Topics: Accounts Receivable Process, cash flow management

Posted on August 28, 2024

Written By Priyanka Rout

Efficient financial management is essential for any successful business, and for finance leaders, it’s especially critical for maintaining stability. In the modern business environment, each decision can impact an organization’s financial health and accounts receivable integration with cash flow management is a key strategy that can make a big difference.

Consider the benefits of seamlessly integrating these two crucial financial functions. When AR software is effectively linked with your billing and accounting systems, it enhances financial efficiency and can lead to faster growth.

However, if AR software isn’t properly integrated, it becomes a standalone system that can slow down cash flow. For example, it’s common for businesses with disconnected systems to send out reminders for overdue payments on invoices that have already been paid. Such systems often require manual data entry across different platforms, which is time-consuming and prone to errors.

The proper integration of AR software allows it to seamlessly operate as part of your broader financial system, enabling a smooth and accurate flow of data. Increasing efficiency and reducing human error, accounts receivable automation benefits companies by streamlining billing processes and improving cash flow management.

This blog post will explore the advantages of combining accounts receivable with cash flow management and how it can transform financial operations, helping finance leaders manage their resources more effectively.

Accounts receivable refers to the outstanding payments that a company is owed by its customers for goods or services rendered. It represents the credit extended to customers and is considered an asset on the company’s balance sheet.

On the other hand, cash flow management focuses on monitoring, analyzing, and optimizing the inflow and outflow of cash within an organization. It involves tracking the movement of cash in real-time, forecasting future cash flows, and making informed decisions to maintain sufficient liquidity for day-to-day operations, investments, and growth initiatives.

Integrating these two aspects of financial management has great potential to streamline processes, improve efficiency, and unleashunlock many benefits that propel organizations toward financial success.

Delayed Accounts Receivable Integration Implications: When Accounts Receivable (AR) collections are delayed, it directly impacts cash flow, creating a shortage of readily available funds. This delay can hinder a company’s ability to cover operational costs, fulfill payroll obligations, and make timely investments in capital improvements or market expansions.

Discover key metrics that can transform your AR management by reading our blog on benchmarking performance in AR outsourcing!

One of the significant advantages of integrating accounts receivable with cash flow management is its transformative impact on invoice and payment handling. Receivable solutions streamline collections, improve payment accuracy, and boost the overall financial health of a business by optimizing the accounts receivable process. Invoices are generated and dispatched automatically, eliminating the need for manual intervention. Tracking overdue payments becomes seamless, enabling finance leaders to take prompt action. This streamlined and efficient approach not only expedites collections but also enhances the overall customer experience.

Improving cash flow with automated accounts enables businesses to enhance financial visibility and control, leading to more efficient capital management and reduced operational costs. Integration empowers finance leaders with real-time visibility into cash flow, granting access to accurate and up-to-date information. This invaluable insight enables them to proactively anticipate cash shortages or surpluses, allocate resources efficiently, manage working capital effectively, and make well-informed investment decisions. Moreover, it cultivates stronger relationships with stakeholders, fostering trust and paving the way for favorable financing terms and fruitful partnerships.

Accounts receivable integration empowers finance leaders to enhance receivables management, resulting in optimized collections and reduced bad debts. Aging analysis provides a comprehensive view of outstanding balances categorized by time periods. With a clear understanding of receivables’ aging, finance leaders can take targeted actions to recover payments and minimize the risk of bad debts.

Furthermore, integration offers the significant benefit of real-time credit risk assessment. This allows finance leaders to evaluate customer creditworthiness by accessing data and analytics. With this information, they can make informed decisions about credit limits, payment terms, and credit extensions. This assessment empowers finance leaders to mitigate potential bad debts and establish effective credit control measures.

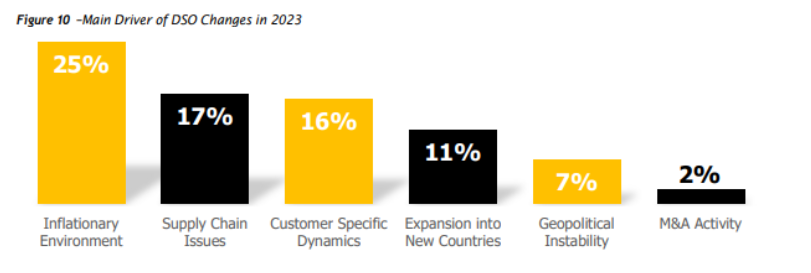

By integrating accounts receivable and cash flow management, businesses streamline processes and shorten the average payment collection time, known as Days Sales Outstanding (DSO). This acceleration in collections brings substantial benefits to cash flow and working capital. It ensures a steady flow of funds to support operations and growth, while also freeing up resources to address critical needs. Ultimately, integration’s impact on DSO strengthens financial stability and enhances profitability.

When businesses integrate accounts receivable and cash flow management, they gain the ability to swiftly identify and address cash flow snags or liquidity concerns in their early stages. With real-time visibility into cash flow, finance leaders can promptly detect issues and take decisive action to maintain liquidity. This integration also facilitates accurate cash flow predictions, enabling better anticipation of liquidity challenges and informed cash management decisions. Moreover, cross-team collaboration fosters a comprehensive understanding of financial risks and a synchronized approach to minimize them.

By integrating accounting systems and ERPs with accounts receivable and cash flow management, businesses can achieve a unified view of financial data, eliminating data silos and reducing the need for manual data entry. This seamless data flow streamlines workflows, eliminates duplicate tasks, and enhances efficiency & productivity. For instance, automated data transfer between systems eliminates the need for manual entry or reconciliation, saving time and enabling finance teams to focus on value-added activities.

Furthermore, integration empowers finance leaders to generate accurate reports, perform in-depth analysis, and make informed decisions based on a holistic view of financial performance. Integration also facilitates regulatory compliance, simplifies audits, and ensures data consistency and traceability.

Accounts receivable integration isn’t just about smoothing out internal operations – it also deeply influences customer happiness and relationships. Imagine offering your customers a flawless invoicing and payment journey. That’s what integration can do, sparking customer loyalty and encouraging repeat business.

But there’s more – integration also ramps up communication and clarity with customers. Businesses can share instant updates on payment statuses and provide self-service portals where customers can conveniently manage their accounts and review payment history. This transparent approach not only builds trust but also keeps communication channels wide open, crafting a positive customer experience.

Advancements in technology offer transformative opportunities for integrating Accounts Receivable (AR) with cash flow management, enhancing efficiency, accuracy, and security. Here’s how different technologies play a role:

Discover how QX helped a leading recruitment business streamline credit control and accounts receivable processes!

Accounts receivable integration and cash flow management is a powerful game-changer, blending the best of financial efficiency and customer satisfaction. It empowers businesses to streamline operations, enhance transparency, and foster customer relationships, transforming the very fabric of financial management.

Yet, harnessing this power requires expertise. That’s where QX Global Group shines. As pioneers in next-gen outsourced AR service providers, we understand the nuances of this integration and how to tailor it to your unique business needs. We help you redirect resources from mundane tasks like invoice processing to growth-driven initiatives, all while ensuring optimal efficiency and minimal errors. Embrace the future of finance with QX Global Group – let’s embark on your finance transformation journey together!

A good accounts receivable turnover ratio typically ranges between 6 to 12 times annually, indicating efficient collections and credit policies. Higher ratios suggest faster collection of receivables, enhancing liquidity. To evaluate accounts receivable, analyze the aging report, assess the turnover ratio, and review the percentage of receivables against total sales. Regularly evaluating these aspects helps identify trends, potential bad debts, and the effectiveness of credit policies. The best strategy for managing accounts receivable involves implementing robust credit checks, maintaining clear credit terms, utilizing automated reminders for payments, and fostering strong relationships with customers to encourage timely payments. Originally published Aug 28, 2024 03:08:34, updated Jan 15 2025 Topics: Accounts Receivable Process, cash flow managementFAQs

What is a good accounts receivable ratio?

How to evaluate accounts receivable?

What is the best strategy for accounts receivable?

Don't forget to share this post!