Topics: Finance and Accounting Transformation, PBSA

A Finance Leader’s Guide for Student Housing Properties: Meeting Contemporary Demands

Posted on September 02, 2024

Written By Priyanka Rout

Let’s Get Started!

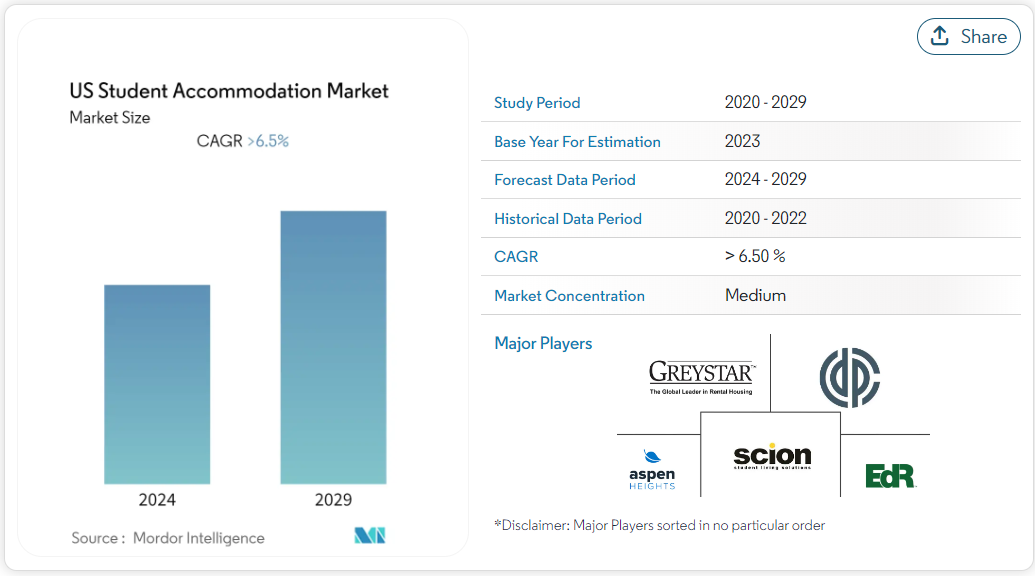

US Student Accommodation Market; Source: Mordor Intelligence

The landscape of student housing is undergoing a significant transformation, shaped by the evolving preferences and demands of a new generation of learners. Institutions are now grappling with an unprecedented surge in demand for student housing, a critical component of the college experience, which includes access to on-campus amenities such as dining services, counseling, and recreational facilities.

This growing demand is creating long waitlists and a scarcity of housing options, pushing some students to base their educational choices on the availability and affordability of local housing. In response, universities are initiating large-scale capital projects aimed at expanding their housing stock. Yet, this expansion must be managed prudently to ensure long-term sustainability and to align with the students’ changing lifestyles, which are increasingly influenced by technology, economic conditions, and a drive towards greener living.

Recent studies and survey data reveal a shift towards preferences for flexible living arrangements that blend convenience, technology, and sustainability. For instance, modern students show a strong preference for housing that offers technological amenities, co-living spaces that foster a sense of community, and environmentally friendly living solutions. These preferences not only reflect a deeper consciousness about lifestyle and environmental impact but also reshape how institutions and private property owners design and market student accommodations.

Finance guide for student housing properties explores these trends in detail, providing finance leaders with the insights needed to navigate this dynamic sector.

Modern Student Housing Trends in the USA Student Housing Industry

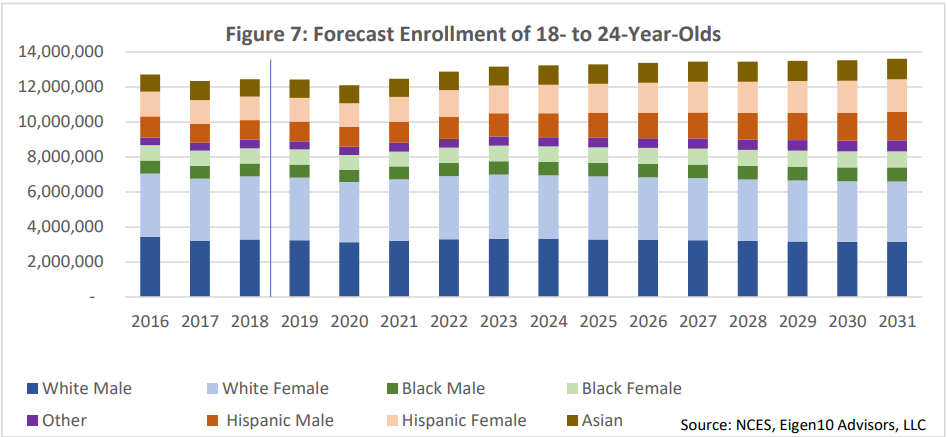

Enrollment Projections for USA, Source: NMHC Report

- Demand for student housing in the U.S. is rising, primarily driven by an increase in international students and university enrollment expansions. With the U.S. being a leading destination for over one million international college students in 2023, the market presents a robust opportunity for investors.

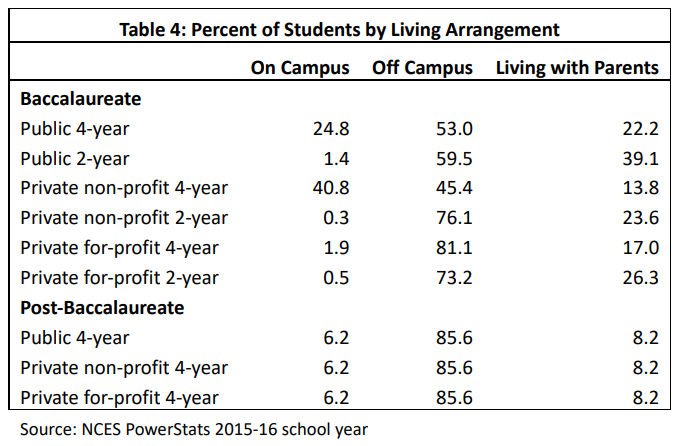

- Interestingly, only 22% of undergraduate students reside on campus, underscoring a significant gap between available on-campus accommodations and student demand. Consequently, the majority of students opt for off-campus housing, which better meets their need for personal space, with about 63% of these accommodations offering private rooms.

- The market outlook for 2024 is optimistic, anticipating an average occupancy rate of 95% among top universities and an enrollment projection of 19.25 million students.

- Additionally, sustainability is becoming increasingly important, with 87% of students favoring more eco-friendly accommodations. This trend is not only socially responsible but also attractive to investors.

- To differentiate in a competitive market, properties are enhancing amenities to create a comprehensive living experience. Popular facilities include fitness centers, communal spaces, and study lounges, with Wi-Fi and gym access being particularly in demand.

- However, affordability remains a significant concern, with rent prices continuing to climb, pushing students towards more economical off-campus options. Strategic property locations close to campuses, well-connected to public transport, are highly sought after for their growth potential and convenience.

USA Student Housing Properties: Latest Updates on Demands and Projections

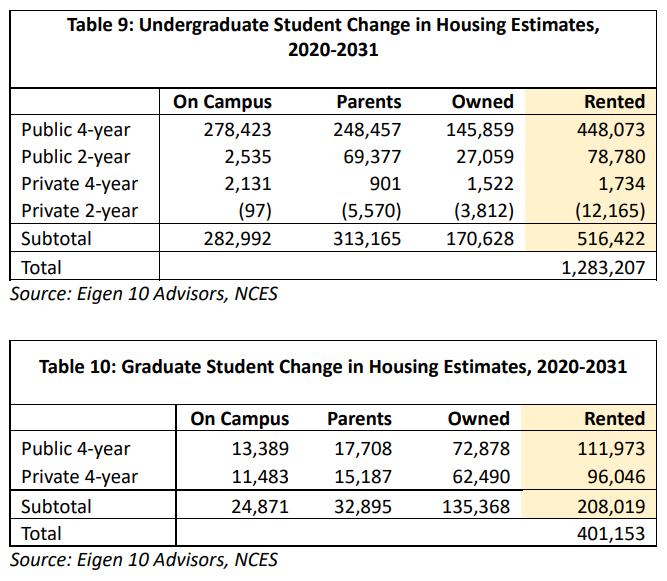

Undergraduate and Graduate Student Change in Housing Estimates (2020-2031); Source: NMHC

The U.S. student housing market is anticipated to grow in the coming years, requiring flexibility and adaptability to meet student needs.

The National Multi-Family Housing Council (NMHC) reports that:

- Student housing is projected to expand from 8.5 million beds in 2020 to 9.2 million by 2031.

- This represents an increase of 734,000 beds, with an average annual growth rate of 0.8%.

Key growth drivers:

- Public four-year universities:

- Expected to see an increase of 448,000 undergraduate beds by 2031.

- An additional 112,000 beds will be needed for graduate enrollment.

- Private four-year universities:

- Growth will primarily be in graduate programs, with an estimated increase of 96,000 beds.

- Public two-year universities:

- Despite fluctuating enrollment trends, an additional 79,000 beds are projected to be needed.

RELATED CASE STUDY: Discover how QX Global Group transformed financial operations for a leading PBSA provider, reducing costs by 50% and enhancing efficiency.

Financial Implications

Students opting for On-Campus vs. Off-Campus; Source: NMHC Report

Cost Analysis

The adaptation to modern student preferences necessitates a thorough financial review. Housing operators are exploring the feasibility of integrating cutting-edge amenities, which may include advanced technology zones, eco-friendly living spaces, or versatile furniture that accommodates various learning environments. Each addition comes with its costs:

- Initial Investment: The upfront cost of adding these amenities can be significant. For example, retrofitting buildings with high-efficiency appliances or installing smart technology systems for room control (like lighting and temperature) requires a sizable initial investment.

- Ongoing Maintenance: Beyond installation, there’s the cost of maintaining these new technologies and amenities. Smart systems, for instance, might require regular updates and professional servicing.

- Structural Modifications: Adapting existing spaces to align with new preferences often involves considerable construction or remodeling expenses. This might include expanding common areas to accommodate group studies or creating green spaces that promote sustainability.

Revenue Opportunities

Adapting to the evolving preferences of students not only entails costs but also opens up several revenue streams:

- Premium Charges: Modern amenities allow housing providers to charge a premium. Upgraded facilities that offer enhanced connectivity, sustainable living options, or health and wellness centers are highly attractive to students, who are often willing to pay more for these features.

- Increased Retention Rates: Facilities that cater well to student needs and preferences tend to experience higher retention rates. Satisfied students are more likely to continue renting in spaces that meet their academic and lifestyle needs, reducing turnover costs.

- Attractiveness to New Applicants: A student housing facility equipped with the latest amenities and sustainable technologies becomes more attractive to prospective students. This can lead to a higher number of applications, allowing facilities to select the best candidates and maintain a competitive edge in the market.

Strategic Adaptations for Financial Management

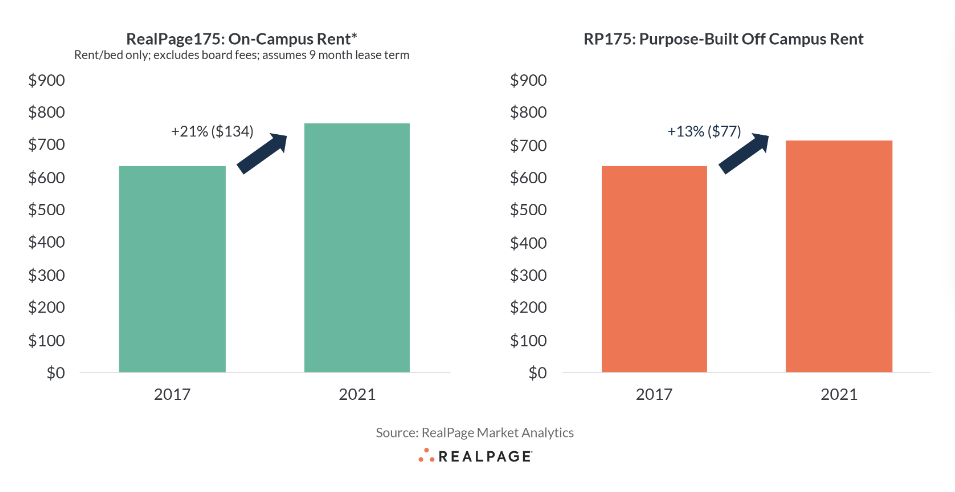

On Campus Rent vs. Purpose-Built Off Campus Rent; Source: Realpage

Budgeting for Upgrades

In today’s world, with inflation and rising costs putting pressure on margins, simply increasing budgets isn’t always an option. So, financial managers are getting creative. One approach that’s gaining traction is using predictive analytics to figure out which upgrades will give you the most bang for your buck, allowing for smarter budget allocation. Another strategy is to prioritize what needs to be done first—like upgrading to energy-efficient systems that cut down on operating costs—while planning more ambitious improvements over time. And, instead of tapping into your core budget, crowdfunding for community-focused projects, such as sustainable living initiatives, is becoming a popular way to finance upgrades. By 2030, it’s expected that

students will favor spaces that prioritize sustainability over luxury, transforming places like big

parking lots into areas for ride-sharing and electric charging stations, according to a 2017

forecast by McBride.

Investment Prioritization

Students today are looking for more than just a gym or a lounge. They want amenities that fit their lifestyle and values, like mental health resources, eco-friendly features, and spaces that can easily adapt to hybrid learning. The 2021 Princeton Hopes and Dreams survey showed a significant shift: 75% of respondents (up from 66% in 2020) said a college’s environmental commitment would influence their choice to apply. The trick is to figure out which of these investments will not only boost your bottom line but also keep your tenants happy and coming back. Digging into student preferences and behaviors can help you see what really matters to them. For instance, properties that focus on wellness, offering things like meditation rooms or outdoor fitness areas, are seeing higher lease renewal rates.

Tech Integration

Tech isn’t a luxury anymore; it’s a must-have. But it’s not just about installing the latest gadgets—it’s about creating a seamless, future-proof system that makes life better for students and keeps operations running smoothly. For example, integrating IoT devices can help lower energy costs and send out maintenance alerts before problems escalate, saving both time and money. The real game-changer, though, is AI-driven property management that gives you real-time insights, helps you adjust pricing on the fly, optimizes resource use, and even tailors services to individual students. As remote and hybrid learning becomes the norm, properties with solid tech infrastructure will be the ones attracting the most students and keeping them satisfied.

Risk Management

Assessing Risks

When it comes to student housing investments, it’s not just about spotting the next big trend—it’s about smartly integrating it into your strategy. Pilot projects are your best friend here. They’re like test-driving a car; you get to see how it performs before you buy it. This hands-on approach lets you tweak things in real-time, ensuring you only scale up those initiatives that truly resonate with students. Think of phased rollouts as your safety net. They allow you to introduce innovations step-by-step, watch how they perform, and make adjustments on the go. It’s about being prudent, not just progressive.

Monitoring and Feedback

Keeping your finger on the pulse of student preferences isn’t just good practice—it’s essential. The student demographic is diverse, and their preferences can change almost as quickly as the latest social media trend. Regular check-ins and feedback sessions are invaluable touchpoints that keep your offerings fresh and relevant. And with today’s tech, you can dive deep into data analytics to really understand the impact of your changes. This isn’t about drowning in spreadsheets; it’s about gaining clear, actionable insights that help you stay agile in a competitive market.

RELATED BLOG: Ensure the financial health of your student housing operations is in top shape. Read our insightful blog on diagnosing and optimizing your financial strategies today!

What’s the Bottom Line?

As student housing continues to evolve, staying agile is key for finance executives in this field. Effective financial leadership in housing is essential for navigating the complex challenges of property management, ensuring profitability and sustainability in both commercial and residential markets. With sustainability, affordability, and quality amenities becoming increasingly important to students, it’s essential to keep adapting and staying ahead of the curve.

We encourage you to take a close look at your current strategies and see how you can integrate the insights we’ve discussed in this finance guide for student housing properties. CFO strategies in commercial real estate focus on maximizing asset value through innovative financing, cost management, and strategic investments in emerging markets. By updating your approach and planning with these trends in mind, you’ll be better positioned to meet the needs of today’s students and those of tomorrow.

FAQs

What are the key financial challenges in managing student housing facilities?

The financial side of managing student housing is tricky. From the hefty costs of maintenance and utilities to the unpredictability of cash flow due to the academic year, managers have their hands full. Add frequent rent payment delays to the mix, and the revenue stream can become quite unstable. Moreover, keeping properties modern and attractive requires continuous student accommodation investment, further straining budgets.

How can CFOs optimize their student housing portfolios in the current market?

CFOs can get more out of student housing investments by embracing dynamic pricing to adjust rent based on current market conditions and demand. Diversifying the types and locations of properties can cushion against market fluctuations. Leveraging technology to manage properties can cut down on overhead costs and keeping tenants happy and in place reduces vacancy rates and boosts the bottom line.

What strategies can finance leaders employ to enhance ROI in student housing?

Boosting ROI in student housing often means making the properties more appealing to justify higher rents—think reliable high-speed internet and chic, functional living spaces. Energy efficiency is another win, cutting utility costs and drawing in environmentally aware students. On the financial front, refinancing to snag lower interest rates can reduce costs significantly. Also, partnering with universities to secure a steady stream of tenants can fill rooms and stabilize income.

Originally published Sep 02, 2024 10:09:00, updated Sep 10 2024

Topics: Finance and Accounting Transformation, PBSA