Topics: Finance and Accounting Outsourcing Services, Property Management

Posted on July 19, 2024

Written By Priyanka Rout

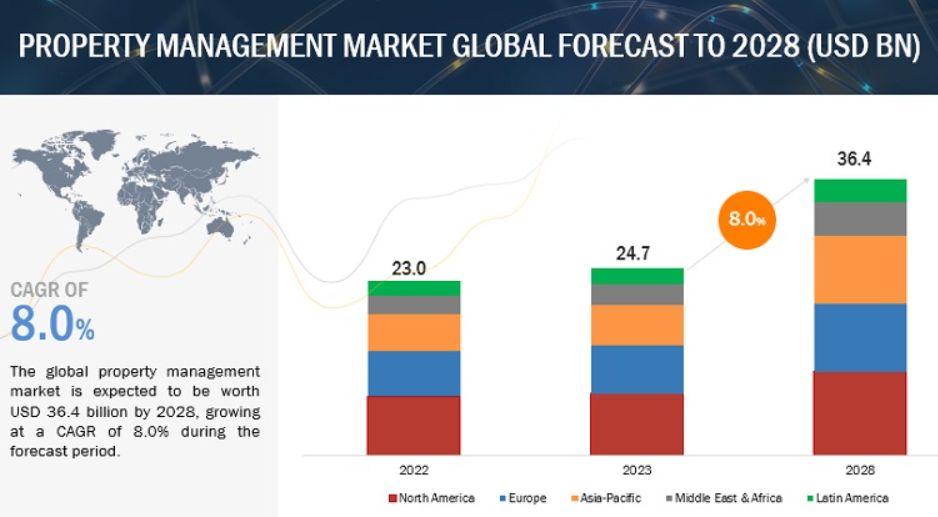

Property Management Market Global Forecast To 2028 (USD BN); Source: Markets and Markets

According to Wi-Fi Talents, the market for residential property management software is expected to surpass $3 billion by 2027. Although the market appears lucrative, the property management industry is riddled with its own set of unique challenges.

Managing properties involves a broad range of responsibilities—from finding suitable tenants and conducting inspections to addressing maintenance issues, collecting rent, and preparing for emergencies. Every landlord or property manager knows too well the high costs associated with tenant turnover. Achieving a high tenant retention rate not only mitigates these costs but also alleviates much of the stress associated with property management. While securing good tenants is challenging, retaining them is an even greater task.

In this context, the role of property management accounting emerges as a critical yet often overlooked component of tenant retention strategies. Effective accounting practices do more than manage finances—they enhance tenant relations and contribute to a sustainable environment where tenants want to stay long term. By ensuring-

accounting can significantly impact tenant satisfaction and retention.

From the quality of interactions with building management to the availability of community-building efforts, tenants today are looking for spaces that enhance their productivity and wellbeing. Through strategic accounting practices, property managers can deliver on these expectations, thereby fostering environments that attract and retain tenants effectively. Ensuring tenant satisfaction might seem daunting, but we’re here to offer actionable tips on strategic accounting practices that you can start applying today to make a difference.

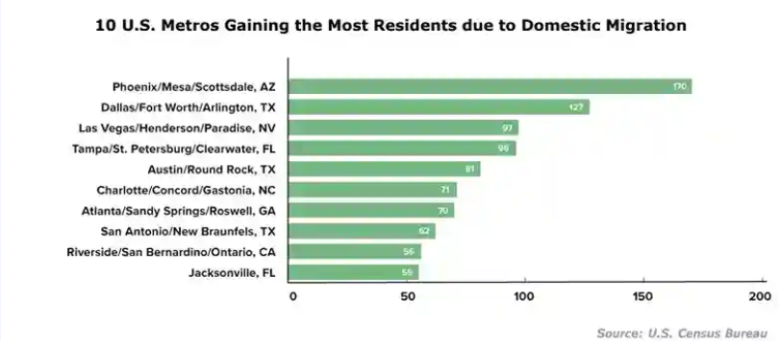

10 US Metros Gaining the Most Residents; Source: U.S. Census Bureau

10 US Metros Losing the Most Residents; Source: U.S. Census Bureau

Retaining tenants is essential for running a stable and profitable rental business. Landlords who focus on keeping their tenants happy can significantly reduce costs, which in turn increases their overall rental income.

Retaining tenants helps landlords avoid various costs. For instance, advertising vacancies can cost anywhere from $50 to several hundred dollars. Hiring staff or an agent to fill these vacancies can be even more costly, sometimes requiring a fee up to an entire month’s rent. Additionally, the gap between tenants, which can last from 30 to 45 days or longer, may lead to lost rental income for one or more months.

The average expense to prepare a property for new tenants is about $2,500, but this can increase depending on various factors. By minimizing tenant turnover, landlords not only save money but also free up their time from tasks like creating listings, showing the property, screening applicants, managing repairs, and conducting inspections. This extra time can then be devoted to other important activities.

Maintaining high tenant retention rates is essential for stability and profitability. Retaining tenants not only ensures a steady revenue stream but also reduces the costs associated with turnover, such as marketing, refurbishment, and vacancy losses. While typical retention strategies focus on tenant engagement and property upkeep, the role of accounting practices in fostering tenant loyalty is less obvious but equally vital.

The clarity and accuracy of financial interactions plays a pivotal role in building tenant trust. In today’s digital age, tenants expect not only transparency but also ease of access to their financial dealings with property management. Implementing automated billing systems that provide real-time, itemized breakdowns of charges helps eliminate confusion and disputes.

According to Wi-Fi Talents , about 73% of landlords and property managers regularly use digital payments, and over 75% of tenants prefer paying rent online instead of traditional methods.

For instance, advanced software solutions now enable tenants to view their billing history, utility consumption, and payment statuses online or via mobile apps. This not only streamlines the process but also enhances transparency, thereby increasing tenant satisfaction and trust. Additionally, ensuring that invoices are accurate and delivered on time reinforces professionalism and reliability, encouraging tenants to continue their leases.

Proactive financial management is essential for maintaining the quality of properties and the satisfaction of tenants. By adopting responsive budgeting practices, property managers can allocate funds more effectively for regular maintenance and timely upgrades. This approach involves using predictive analytics to forecast and budget for future repairs and enhancements based on historical data and tenant feedback. According to Wi-Fi Talents span data-contrast=”auto”>, 60% of property management companies use data analytics to enhance operational efficiency.

For example, if data shows that HVAC systems in a building typically require significant repairs after five years, budgeting for these upgrades proactively can prevent downtime and tenant discomfort. Furthermore, responsive budgeting can allow for the adaptation of spaces to meet evolving tenant needs, such as creating more collaborative workspaces or enhancing security measures, which can significantly boost retention.

Incentivizing long-term tenancies through financial rewards can increase tenant retention. Property managers might consider implementing loyalty programs that offer rent stabilization for renewing leases, thereby providing a financial benefit to tenants who choose to stay longer. Another strategy could involve offering periodic upgrades at reduced rates for long-standing tenants.

For instance, after a certain period, tenants could be eligible for kitchen or bathroom renovations at a fraction of the usual cost. Additionally, customized payment plans, such as allowing tenants to choose their payment dates or offering graduated rent increases, can cater to the financial circumstances of tenants, enhancing their loyalty and satisfaction.

RELATED BLOG: 10 Common Challenges in Property Management Accounting and How to Solve Them?

Property managers increasingly rely on property management software. Access to essential industry statistics is a major concern for managers worldwide. The billion-dollar property management software market is projected to grow by another 4.8% from 2021 to 2028. .

Automated financial transactions are a fundamental feature of property management accounting software. By automating processes such as rent collections, dues, and billing, the software minimizes human intervention, which in turn reduces the potential for errors.

This automation ensures that payments are collected and recorded on time, which not only helps maintain a steady cash flow but also enhances tenant satisfaction by providing reliable and consistent billing experiences. For property managers, this means less time spent on mundane tasks and more on strategic activities.

Property management accounting software often includes robust reporting and analytics tools that provide deep insights into various financial aspects of property management. These tools allow managers to generate detailed financial reports effortlessly, revealing insights into spending patterns and tenant payment behaviors.

Such data is invaluable for making informed decisions about property maintenance and upgrades, which are critical for tenant retention. Furthermore, analytics can help forecast future financial needs and investment opportunities, enabling property managers to plan and allocate resources more effectively, ensuring the sustainability and growth of their properties.

Transparency and effective communication are vital in maintaining positive relationships with tenants. Many property management accounting platforms include integrated communication tools that facilitate direct and clear communication with tenants regarding financial matters. These tools can be used to notify tenants about upcoming dues, changes in billing, or general financial updates.

By fostering an open line of communication, these tools not only enhance tenant trust but also contribute to a more organized and transparent financial management process.

RELATED CASE STUDY: F&A Operations Transformation For a Global Real Estate Company Through Shared Services

Selecting the ideal software is pivotal for enhancing operational efficiency and tenant satisfaction in property management. The right tools not only streamline day-to-day tasks but also bolster your ability to manage diverse property types effectively.

We will guide you through the critical factors to consider when evaluating software solutions, ensuring you choose a system that fits your specific needs and scales with your business growth. Here are the key aspects to focus on:

According to Markets and Markets, the global Property Management Market is valued at USD 24.7 billion in 2023 and is projected to reach USD 36.4 billion by 2028, with a CAGR of 8.0%. Various business drivers are expected to significantly boost the market’s growth during this period. As the property management market expands, it is imperative that property managers adapt to changes and proactively enhance their accounting practices.

Regular financial reporting and robust feedback mechanisms are crucial strategies that can significantly influence tenant satisfaction and retention. Property managers should consider investing in innovative technologies such as interactive financial dashboards, real-time transaction notifications, and AI-driven feedback analysis to provide tenants with transparency, engagement, and responsiveness they expect and deserve.

By focusing on these aspects, property managers can ensure a higher level of tenant satisfaction, which is directly linked to improved retention rates and overall property management success. Take action today to set your properties apart in a competitive market and build a more loyal tenant base for the future.

Property management accounting refers to the specialized accounting processes and practices that deal with managing the financial aspects of rental properties. This includes tracking income and expenses, managing tenant leases, handling rent collections, and generating financial reports, all aimed at maintaining the fiscal health of the property. Effective property management accounting helps in tenant retention by ensuring transparent, consistent, and accurate financial interactions with tenants. By providing timely and accurate billing, regular financial reports, and responsive handling of financial queries, it builds trust and satisfaction among tenants, which are crucial for encouraging long-term stays. Financial strategies that can improve tenant retention include: FAQs

What is the meaning of property management accounting?

How does accounting for property management companies aid in tenant retention?

What financial strategies can improve tenant retention?

Originally published Jul 19, 2024 01:07:54, updated Jan 16 2025

Topics: Finance and Accounting Outsourcing Services, Property Management