Topics: Finance and Accounting Outsourcing Services, Multifamily

Posted on May 31, 2024

Written By Priyanka Rout

Selecting the right multifamily accounting software isn’t just a purchase—it’s a pivotal decision that can redefine the efficiency and compliance of property management firms. It doesn’t merely track financial transactions; it serves as the backbone of strategic decision-making and operational harmony.

Multifamily accounting software is designed with unique features that go beyond what standard accounting systems provide. These specialized programs include essential financial reporting and payroll capabilities, but they also incorporate specific details about vacancies, units, tenants, and maintenance directly into the real estate management system.

Additionally, the more advanced tools in this category offer functionalities to handle property listings, track referrals, and associate electronic documents with sales transactions, ensuring that all company information is streamlined and accessible. This guide dives deep into the essential features that differentiate effective software solutions, empowering property managers to navigate financial complexities with precision and ease.

Multifamily accounting software is specialized software designed to manage the financial and operational aspects of multifamily residential properties, such as apartment complexes, condominiums, and other multi-unit buildings. This software helps property managers, owners, and accounting professionals streamline their financial processes, ensure compliance, and maintain accurate records.

RELATED CASE STUDY: After a major merger, a top PBSH company wanted to improve their financial accounting and reporting. Read the case study to see how QX helped achieve these goals.

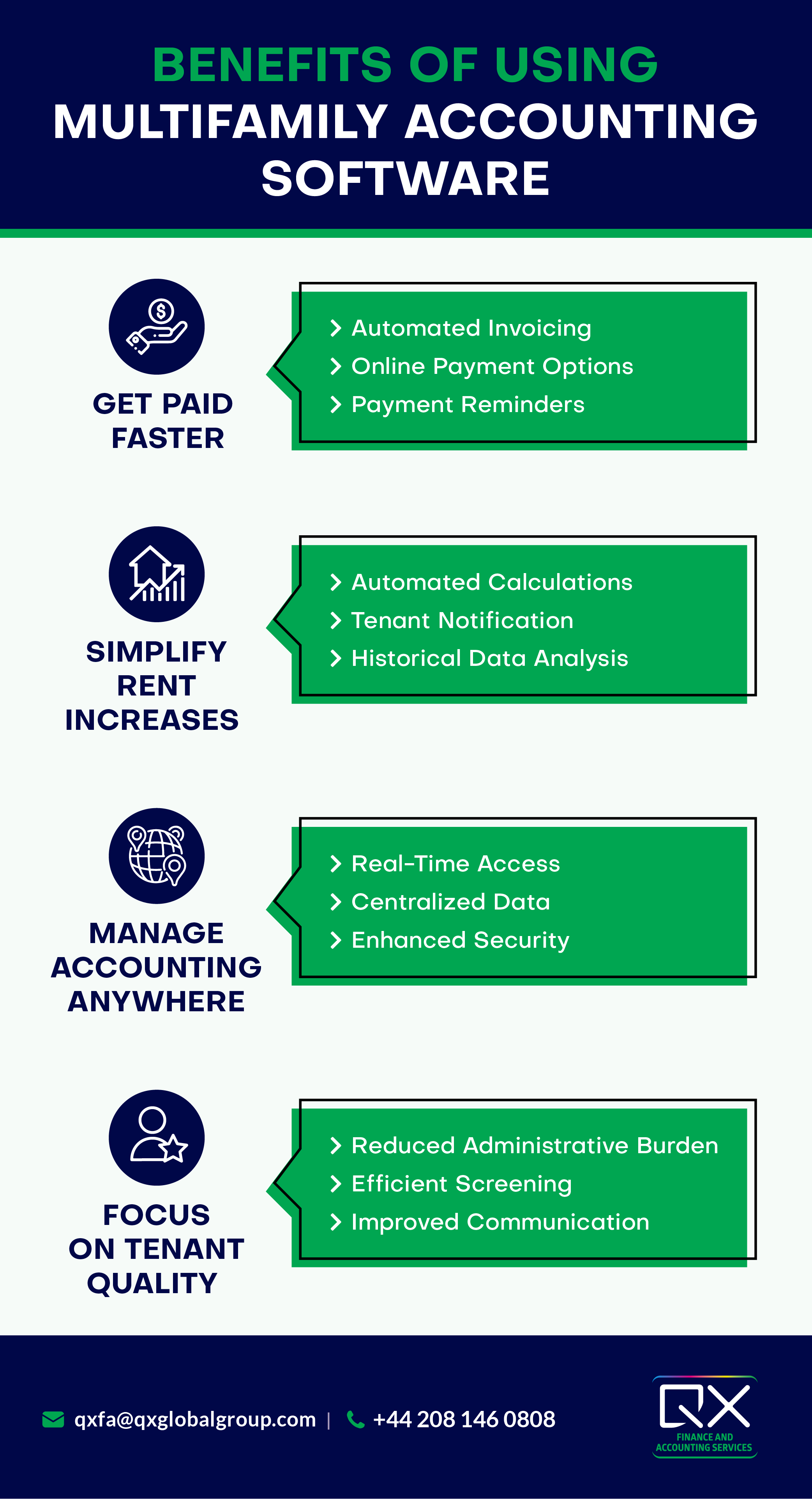

Multifamily accounting software offers numerous advantages for landlords and property managers, streamlining operations and improving efficiency. Here are some key benefits:

Choosing the right software vendor involves a thorough vetting process to ensure they meet your business needs and standards. Start by researching potential vendors to evaluate their offerings and identify those that specialize in multifamily accounting solutions. Next, request demos to see the software in action and assess its user interface and features. During this phase, consider the following steps:

RELATED BLOG: Find out 5 ways in which CFOs and finance directors can streamline procure-to-pay for multifamily businesses by clicking here.

Also Read : One-stop Solution to All Multifamily Operational Challenges

As we conclude our exploration of choosing the right multifamily accounting software, it’s crucial to recognize that this decision goes beyond mere functionality. It strategically influences your property management operations, financial clarity, and ultimately, your portfolio’s success. The right software acts as a backbone, supporting your business today while flexibly adapting to tomorrow’s challenges and opportunities.

QX Global Group is committed to guiding companies through the vital transition from manual processes to advanced digital solutions, ensuring a seamless integration of industry-standard tools. Our pride in facilitating such transformations is bolstered by our team of expert accountants who are proficient in these technologies.

By partnering with us, you gain long-term operational efficiencies and significant cost savings, ultimately enhancing your competitive edge in the market. Contact us today to learn how our tailored solutions can benefit your organization. Together, let’s unlock the full potential of your processes and propel your business forward.

When selecting multifamily accounting software, prioritize features like comprehensive financial reporting, budgeting tools, and real-time data access. Ensure the software supports multiple entities under a single platform for streamlined operations. Compatibility with rent payment systems and maintenance management functionalities are also crucial for efficient tenant and property management. Multifamily accounting software enhances financial accuracy by automating key processes such as rent collection, expense tracking, and bank reconciliations. Automation reduces human error and ensures that financial data is precise and timely. Additionally, the software typically includes audit trails and compliance management features to further safeguard accuracy and adherence to financial regulations. Yes, most modern multifamily accounting software is designed to integrate seamlessly with other property management systems. This integration capability allows for a unified management experience, connecting accounting with other operational aspects such as tenant screening, lease management, and facility maintenance. Look for software that offers open APIs to ensure it can easily connect with existing systems you might already be using. Multifamily Property Management Software helps streamline operations, enhances tenant communication, and improves financial reporting accuracy, making it essential for efficient property management. The best multifamily accounting software offers comprehensive features like automated rent collection, expense tracking, and financial reporting, which significantly aid in accurate budgeting and financial oversight. When selecting multifamily software companies, consider factors such as the software’s scalability, customer support, integration capabilities, and specific features that meet your property management needs. Property management software facilitates faster response to maintenance requests, easier rent payment options, and better communication channels, all of which enhance tenant satisfaction. Multifamily property management companies should invest in specialized software to handle complex operational challenges unique to multifamily units, such as tenant screening, lease management, and multiple property oversight. Current trends include the integration of AI for data analysis and decision support, the use of IoT for building management and maintenance, and enhanced security features, all aimed at increasing efficiency and tenant safety.FAQs

What are the key features to look for in multifamily accounting software?

How does multifamily accounting software improve financial accuracy?

Can multifamily accounting software integrate with other property management systems?

What are the benefits of using Multifamily Property Management Software?

How does the best multifamily accounting software improve financial management?

What should you look for when choosing multifamily software companies?

How can property management software impact tenant satisfaction?

Why should multifamily property management companies invest in specialized software?

What trends are shaping the development of multifamily property management software?

Education:

BA (English Literature); Executive MBA (Marketing)

Priyanka Rout is a B2B marketing professional with 5+ years of experience in marketing, specialising in content-led growth, performance strategy, and sector-driven brand building. She has worked extensively on developing structured marketing programs that align closely with sales priorities, measurable outcomes, and executive-level engagement. At QX Global Group, she leads hospitality-focused marketing initiatives while overseeing central SEO and social media strategy across the UK and USA markets. Working closely with business development and sector leaders, Priyanka develops thought leadership, event-led campaigns, and digital programs that translate complex finance and outsourcing themes into commercially relevant narratives for CFOs and senior decision-makers.

Expertise: B2B Marketing Strategy & Sector Positioning, Hospitality Industry Marketing (UK Focus), Finance & Accounting Services Marketing, Content-Led Growth & Thought Leadership Development, CFO & Executive-Level Content Strategy, Sales Enablement & Marketing Alignment, Event Marketing & Industry-Led Campaigns, SEO Strategy & Organic Growth (UK & USA Markets), Social Media Strategy & Brand Visibility, Outsourcing & Global Delivery Narratives, Industry-Specific Campaign Development, Performance-Driven Digital Marketing Programs

Originally published May 31, 2024 07:05:53, updated Feb 05 2026

Topics: Finance and Accounting Outsourcing Services, Multifamily