Topics: commercial real estate, cost optimization, Inflation and Recession, Outsourcing, real estate

Cost Optimization for Commercial Real Estate Companies: The Key to Navigating Recession

Posted on October 18, 2022

Written By Siddharth Sujan

Despite a prolonged period marred by COVID-induced uncertainties, the commercial real estate (CRE) sector, as a whole, showed extreme resilience and only emerged stronger from the socio-economic crisis. Just when things seemed to be finally stabilizing for good, the sector finds itself at the brink of what could be another meltdown.

While industry insiders are projecting continued revenue growth for the remainder of 2022, the 2023 and beyond outlook is raising significant concerns. With the threat of a global recession looming large, it has become imperative for commercial real estate companies to pull up their socks and start preparing for the absolute worst.

Let us dig deep and try to understand:

- What costs are going to hurt CRE owners the most in 2023 & beyond?

- Why is cost optimization the need of the hour?

- What measures are industry leaders taking to tackle these challenges?

2023 Revenue Expectations – A Call to Restrategize

Over the last two quarters, businesses have been hit hard by sky-high inflation, supply chain disruptions and tax policy changes. While real estate has often been called a ‘recession-proof’ industry, the current economic and geopolitical climate suggests that not all sectors & businesses might be able to generate the same ROI this time around.

In fact, if early projections are to go by, economic concerns are already the biggest concern for most global commercial real estate leaders. According to Deloitte’s 2023 Commercial Real Estate Outlook, 40% of respondents expect their revenues to improve compared to last year while 48% see revenues decreasing, and 12% expect no change at all. These numbers clearly highlight a big outlook shift as the previous year’s survey had about 80% of the respondents expecting a revenue increase.

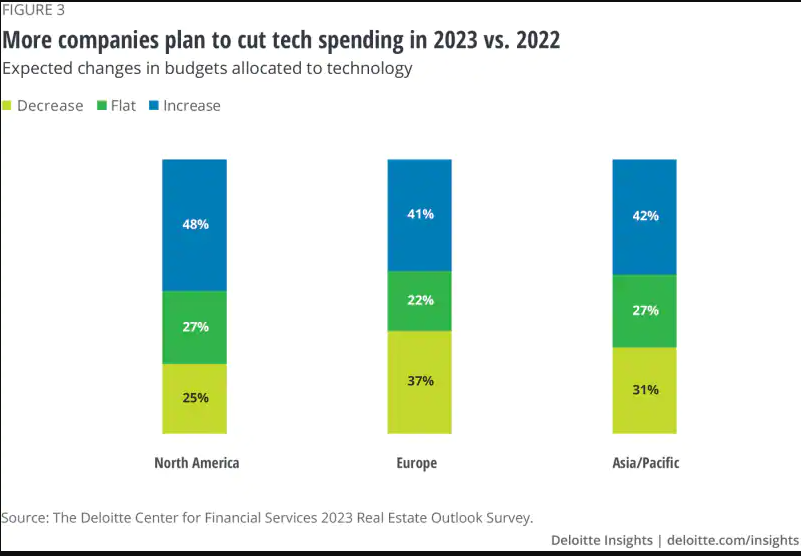

To address this potential revenue shortfall, business owners & executives are expected to prioritize cost cutting over the next few months. Forward-thinking businesses have already taken up to examining their inventories & supply chains, conducting thorough audits and adopting a strategic approach in terms of staffing. Though technology investment is expected to be limited, companies that invest in the right staff and tools at this stage are likely to reap its profits in the longer run.

The Cost of ESG in Commercial Real Estate

If there’s one aspect of the commercial real estate industry that can be credited with being the primary driver of change in the last few years, it has to be the ESG (Environmental, Social and Governance) principles. Governments around the world have been getting tough on developers to ensure that climate change risks are minimized, and that the developed spaces are more inclusive.

Businesses are now expected to develop buildings that are highly accessible in nature, whilst measure & publicly report carbon emissions, energy & water use and waste management measures, amongst other mandates – regulatory expectations that are fairly new to the industry.

While these regulatory needs open the door for innovation in terms of design, planning and development, they are also bringing about a whole bunch of costs with them. Combined with a fragile economic climate, these additional costs could hurt businesses significantly in times to come.

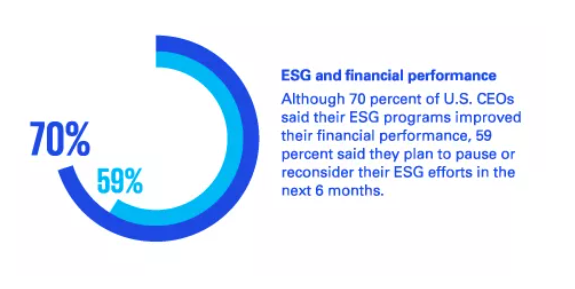

According to a new survey by KPMG, around 59% businesses are already reconsidering their ESG commitments, as a part of their preparations for a potential recession. Therefore, it will become critical for companies to find a fine balance such that ESG costs are minimized without making them vulnerable to long-term financial risks.

Catering to the Consumer of Tomorrow

In the traditional sense, commercial real estate has been quite unidimensional in its approach. That is, until the pandemic hit. Ever since the world has taken its steps back to normalcy, developers are experiencing the need to cater to a completely new set of consumer expectations. In order to cater to the needs of the modern-day consumer, CRE businesses will have to constantly adapt to new trends of this reimagined world and provide spaces that go above & beyond to provide memorable experiences – expectations that will possibly incur additional costs to developers.

When asked about the changing consumer behavior and how businesses can efficiently address them, Pom Chakravarti, CSO of QX Global Group said, “As the world continues to unlock, the wider shift in consumerism will continue and this will essentially encourage businesses to continue innovating and become more agile with hybrid working. There will also be more dependency on trying to adopt digital solutions. With all of these changes, businesses will look to source external expert partners who can enable and fuel the growth of their businesses.”

RELATED CASE STUDY: Do you know that QX worked with one of the biggest student accommodation providers in the UK to optimize & automate their F&A processes, helping by them reduce operating costs by 50%? Read the case study now!

Ever since the advent of outsourcing, cost cutting has been one of the key drivers for businesses to offshore business functions to third-party specialists. Modern business solution providers, however, allow leverage flexible operating models to deliver continued cost optimization over the course of engagement.

QX Global Group is a Business Process Management (BPM), Technology and Consulting company with expertise in setting up future-ready Shared Services and GBS centers for commercial real estate companies. We deploy the right mix of people, processes and platforms for our clients – allowing them to reduce their back-office operational costs by up to 50%.

Our end-to-end business solutions are highly flexible in nature and can be tailored to meet your specific organizational needs. Connect with our transformation experts and start optimizing costs for your business today.

Originally published Oct 18, 2022 10:10:52, updated Sep 04 2024

Topics: commercial real estate, cost optimization, Inflation and Recession, Outsourcing, real estate