or contact us directly. Let QX Global Group help you optimise your AP processes and drive your business forward.

Accounts payable shared services involve consolidating back-office functions like Accounts Payable (AP) into a central location, typically a shared services center (SSC). This setup allows companies to streamline resources from different parts of their organisation into one unified service center. An accounts payable specialist oversees financial records management, while an AP clerk focuses on tasks like bookkeeping, such as preparing invoices, bills, and financial statements. Outsourcing in AP refers to hiring an external vendor to handle specific accounts payable tasks, such as invoice processing and payments. It falls under the broader category of business process outsourcing (BPO).FAQs

What are accounts payable shared services?

What is the difference between an accounts payable clerk and an accounts payable specialist?

What is outsourcing in AP?

Education:

BA (English Literature); Executive MBA (Marketing)

Priyanka Rout is a B2B marketing professional with 5+ years of experience in marketing, specialising in content-led growth, performance strategy, and sector-driven brand building. She has worked extensively on developing structured marketing programs that align closely with sales priorities, measurable outcomes, and executive-level engagement. At QX Global Group, she leads hospitality-focused marketing initiatives while overseeing central SEO and social media strategy across the UK and USA markets. Working closely with business development and sector leaders, Priyanka develops thought leadership, event-led campaigns, and digital programs that translate complex finance and outsourcing themes into commercially relevant narratives for CFOs and senior decision-makers.

Expertise: B2B Marketing Strategy & Sector Positioning, Hospitality Industry Marketing (UK Focus), Finance & Accounting Services Marketing, Content-Led Growth & Thought Leadership Development, CFO & Executive-Level Content Strategy, Sales Enablement & Marketing Alignment, Event Marketing & Industry-Led Campaigns, SEO Strategy & Organic Growth (UK & USA Markets), Social Media Strategy & Brand Visibility, Outsourcing & Global Delivery Narratives, Industry-Specific Campaign Development, Performance-Driven Digital Marketing Programs

Originally published Jul 02, 2024 10:07:01, updated Oct 27 2025

Topics: Accounts Payable Automation, Finance and Accounting Outsourcing Services