Topics: Finance and Accounting Outsourcing Services, Finance and Accounting Transformation

Student Housing Finance: A Guide to Checking Financial Health

Posted on June 27, 2024

Written By Priyanka Rout

The student housing sector is experiencing an unprecedented surge, with a projected compound annual growth rate of 4.95% from 2021 to 2032, as reported by Business Market Research.

This remarkable expansion underscores the growing demand for accommodations specifically designed for college students. For real estate investors aiming to leverage this thriving market, a deep understanding of student housing financials is essential.

Purpose-Built Student Housing faces constant financial challenges and opportunities. As the demand for high-quality, student-focused living spaces continues to rise, PBSH operators must ensure their financial foundations are robust to harness this growth effectively. This is where regular financial health checks become crucial.

Imagine the complexities of the PBSH market without a clear financial roadmap—missing hidden costs, underestimating cash flow needs, or overlooking lucrative investment opportunities.

Financial health checks are not mere routine audits; they are strategic tools that empower PBSH operators to make data-driven decisions, enhance operational efficiency, and maintain profitability in a competitive landscape.

These health checks scrutinize key areas such as occupancy rates, rent collection efficiency, maintenance expenses, and future financial projections. By conducting these checks regularly, PBSH operators can identify potential financial risks, ensure regulatory compliance, and uncover growth and innovation opportunities.

In a sector where student expectations and market dynamics are constantly changing, maintaining a proactive financial strategy is more crucial than ever. Let’s explore how integrating financial health checks can provide your PBSH operations with the competitive edge needed for long-term success.

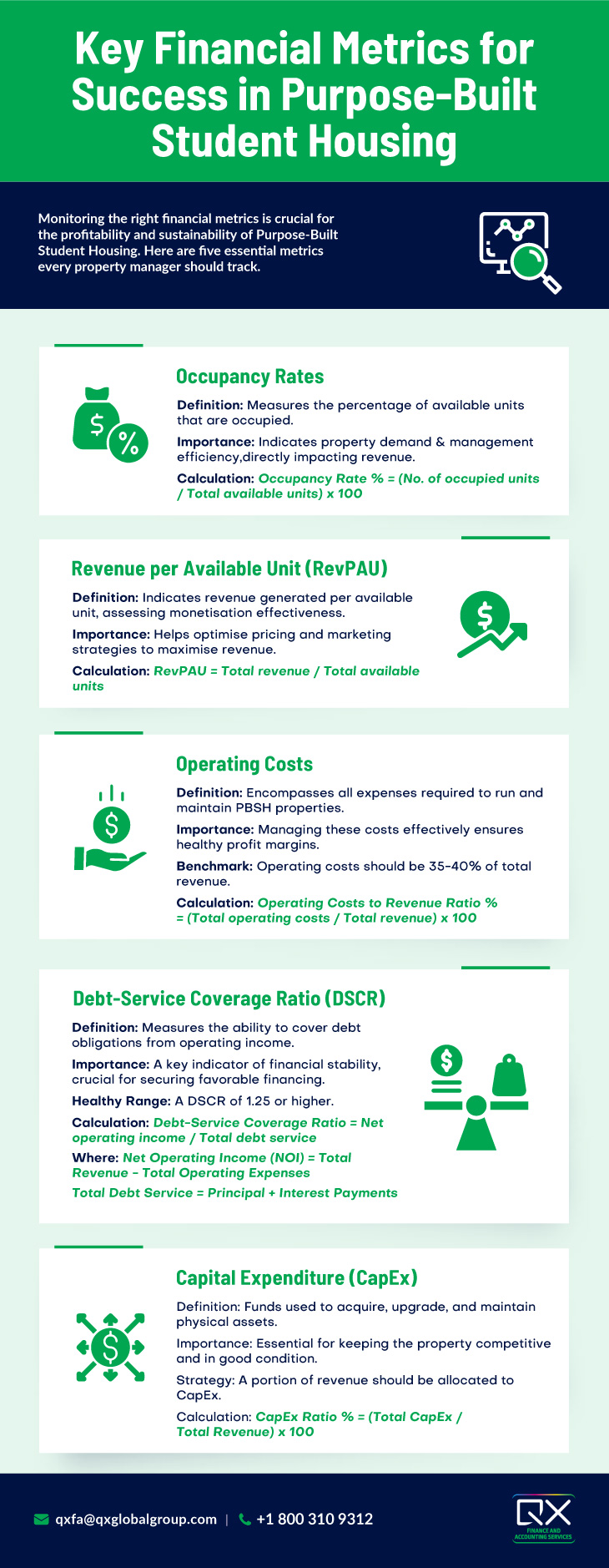

Key Financial Metrics to Evaluate in Purpose Built Student Housing (PBSH)

1. Occupancy Rates:

Occupancy rates are a cornerstone metric in assessing the financial health of PBSH properties. This metric represents the percentage of available units that are occupied over a given period. High occupancy rates typically indicate strong demand and efficient property management, translating directly into increased revenue.

In the context of PBSH, fluctuations in occupancy rates can be influenced by factors such as university enrollment trends, the appeal of the accommodation, and the proximity to academic institutions. Maintaining a high occupancy rate is crucial for optimizing rental income, and property managers should continuously analyze trends and implement strategies to attract and retain students, such as offering flexible lease terms, enhancing amenities, and ensuring competitive pricing.

How To Calculate?

Occupancy Rate % = (No. of occupied units / Total available units) x 100

2. Revenue per Available Unit (RevPAU):

RevPAU is a critical metric that provides insight into the revenue generated per available unit. This metric helps property managers understand how effectively they are monetizing their units, regardless of occupancy rates.

To interpret RevPAU, one must consider both rental rates and occupancy levels. A higher RevPAU suggests that the property is maximizing its revenue potential, either through premium pricing, high occupancy, or both. Regularly monitoring RevPAU allows managers to adjust pricing strategies, marketing efforts, and operational efficiencies to enhance revenue generation.

How To Calculate?

RevPAU = Total revenue / Total available units

3. Operating Costs:

Operating costs encompass all expenses required to run and maintain a PBSH property, including utilities, maintenance, staffing, and administrative expenses. Breaking down these costs provides a clear picture of where money is being spent and helps in identifying areas for cost savings. Ideal ratios of operating costs to revenue typically vary by market, but a common benchmark is that operating costs should not exceed 35-40% of total revenue.

By keeping operating costs within this range, properties can maintain healthy profit margins. Regularly reviewing and optimizing operating costs is essential for sustaining financial performance, and this can be achieved through measures such as energy efficiency initiatives, streamlined maintenance processes, and effective vendor management.

How To Calculate?

Operating Costs to Revenue Ratio % = (Total operating costs / Total revenue) x 100

4. Debt-Service Coverage Ratio (DSCR):

The DSCR is a measure of a property’s ability to service its debt obligations from its operating income. A DSCR of 1.25 or higher is generally considered healthy, indicating that the property generates sufficient income to cover its debt obligations with a cushion.

This metric is crucial for understanding financial stability and is often scrutinized by lenders when assessing the risk of financing a property. Maintaining a strong DSCR is vital for ensuring long-term financial viability and accessing favorable financing terms.

How To Calculate?

Debt-Service Coverage Ratio = Net operating income / Total debt service

Where:

Net Operating Income (NOI) = Total Revenue – Total Operating Expenses

Total Debt Service = Principal + Interest Payments

5. Capital Expenditure (CapEx):

CapEx refers to funds used to acquire, upgrade, and maintain physical assets such as buildings and equipment. In the PBSH sector, regular reinvestment in property facilities is essential to meet the evolving demands of students and remain competitive.

Analyzing CapEx involves reviewing how much is being spent on maintaining existing facilities and upgrading amenities to enhance the property’s appeal. Ideally, a portion of the revenue should be allocated to CapEx to ensure that properties remain in good condition and can attract high occupancy rates. By tracking CapEx, property managers can plan for long-term improvements, prevent deferred maintenance issues, and sustain the property’s value.

How To Calculate?

CapEx Ratio % = (Total CapEx / Total Revenue) x 100

Analyzing Cash Flow: A Step-by-Step Guide

Cash flow analysis is crucial for understanding a company’s liquidity and operational efficiency, especially in the Purpose-Built Student Housing (PBSH) sector, where financial health is vital for maintaining and expanding facilities. Here’s a step-by-step guide to help you navigate this process effectively:

Step 1: Gather Cash Flow Statements

Start by collecting the cash flow statements for the period you wish to analyze. Ensure you have the statements for multiple periods to identify trends and patterns.

Step 2: Understand the Structure

Cash flow statements are divided into three sections:

- Operating Activities: Cash generated or used in the core business operations.

- Investing Activities: Cash spent on or generated from investments in assets and other ventures.

- Financing Activities: Cash flows from borrowing, repaying debt, issuing equity, or paying dividends.

Step 3: Calculate Net Cash Flow

Determine the net cash flow by summing up the cash from operating, investing, and financing activities. This figure will give you a snapshot of the overall cash movement.

Step 4: Analyze Operating Cash Flow

Operating cash flow is a key indicator of day-to-day liquidity. Compare it against net income to assess the quality of earnings. Positive operating cash flow suggests that the business generates sufficient cash from its core operations.

Step 5: Evaluate Cash Flow from Investing Activities

Examine cash outflows for capital expenditures (CapEx) to understand how much is being reinvested into the business. High CapEx in PBSH often indicates expansion or major upgrades, essential for staying competitive.

Step 6: Review Cash Flow from Financing Activities

Assess the company’s approach to financing its operations and growth. Look at debt repayments versus new borrowing and dividend payments. A balanced approach ensures sustainable growth without overleveraging.

Step 7: Calculate Free Cash Flow

Free Cash Flow (FCF) is crucial for PBSH providers, indicating the cash available after maintaining or expanding the asset base. Calculate FCF by subtracting capital expenditures from operating cash flow. Positive FCF signifies potential for reinvestment or distribution to stakeholders.

Step 8: Trend Analysis

Conduct a trend analysis over several periods to identify patterns. Consistent positive cash flow from operations and stable or growing free cash flow are indicators of a healthy financial state.

Step 9: Compare with Industry Benchmarks

Compare the cash flow metrics with industry benchmarks. In the PBSH sector, understanding how your cash flow metrics stack up against competitors can provide insights into your operational efficiency and financial health.

Profitability Analysis: Assessing Financial Health

Profitability analysis is essential for gauging the financial success and efficiency of a business. For PBSH providers, this involves evaluating various ratios and indicators to get a clear picture of profitability.

Net Profit Margin

Formula: Net Profit Margin = (Net Profit / Revenue) * 100

Purpose: This ratio measures how much of each dollar of revenue translates into profit. A higher net profit margin indicates efficient cost management and strong profitability.

Analysis: Regularly track the net profit margin to monitor trends and compare it with industry averages. In PBSH, a high net profit margin could reflect effective cost control and high occupancy rates.

Return on Investment (ROI)

Formula: ROI = (Net Profit / Total Investment) * 100

Purpose: ROI measures the profitability of investments. In the PBSH sector, this could include investments in new buildings, renovations, or amenities.

Analysis: Calculate ROI for different projects to identify the most lucrative investments. A higher ROI indicates that the investments are yielding substantial returns, essential for strategic decision-making.

Gross Profit Margin

Formula: Gross Profit Margin = (Gross Profit / Revenue) * 100

Purpose: This ratio evaluates the efficiency of production and pricing strategies by measuring the percentage of revenue that exceeds the cost of goods sold (COGS).

Analysis: A stable or increasing gross profit margin suggests good cost control and effective pricing strategies. In PBSH, it can highlight the efficiency of operational management and the effectiveness of cost control measures.

Operating Profit Margin

Formula: Operating Profit Margin = (Operating Profit / Revenue) * 100

Purpose: This ratio measures the proportion of revenue left after paying for variable costs of production, such as wages and raw materials, but before paying interest or tax.

Analysis: It provides insight into the core business efficiency. For PBSH providers, a healthy operating profit margin indicates that the core operations are profitable, excluding the effects of financial and tax structures.

Return on Assets (ROA)

Formula: ROA = (Net Profit / Total Assets) * 100

Purpose: ROA measures how effectively a company uses its assets to generate profit.

Analysis: A higher ROA indicates more efficient use of assets. For PBSH providers, this can highlight how well the properties and facilities are being utilized to generate income.

Return on Equity (ROE)

Formula: ROE = (Net Profit / Shareholder’s Equity) * 100

Purpose: ROE measures the profitability relative to shareholders’ equity. It indicates how well the company is using investment funds to generate earnings growth.

Analysis: A higher ROE signifies efficient management and profitability. For PBSH providers, this can demonstrate effective management and the ability to generate profits from shareholders’ investments.

Identifying Red Flags in Student Housing Operations

1. Increasing Delinquency Rates

Problem: A rise in delinquency rates can signal issues with tenant satisfaction, economic challenges faced by students, or ineffective rent collection processes. It indicates that more students are falling behind on their rent payments, which can severely impact cash flow.

Potential Causes:

- Poor tenant screening processes leading to high-risk tenants.

- Insufficient communication regarding rent payment policies.

- Economic downturns affecting students’ financial stability.

Solutions:

- Implement a more rigorous tenant screening process to ensure financial reliability.

- Enhance communication with tenants regarding payment schedules and available support options.

- Offer flexible payment plans or financial counseling services to help struggling students.

2. Declining Occupancy Rates

Problem: A decrease in occupancy rates can drastically reduce revenue, leading to financial instability. This issue might be symptomatic of broader problems within the property or its management.

Potential Causes:

- Poor property conditions or lack of amenities.

- Ineffective marketing and leasing strategies.

- Increased competition from other housing options.

Solutions:

- Invest in property upgrades and ensure regular maintenance to improve living conditions.

- Revamp marketing strategies to highlight unique selling points and attract new tenants.

- Conduct market research to stay competitive and adjust pricing or amenities accordingly.

3. Escalating Maintenance Costs

Problem: Rising maintenance costs can quickly erode profits and signal underlying issues with property management or aging infrastructure.

Potential Causes:

- Deferred maintenance leading to larger, more expensive repairs.

- Inefficiencies in maintenance management or poor contractor choices.

- Aging buildings require more frequent and costly upkeep.

Solutions:

- Adopt a proactive maintenance schedule to address issues before they become major problems.

- Streamline maintenance processes and negotiate better rates with reliable contractors.

- Invest in renovations or upgrades to reduce long-term maintenance costs.

4. Issues with Cash Flow Management

Problem: Problems in managing cash flow can jeopardize the ability to cover expenses, pay employees, or invest in property improvements.

Potential Causes:

- Poor financial planning and budgeting practices.

- Inefficient rent collection or high delinquency rates.

- Unanticipated expenses or revenue shortfalls.

Solutions:

- Implement robust financial planning and budgeting tools to better manage cash flow.

- Improve rent collection processes and address delinquency issues promptly.

- Establish an emergency fund to handle unexpected expenses without disrupting operations.

RELATED BLOG: The Investor’s Perspective: Why Streamlined F&A Operations are Crucial for PBSA Companies

Tailored Recommendations for Financial Performance Enhancement

1. Cost-Cutting Measures

- Operational Efficiency: Implementing advanced property management software can streamline operations, reducing administrative overheads. Automation of routine tasks such as maintenance requests, billing, and communication can lead to significant cost savings.

- Bulk Purchasing: Negotiating bulk purchase agreements for common supplies and services can leverage economies of scale. This could include everything from cleaning supplies to internet services.

- Outsourcing Non-Core Activities: Outsourcing functions like housekeeping, security, and even aspects of financial management to specialized service providers can reduce labor costs while ensuring high service quality.

2. Revenue Enhancement Strategies

- Diversified Revenue Streams: Exploring ancillary revenue opportunities such as vending machines, laundry services, and bike rentals can add to the income. Additionally, offering premium services like high-speed internet or exclusive study spaces for an additional fee can attract more revenue.

- Dynamic Pricing Models: Implementing dynamic pricing strategies based on demand fluctuations can optimize room rates. This involves adjusting prices according to seasonal trends, market demand, and competitor pricing to maximize occupancy and revenue.

- Flexible Lease Terms: Offering flexible lease options, such as short-term leases or semester-based leases, can attract a broader range of tenants, including international students and those on exchange programs, thereby increasing occupancy rates and revenue.

3. Tenant Retention Tactics

- Community Building: Creating a sense of community through regular events, social activities, and student engagement initiatives can enhance tenant satisfaction and retention. A strong community atmosphere can lead to positive word-of-mouth and higher renewal rates.

- Feedback Mechanism: Establishing a robust feedback mechanism to understand tenant needs and concerns allows for proactive issue resolution. Regular surveys and suggestion boxes can provide insights into tenant satisfaction and areas for improvement.

- Maintenance and Upkeep: Ensuring prompt and efficient maintenance services can significantly improve tenant satisfaction. Regularly updating common areas and providing a clean, safe living environment are critical for retaining tenants.

Taking Action

In the PBSH sector, proactive financial health checks are essential. These assessments help identify and address potential issues early, ensuring your operations remain strong and resilient. By continuously monitoring and periodically re-evaluating your financial strategies, you can adapt to changing market conditions and operational challenges, turning potential threats into opportunities for growth.

The PBSH market is constantly changing, influenced by student preferences, technological advancements, and regulatory updates. This requires a keen eye on your financial health and readiness to adjust as needed. Make financial health checks a regular part of your strategy to ensure your PBSH venture not only survives but thrives, securing a brighter and more profitable future.

FAQs

What is financial health in the context of student housing?

It’s about making sure student housing operations are profitable and can keep up with financial obligations.

What are the key financial metrics to monitor in student housing?

Focus on tracking occupancy rates, rental income, operating expenses, cash flow, and debt payments.

Why is financial health important for student housing providers?

Strong financial health means providers can keep properties in top shape, support students better, and plan for growth.

How does student finance affect housing benefit?

Student finance can influence how much housing support a student is eligible for, affecting their housing options.

How does a student’s financial health affect their housing aid eligibility?

A student’s financial standing, like their credit score and income, plays a big role in what kind of housing aid they can get. Better finances often mean better aid options, helping secure more stable living situations.

What are some top tips for managing finances in student housing?

To keep the finances of student housing smooth, it’s crucial to stick to a budget, keep an eye on your spending, and make sure you’re clear about your financial activities with everyone involved. Using tech tools for payments and budget tracking can really help too.

Where can I find a detailed guide on student housing finances?

Look for detailed financial guides for student housing on educational portals, real estate blogs, or through housing associations. These resources typically cover everything from how to plan your finances to smart investment moves in student housing.

Originally published Jun 27, 2024 08:06:07, updated Apr 16 2025

Topics: Finance and Accounting Outsourcing Services, Finance and Accounting Transformation