Topics: Accounts Payable Automation, Senior Living

Posted on November 28, 2024

Written By Chithrakala Babu

As senior living operators move into 2026, finance teams are being asked to run tighter, faster, and with far less room for error. Accounts payable sits at the center of that pressure. What was once a back-office function now has a direct impact on cash flow control, vendor relationships, and audit readiness.

This blog looks at where manual AP processes continue to hold senior living communities back, and how a more structured approach to assisted living AP automation helps reduce friction without disrupting existing finance operations. The focus is practical: identifying real bottlenecks, understanding where automation adds value, and separating meaningful improvements from unnecessary complexity.

Accounts payable automation refers to the use of software and digital tools to streamline how invoices are received, validated, approved, and paid. Instead of relying on manual data entry and paper-based approvals, modern AP systems digitize each step of the process to improve accuracy, speed, and control.

At its core, AP automation technology combines tools such as OCR (Optical Character Recognition), rule-based workflows, and system integrations to capture invoice data, route it for approvals, and post it directly into accounting platforms. More advanced setups may also use AI and RPA to handle exception management, duplicate detection, and continuous process monitoring.

For senior living operators, this approach replaces fragmented, manual workflows with a more structured and auditable process. The result is greater visibility into liabilities, faster invoice turnaround, and fewer errors—without changing how finance teams govern spend or approvals.

Assisted living AP automation is designed to support finance teams managing invoices across multiple communities, vendors, and approval structures. Rather than changing how spend is governed, automation standardizes how invoices are captured, routed, and tracked across locations.

For teams handling assisted living accounts payable, automation reduces the time spent coordinating invoices between facilities. Invoices are captured centrally and routed based on predefined rules, eliminating delays caused by manual follow-ups and physical paperwork.

Automation also improves vendor payment timelines. Faster, more predictable payments help maintain supplier relationships—particularly for vendors tied directly to care delivery, maintenance, and staffing.

Finally, standardized financial services accounts payable automation provides real-time visibility into invoice status and liabilities across all facilities. This gives finance leaders clearer insight into outstanding payables, approval bottlenecks, and cash flow exposure at both the facility and portfolio level.

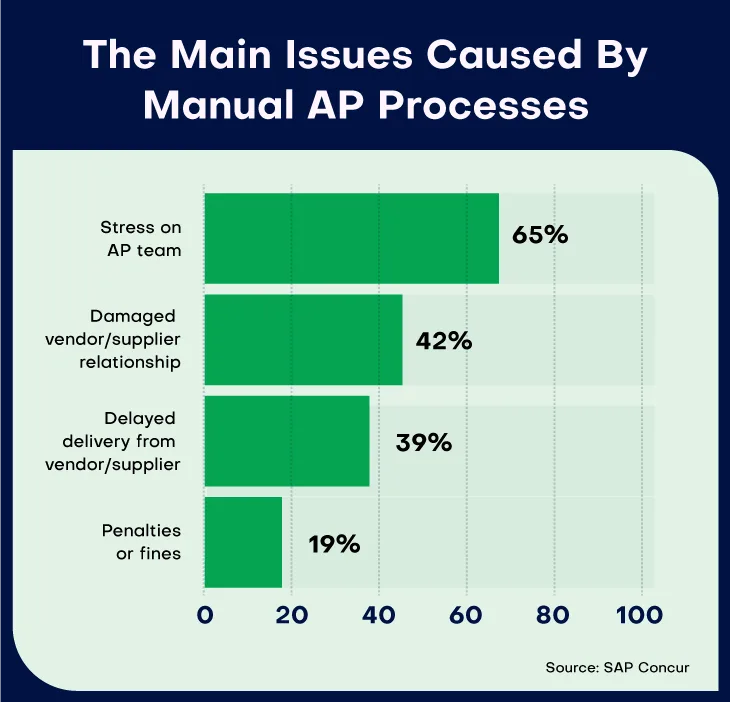

Managing assisted living accounts payable (AP) manually presents significant hurdles for senior living facilities, especially as the demand for high-quality care continues to grow. Here are some of the most pressing challenges finance teams face daily:

1) Paper-Based Processes: Storing and managing physical invoices is cumbersome and increases the risk of loss or misplacement. This can lead to delays in payments, strained vendor relationships, and difficulties in retrieving documents during audits. Without a structured accounts payable automation process, finance teams often spend more time searching for paperwork than managing spend.

2) Time-Consuming Invoice Processing: Manual data entry and matching invoices with purchase orders is slow and error-prone. This inefficiency can cause payment discrepancies, disputes, and added workload for finance teams—challenges that automated accounts payable systems are specifically designed to eliminate.

3) Lack of Real-Time Visibility: Without centralized systems, tracking invoice statuses and cash flow becomes difficult. Bottlenecks go unnoticed until they escalate, leading to late payments and missed opportunities for early payment discounts. Modern accounts payable invoice workflow automation enables real-time visibility across invoices, approvals, and payments.

4) Regulatory Compliance Pressures: Meeting stringent requirements related to resident billing, reimbursements, and financial reporting is challenging without proper systems in place. Manual tracking increases the risk of errors, non-compliance, and potential penalties during audits—particularly when finance teams lack standardized financial services accounts payable automation controls.

5) Scalability Issues: As facilities grow, the volume of invoices, vendors, and transactions also increases. Manual processes struggle to keep up, requiring additional staff and costs to manage the workload effectively. This is where scalable AP automation technology becomes critical.

6) Delayed Approval Workflows: Routing physical documents for approvals can lead to delays, especially with multiple departments or individuals involved. Lack of automation often results in confusion over approval statuses.

7) Audit and Reporting Complexities: Consolidating data for audits and creating accurate financial reports manually is both time-intensive and error-prone. The lack of streamlined processes makes it harder to meet tight deadlines or provide detailed audit trails.

Enter accounts payable automation—a proven way to improve efficiency, reduce costs, and free up time for what matters most: delivering exceptional care to residents.

The senior living industry is facing unprecedented financial pressures. Rising operational costs, regulatory demands, and staffing challenges make it vital to find efficiency gains wherever possible. Automating AP is one solution that’s gaining traction across industries—and for good reason.

Traditional AP processes are often plagued by delays. A 2023 report show that 56% of respondents spend more than 10 hours per week processing invoices and all respondents who spend less than 1 hour have an automated process.

By automating tasks like data capture, routing, and approvals, facilities can eliminate bottlenecks, ensuring invoices are processed quickly and accurately.

Manual AP processes are prone to human error, from incorrect data entry to duplicate payments. According to a 2023 study, about 39% of invoices contain errors. Advanced accounts payable solution platforms use smart technologies like OCR (Optical Character Recognition) to extract data from invoices, reducing the likelihood of errors.

Additionally, automation enhances fraud detection by flagging suspicious transactions, ensuring compliance with regulatory standards, and maintaining financial integrity.

In the senior living industry, cash flow is king. Late payments not only incur penalties but can also strain vendor relationships. Automation provides greater visibility into payment schedules, allowing facilities to take advantage of early payment discounts and avoid unnecessary fees. This level of control is a key benefit of modern accounts payable automation companies serving the senior living sector.

Finance teams in senior living facilities often spend a disproportionate amount of time on repetitive, low-value tasks. By implementing automated accounts payable, teams can redirect their focus toward forecasting, spend analysis, and strategic initiatives that directly support resident care and long-term sustainability.

While the benefits of AP automation are clear, many senior living facilities hesitate to adopt these technologies due to perceived challenges such as cost, complexity, or change management. However, these barriers are easier to overcome than they may seem:

Reality: With solutions like QX ProAP, the return on investment is substantial. The savings from reduced errors, faster processing, and early payment discounts can offset initial costs quickly.

Reality: Modern AP automation technology is designed to integrate seamlessly with existing ERPs and accounting systems. A phased rollout minimizes disruption while delivering early wins.

Reality: When staff see how automation reduces manual effort and improves accuracy, adoption accelerates. Education and clear communication play a key role in successful accounts payable automation services adoption.

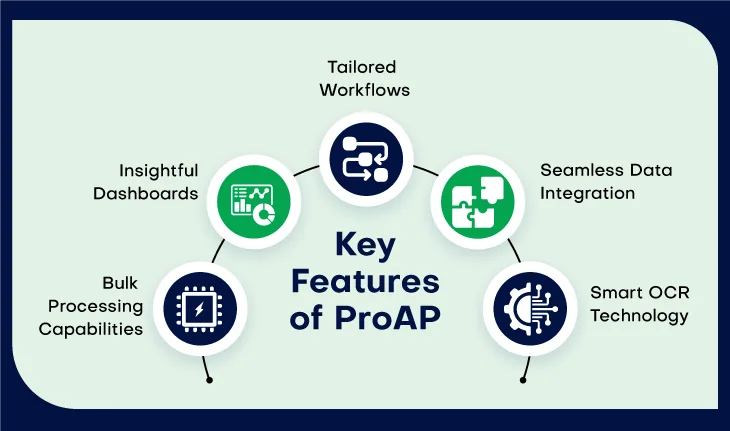

For senior living facilities looking to simplify AP processes and unlock their full potential, QX ProAP offers a tailored solution. Here’s how QX ProAP transforms accounts payable operations:

The advantages of automating AP go beyond efficiency gains. It’s about creating a ripple effect of improvements that touch every aspect of your operations:

Automating accounts payable is no longer a choice—it’s a necessity for senior living facilities aiming to stay competitive, efficient, and resident-focused. By partnering with QX Global Group, you gain access to QX ProAP, a proven accounts payable solution designed to transform your AP processes and help you achieve operational excellence.

Ready to make the shift? Schedule a quick call here and let’s discuss how QX ProAP can support your facility and start your journey toward smarter, more efficient finance operations.

AP automation software reduces manual data entry, enforces validation rules, and creates standardized approval workflows. This minimizes common errors such as duplicate payments, incorrect coding, and missed approvals, while also improving audit trails and reporting accuracy across facilities.

An effective accounts payable automation provider should offer seamless ERP integration, configurable approval workflows, strong compliance controls, and proven experience in regulated environments like senior living. Equally important is implementation support that minimizes disruption to existing finance operations.

Accounts payable automation replaces fragmented, manual workflows with a centralized system for invoice capture, approvals, and payments. This reduces cycle times, improves visibility, and allows finance teams to manage higher volumes without adding headcount.

Yes. Automated accounts payable for senior living reduces labor-intensive tasks, lowers error-related rework, and improves early-payment discount capture. Over time, this leads to measurable reductions in processing costs and better control over operating expenses.

Senior living accounts payable invoice workflow automation ensures invoices move through approvals consistently and on time, even across multiple facilities. It improves transparency, reduces bottlenecks, and strengthens cash flow planning at both the community and portfolio level.

Financial services accounts payable automation support compliance by enforcing approval hierarchies, maintaining detailed audit trails, and standardizing documentation. This makes it easier to meet regulatory requirements and respond to audits without last-minute data gathering.

QX ProAP is an accounts payable solution designed to handle the scale, complexity, and compliance needs of senior living finance teams. It combines intelligent automation with configurable workflows, real-time visibility, and integration with existing accounting systems.

QX Global Group as an accounts payable automation provider supports assisted living operators by pairing technology with domain expertise. Our accounts payable automation services help standardize processes, improve control, and scale AP operations without increasing internal workload.

Originally published Nov 28, 2024 04:11:54, updated Dec 17 2025

Topics: Accounts Payable Automation, Senior Living