Topics: Credit Control Process

Want to reduce DSOs? Work with expert credit control companies

Posted on April 02, 2020

Written By QX Global Group

To say that 2020 is on the verge of being royally disrupted because of the COVID-19 and the potential recession is an understatement. Businesses are scrambling to revisit their forecasting and trying to get a handle on the future. There are many organisational processes that will be under a lot of stress and one such critical process is credit control; and within credit control it is DSO or Day Sales Outstanding that is critical to maintain a company’s cash flow.

Even in the best of times, DSO is not a strong point for many businesses.

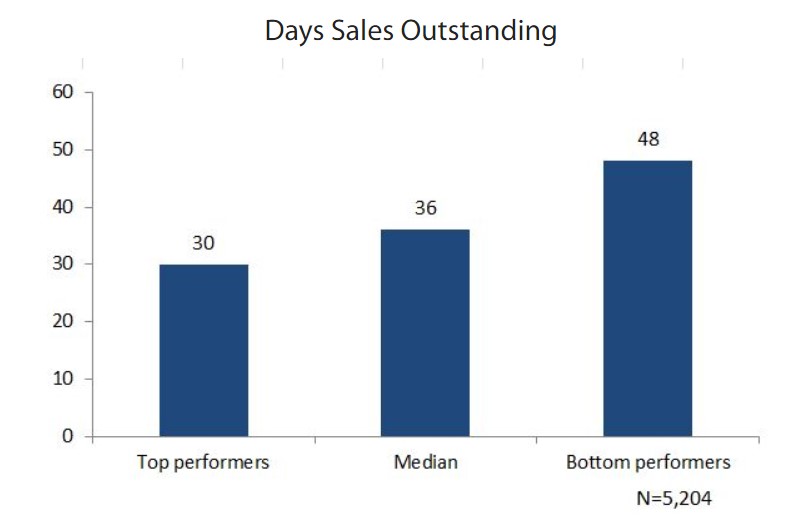

Before we begin discussing how companies can stop reducing DSO, let’s understand what DSO stands for, and why it is important. DSO is the average number of days a company’s accounts receivables remain outstanding before they are converted into cash. The higher the DSO the lesser the amount of cash flow and lower the DSO, the more the amount of cash flow.

This means it is of critical importance that a credit control department works hard to bring down DSO by ensuring that invoices are paid on time, in most cases. This is a challenging undertaking and is one of the reasons why many companies partner with a company delivering credit control outsourcing services. By outsourcing credit control, the onus is on the services provider to ensure the DSOs are reduced and managed optimally.

If you want to reduce your DSO, here are 3 ways that can happen:

1) Customer Credit is Everything

The top credit control performers across diverse industries aim to get paid within 30 days. If you want to be one of these companies, you must work with credit worthy customers only. Good customers are credit worthy customers who you are very sure will pay their invoices on time. And how do you know this will happen? It is by evaluating and analysing a customer’s credit risk. You must put in place stringent customer credit requirements and adhere to them.

As can be imagined, this is a time intensive task and you don’t want the activities of your credit control department held up because assessing credit worthiness is taking time. Why not work with credit control companies with focused expertise in DSO to ensure you work only with customers with ideal credit worthiness.

2) Accurate and Timely Invoicing

Unfortunately, one of the reasons why a company’s DSOs might be on the higher side is because of delayed invoicing. Yes, there are occasions wherein the company is unable to send invoices on time, because the F&A department is either short of staff or time, using manual invoicing processes, or is just not managed well. What’s more, just focusing on sending invoices out on time isn’t important, the invoice should be accurate and must contain all necessary information that allows the customer to pay on time.

Back and forth needs to be avoided at all costs. This can result in invoice disputes that will impact your DSO. If your company is finding it difficult to manage invoice processing, moving the entire credit control function to a credit control outsourcing services company is a good idea. One of the outsourcing partner’s KRA will be guaranteeing on-time and accurate invoicing.

3) Invoicing Perfect? What About Collections?

Another important element of DSO is having a seamless and dedicated collection process. For this to happen, your employees need the right tools that not only help them stay on top of pending payments but also ensure they are able to communicate with customers in a hassle-free manner. Again, tools are not enough, what is also important is your staff’s ability to convince customers to pay up in a polite albeit assertive manner. There should also be a system of regular follow-up until the customer has made the payment in full.

The ‘collections process’ requires investment in technology, special skillsets, and requires maintaining certain communication protocols. If you think this is too much of a headache for your staff (and many a times, it is, resulting in high DSO), the solution is to hire the services of credit control companies with UK expertise, whose team has the requisite skillsets and leverages cutting-edge infrastructure to ensure your company is paid on time.

To Conclude

Credit control companies, the reputed ones, have a history of successfully managing process and delivering sustainable ROI. Work with an experienced company with a proven track record of taking care of not only DSO but also all the activities that come under the ambit of finance & accounting.

Originally published Apr 02, 2020 10:04:17, updated Jul 03 2024

Topics: Credit Control Process