Topics: Finance and Accounting Transformation

Digital technology and advanced analytics – new additions to the CFO skill mix

Posted on December 12, 2016

Written By Vatsal

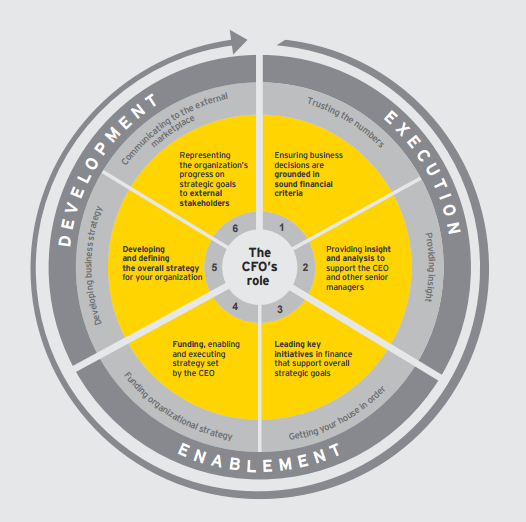

Digital technology is disrupting businesses across the world.” Most of us have heard or spoken these words too many times and the statement carries with it a whiff of cliché. But the fact remains true – technology innovation continues, and it continues to disrupt businesses. Modern CFOs (Chief Financial Officers), who often have the most comprehensive view of the business, are frequently at the forefront of the organisation’s response to technology. EY’s 2011 report on the DNA of the CFO highlighted the key segments that covered the CFO’s horizon:

In 2017, the role of the CFO is even more challenging with the remit broadening even further to include oversight of technology and data. In a recent survey by EY, 57% of group CFOs identified advanced analytics and delivery of data as critical to finance functions; while 58% of finance leaders stressed the need to learn more about digital solutions and innovations.

In 2017, the role of the CFO is even more challenging with the remit broadening even further to include oversight of technology and data. In a recent survey by EY, 57% of group CFOs identified advanced analytics and delivery of data as critical to finance functions; while 58% of finance leaders stressed the need to learn more about digital solutions and innovations.

Modern CFOs are keenly aware of the threats and opportunities provided by digital solutions. They frequently act as technology evangelists and nudge their organisations to adopt cloud and mobile technologies with an eye on efficiency improvements and cost savings. At the same time, CFOs leverage digitisation, automation and new data analytics solutions to discover and deliver deeper insights to the business.

Jim Johnson, Adaptive Insights CFO, in an interview with Jeff Thomson, says: “The ability to mine, organize, analyze, and act upon data is crucial to the modern CFO. Technology goes hand in hand with data management. CFOs are taking a leadership role in deploying the technology they need to define and measure performance… Today, with the increase of data across organizations, CFOs are now looked upon to provide predictive insights into the business and advise business leaders as they plan out the strategic future of the company. ”

A snapshot of how modern CFOs are leveraging technology

In addition to supporting the digitisation initiatives in different parts of the business, CFOs also oversee their organisation’s foray into digital business models. With a vital role to play in the endeavours for business transformation, they are quick to harness the new wave of technologies to achieve operational excellence in the finance functions. Let’s take a look at the key technologies that are – or will in near future – a part of the modern CFO’s arsenal.

1. Cloud and SaaS

CFOs have acted as well-informed technology consumers while navigating the rise of cloud-based software solutions over the last few years. Finance functions across industries have benefitted through the adoption of Software as a Service (SaaS) and cloud-based solutions which are flexible and cost efficient.

2. Robotic process automation (RPA) technology

While the adoption of RPA is not yet widespread, the concept is grabbing the attention of CFOs around the world. Capgemini’s survey shows that 86% finance leaders see RPA as a technology that can reduce costs, reduce risk and improve process efficiency.

3. Advanced data analytics

Modern businesses are not in a position to carve long-term strategies in stone. Every business generates a large volume of data on a daily basis, and all of this data is collected at different touch points. Within this data are hidden the signposts for the future direction of the business. At the same time, there is the data from external events that also has an impact on the business. CFOs are investing in advanced data analytics solutions to predict outcomes and manage risk better. The ability to analyse data at a granular level also paves the way for better financial decisions and performance measurement.

4. Blockchain

CFOs are intrigued with the blockchain technology which promises to revolutionise the finance functions. In addition to streamlining finance processes, this technology also offers a new and more secure way of enforcing contracts and increasing transparency. Most CFOs are exploring the new technology and getting ready to dip a toe into the uncharted waters of the blockchain technology.

Wrap up

CFOs and other financial leaders are not untouched by the digital revolution that is disrupting businesses across the world. Tech savvy CFOs are riding the waves of new technologies to deliver greater efficiency and shifting their focus towards higher-value activities.

Originally published Dec 12, 2016 08:12:50, updated Jul 23 2024

Topics: Finance and Accounting Transformation