CFOs in 2026 are no longer alone, AI has matured into a dependable, outcome-oriented partner.

As we toast to 2026, CFOs face a familiar reality: quarterly closes demanding perfection, board meetings where every number tells a story, investor calls that move markets, and audit seasons that test organizational resilience.

More complexity. Less time. Higher expectations.

Here’s the good news: you have a friend working beside you. One that never sleeps, never complains, and has been quietly maturing over the past few years. It’s invisible, yet its impact is remarkably visible.

Yes, you guessed it right.

Welcome to the era where AI becomes your most reliable ally in finance.

Your 2026 calendar tells the story: year-end close intensity, strategic planning pressure, audit season rush, and constant board and investor scrutiny. Add monthly board meetings, planning sessions, investor calls, and earnings announcements, each demanding instant insights, zero errors, and strategic clarity.

The common thread?

Time pressure, data complexity, and zero margin for error.

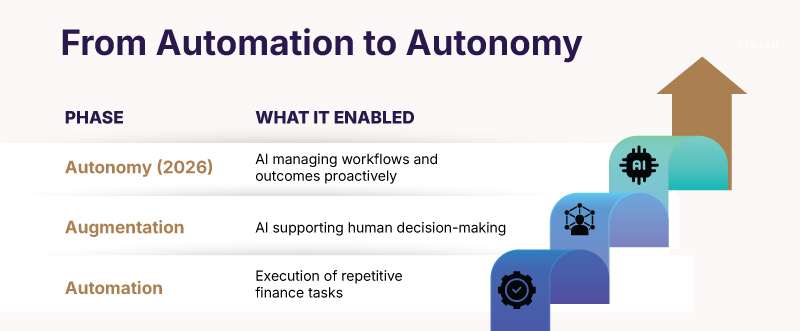

Remember the journey?

RPA bots that broke with every system update.

Machine-learning models that required constant human interpretation.

Early generative AI that could draft memos but couldn’t manage workflows.

Thankfully, that phase is behind us.

In 2026, we are operating in the era of Agentic AI, systems that proactively manage workflows, make contextual decisions, and orchestrate complex processes end-to-end.

Your invisible friend has evolved:

It no longer waits for instructions, nor does it bypass human judgment. Instead, it anticipates needs and helps deliver solutions, often before the problem is fully articulated.

Many organizations have already implemented AI for foundational finance processes such as invoice processing, AP/AR, and reconciliations.

If not, it’s high time, AI has already delivered tangible ROI as early as 2025.

In 2026, the value moves beyond efficiency and into strategic advantage.

What makes this year different is not experimentation, it’s maturity.

AI is no longer noisy or intrusive.

It works quietly in the background, exactly where finance needs it.

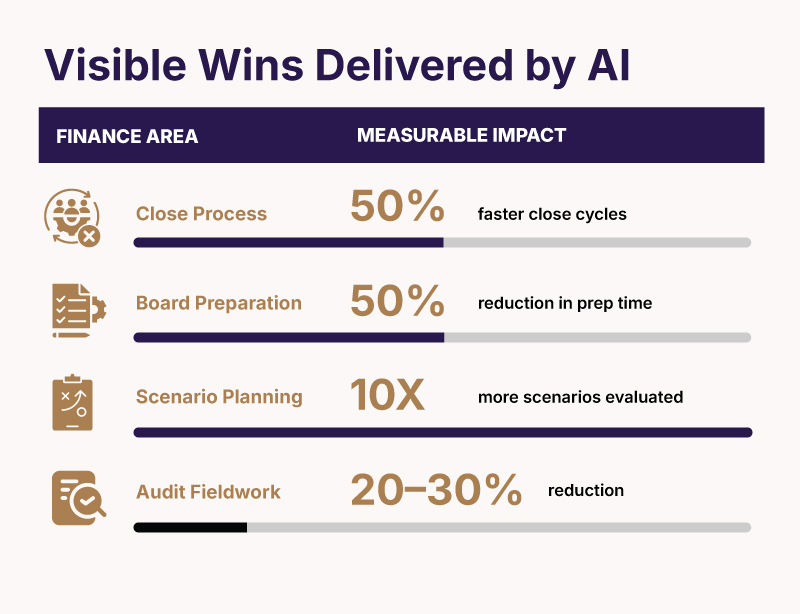

As this invisible friend becomes more capable, CFOs are unlocking measurable impact across the finance lifecycle:

These are no longer pilots, they are operating advantages.

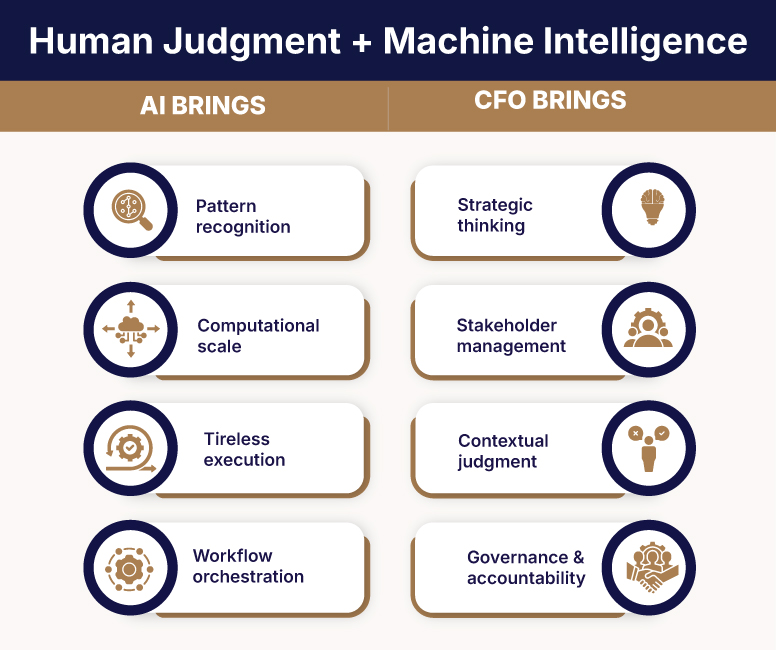

The most successful CFOs in 2026 won’t resist AI, or adopt it blindly.

They will integrate it thoughtfully.

Your AI ally excels at pattern recognition, computational analysis, and tireless execution.

You excel at strategic thinking, stakeholder management, and contextual judgment.

Together, this partnership is formidable.

The gift of 2026 is this: technology has finally caught up with the complexity of modern finance.

Your invisible friend is ready to deliver visible benefits, faster closes, better insights, reduced risk, and more time for what matters most: steering your organisation toward sustainable success.

The Big Four, leading analysts, and forward-thinking CFOs have already validated the path.

Now it’s your turn to walk it.

Welcome to 2026.

Your invisible friend is already at work.

Note: The most successful AI implementations combine cutting-edge technology with deep domain expertise. The right partner understands both the technical possibilities and the practical realities of finance operations, turning your invisible friend into one of your most valuable team members.

Ready to turn AI into a strategic advantage for your finance function?

Talk to our experts to identify the right AI strategy and tools for your business.

QX Global Group will use your information to contact you regarding new blog posts by email. You can unsubscribe from it at any time! For more information, check out our privacy policy.

Let’s explore how our AI-powered solutions can simplify, streamline, and scale your processes.

QX Global Group will use your information to contact you regarding new blog posts by email. You can unsubscribe from it at any time! For more information, check out our privacy policy.