Topics: AML, compliance services, compliance strategies, GDPR, IR35, NMW, recruitment agencies, regulatory landscape, UK staffing compliance

Posted on August 24, 2024

Written By Abishek Balakumar

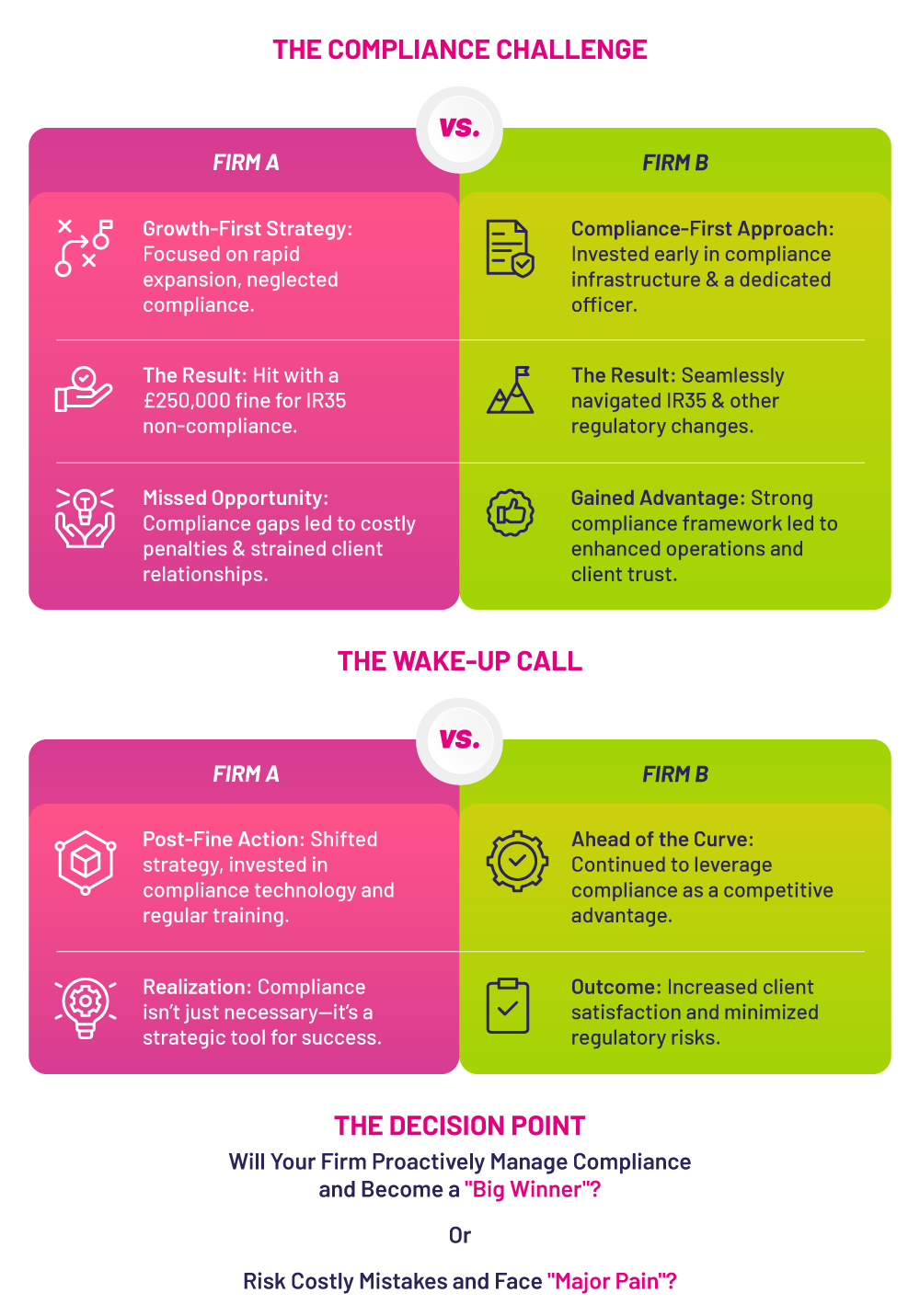

Note: To illustrate this, let’s consider two hypothetical staffing firms, Firm A and Firm B. Both have established themselves as leaders in the UK outsourcing and staffing industry, earning strong reputations for excellence. However, as the regulatory landscape begins to shift, each firm faces a critical decision point.

According to the Cyber Security Breaches Survey, 75% of UK businesses reported a cyber security breach. No sector appears to be an exception, and the staffing sector itself stands more exposed since it contains huge amounts of personal data. The average cost of non-compliance is £1.2 million, as Thomson Reuters has pointed out, so obviously, non-compliance is not just a legal but a financial risk as well.

Add to this that Qdos Contractor predicts 50% of contractors will be inside IR35 by 2025, and the stakes for staffing firms go through the roof. The shifting regulatory landscape is a call for more than compliance—foresight, strategy, and being proactive.

The UK government is set to introduce legislation next year to regulate the ESG ratings industry. This move aims to enhance transparency in a sector that significantly influences trillions of pounds in investments. Chancellor Rachel Reeves is leading the charge to bring the UK in line with global standards, particularly those of the EU. The Financial Conduct Authority will oversee the new regulatory framework. While the industry welcomes increased oversight, concerns remain about potential restrictions on ESG data flow, which could hinder investment decisions.

The face of the regulatory environment is changing, including some major changes on the horizon:

These changes can be difficult to manage and risky for those who aren’t prepared. However, for those who plan ahead and adapt quickly, they offer a chance to stand out as leaders in the industry.

Maintaining compliance doesn’t have to be a major drain on finances. With the right strategies, firms can effectively manage their compliance requirements while also minimizing costs and enhancing their overall financial performance by:

Such strategies allow firms to manage compliance effectively without adding to costs and help translate associated challenges into competitive advantages.

As the regulatory landscape for UK staffing firms evolves, adapting to these changes is not just a necessity but a strategic opportunity. The shift in regulations, including the anticipated increase in IR35 compliance requirements—with up to 50% of contractors expected to be inside IR35 by 2025—presents both challenges and opportunities for growth.

The statistics are striking: according to Thomson Reuters, the average cost of non-compliance is £1.2 million, highlighting the significant financial risks involved. Moreover, the Cyber Security Breaches Survey indicates that 75% of UK businesses experienced a cybersecurity breach, underscoring the heightened risks for firms handling extensive personal data.

Staffing firms that proactively address compliance—through regular compliance audits, clear onboarding processes, and ongoing training—can transform these challenges into competitive advantages. By investing in compliance technology and simplifying processes, firms can not only avoid costly penalties but also enhance their operational efficiency and client trust

As new regulations such as the Good Work Plan, GDPR, and stricter Right to Work checks come into play, firms have the chance to position themselves as industry leaders. Those who are prepared will not only navigate these regulatory changes successfully but also stand out in an increasingly competitive market.

The choice is clear: embrace compliance as a strategic tool for growth and leadership, or risk facing significant financial and operational setbacks. The firms that seize this opportunity will thrive, emerging as “Big Winners” in the evolving landscape. Will your firm be ready to lead or face the repercussions of inaction? The decision is yours to make.

Originally published Aug 24, 2024 10:08:17, updated Sep 09 2024

Topics: AML, compliance services, compliance strategies, GDPR, IR35, NMW, recruitment agencies, regulatory landscape, UK staffing compliance